Summary Of the Markets Today:

- The Dow closed down 305 points or 0.90%,

- Nasdaq closed down 0.70%,

- S&P 500 down 0.73%,

- WTI crude oil settled at $71 down $0.06,

- USD $104.97 up $0.20,

- Gold $1808 up $6.10,

- Bitcoin $17,105 down 0.50% – Session Low 17,098,

- 10-year U.S. Treasury 3.575% up 0.83%

- Baker Hughes Rig Count: U.S. -4 to 780 Canada + 7 to 202

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for December 2022

Today’s Economic Releases:

The Producer Price Index for final demand moderated to 7.4% for the 12 months ended in November. One would expect the Consumer Price Index to come in next week around the same level.

October 2022 sales of merchant wholesalers, except manufacturers’ sales branches and offices, after adjustment for seasonal variations and trading day differences but not for price changes, were up 11.9% from the revised October 2021 level. Total inventories were up 21.9% from the revised October 2021 level. The October inventories/sales ratio for merchant wholesalers was 1.32. The October 2021 ratio was 1.21. Sales to inventory ratio is the proper way to look at wholesale trade as it does not need to be adjusted for inflation. A rising ration normally signals a slowing economy.

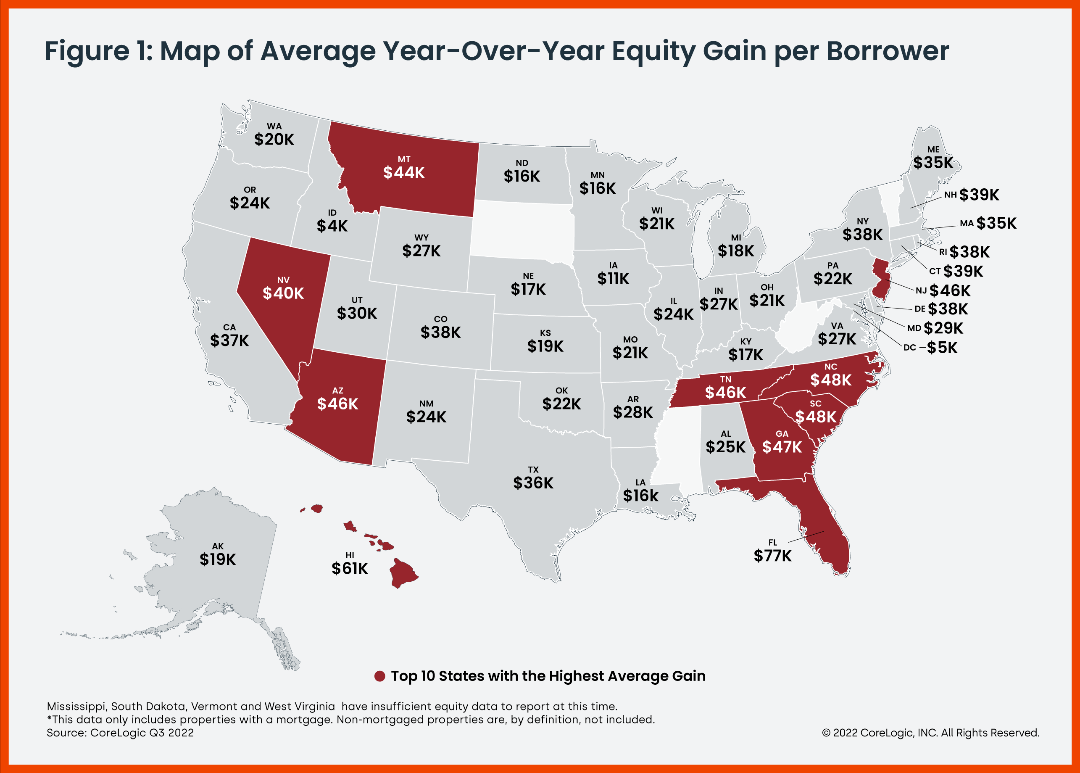

CoreLogic today released the Homeowner Equity Report (HER) for the third quarter of 2022. The report shows that U.S. homeowners with mortgages (which account for roughly 63% of all properties) saw equity increase by 15.8% year over year, representing a collective gain of $2.2 trillion, for an average of $34,300 per borrower, since the third quarter of 2021. Annual home equity gains began to slow in the third quarter of 2022, with the average borrower netting $34,300, compared with the nearly $60,000 year-over-year gain recorded in the second quarter.

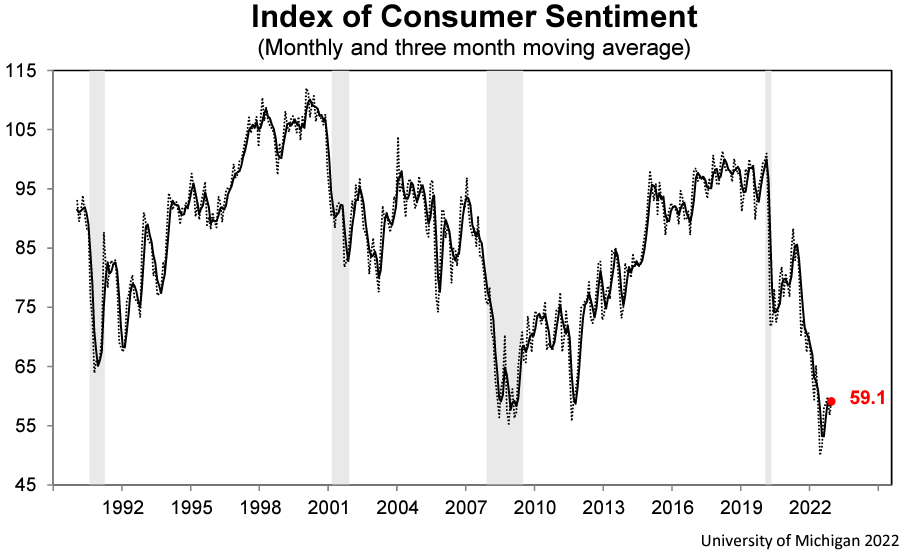

The University of Michigan Preliminary consumer sentiment for December 2022 rose 4% above November, recovering most of the losses from November but remaining low from a historical perspective. All components of the index lifted, with one-year business conditions surging 14% and long-term business conditions increasing a more modest 6%.

A summary of headlines we are reading today:

- Battery Metal Prices Slide Sideways

- JPMorgan’s Kolanovic: Sell Oil Stocks Now

- U.S. Oil And Gas Rig Count Falls Slightly

- Stellantis to indefinitely idle Jeep plant, lay off workers to cut costs for EVs

- Marijuana industry sales slow down after pandemic surge

- Covid and flu hospitalizations increase as holidays approach, while RSV retreats in some states

- “There Is No Soft Landing” – RH CEO Warns Housing Market “Looks More Like A Crash-Landing”

- The Jobs “Boom” Isn’t So Hot When We Remember Nearly Six Million Men Are Missing From The Workforce

- Store Credit Cards Hit 30% Interest Rates As Consumer Balances Rise

- Foreclosure activity rose 64% from a year ago in November and was highest in these U.S. cities

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Artic Blast Draws Down European Natural Gas InventoriesA continuing cold blast across Europe, something we pointed out at the first of the month was forecasted to happen, has led to higher energy prices and drawn down NatGas inventories. We explained on Dec. 1 that a weather phenomenon known as a “Greenland blocking” event would pour cold Arctic air over Europe in the first half of the month. Latest forecasts via Bloomberg show average temperatures across Northwest Europe are expected to continue sliding well below a 30-year trendline to around 27 degrees Fahrenheit by Dec. 18. The cold Read more at: https://oilprice.com/Energy/Natural-Gas/Artic-Blast-Draws-Down-European-Natural-Gas-Inventories.html |

|

Battery Metal Prices Slide SidewaysVia AG Metal Miner The December Renewables MMI (Monthly MetalMiner Index) traded sideways, practically in a straight line. Overall, metal prices within the index only dropped 0.83%. This sideways trend contrasts sharply with the steep drop renewables saw just six months ago. Battery metals within the index, such as cobalt and silicon, held a steady sideways trend, only rising or dropping slightly. However, steel plate dropped both domestically and globally, with the only exception being Japanese steel plate. In general, the index appears pushed Read more at: https://oilprice.com/Metals/Gold/Battery-Metal-Prices-Slide-Sideways.html |

|

JPMorgan’s Kolanovic: Sell Oil Stocks NowInvestors should use the divergence in the performance of oil stocks and crude oil so far this year to sell energy stocks in the near term, Marko Kolanovic, JPMorgans chief global market strategist, says. Kolanovic, still bullish on the energy sector in the longer term, believes that share prices could soon start to drop, he told clients in a recommendation note dated Thursday and quoted by Bloomberg. Investors now have the opportunity to sell in the near term because an enormous gap has opened between energy stocks and the price Read more at: https://oilprice.com/Latest-Energy-News/World-News/JPMorgans-Kolanovic-Sell-Oil-Stocks-Now.html |

|

U.S. Oil And Gas Rig Count Falls SlightlyThe number of total active drilling rigs in the United States slipped this week, according to new data from Baker Hughes published on Friday. The total rig count fell 4 to 780 this week204 rigs higher than the rig count this time in 2021, and 295 rigs lower than the rig count at the beginning of 2019, prior to the pandemic. Oil rigs in the United States fell by 2 this week, at 625. Gas rigs also fell by 2, to 153. Miscellaneous rigs stayed the same at 2. The rig count in the Permian Basin stayed the same this week at 350. Rigs in the Eagle Read more at: https://oilprice.com/Energy/Crude-Oil/US-Oil-And-Gas-Rig-Count-Falls-Slightly.html |

|

Texas Senate Committee Takes Aim At BlackRock Over ESG PoliciesThe Texas legislature has subpoenaed investment firm BlackRock, together with its subsidiaries and affiliate entities in the state, for documents related to the institutions promotion of environmental, social, and governance (ESG) policies. The subpoena was issued by the Texas Senate Committee on State Affairs last month and asks the sergeant-at-arms for the committee or any peace officer of the state to summon BlackRock and associated entities to appear before the committee on Dec. 15. The summoned entities are expected to produce for committee Read more at: https://oilprice.com/Energy/Energy-General/Texas-Senate-Committee-Takes-Aim-At-BlackRock-Over-ESG-Policies.html |

|

Bulgaria, Romania Snubbed In Schengen BidCroatia has received the go-ahead to join Europe’s Schengen passport-free travel zone in January in a long-awaited decision that leaves out Bulgaria and Romania. The decision came on December 8 during a meeting in Brussels of interior and justice ministers of EU and Schengen states and was heartily welcomed by Croatia but greeted unhappily by Bulgaria and Romania. “The Schengen area is growing for the first time in more than a decade,” tweeted the Czech Republic, which holds the EUs rotating presidency. “Ministers approved Croatias Read more at: https://oilprice.com/Latest-Energy-News/World-News/Bulgaria-Romania-Snubbed-In-Schengen-Bid.html |

|

Walmart-backed fintech startup plans to launch its own buy now, pay later loansThe fintech startup, called One, wants to launch a service that shoppers could use at Walmart’s website and stores, as well as at other retailers. Read more at: https://www.cnbc.com/2022/12/09/walmart-fintech-startup-one-to-launch-buy-now-pay-later-loans.html |

|

Brad Pitt sells 60% of his Plan B production company to French media conglomerate Mediawan, sources sayBrad Pitt continues the trend of actors selling stakes in their production companies, reaching a deal with Mediawan that could be announced this weekend. Read more at: https://www.cnbc.com/2022/12/09/brad-pitt-sells-majority-of-plan-b-to-mediawan.html |

|

Stellantis to indefinitely idle Jeep plant, lay off workers to cut costs for EVsStellantis said the plant, which produces the Jeep Cherokee SUV, will cease production as of Feb. 28. Read more at: https://www.cnbc.com/2022/12/09/stellantis-to-idle-jeep-plant-lay-off-workers-to-cut-costs-for-evs.html |

|

Marijuana industry sales slow down after pandemic surgeAfter years of rapid growth, the U.S. cannabis industry is showing signs of fatigue amid challenging economic conditions and growing pains. Read more at: https://www.cnbc.com/2022/12/09/marijuana-industry-sales-slowdown.html |

|

Here’s a map of Starbucks stores that voted to unionizeFriday marks the one-year anniversary of Starbucks Workers United’s first win, in Buffalo, New York. Read more at: https://www.cnbc.com/2022/12/09/map-of-starbucks-stores-that-voted-to-unionize.html |

|

Federal prosecutors ask judge to postpone SEC case in alleged New Jersey deli stock fraudFederal prosecutors want the SEC to postpone their civil case against the suspects behind the $100 million New Jersey deli. Read more at: https://www.cnbc.com/2022/12/09/nj-deli-fraud-case-federal-prosecutors-sec.html |

|

CBS-owned stations added to free, rapidly growing local news streaming service VUitVUit’s audience has grown exponentially in the past year, and it offers feeds from over 260 broadcast stations. Read more at: https://www.cnbc.com/2022/12/09/cbs-stations-added-vuit-free-streaming.html |

|

Taylor Swift signs on to direct a movie for Disney as she campaigns for short film OscarTaylor Swift has written an original script that will be produced by Disney’s Searchlight Pictures. Read more at: https://www.cnbc.com/2022/12/09/taylor-swift-direct-first-feature-film-disney.html |

|

GM battery plant workers vote to unionize with UAW, a key win for labor as industry shifts to EVsThe vote was being closely watched as such battery plants are viewed as crucial for automakers to transition to all-electric cars and trucks. Read more at: https://www.cnbc.com/2022/12/09/gm-lg-ev-battery-plant-uaw-union-vote.html |

|

Covid and flu hospitalizations increase as holidays approach, while RSV retreats in some statesAs respiratory illnesses surge, about 80% of hospital beds are currently occupied in the U.S. Read more at: https://www.cnbc.com/2022/12/09/covid-and-flu-hospitalizations-increasing-rsv-declining.html |

|

These are the best 10 metro areas for first-time home buyers — and how to make it more affordable no matter where you’re buyingCertain markets have become more appealing for first-time home buyers in 2023, according to a Zillow report. Here’s what to know. Read more at: https://www.cnbc.com/2022/12/09/heres-how-to-afford-to-buy-your-first-home-with-a-lower-down-payment.html |

|

BuzzFeed to cut 12% of its workforceBuzzFeed on Tuesday announced plans to cut its workforce by nearly 12%, or around 180 staffers. Read more at: https://www.cnbc.com/2022/12/06/buzzfeed-to-cut-12percent-of-its-workforce.html |

|

Paramount shares fall as CEO lowers fourth-quarter ad revenue forecastParamount CEO Robert Bakish warned that the company’s advertising in the fourth quarter will come in “a bit below” numbers seen in the third quarter. Read more at: https://www.cnbc.com/2022/12/06/paramount-shares-fall-as-ceo-lowers-ad-revenue-forecast.html |

|

“There Is No Soft Landing” – RH CEO Warns Housing Market “Looks More Like A Crash-Landing”In April, RH (the stock-buyback/short-squeeze mogul formerly known as Restoration Hardware) reported dismal earnings which sent its stock plunging and prompted CEO Gary Friedman to give an ominous assessment of the overall macro situation.

This was shocking at the time as it was the first direct admission of tangible weakness in consumer end-demand, and was soundly mocked by all the ‘consumer is strong’ narrative-pushers as idiosyncratically focused on RH and not systemically based.

Read more at: https://www.zerohedge.com/personal-finance/there-no-soft-landing-rh-ceo-warns-housing-market-looks-more-crash-landing |

|

Deflation, Rather Than Inflation, Is Currently The Main Risk Faced By ChinaBy Stefan Koopman, Senior Macro Strategist of Rabobank In stark contrast to last year, China is now having a positive impact on global inflation dynamics. Weak domestic demand, price declines in raw materials and the return to more normal supply- and logistics conditions, have resulted in China exporting deflation once again. This was evident in the country’s large trade surpluses, which were updated on Wednesday, and in this morning’s producer and consumer price inflation data.

Factory-gate prices fell 1.3% year-over-year in November, while consumer inflation eased to 1.6%. Core inflation remained unchanged at 0.6% year-over-year. Deflation, rather than inflation, is currently the main risk faced by China. The relaxation of the most stringent Covid-19 measures should support consumer demand, but it’s unlikely we will see latent demand being unleashed in the same way as we saw in cash-rich Europe and the United States. Moreover, the road to f … Read more at: https://www.zerohedge.com/markets/deflation-rather-inflation-currently-main-risk-faced-china |

|

The Jobs “Boom” Isn’t So Hot When We Remember Nearly Six Million Men Are Missing From The WorkforceAuthored by Ryan McMaken via The Mises Institute, Last week, the employment news was all about how payrolls increased by 269,000 jobs and blew past expectations. Yet, when we looked at the actual number of employed persons, it turned out that the number of employed people has gone down in recent months. At 158.4 million, total employment is still nearly 400,000 workers below where it was before the Covid Panic of 2020.

Those who support the everything-is-great narrative have responded to the unimpressive employed-workers numbers by dismissing them as a result of workers retiring and other demographic changes. These explanations, however, require that we ignore the fact that millions of men aged 25-54—t … Read more at: https://www.zerohedge.com/personal-finance/jobs-boom-isnt-so-hot-when-we-remember-nearly-six-million-men-are-missing |

|

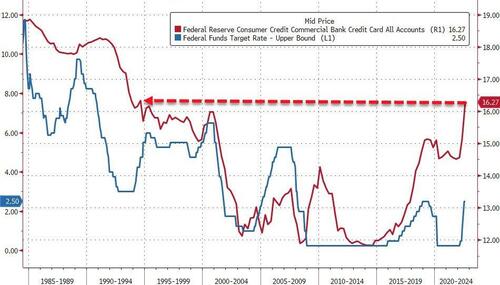

Store Credit Cards Hit 30% Interest Rates As Consumer Balances RiseThere has been a massive surge in credit card usage by US households, a troubling sign that could suggest that in lieu of disposable income, many consumers are forced to max out credit cards to survive the inflation storm. A major problem with inflation is that monthly balances keep rising as the cost of goods becomes more expensive, but the interest rates consumers pay on the debt are also rising because of the Federal Reserve’s most aggressive tightening spree in a generation to quell inflation. As consumer balance sheets become more saturated with credit card debt, it will become harder to pay off as rates rise. According to the Federal Reserve Bank of New York, the total US household debt swelled by $351 billion in the third quarter to $16.5 trillion. Credit card balances jumped 15%, the fastest annual rate in two decades.

Households are taking on insurmountable credit card debts while rates are climbing — as wel … Read more at: https://www.zerohedge.com/markets/some-store-credit-cards-hit-30-interest-rates-consumer-balances-rise |

|

WTO says Trump’s US steel tariffs broke global trade rulesThe US said it disagreed with the ruling and would not remove the border taxes. Read more at: https://www.bbc.co.uk/news/business-63920063?at_medium=RSS&at_campaign=KARANGA |

|

Royal Mail workers begin a wave of Christmas strikesMillions of pieces of mail have been piling up as more than 115,000 postal staff walk out. Read more at: https://www.bbc.co.uk/news/business-63903488?at_medium=RSS&at_campaign=KARANGA |

|

Royal Mail: Views from both sides of the picket lineThe BBC speaks to a striking worker on the picket line and someone choosing to work on strike day. Read more at: https://www.bbc.co.uk/news/business-63917328?at_medium=RSS&at_campaign=KARANGA |

|

US stocks open lower as inflation data stokes rate hike worriesWall Street’s main indexes have come under pressure in December after two consecutive months of gains on fears of a potential recession next year due to extended U.S. rate hikes Read more at: https://economictimes.indiatimes.com/markets/stocks/news/us-stocks-open-lower-as-inflation-data-stokes-rate-hike-worries/articleshow/96115857.cms |

|

Yes Bank rallies 15% on heavy volumes. Is it ready to become a multibagger?The private lender filed the petition under Section 7 of the Insolvency and Bankruptcy Code, which allows a financial creditor to apply for initiating the process. The NCLT has issued a notice to Digital Ventures. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/yes-bank-rallies-15-on-heavy-volumes-is-it-ready-to-become-a-multibagger/articleshow/96104675.cms |

|

Year 2022 an icing on the cake for this FMCG stock; do you own it?According to Nomura Financial Advisory and Securities, this tie-up opens up export avenues for Britannia, and given that Bel Group is a major player in the healthy dairy, fruit and plant-based snacks, it will give the former access to new categories from its global portfolio. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/year-2022-an-icing-on-the-cake-for-this-fmcg-stock-do-you-own-it/articleshow/96100295.cms |

|

The Ratings Game: Broadcom’s ‘excellent backlog management’ earns Wall Street’s trust as other chip makers struggleBroadcom shows it’s an outlier of consistency in a turbulent semiconductor market. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7166-46BBAD09E874%7D&siteid=rss&rss=1 |

|

Foreclosure activity rose 64% from a year ago in November, and was highest in these U.S. citiesThe foreclosure process began on nearly 20,700 U.S. properties last month, though that was down 5% from October, Attom said in a new report. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7166-9D14C153317A%7D&siteid=rss&rss=1 |

|

Financial Face-Off: Financial Face-off: Should you opt for a high-deductible health plan with lower monthly costs?It’s open-enrollment season: Here’s what to know if you’re considering a high-deductible health plan. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7165-B35378665591%7D&siteid=rss&rss=1 |