Summary Of the Markets Today:

- The Dow closed down 143 points or 0.42%,

- Nasdaq closed down 0.76%,

- S&P 500 closed down 0.61%,

- Gold $1819 down $6.30,

- WTI crude oil settled at $77 up $1.98,

- 10-year U.S. Treasury 3.476% down 0.026 points,

- USD index $103.63 down $0.35,

- Bitcoin $17,827 up $54.60

Click here to read our Economic Forecast for December 2022

Today’s Economic Releases:

U.S. import prices moderated in November 2022 to 2.7% year-over-year from 4.1% the previous month. Lower nonfuel and fuel prices contributed to the November decline in U.S. import prices. U.S. export prices also moderated to 6.3% from 7.4% the previous month. Lower nonagricultural prices in November more than offset higher agricultural prices. This is another sign that inflation is moderating.

A summary of headlines we are reading today:

- WTO Ruling Reignites U.S.-China Trade Spat

- Fed Raises Interest Rates By Half Percentage Point

- Here’s what changed in the new Fed statement

- Fed interest rate hike sends business loans to steepest cost since 2007, breaking 10% sticker shock level

- Another Big Reversal FOMC Day: Markets Call Hawkish Fed’s Bluff

- Powell Opens The Door To Higher Inflation Target “As Part Of A Longer-Term Project”

- Deportations Plunge Under Biden In US Interior: Data

- Fed hikes rates again and warns of more rises

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

WTO Ruling Reignites U.S.-China Trade SpatBy AG Metal Miner In the latest US steel news, a WTO ruling has sparked a new war of words between the United States and China. Last weekend, the WTO finally ruled on the 25% taxes on global steel imports and 10% import tariffs on aluminum imposed under former US President Donald Trump. The WTO dispute settlement panel ruled that these taxes violated their rules. That was enough for China, the most affected party, to lambast the US for its protectionist policies. They also asked the country to correct its wrongdoings and work with Read more at: https://oilprice.com/Geopolitics/International/WTO-Ruling-Reignites-US-China-Trade-Spat.html |

|

What’s Next For The EU’s Eastern Partnership?On December 12, the foreign ministers of Armenia, Azerbaijan, Georgia, Moldova, and Ukraine will meet (via video link) with their 27 EU counterparts in Brussels for a scheduled three-hour “Eastern Partnership (EaP) foreign ministers meeting.” Few concrete outcomes are expected — and the question likely on the minds of many politicians and bureaucrats is whether the Eastern Partnership has outlived its purpose. Created back in 2009 after a Polish-Swedish initiative, the EaP aimed to bring six former Soviet republics closer to the bloc without the Read more at: https://oilprice.com/Energy/Energy-General/Whats-Next-For-The-EUs-Eastern-Partnership.html |

|

Fed Raises Interest Rates By Half Percentage PointThe Federal Reserve raised interest rates by half a percentage point at the conclusion of its two-day meeting Wednesday, in a move that represents a shrinking of the magnitude of rate hikes after Tuesday CPI data showing inflation had easy to 7.1% in the 12 months to November. While the Federal Reserve Chairman was still speaking as of 2:22 p.m. EST, with investors paying close attention to any indications about future Fed policy, CNBC cited NatWest strategist John Briggs as calling the speech hawkish so far, referring to the Read more at: https://oilprice.com/Latest-Energy-News/World-News/Fed-Raises-Interest-Rates-By-Half-Percentage-Point.html |

|

Georgia Aims To Resume Construction Of Controversial Deep Sea PortGeorgia’s government says it will revive a multi-billion-dollar deep sea port project at Anaklia, on the Black Sea coast, as the country sees a steep rise in demand for cargo transportation amid Russia’s war on Ukraine. Prime Minister Irakli Garibashvili announced on December 12 that the state will own a controlling share in the new port, though he provided few details about how the project would be financed. The decision comes almost three years after Tbilisi withdrew from Anaklia amid political controversy and fears of the economic Read more at: https://oilprice.com/Geopolitics/International/Georgia-Aims-To-Resume-Construction-Of-Controversial-Deep-Sea-Port.html |

|

Investors Run For Exit As Brazil Lets Politicians Run State-Run FirmsBrazilian financial markets were left in turmoil after the lower house of Congress voted late on Tuesday to make it easier for politicians to take roles at state-run firms, causing a market rout on Wednesday, Reuters reports. The bill, which now heads to the Senate, seeks to cut the quarantine for people with decision-making roles in political parties or electoral campaigns to take positions at state-owned companies from 36 months to just one month. Shares in state-run firms were some of the hardest hits, with oil company Petroleo Brasileiro Read more at: https://oilprice.com/Latest-Energy-News/World-News/Investors-Run-For-Exit-As-Brazil-Lets-Politicians-Run-State-Run-Firms.html |

|

China’s Reopening Sparks A Surge In Air TravelBeijing’s abrupt end to zero Covid policies that shuttered factories and cities and crushed economic growth in the world’s second-largest economy has produced at least one of the first signs of green shoots: Air travel rebound. Chinese aviation data company VariFlight reported domestic flight activity soared to 65% of pre-pandemic levels Monday, from only 22% on Nov. 29, according to Bloomberg. Thousands of flights are returning to the skies as air travel demand rebounds ahead of Lunar New Year next month. Surging air travel demand is expected Read more at: https://oilprice.com/Energy/Energy-General/Chinas-Reopening-Sparks-A-Surge-In-Air-Travel.html |

|

‘Avatar: The Way of Water’ could be heading for a $175 million box office openingThe long-awaited sequel “Avatar: The Way of Water” is set to snare between $150 million and $175 million domestically during its opening weekend. Read more at: https://www.cnbc.com/2022/12/14/avatar-the-way-of-water-heads-for-175-million-box-office-opening.html |

|

Delta expects 2023 earnings to nearly double thanks to ‘robust’ travel demandDelta expects its adjusted earnings to nearly double to as much as $6 per share next year, above analysts’ estimates. Read more at: https://www.cnbc.com/2022/12/14/delta-2023-earnings-forecast-sees-robust-travel-demand.html |

|

Mortgage demand inches higher as interest rates move lowerBorrowers are finally reacting to lower mortgage rates, boosting demand for both refinances and loans to purchase homes. Read more at: https://www.cnbc.com/2022/12/14/mortgage-demand-inches-higher-as-interest-rates-move-lower-.html |

|

Dollar General’s new Popshelf stores chase inflation-weary shoppers in the suburbsDollar General said it sees opportunity to grow to 3,000 Popshelf stores across the country. Read more at: https://www.cnbc.com/2022/12/13/inflation-dollar-general-chases-suburban-shoppers-popshelf.html |

|

Ford boosts production of electric F-150 Lightning pickup truckFord Motor has added a third production shift to its Michigan plant that produces the electric F-150 Lightning as it looks to boost output. Read more at: https://www.cnbc.com/2022/12/13/ford-moves-to-boost-production-of-electric-f-150-lightning-pickup-truck.html |

|

‘Harry & Meghan’ becomes Netflix’s biggest-ever documentary debutNetflix’s documentary series about Britain’s Prince Harry and his wife, Meghan, has become the streaming platform’s biggest documentary debut yet. Read more at: https://www.cnbc.com/2022/12/14/harry-and-meghan-biggest-netflix-documentary-debut.html |

|

Here’s what changed in the new Fed statementThis is a comparison of Wednesday’s Federal Open Market Committee statement with the one issued after the Fed’s previous policymaking meeting on Nov. 2. Read more at: https://www.cnbc.com/2022/12/14/heres-what-changed-in-decembers-federal-reserve-statement.html |

|

Fed interest rate hike sends business loans to steepest cost since 2007, breaking 10% sticker shock levelThe Fed rate hike of half a percentage point moves the Prime Rate to a level that means business owners will be paying 10%-plus interest on debt. Read more at: https://www.cnbc.com/2022/12/14/fed-rate-hike-pushes-business-loans-over-10percent-for-first-time-since-2007.html |

|

Health insurance is helping cool inflation. But ‘it’s not a very good reflection’ of what people pay, cautions economistHealth insurance prices deflated the last two months, per the consumer price index, and are poised to fall more. That may not reflect what consumers pay. Read more at: https://www.cnbc.com/2022/12/14/heres-how-health-insurance-is-helping-to-cool-inflation.html |

|

Stocks making the biggest moves midday: SoFi Technologies, Charter Communications, Delta and moreThese are the stocks posting the largest moves midday. Read more at: https://www.cnbc.com/2022/12/14/stocks-making-the-biggest-moves-midday-sofi-technologies-charter-communications-delta-and-more.html |

|

Jim Cramer’s Investing Club meeting Wednesday: Fed decision, Qualcomm, Eli LillyThe Investing Club holds its “Morning Meeting” every weekday at 10:20 a.m. ET. Read more at: https://www.cnbc.com/2022/12/14/jim-cramers-investing-club-meeting-wednesday-fed-decision-qualcomm.html |

|

Billionaire Ken Griffin sues the IRS after his tax records were disclosedBillionaire Ken Griffin has sued the IRS and the Treasury Department over the “unlawful disclosure” of his tax information. Read more at: https://www.cnbc.com/2022/12/13/billionaire-ken-griffin-sues-irs-over-tax-disclosure.html |

|

Tesla shares have fallen 28% since Elon Musk took over Twitter, lagging other carmakersMusk sold billions of dollars worth of his Tesla holdings to finance the Twitter takeover and has been embroiled in controversy ever since. Read more at: https://www.cnbc.com/2022/12/13/tesla-stock-down-28percent-since-elon-musk-took-over-twitter.html |

|

Another Big Reversal FOMC Day: Markets Call Hawkish Fed’s BluffThe day started off with a drop in import and export price inflation. But that was just a side-show as stocks limped higher into the main event. Then The Fed and Powell’s presser smashed the vase of fantasy on the ground of reality with a hawkish statement and projections and an even more hawkish Powell. POWELL: LABOR MARKET REMAINS EXTREMELY TIGHT POWELL: A RESTRICTIVE POLICY STANCE LIKELY NEEDED FOR SOME TIME POWELL: NEED SUBSTANTIALLY MORE EVIDENCE OF LOWER INFLATION POWELL: FED STILL HAS SOME WAYS TO GO ON RATE HIKES POWELL: STANCE ISN’T YET RESTRICTIVE ENOUGH EVEN W/ TODAY’S MOVE POWELL: NO RATE CUTS UNTIL CONFIDENT INFLATION MOVING TOWARD 2% POWELL: WILL HAVE TO HOLD RESTRICTIVE RATES FOR SUSTAINED TIME All of which sent rate-hike expectations surging, but they gave back some of that hawkishness as Powell spoke… Read more at: https://www.zerohedge.com/markets/markets-swing-wildly-hawkish-powell-pummels-pause-narrative-then-opens-door |

|

Powell Opens The Door To Higher Inflation Target “As Part Of A Longer-Term Project”While Powell showered the market with trite platitudes, eager to convince the market that the market is wrong in expecting the Fed to not only push the economy into a recession, but to end 2023 with a 5.1% rate (the market-implied rate is 4.36%, more than 70bps below the Fed’s forecast anticipating at least one rate cut from the current level), the most important exchange at the Powell press conference took place when someone asked the central banker if the Fed’s 2% inflation target would be changed (a topic of great significance, and one which we have covered extensively here, here and here). So what did Powell respond? Well, at first blush, nothing one didn’t expect and certainly nothing that could have crushed the Fed’s credibility in a millisecond (because that’s precisely what raising the inflation target from 2% to 3% will do, not to mention pushing gold from $1800 to $10,000 and bitcoin limit up). Indeed, the word salad out of Powell’s mouth was best summarized by the Fed chair’s own mouthpiece, WSJ’s Nick Timiraos: “Powell on changing the Fed’s 2% inflation target: “We’re not going to consider that under any circumstances.”

|

|

Deportations Plunge Under Biden In US Interior: DataAuthored by Zachary Stieber via The Epoch Times (emphasis ours), Deportations have plunged by up to 100 percent in U.S. counties under President Joe Biden, according to newly released data.

The Center for Immigration Studies, which obtained and released the data, pointed to Howard County, Texas, as an example. In the county, which has about 35,000 residents, 655 illegal aliens were removed from January through September 2019, when President Donald Trump was in … Read more at: https://www.zerohedge.com/political/deportations-plunge-under-biden-us-interior-data |

|

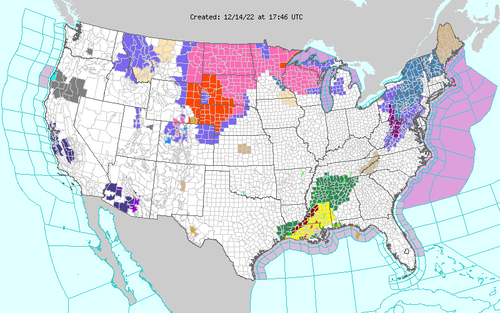

Coast-To-Coast Winter Storm Sets Crosshairs On NortheastA destructive storm traversing the US unleashed blizzard conditions across parts of the Great Plains, spawned deadly tornadoes in the South, and has the Northeast in its crosshairs later this week.

Eastern Wyoming, western South Dakota, western Nebraska, and southeastern Montana have blizzard warnings for the second day Wednesday.

To the south, the huge storm unle … Read more at: https://www.zerohedge.com/weather/coast-coast-winter-storm-sets-crosshairs-northeast |

|

Who is striking? How Thursday 15 December’s walkouts will affect youWhat you need to know about the nurses’ strike in England, Wales and NI – by the BBC’s Zoe Conway. Read more at: https://www.bbc.co.uk/news/uk-63976253?at_medium=RSS&at_campaign=KARANGA |

|

Fed hikes rates again and warns of more risesThe US central bank raised its key interest rate by 0.5 percentage points. Read more at: https://www.bbc.co.uk/news/business-63977120?at_medium=RSS&at_campaign=KARANGA |

|

Twitter suspends @ElonJet account that tracked owner Elon Musk’s private planeTwitter owner Elon Musk had previously said he would not take the step as he values free speech. Read more at: https://www.bbc.co.uk/news/world-us-canada-63978323?at_medium=RSS&at_campaign=KARANGA |

|

Nifty forms doji candle. What traders should do on Thursday“Nifty is now placed at the crucial resistance of 18,650 level and is not showing any strength to surpass the hurdle decisively. A sustainable up move from here could confirm an upside breakout of the resistance and any failure is likely to result in minor downward correction ahead,” said Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-doji-candle-on-daily-charts-what-traders-should-do-on-thursday/articleshow/96227498.cms |

|

This PSU bank stock doubled in just one month. What’s driving the rally?Morgan Stanley analysts said PSU banks should see relatively higher margin expansion compared to many private banks over F22-F24, reflecting a higher starting point of liquidity, sharp moderation in NPA formation, reducing interest income reversals and lower share of wholesale deposits relative to select private banks. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/this-psu-bank-stock-doubles-in-just-one-month-whats-driving-the-rally/articleshow/96218899.cms |

|

Two-day Finbridge Expo to be held in Mumbai on December 17-18Catering exclusively to the financial services & technology industry, Finbridge Expo has become a mainstream platform for many financial service providers to showcase their products and services. The event would be held from December 17-18 at Nehru Centre, Worli, Mumbai from 17th – 18th December. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/two-day-finbridge-expo-to-be-held-in-mumbai-on-december-17-18/articleshow/96222104.cms |

|

After the Fed, the ECB and the Bank of England are set to lift interest rates. Here’s what to expect.The BoE will deliver its decision at 7 a.m. and the ECB at 8:15 a.m. Eastern on Thursday. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7168-DBEAE4F2CC4D%7D&siteid=rss&rss=1 |

|

Market Extra: U.S. bonds wrap up worst year on record. Here’s what may be in store for 2023.Analysts see inflation easing further off four-decade highs in 2023, obviating the need for the Federal Reserve to keep aggressively hiking rates next year. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7164-7EFC90457420%7D&siteid=rss&rss=1 |

|

The Margin: It’s Argentina vs. France in the World Cup final: Here’s everything to know about the matchYour guide to the kickoff time, who’s favored to win and more. The teams, led by Lionel Messi and Kylian Mbappé, were favorites heading into the tournament. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7169-51D092CF03AE%7D&siteid=rss&rss=1 |

Illegal immigrants wait in a holding cell at a U.S. Immigration and Customs Enforcement (ICE) processing center on April 11, 2018. (John Moore/Getty Images)Deportations, or the removal of illegal immigrants, have dropped by as much as 95 percent in U.S. states, the data show. And in counties across the country, far fewer illegal aliens are being kicked out of the country.

Illegal immigrants wait in a holding cell at a U.S. Immigration and Customs Enforcement (ICE) processing center on April 11, 2018. (John Moore/Getty Images)Deportations, or the removal of illegal immigrants, have dropped by as much as 95 percent in U.S. states, the data show. And in counties across the country, far fewer illegal aliens are being kicked out of the country.