Summary Of the Markets Today:

- The Dow closed up 700 points or 2.13%,

- Nasdaq closed up 2.56%,

- S&P 500 closed up 2.28%,

- Gold $1871 up $31,

- WTI crude oil settled at $74 little changed,

- 10-year U.S. Treasury 3.567% down 0.155 points,

- USD index $103.90 down $1.14,

- Bitcoin $16,918 up $93.10

Click here to read our Economic Forecast for January 2023

Today’s Economic Releases:

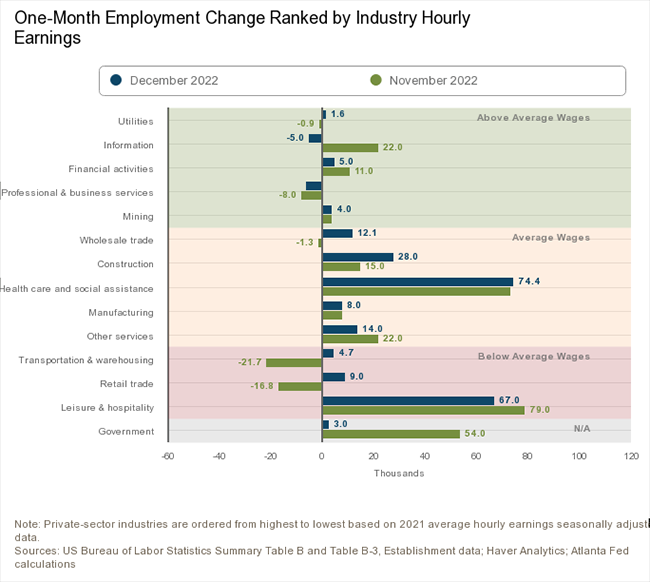

Total nonfarm payroll employment increased by 223,000 in December, and the unemployment rate edged down to 3.5%. Notable job gains occurred in leisure/hospitality and health care. The household survey shows employment gains of 717,000 versus the establishment’s 223,000. And interestingly, the household survey increased the workforce by 439,000 which makes the 3.5% unemployment rate remarkable. The employment situation remains strong and continues to give the Federal Reserve room to continue to fight inflation. The report did show a slowing of wage growth.

Elliott Wave International have a free report that is a heavy excerpt from EWI president Robert Prechter’s latest Elliott Wave Theorist. Every month since 1978, the Theorist has helped investors prepare by shining a light on the parts of the financial world that are right under the mainstream experts’ noses, but which they don’t — or don’t care to — see. The latest Theorist is like that. The issue is full of insights that you’ll look at and, slapping hand to head, say — gosh, how could ANYONE not see that? The two excerpts from the latest Elliott Wave Theorist are “Warning Signs in the Property Market” and “Warning Signs in Banking.” Read both now, FREE ($49 value)

For reference, your case ID number is: 5004z00001kj4V0AAI

A summary of headlines we are reading today:

- Largest U.S. Refinery Back Up and Running

- Hardliners Are Gaining Influence Within Russia

- A Recession Is Looming For The U.S.

- Costco’s December sales beat shows the Club holding is still the retailer to own

- SBF Seeks Access To $450 Million In Seized Robinhood Shares To Pay His Legal Fees

- Who Would Benefit From A Severe Global Recession?

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Largest U.S. Refinery Back Up and RunningThe largest crude oil refinery in the United States has returned to production, people familiar with the plants operations told Reuters on Friday. The nations largest crude oil refinery, Motiva Enterprises, shut down on December 23 as a cold snap ripped through much of the country. Motiva, located in Port Arthur, Texas, has a capacity of more than 630,000 bpd, according to the company website. The Motiva refinery in Port Arthur the largest in the United States is wholly owned by Saudi Aramco, the state-run oil giant of Read more at: https://oilprice.com/Energy/Energy-General/Largest-US-Refinery-Back-Up-and-Running.html |

|

U.S. Oil, Gas Rig Activity Dips In First Count Of New YearThe total number of total active drilling rigs in the United States fell by 7 this week, according to new data from Baker Hughes published on Friday. The total rig count fell to 772 this week184 rigs higher than the rig count this time in 2022, and 303 rigs lower than the rig count at the beginning of 2019, prior to the pandemic. Oil rigs in the United States fell by 3 this week, to 618. Gas rigs fell by 4, to 152. Miscellaneous rigs stayed the same at 2. The rig count in the Permian Basin and Eagle Ford stayed the same. Primary Visions Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Gas-Rig-Activity-Dips-In-First-Count-Of-New-Year.html |

|

3 Energy Stock Picks For 2023If you are reading this, I know that you are interested in the energy sector, and therefore you are aware that 2022 was an outstanding year for energy stocks. The sector ETF, XLE, delivered a total return of over 64%, which is impressive enough on its own, but when put in the context of a year when the broad equity benchmark, the S&P 500, lost 18.1% is truly remarkable. As I have said here before that has resulted in some serious schadenfreude for those of us who remained loyal to energy during years of underperformance, and particularly for Read more at: https://oilprice.com/Energy/Energy-General/3-Energy-Stock-Picks-For-2023.html |

|

Oil Traders Attempt To Claw Back LossesU.S. West Texas Intermediate crude oil futures edged higher on Thursday in a mostly uneventful trade, highlighted by a benign government weekly inventories report. Traders were trying to claw back losses from the biggest two-day setback for the start of a year in three decades. Helping to underpin the market was a shutdown of a U.S. fuel pipeline while economic concerns are capping gains. But fear of a global recession and lower demand capped gains. Steep Plunge to Start New Year WTIs cumulative decline of more than 9% on Tuesday and Wednesday Read more at: https://oilprice.com/Energy/Energy-General/Oil-Traders-Attempt-To-Claw-Back-Losses.html |

|

A Recession Is Looming For The U.S.1. The Spectre of Recession Is Getting Closer- US manufacturing contracted for a second straight month, with the manufacturing PMI index issued by the Institute for Supply Management coming in at 48.4 for December, the lowest since May 2020. – Exceeding analysts forecasts, the decline in manufacturing accounting for 11.3% of the US economy is perceived by many as a harbinger of a soon-to-come recession. – A robust labor market is by now pretty much the only thing keeping the US from plunging into a recession, Read more at: https://oilprice.com/Energy/Energy-General/A-Recession-Is-Looming-For-The-US.html |

|

Hardliners Are Gaining Influence Within RussiaPolitics, Geopolitics & Conflict Investors are still running for the hills in Brazil, where Lulas first day in office (and his return to the presidency for a third term) resulted in a market rout and sent shares of Petrobras tumbling further. Analysts predict lots of market intervention ahead, and the new incoming CEO of Petrobras (Lula ally Senator Prates) has suggested he is taking the company toward renewables in a big way.Cracks are showing in the Libyan stalemate/powder keg, with Italian sources saying they have intel that General Read more at: https://oilprice.com/Energy/Energy-General/Hardliners-Are-Gaining-Influence-Within-Russia.html |

|

McDonald’s plans reorganization, job cuts as it accelerates restaurant openingsMcDonald’s will be evaluating staffing levels as the company undergoes a reorganization and refocuses its priorities to accelerate restaurant expansion. Read more at: https://www.cnbc.com/2023/01/06/mcdonalds-plans-reorganization-job-cuts.html |

|

Automakers are cautiously optimistic for a 2023 rebound after worst new vehicle sales in more than a decadeAutomakers are hoping last year’s new vehicle sales — the worst in more than a decade will mark a bottom for the market. Read more at: https://www.cnbc.com/2023/01/06/2022-us-auto-sales-are-worst-in-more-than-a-decade-.html |

|

Bed Bath & Beyond shares plummet after company warns of potential bankruptcyThe embattled home goods retailer said it is exploring financial options, including filing for bankruptcy. Read more at: https://www.cnbc.com/2023/01/05/bed-bath-beyond-shares-plummet-as-company-warns-of-deeper-financial-troubles.html |

|

WWE confirms Vince McMahon is rejoining the board, stock spikesWWE has confirmed that former CEO Vince McMahon will return to the company’s board. Read more at: https://www.cnbc.com/2023/01/06/wwe-confirms-vince-mcmahon-is-rejoining-the-board-stock-spikes.html |

|

Pickleball popularity exploded last year, with more than 36 million playing the sportPickleball now boasts the support of LeBron James, Tom Brady and more than 36 million other Americans. Read more at: https://www.cnbc.com/2023/01/05/pickleball-popularity-explodes-with-more-than-36-million-playing.html |

|

Walgreens executive says ‘maybe we cried too much last year’ about theftWalgreens acknowledged it may have overblown concerns about thefts in their stores after shrinkage stabilized over the past year. Read more at: https://www.cnbc.com/2023/01/05/walgreens-may-have-overstated-theft-concerns.html |

|

Stitch Fix plans 20% job cuts as CEO steps down, founder Katrina Lake to reassume postStitch Fix founder Katrina Lake on Thursday announced the company will be cutting 20% of its salaried workforce and that she will reassume her post as CEO. Read more at: https://www.cnbc.com/2023/01/05/stitchfix-ceo-steps-down-20percent-of-salaried-workforce-to-be-cut.html |

|

We’re selling shares in this cosmetics giant, locking in an 18% gainWe’re taking a big win in this prestige beauty firm Friday, locking in a gain of about 18% on stock we purchased in late September of 2022. Read more at: https://www.cnbc.com/2023/01/06/were-selling-shares-in-this-cosmetics-giant-locking-in-an-18percent-gain-.html |

|

How to balance retirement and emergency savings in a shaky economyExperts cover how to decide between saving to your 401(k) for retirement versus your emergency fund in an unsteady economy. Read more at: https://www.cnbc.com/2023/01/06/how-to-balance-retirement-and-emergency-savings-in-a-shaky-economy.html |

|

FDA approves Alzheimer’s drug that slowed cognitive decline in clinical trialThe FDA’s decision comes after clinical trial results indicated that lecanemab slows cognitive decline somewhat in people with mild impairment from Alzheimer’s. Read more at: https://www.cnbc.com/2023/01/06/alzheimers-disease-fda-decision-on-biogen-eisai-treatment-lecanemab.html |

|

Costco’s December sales beat shows the Club holding is still the retailer to ownClub holding Costco Wholesale (COST) delivered strong sales growth in December, demonstrating the retailer’s ability to consistently attract customers. Read more at: https://www.cnbc.com/2023/01/06/costcos-december-sales-beat-shows-club-holding-still-retailer-to-own-.html |

|

Mega Millions jackpot is $940 million: Here’s what to do if you come into a large sum of moneyWhether it’s an inheritance, sale of a property, bonus or even a tax refund, there are many ways to end up with a windfall apart from winning the lottery. Read more at: https://www.cnbc.com/2023/01/06/mega-millions-jackpot-nears-1-billion-tips-for-handling-a-windfall.html |

|

Omicron XBB.1.5 is rising in U.S. though revised CDC data shows slower increase than previously reportedXBB.1.5 made up 27.6% of sequenced Covid cases nationally for the week ending Jan. 7 compared to 18.3% for the week end Dec. 31. Read more at: https://www.cnbc.com/2023/01/06/omicron-xbbpoint1point5-is-rising-in-us-though-revised-cdc-data-shows-slower-increase.html |

|

Nearly 80% Of COVID Cases Among International Arrivals In South Korea Are From ChinaAuthored by Lisa Bian via The Epoch Times, On Jan. 3, the South Korean government announced that travelers from Hong Kong and Macau must provide a negative COVID-19 test from Jan. 7, in addition to arrivals from mainland China, and 76 percent of positive COVID-19 cases at the South Korean border were in Chinese people.

The Korea Disease Control and Prevention Agency (KDCA) said that from Saturday, visitors from Hong Kong and Macau would be required to show proof of a negative PCR test within 48 hours of departure, or a negative rapid antigen test within 24 hours when entering Korea. Travelers would be required to upload test results on the Q-CODE website before boarding the plane. Travele … Read more at: https://www.zerohedge.com/crypto/nearly-80-covid-cases-among-international-arrivals-south-korea-are-china |

|

SBF Seeks Access To $450 Million In Seized Robinhood Shares To Pay His Legal FeesSam Bankman-Fried is fighting to persuade a US court that he should be able to access Robinhood shares worth around $450 million to help pay for his legal fees. The problem: the Department of Justice – which does not believe the 56 million shares of Robinhood were property of the bankrupt FTX estate – moved on Wednesday to seize the shares. Another problem: both FTX and BlockFi are also laying claim to the shares as well. And while FTX’s creditors hope the shares can help make them whole, Bankman-Fried said he needs the funds to cover his legal fees. Lawyers for the disgraced former CEO in a Delaware court filing on Thursday that the 56.3 million Robinhood shares should be returned to Bankman-Fried because the company that owns them, Emergent Fidelity Technology Ltd, is not part of the bankruptcy estate (at least not yet). Bankman-Fried owns 90% of Emergent. He and former FTX chief technology officer Gary Wang borrowed $546 million from Alameda Research (in other words used money stolen from FTX clients) to buy the Robinhood shares, according to court filings. Robinhood’s shares closed at $8.11 on Thursday, giving the stake a value of $456 million. “Mr. Bankman-Fried has not been found criminally or civilly liable for fraud, and it is improper for the FTX Debtors to ask the Court to simply assume that everything Mr. Bankman-Fried ever touched is presumptively fraudulent,” his lawyers said in the filing. They added that Bankman-Fried’s need to pay his legal bills is greater than the “economic loss” that FTX faces, citing several legal precedents; we are confident that FTX clients … Read more at: https://www.zerohedge.com/markets/sbf-seeks-access-450-million-seized-robinhood-shares-pay-his-legal-fees |

|

Who Would Benefit From A Severe Global Recession?Authored by Charles Hugh Smith via OfTwoMinds blog, As painful as this liquidation and repricing of risk is for borrowers and lenders, those without debt, those with cash and those with essential skills that are in demand regardless of boom or bust will all benefit.

Who would benefit from a severe global recession? The typical answer is “no one,” as a drop in economic activity is assumed to hurt everyone. But it’s not quite that simple; there are silver linings for some in all those dark clouds. When demand for energy plummets, the price of oil tends to drop dramatically. There are several reasons for this:

|

|

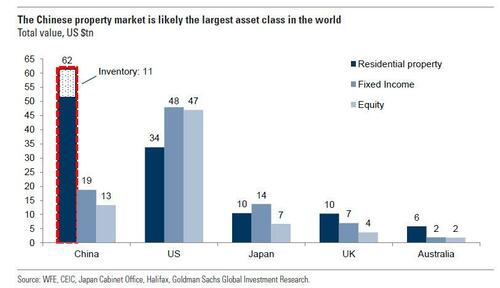

In Huge Policy Reversal, China Will Ease “Three Red Lines” Rule To Kickstart World’s Biggest Asset BubbleBack in 2020, around the time Xi Jinping decided to burst the Chinese housing bubble, which as a reminder was estimated by Goldman at the time to be the world’s single largest asset class (and bubble) at over $62 trillion, larger than either the US equity and bond markets…

… China unveiled the so-called “three red lines” policy, which sought to reduce developers’ leverage, lower risk in the financial sector and make homes more affordable as part of President Xi Jinping’s common prosperity push and practically meant that only companies that have very little debt (which basically meant nobody) were allowed to grow their debt at a max of 15%, and since most Chinese developers were in the 2 or 3 red lines category, it prohibited them from growing debt (a full breakdown of the three criteria is shown below), Read more at: https://www.zerohedge.com/markets/huge-policy-reversal-china-will-ease-three-red-lines-rule-kickstart-worlds-biggest-asset |

|

Train drivers offered pay rise in bid to end strikesThe Rail Delivery Group says its offer would see wages for drivers rise by £5,000 by the end of 2023. Read more at: https://www.bbc.co.uk/news/business-64191654?at_medium=RSS&at_campaign=KARANGA |

|

Strike daily: How Saturday 7 January’s train strikes will affect youWhat you need to know about the rail strike and other industrial action, by the BBC’s Zoe Conway. Read more at: https://www.bbc.co.uk/news/business-64177886?at_medium=RSS&at_campaign=KARANGA |

|

BA unveils jumpsuits in first uniform revamp for 20 yearsThe airline has updated its workwear for the first time in 20 years with designs by Ozwald Boateng. Read more at: https://www.bbc.co.uk/news/business-64184902?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty forms Inside Bar candle on weekly charts. What traders should do next weekWeak global cues are largely weighing on sentiment in the absence of any major trigger from the domestic front. We may see some breather in the Nifty index after the recent slide but the tone is likely to remain negative, citing the weak structure of several index heavyweights. Participants should align their positions accordingly while keeping a check on leveraged trades Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-inside-bar-candle-on-weekly-charts-what-traders-should-do-next-week/articleshow/96794124.cms |

|

Chart Check: After 30% returns in 3 months, trendline breakout makes REC an attractive buyThe stock bottomed out near 80 levels when it hit a 52-week low of Rs 83 on 20 June 2022. The stock has been making higher highs and higher lows on the monthly charts for the past 4 months. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/chart-check-after-30-returns-in-3-months-trendline-breakout-makes-rec-an-attractive-buy/articleshow/96785679.cms |

|

Nifty valuation undoubtedly challenging: Chris Wood of Jefferies“If Asia looks better in aggregate on comparative valuations, there is one market where valuations are undoubtedly challenging. That is GREED & fear’s long-term favourite, India. The Nifty index now trades at 18.8x 12-month forward earnings, compared with a historic 10-year average of 17.2x,” Wood said in his weekly note. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nifty-valuation-undoubtedly-challenging-chris-wood-of-jefferies/articleshow/96783355.cms |

|

Market Extra: What stock-market investors need to know about the ‘January Indicator Trifecta’The U.S. stock market got off to a bumpy start in 2023. A bearish backdrop means investors looking to a popular January indicators to clues to how the year will pan out should approach the data with caution, analysts said. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7176-2FAD38D0A1BA%7D&siteid=rss&rss=1 |

|

Revolution Investing: No one’s having fun in the stock market these days, and that might be a sign that a bottom is nearWhen apathy sets in, it will be time to begin buying tech stocks again. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7178-7F3CB3F1C3D3%7D&siteid=rss&rss=1 |

|

Earnings Watch: Banks gain favor in risk-off environment but earnings uncertainty remainsJPMorgan Chase, Wells Fargo, Citi and Bank of America are on deck to provide fourth-quarter results next Friday, while Goldman and Morgan Stanley report on Jan. 17. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7177-E10174A1F466%7D&siteid=rss&rss=1 |