Summary Of the Markets Today:

- The Dow closed up 186 points or 0.56%,

- Nasdaq closed up 1.01%,

- S&P 500 up 0.70%,

- WTI crude oil settled at $75 up 0.43,

- USD $103.28 up $0.28,

- Gold $1882 up $4.10,

- Bitcoin $17,472 up $277.80 – Session Low 17,152,

- 10-year U.S. Treasury 3.613% up 0.094 points

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for January 2023

Today’s Economic Releases:

November 2022 sales of merchant wholesalers were up 8.7% from the revised November 2021 level. Total inventories of merchant wholesalers were up 20.9% from the revised November 2021 level. The November inventories/sales ratio for merchant wholesalers was 1.35. The November 2021 ratio was 1.21. All this data has not been adjusted for inflation – however, the inventory/sales ratio negates the need for inflation adjustment and is the most important data point. The graph below shows this ratio, and generally, a high or rising ratio (like what is shown on this graph) is indicative of a slowing economy.

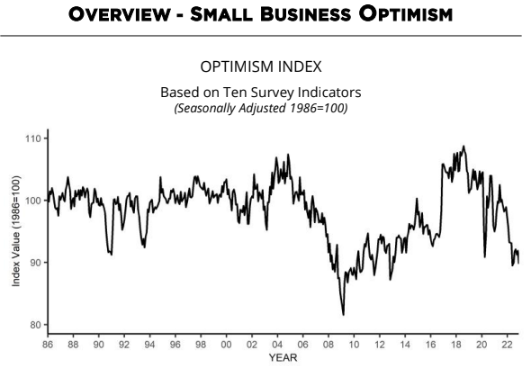

The NFIB Small Business Optimism Index declined 2.1 points in December to 89.8, marking the 12th consecutive month below the 49-year average of 98. Owners expecting better business conditions over the next six months worsened by eight points from November to a net negative 51%. Inflation remains the single most important business problem with 32% of owners reporting it as their top problem in operating their business.

The federal budget deficit was $418 billion in the first quarter of the fiscal year 2023, the Congressional Budget Office estimates—$41 billion more than the shortfall recorded during the same period last year. Revenues were $26 billion (or 2 percent) lower and outlays were $15 billion (or 1 percent) higher from October through December 2022 than they were in the first quarter of the prior fiscal year.

A summary of headlines we are reading today:

- Barclays Sees $15-$25 Barrel Downside If Manufacturing Activity Slows

- Biofuel Production Is Set To Soar In The U.S.

- U.S. Congress To Vote On Ending SPR Oil Sales To China

- Oil Steady Ahead Of Fed Rate Hike Decision

- Bed Bath & Beyond reports wider-than-expected loss as possible bankruptcy looms

- Powell reiterates Fed is not going to become a ‘climate policymaker’

- House Republicans vote to strip IRS funding, following pledge to repeal nearly $80 billion approved by Congress

- The Tell: Goldman sees lower rents pulling a key core inflation gauge below 3% this year

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Barclays Sees $15-$25 Barrel Downside If Manufacturing Activity SlowsBarclays cautioned on Tuesday that we could see a $15-$25 barrel downside risk for crude oil prices compared to its current forecast of $98 per barrel, according to Reuters. In a recent note, Barclays linked that downside risk to a possible continued slowdown in global manufacturing activity. Given the challenging macroeconomic backdrop (we) highlight $15-25/barrel of downside to our forecast if the slump in global manufacturing activity worsens similar to the 2008-09 episode, Barclays said, adding that it would imply 1-2 million Read more at: https://oilprice.com/Energy/Crude-Oil/Barclays-Sees-15-25-Barrel-Downside-If-Manufacturing-Activity-Slows.html |

|

What Options Do Global Industries Have To Lower Fossil Fuel Consumption?Few of us think about heat as an essential ingredient in the products we use every day. Yet, industrial process heat constitutes two-thirds of all energy used by industry. It is used to melt and form metals, make ceramics, refine crude oil, make industrial chemicals, dry crops, process food, sterilize medical instruments, and heat the facilities within which industries operate. Practically, everything we use on a regular basis has at some point required heat to process. And it turns out that the challenges society faces Read more at: https://oilprice.com/Energy/Energy-General/What-Options-Do-Global-Industries-Have-To-Lower-Fossil-Fuel-Consumption.html |

|

Biofuel Production Is Set To Soar In The U.S.What makes an energy source renewable? This question has been at the center of numerous debates in recent months as government agencies around the world rewrite their energy policies in the wake of the massive energy sector shakeup brought on by the Covid-19 pandemic and pushed into overdrive by Russia’s war in Ukraine. We are currently living through a global energy crisis of unprecedented depth and complexity, according to the recently released World Energy Outlook 2022, an annual flagship report from the International Energy Read more at: https://oilprice.com/Alternative-Energy/Biofuels/Biofuel-Production-Is-Set-To-Soar-In-The-US.html |

|

U.S. Congress To Vote On Ending SPR Oil Sales To ChinaThe U.S. House of Representatives is set to vote this week on ending sales of the U.S. Strategic Petroleum Reserves to China, House Majority Leader Steve Scalise said in a Tweet. The vote on the measure will take place Tuesday or Wednesday, Scalise said. Senators James Lankford and Ted Cruz introduced a No Emergency Crude Oil for Foreign Adversaries Act over the summer – this bill would have banned the export of crude oil from the nation’s reserve stockpile to countries such as China. At a time of skyrocketing inflation and Read more at: https://oilprice.com/Energy/Crude-Oil/US-Congress-To-Vote-On-Ending-SPR-Oil-Sales-To-China.html |

|

Iraq’s First New Refinery In Decades Set To Hit Full Capacity By JulyThe new Karbala refinery south of Baghdad is expected to reach full 140,000 barrels per day (bpd) capacity by July this year, a source at the facility told Reuters on Tuesday. The Karbala refinery, estimated to have cost just over $6 billion, is expected to begin commercial production of fuels in the middle of March, Iraqi Oil Minister Hayan Abdel Ghani said this weekend. The start of production will see the refinery doing test runs at 60% of capacity, according to the source who spoke to Reuters. Karbala, Iraq’s first new refinery Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iraqs-First-New-Refinery-In-Decades-Set-To-Hit-Full-Capacity-By-July.html |

|

Oil Steady Ahead Of Fed Rate Hike DecisionOnce again, oil price watchers are looking at U.S. Federal Reserve decisions rather than supply-demand balances, with the community eagerly anticipating Thursday’s inflation data to gauge the extent of upcoming interest rate hikes. The main bullish factor of the past weeks, namely China’s widely expected return to oil markets, is still yet to boost oil prices as trust in Chinese consumption growth remains tepid. Chart of the Week: When Is China Going to Come Back for Real?- After three years of closures, China has opened its borders and Read more at: https://oilprice.com/Energy/Energy-General/Oil-Steady-Ahead-Of-Fed-Rate-Hike-Decision.html |

|

Bed Bath & Beyond lays off more employees as it fights to surviveBed Bath & Beyond is cutting jobs and is at risk of bankruptcy. Read more at: https://www.cnbc.com/2023/01/10/bed-bath-beyond-lays-off-more-employees-as-it-fights-to-survive.html |

|

‘Top Gun: Maverick’ and Disney were the box office leaders in an otherwise soft 2022While Paramount’s “Top Gun: Maverick” topped the charts as the highest-grossing film of the year, Disney is the studio that wears the 2022 box office crown. Read more at: https://www.cnbc.com/2023/01/10/top-gun-maverick-disney-top-box-office-2022.html |

|

Virgin Orbit stock plummets after the failure of its first UK rocket launchVirgin Orbit shares fell after the company confirmed Monday that its first launch out of the United Kingdom failed to reach orbit. Read more at: https://www.cnbc.com/2023/01/09/virgin-orbit-stock-plummets-after-uk-launch-failure.html |

|

Bed Bath & Beyond reports wider-than-expected loss as possible bankruptcy loomsDays after Bed Bath warned of potential bankruptcy, it reported negative operating cash flow for the third quarter and ballooning net losses. Read more at: https://www.cnbc.com/2023/01/10/bed-bath-beyond-bbby-q3-2023-earnings.html |

|

Babies R Us attempts a comeback, plans to open store at American Dream mall in New JerseyBabies R Us, which went out of business in 2018, will open a flagship store at the American Dream megamall in New Jersey. Read more at: https://www.cnbc.com/2023/01/10/babies-r-us-to-open-new-flagship-store-at-american-dream-in-new-jersey.html |

|

Capella Space raises $60 million from a fund run by billionaire entertainment exec Thomas TullSan Francisco-based satellite imagery specialist Capella Space raised $60 million from the U.S. Innovative Technology Fund of billionaire Thomas Tull. Read more at: https://www.cnbc.com/2023/01/10/capella-space-raises-60-million-from-billionaire-thomas-tulls-fund.html |

|

2 of our stocks get nice pops. Here’s the news and what we thinkAs Wall Street on Tuesday attempted to hold onto recent gains, we received updates on Danaher (DHR) and Constellation Brands (STZ). Read more at: https://www.cnbc.com/2023/01/10/2-of-our-stocks-get-nice-pops-heres-the-news-and-what-we-think.html |

|

Powell reiterates Fed is not going to become a ‘climate policymaker’Powell said that climate change is not a main consideration for the Fed when developing monetary policy. Read more at: https://www.cnbc.com/2023/01/10/powell-reiterates-fed-is-not-going-to-become-a-climate-policymaker.html |

|

House Republicans vote to strip IRS funding, following pledge to repeal nearly $80 billion approved by CongressHouse Republicans on Monday night voted to slash funding for the IRS, following a pledge to repeal the nearly $80 billion approved by Congress last year. Read more at: https://www.cnbc.com/2023/01/10/house-republicans-have-voted-to-cut-irs-funding-.html |

|

Amazon’s Buy with Prime is a positive step, but the stock is still expensiveAmazon’s (AMZN) soon-to-be widely available Buy with Prime service could be a profitable revenue channel for the e-commerce giant. Read more at: https://www.cnbc.com/2023/01/10/amazons-buy-with-prime-a-positive-step-but-stock-remains-overvalued-.html |

|

Stocks making the biggest moves midday: Bed Bath & Beyond, Coinbase, Virgin Orbit, and moreThese are the stocks posting the largest moves midday. Read more at: https://www.cnbc.com/2023/01/10/stocks-making-the-biggest-moves-midday-virgin-orbit-bed-bath-beyond-coinbase-and-more.html |

|

Sen. Bernie Sanders urges Moderna not to hike the price of Covid-19 vaccinesSanders, the incoming chair of the Senate health committee, called the price increase “outrageous” in a letter to Moderna CEO Stephane Bancel. Read more at: https://www.cnbc.com/2023/01/10/bernie-sanders-urges-moderna-not-to-hike-covid-19-vaccine-price.html |

|

Bob Iger tells Disney employees they must return to the office four days a weekDisney CEO Bob Iger told hybrid employees on Monday they must return to corporate offices four days a week starting March 1. Read more at: https://www.cnbc.com/2023/01/09/disney-ceo-bob-iger-tells-employees-to-return-to-the-office-four-days-a-week.html |

|

Power-Crazed Biden Administration May Ban Gas StovesGas stoves, which are used in about 40% of American homes and are loved for their easy and speedy adjustability, may be banned by the Biden administration over concerns about their production of indoor pollutants. “This is a hidden hazard,” U.S. Consumer Product Safety Commission (CPSC) commissioner Richard Trumka Jr told Bloomberg. “Any option is on the table,” said the son of the late AFL-CIO president. “Products that can’t be made safe can be banned.”

Read more at: https://www.zerohedge.com/political/biden-administration-may-ban-gas-stoves |

|

“The Fed Should Be Irrelevant” – Peter Schiff Warns It’s “Not How Capitalism Is Supposed To Work”Authored by Liam Cosgrove via The Epoch Times, Peter Schiff, chief economist and global strategist of Euro Pacific Asset Management, is famous for his bearish takes. A falling stock market, a deep recession, and a sovereign debt crisis were among his predictions in the past.

As the first trading week in January came to a close, The Epoch Times sat down with Schiff to get his outlook for the new year. According to the libertarian economist, the outlook is grim and driven by two factors: inflation and the Federal Reserve. “The last couple of times the Fed was able to orchestrate a pi … Read more at: https://www.zerohedge.com/markets/fed-should-be-irrelevant-peter-schiff-warns-its-not-how-capitalism-supposed-work |

|

Hedge Fund Shorting Of Tech Stocks Hits Record High, Goldman Prime FindsYesterday we quoted from the latest weekly JPMorgan Prime Brokerage report, “Signs the US Shorting Getting Extreme…EU Bought, China Not, Credit / FI ETFs Turn Risk Off” (note available here), which laid out several reasons why a tech short-squeeze is looking increasingly likely; specifically, according to JPM Prime, hedge funds have been on a shorting stampede and high short interest stocks in the US have seen a 6 week period of persistent short additions: “The magnitude and duration of these short additions is on par with the largest we’ve seen in past years and the cumulative additions put shorts in these types of stocks back at multi-year highs.” Today we compare JPM’s data with the latest Prime Brokerage data, this time from Goldman (full note available here), and find that hedge funds are indeed running for the hills, and shorting everything tech-r … Read more at: https://www.zerohedge.com/markets/hedge-fund-shorting-tech-stocks-hits-record-high-goldman-prime-finds |

|

Judge Dismisses Lawsuit About Big Oil ConspiracyAuthored by Charles Kennedy via OilPrice.com, A federal judge has dismissed a lawsuit brought to a California court last year by a group of individuals claiming the Trump administration and U.S. oil producers colluded with Russia and Saudi Arabia to keep oil and gasoline prices high.

Defendants named in the lawsuit included the American Petroleum Institute, Chevron, Exxon, Occidental Petroleum, Phillips 66, and Energy Transfer. The plaintiffs—about two dozen of them—alleged that the defendants conspired with Saudi Arabia and Russia, with the help of the Trump administration, to keep the prices of … Read more at: https://www.zerohedge.com/energy/judge-dismisses-lawsuit-about-big-oil-conspiracy |

|

Evri says sorry for UK parcel delivery delaysThe firm, formerly known as Hermes, says staff shortages, Royal Mail strikes and bad weather have caused disruption. Read more at: https://www.bbc.co.uk/news/business-64223554?at_medium=RSS&at_campaign=KARANGA |

|

Strikes Update: How Wednesday 11 January’s walkouts will affect youWhat you need to know about the ambulance workers’ strike and other industrial action, by the BBC’s Zoe Conway. Read more at: https://www.bbc.co.uk/news/business-64220259?at_medium=RSS&at_campaign=KARANGA |

|

Grant Shapps unveils new powers in strike lawsUnions say the plans for minimum service levels are “undemocratic and unworkable”. Read more at: https://www.bbc.co.uk/news/uk-politics-64229196?at_medium=RSS&at_campaign=KARANGA |

|

Non-promoter shareholders allowed to sell stakes via OFS: SebiThe OFS mechanism will now be available to companies with a market capitalization of Rs 1,000 crore and above Read more at: https://economictimes.indiatimes.com/markets/stocks/news/non-promoter-shareholders-allowed-to-sell-stake-via-ofs-sebi/articleshow/96885949.cms |

|

Tech View: Nifty forms a bearish engulfing candle. What traders should do on Wednesday“For bulls, 18000 would be the key level to watch out for, and above the same, the index could retest the level of 18100-18150. On the flip side, 17800 would act as a sacrosanct support zone, below which selling pressure is likely to accelerate and drag down the index up to 17700-17675,” said Shrikant Chouhan of Kotak Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-form-bearish-engulfing-candle-what-traders-should-do-on-wednesday/articleshow/96885458.cms |

|

Chris Wood finds Nifty valuation challenging. Is it really so?From a retail investor’s perspective, it is best to ignore top-down market valuations unless one is buying index funds. For stock pickers, bottom-up valuation of individual stocks is much more relevant to make any investment decision. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/chris-wood-finds-nifty-valuation-challenging-is-it-really-so/articleshow/96871692.cms |

|

The Tell: ‘A year of two halves’: Stifel’s Barry Bannister expects a near-term rally in U.S. stocks — and trouble later in 2023Trouble may be brewing in the second half of this year, but there’s a window for a stock-market rally during the first six months of 2023, in the view of Stifel chief equity strategist Barry Bannister. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-717A-A2B68D7EA042%7D&siteid=rss&rss=1 |

|

Student-loan repayment pause helped young people ‘participate in the recent housing boom’The ongoing student-loan payment pause boosted homeownership rates among young Americans, according to a new report. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-717A-A1A9C4B24E82%7D&siteid=rss&rss=1 |

|

The Tell: Goldman sees lower rents pulling a key core inflation gauge below 3% this yearAs asking apartment rents tumble, a top Goldman Sachs economist sees the Federal Reserve’s favored U.S. core inflation gauge dipping below its own year-end 3.5% forecast. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-717A-84B354A2F0F3%7D&siteid=rss&rss=1 |

Has Joe broken this to Jill yet?Gas stoves are even more prevalent in re …

Has Joe broken this to Jill yet?Gas stoves are even more prevalent in re …