Summary Of the Markets Today:

- The Dow closed up 133 points or 0.40%,

- Nasdaq closed up 0.69%,

- S&P 500 up 0.75%,

- WTI crude oil settled at $73 down $3.88,

- USD $104.29 down $0.23,

- Gold $1859 up $13.00,

- Bitcoin $16,798 up 0. 85% – Session Low 16,649,

- 10-year U.S. Treasury 3.683% down 0.111 points

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for January 2023

Today’s Economic Releases:

The number of job openings was little changed at 10.5 million on the last business day of November. Over the month, the number of hires and total separations changed little at 6.1 million and 5.9 million, respectively. Historically, hires and separations do not provide clues of the future of the economy or employment. On the other hand, job openings can, and the below graph demonstrates how year-over-year negative growth affects employment and forewarns of a recession,

Are you wondering whether deflation is in the cards? A recent post by Elliott Wave International discussing this subject offers insight stating: “Inflation is an increase in the total amount of money and credit, and deflation is a decrease in the total amount of money and credit.” The money supply is currently shrinking.

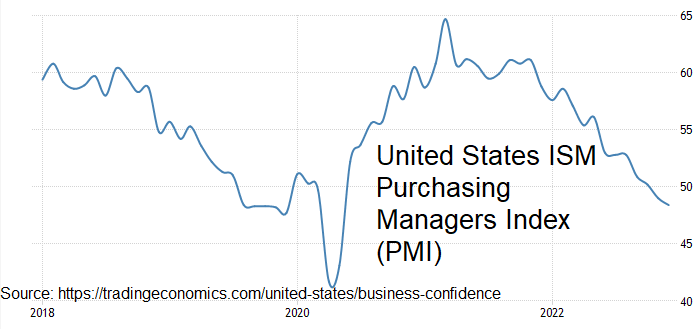

The December 2022 Manufacturing PMI registered 48.4%, 0.6 percentage points lower than the 49.0% recorded in November. Regarding the overall economy, this figure indicates contraction after 30 straight months of expansion. The Manufacturing PMI figure is the lowest since May 2020, when it registered 43.5%.

The Federal Reserve FOMC minutes for their meeting held on December 13–14, 2022 were released today. Highlights:

…. participants noted that recent indicators pointed to modest growth of spending and production. Nonetheless, job gains had been robust in recent months, and the unemployment rate had remained low. Inflation remained elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures …

… With inflation remaining unacceptably high, participants expected that a sustained period of below-trend real GDP growth would be needed to bring aggregate supply and aggregate demand into better balance and thereby reduce inflationary pressures. … [editor’s note: anyone thinking the fed’s tightening policies will be relaxed in 2023 may be disappointed]

… participants noted that growth in consumer spending in September and October had been stronger than they had previously expected, likely supported by a strong labor market and households running down excess savings accumulated during the pandemic. A couple of participants remarked that excess savings likely would continue to support consumption spending for a while. A couple of other participants, however, commented that excess savings, particularly among low-income households, appeared to be lower and declining more rapidly than previously thought or that the savings, the majority of which appeared to be held by higher-income households, might continue to be largely unspent …

… With inflation still well above the Committee’s longer-run goal of 2 percent, participants agreed that inflation was unacceptably high. Participants concurred that the inflation data received for October and November showed welcome reductions in the monthly pace of price increases, but they stressed that it would take substantially more evidence of progress to be confident that inflation was on a sustained downward path. Participants noted that core goods prices declined in the October and November CPI data, consistent with easing supply bottlenecks. Some participants also noted that, by some measures, firms’ markups were still elevated and that a continued subdued expansion in aggregate demand would likely be needed to reduce remaining upward pressure on inflation …

… A few participants remarked that the current configuration of nominal yields, with longer-term yields lower than shorter-term yields, had historically preceded recessions and hence bore watching. However, a couple of them also noted that the current inversion of the yield curve could reflect, in part, that investors expect the nominal policy rate to decline because of a fall in inflation over time …

… No participants anticipated that it would be appropriate to begin reducing the federal funds rate target in 2023. Participants generally observed that a restrictive policy stance would need to be maintained until the incoming data provided confidence that inflation was on a sustained downward path to 2 percent, which was likely to take some time. In view of the persistent and unacceptably high level of inflation, several participants commented that historical experience cautioned against prematurely loosening monetary policy …

A summary of headlines we are reading today:

- Is China Overly Reliant On Middle Eastern Oil?

- U.S. Natural Gas Prices Rise 4% After Huge Selloff

- GM reclaims title as America’s top automaker after a 2.5% jump in sales last year

- Mortgage demand plunges 13.2% to end 2022, as interest rates head higher again

- Where to keep your cash amid high inflation and rising interest rates: It’s ‘a little tricky,’ says expert

- Ford says the F-Series pickup continued its decades-long dominance in 2022

- BofA’s stock indicator is the closest it’s been to ‘buy’ since 2017

- Futures Movers: Oil futures settle at a more than 3-week low on worries over the global growth outlook

- These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

U.S. Oil Majors Focus On Cost Discipline In Spending PlansAs Exxon and Chevron focus more on shareholder returns and less on speculative spending, they are both reining in investments in large international oil projects and focusing more on investing in the Americas. Chevron says it’ll use 70% of its capital allocation for production on oil fields in the U.S., Argentina, and Canada, while Exxon says they will allocate a similar portion of their budget to places like the Permian Basin, Brazil, and LNG projects, The Wall Street Journal reported this week. Both companies are moving out of places like Asia, Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Majors-Focus-On-Cost-Discipline-In-Spending-Plans.html |

|

Is China Overly Reliant On Middle Eastern Oil?In recent years, China’s dependence on Middle Eastern crude oil has been increasing. With much of the world relying on China for a wide array of products, China’s vulnerability is also a global vulnerability. Until China is able to find a way to diversify its suppliers to mitigate risk, this overreliance on Middle Eastern oil is likely to have an outsized impact on both geopolitics and oil markets. A report published in December 2021 revealed that China’s reliance on Middle Eastern oil was increasing. China is the world’s Read more at: https://oilprice.com/Energy/Energy-General/Is-China-Overly-Reliant-On-Middle-Eastern-Oil.html |

|

U.S. Natural Gas Prices Rise 4% After Huge SelloffU.S. Natural gas prices had rebounded by nearly 4% as of midday Wednesday after five consecutive days of sell-off when it became clear that predictions of a supply squeeze were wrong. Henry Hub natural gas futures were trading at $4.145 at 1.38 p.m. EST, up nearly 4% on the day, after gaining as much as 5% earlier in the day. For the five days prior, Henry Hub natural gas futures had been trading below $4 and had lost one-quarter of their value. Now, prices will be waiting on Thursday’s weekly gas storage data from the Energy Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Natural-Gas-Prices-Rise-4-After-Huge-Selloff.html |

|

Ripe For Disruption: U.S. Power Generators Must ActWinter storm Elliott, a mass of frigid, arctic air and blizzard conditions enveloped much of the eastern two-thirds of the US with the worst of it hitting the US on December 22- 25. In its wake, over 200 million Americans were adversely affected and almost 100 died. We wrote about our concerns here on December 20th focusing on Texas. The biggest worry was whether natural gas producers and processors had adequately weatherized key systems, steps required by the Texas Railroad Commission after the previous storm in February 2021. Bottom line: the Read more at: https://oilprice.com/Energy/Energy-General/Ripe-For-Disruption-US-Power-Generators-Must-Act.html |

|

Chevron CEO Pushes Back On Biden Claims Of War ProfiteeringThe oil industry generates around 10% returns on capital employed through the cycle, Chevron’s chief executive Mike Wirth told Bloomberg Television, pushing back on the persistent accusations by the Biden Administration that oil companies are profiteering from the surge in prices after the Russian invasion of Ukraine. Through the cycle, it’s an industry that generates 10%-ish returns on capital employed, which is I think, by the standards of many other industries, a pretty modest return, Wirth told The Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-CEO-Pushes-Back-On-Biden-Claims-Of-War-Profiteering.html |

|

Are Bidens Emissions Reduction Efforts Paying Off?As part of the U.S. aim to achieve net-zero carbon emissions by 2050, as it gradually decarbonizes the economy between now and then, President Biden is adamant that the federal government should be leading by example. As well as introducing several climate policies during his time in government, most recently the Inflation Reduction Act (IRA), he has pledged to reduce government carbon emissions substantially over the next decade by introducing a variety of carbon-cutting measures. Under his administration, the federal government will begin Read more at: https://oilprice.com/Energy/Energy-General/Are-Bidens-Emissions-Reduction-Efforts-Paying-Off.html |

|

GM reclaims title as America’s top automaker after a 2.5% jump in sales last yearGM said Wednesday it sold 2.27 million vehicles in the U.S. in 2022, up by 2.5% for the year. Read more at: https://www.cnbc.com/2023/01/04/general-motors-gm-sales-q4-2022.html |

|

Rivian stock hits new 52-week low after the automaker misses 2022 production targetRivian said it produced 24,337 vehicles last year, slightly missing its 25,000 target. Read more at: https://www.cnbc.com/2023/01/04/rivian-stock-hits-new-52-week-low-after-missing-2022-production-target.html |

|

Mortgage demand plunges 13.2% to end 2022, as interest rates head higher againMortgage application volume was down 13.2% at the end of last week from two weeks earlier as interest rates rose again. Read more at: https://www.cnbc.com/2023/01/04/mortgage-demand-plunges-interest-rates-rise.html |

|

Stellantis beefs up commitment to electric flying vehicle company Archer AviationStellantis will help Archer manufacture its first electric flying vehicle model and invest up to $150 million in the start-up. Read more at: https://www.cnbc.com/2023/01/04/stellantis-archer-aim-to-deliver-electric-flying-cars-by-2025.html |

|

Manhattan apartment sales plunge in the fourth quarter as brokers fear a frozen marketManhattan real estate brokers are concerned both buyers and sellers are staying on the sidelines. Read more at: https://www.cnbc.com/2023/01/04/manhattan-apartment-sales-plunge-q4-brokers-fear-frozen-market.html |

|

Upstart Chinese electric car brand delivered more cars than Nio in 2022Another budget-priced electric car brand is taking off in China, this time selling compact SUVs. Read more at: https://www.cnbc.com/2023/01/04/upstart-chinese-electric-car-brand-delivered-more-cars-than-nio-in-2022.html |

|

Where to keep your cash amid high inflation and rising interest rates: It’s ‘a little tricky,’ says expertThere are many options when saving for short-term goals, and it’s trickier amid high inflation and rising interest rates. Here’s what savers need to know. Read more at: https://www.cnbc.com/2023/01/04/where-to-keep-your-cash-amid-high-inflation-and-rising-interest-rates.html |

|

Share of new car buyers with a monthly payment of more than $1,000 hits record highHigh prices and rising interest rates are causing an affordability problem for many car shoppers. Read more at: https://www.cnbc.com/2023/01/04/share-of-car-buyers-with-monthly-payments-over-1000-hits-record-high.html |

|

Paramount sued for $500 million over 1968 ‘Romeo & Juliet’ nude sceneTwo stars of the 1968 film adaptation of “Romeo & Juliet” have sued Paramount Pictures for more than $500 million over a nude scene the actors shot as teens. Read more at: https://www.cnbc.com/2023/01/04/paramount-sued-for-500-million-over-1968-romeo-juliet-nude-scene.html |

|

Stocks making the biggest moves midday: Wynn Resorts, Microsoft, Honeywell, Salesforce and moreThese are the stocks posting the largest moves midday. Read more at: https://www.cnbc.com/2023/01/04/stocks-making-the-biggest-moves-midday-wynn-resorts-microsoft-honeywell-salesforce-and-more.html |

|

XBB.1.5 omicron subvariant is the most transmissible version of Covid yet, WHO saysThe WHO does not have any data yet on the severity of XBB.1.5, but there’s no indication it makes people sicker than previous subvariants, top official said. Read more at: https://www.cnbc.com/2023/01/04/xbbpoint1point5-omicron-subvariant-is-the-most-transmissible-version-of-covid-yet-who-says.html |

|

Endeavor shares fall after video shows UFC boss Dana White hitting wife on New Year’s EveEndeavor, run by super-agent Ari Emanuel, took full ownership of Dana White-run UFC in 2021. Read more at: https://www.cnbc.com/2023/01/03/endeavor-stock-ufc-dana-white-hits-wife-video.html |

|

Ford says F-Series pickup continued its decades-long dominance in 2022Ford Motor reported sales of its F-Series, which includes the F-150 pickup and its larger siblings, surpassed 640,000 trucks last year. Read more at: https://www.cnbc.com/2023/01/03/ford-f-series-2022-sales-show-pickup-continued-decades-long-dominance.html |

|

Exxon And Chevron Curb International Projects As Focus Turns To Cost DisciplineAs Exxon and Chevron focus more on shareholder returns and less on speculative spending, they are both reining in investments in large international oil projects and focusing more on investing in the Americas. Chevron says it’ll use 70% of its capital allocation for production on oil fields in the U.S., Argentina, and Canada, while Exxon says they will allocate a similar portion of their budget to places like the Permian Basin, Brazil, and LNG projects, The Wall Street Journal reported this week. Both companies are moving out of places like Asia, West Africa, Russia and parts of Latin America, the report says. Ben Cahill, a senior fellow at the Center for Strategic and International Studies, a Washington think tank, told The Wall Street Journal: “The cases of them going to new countries are few and far between. It’s a natural consequence of investors demanding higher returns. Companies are being more selective.” It marks the end of an era where oil companies would search globally for oil to add to their booked reserves. Exxon has already sold or proposed to sell assets in Chad, Cameroon, Egypt, Iraq, and Nigeria, the report says. They mark the largest sales for the company since 2018 and come as part of an overall plan to try and offload at least $15 billion in assets. Read more at: https://www.zerohedge.com/markets/exxon-and-chevron-curb-international-projects-focus-turns-cost-discipline |

|

Border Wall Dismantled In Arizona As Katie Hobbs Becomes GovernorAuthored by Tom Ozimek via The Epoch Times, Arizona has started to dismantle its makeshift border wall made of shipping containers that was championed by former Gov. Doug Ducey but faced opposition from newly minted Gov. Katie Hobbs and were the target of a Biden administration lawsuit.

Footage taken on Jan. 3 showed construction machinery removing a line of shipping containers placed along the U.S.–Mexico border in Yuma, Arizona, which coincided with the day Hobbs was sworn in as governor. Ducey, who in mid-December agreed t … Read more at: https://www.zerohedge.com/political/border-wall-dismantled-arizona-katie-hobbs-becomes-governor |

|

China Calls UN Security Council Meeting Over Israel Minister’s Al-Aqsa VisitChina and the United Arab Emirates have called for a UN Security Council meeting at a moment tensions in Jerusalem are poised to explode, given growing Palestinian outrage in response to Israel’s new far-right National Security Minister Itamar Ben-Gvir having entered the al-Aqsa Mosque compound this week in a hugely controversial move. Jewish firebrand leader Ben-Gvir was just sworn into his post last week as part of PM Netanyahu’s governing coalition, widely seen as the most far-right in Israel’s history, and his first act as national security chief came Tuesday with the highly provocative visit to the Jerusalem mosque, revered by Muslims across the globe as the third holiest site in Islam, only after Mecca and Medina.

A UN council to address the issue and ongoing tensions is expected to convene Thursday, UN sources told Reuters. Arab countries including Egypt, Jordan, Saudi Arabia and UAE were quick to condemn the move, and also Tu … Read more at: https://www.zerohedge.com/geopolitical/china-calls-un-security-council-meeting-over-israel-ministers-al-aqsa-visit |

|

Rickards: On The Cusp Of A Global Liquidity CrisisAuthored by James Rickards via DailyReckoning.com, Is there a financial calamity worse than a severe recession in early 2023? Unfortunately, the answer is “yes” and it’s coming quickly.

That greater calamity is a global liquidity crisis. Before considering the dynamics of a global liquidity crisis, it’s critical to distinguish between a liquidity crisis and a recession. A recession is part of the business cycle. It’s characterized by higher unemployment, declining GDP growth, inventory liquidation, business failures, reduced discretionary spending by consumers, reduced business investment, higher savings rates (for those still employed), larger loan losses, and declining asset prices in stocks and real estate. The length and depth of a recession can vary widely. And although recessions have certain common characteristics, they also have diverse causes. Sometimes the Fed … Read more at: https://www.zerohedge.com/markets/rickards-cusp-global-liquidity-crisis |

|

Strike daily: How Thursday 5 January’s walkouts will affect youWhat you need to know about the rail strike and other industrial action this week, by the BBC’s Zoe Conway. Read more at: https://www.bbc.co.uk/news/business-64163453?at_medium=RSS&at_campaign=KARANGA |

|

Meta fined €390m over use of data for targeted adsThe EU data watchdog says the way Meta obtained permission to process users’ data for ads broke data law. Read more at: https://www.bbc.co.uk/news/technology-64153383?at_medium=RSS&at_campaign=KARANGA |

|

Warm winter may lower energy bills later this yearForecasts suggest bills for households may drop later in the year, although a rise in April remains certain. Read more at: https://www.bbc.co.uk/news/business-64162811?at_medium=RSS&at_campaign=KARANGA |

|

BofA’s stock indicator is the closest it’s been to ‘buy’ since 2017One reason we are more constructive on equities in 2023 is the big drop in sentiment during 2022,” Bank of America’s strategists including Savita Subramanian wrote in note to clients. “It has been a bullish signal when Wall Street strategists were extremely bearish, and vice versa. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/bofas-stock-indicator-is-the-closest-its-been-to-buy-since-2017/articleshow/96724859.cms |

|

Looking for ideas to invest Rs 10 lakh this year? Here are a few allocation tips by expertsSecondly, we must remember the fundamental principle of finance that risk and return go hand in hand. We are constantly trying to achieve that ideal point where the return on investment is highest. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/looking-for-ideas-to-invest-rs-10-lakh-this-year-here-are-a-few-allocation-tips-by-experts/articleshow/96727454.cms |

|

Coronavirus Update: As EU works to coordinate response to China’s COVID wave, Beijing and airlines are unhappyEU officials are working to coordinate a response to China’s current wave of COVID cases and are likely to mandate tests for travelers. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7175-406FEDA02C6D%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil futures settle at a more than 3-week low on worries over the global growth outlookOil futures settled Wednesday at a more than three-week low on fears over the outlook for global economic growth and surging COVID cases in China. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7175-1CA969560FA6%7D&siteid=rss&rss=1 |

|

If federal employees keep working from home, D.C. mayor says White House should flip ‘vast property holdings’ to residential use. How would that work?D.C. Mayor Muriel Bowser said as she was sworn in for a third term Monday that converting office space into housing could be a huge help. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7174-F02F027974E2%7D&siteid=rss&rss=1 |