Summary Of the Markets Today:

- The Dow closed up 3 points or 0.01%,

- Nasdaq closed down 0.59%,

- S&P 500 closed down 0.16%,

- Gold $1747 up $6.80,

- WTI crude oil settled at $78 up $1.19,

- 10-year U.S. Treasury 3.757% uo 0.057%,

- USD index $106.85 up $0.17,

- Bitcoin $16,479 up $273.00

Today’s Economic Releases:

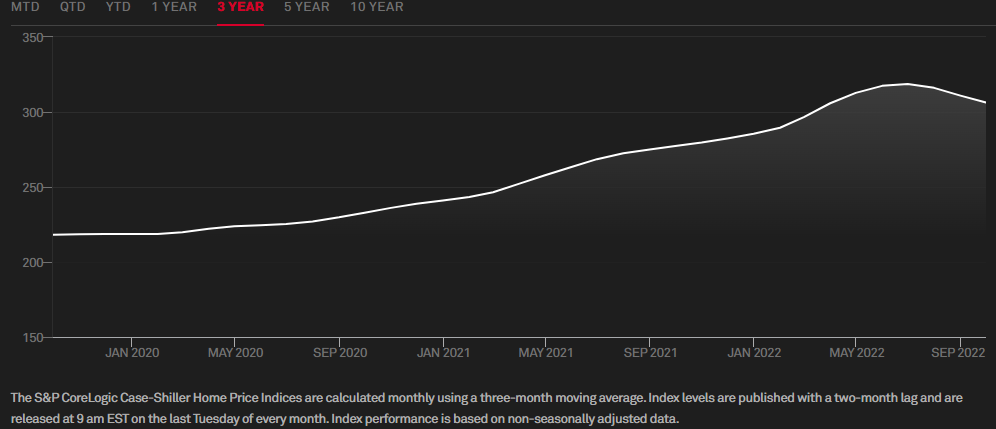

The S&P CoreLogic Case-Shiller 20-City Composite posted a 10.4% year-over-year gain, down from 13.1% in the previous month. CoreLogic Deputy Chief Economist Selma Hepp said:

In September, the CoreLogic S&P Case-Shiller Index gains continued to quickly approach single digits, posting a 10.6% year-over-year increase — marking the sixth straight month of decelerating annual home price growth and the slowest since December 2020. Compared to the 2022 spring peak, home prices are down 3% nationally, with over 10% declines in San Francisco and Seattle. Historically, home prices have increased by about 1% from spring to September. Housing markets continue to face a loss of consumer confidence and the ongoing standoff between buyers and sellers. Potential buyers are held back by the rapidly rising cost of homeownership and fears of price declines. At the same time, potential sellers continue to contend with the lock-in effect of notably lower mortgage rates than the current market rates, which financially disincentivizes them from moving. For the remainder of the year, housing market activity will continue to be depressed, both due to seasonality and fall’s vast surge in mortgage rates, which will keep the home price growth rate moving closer to low single digits.

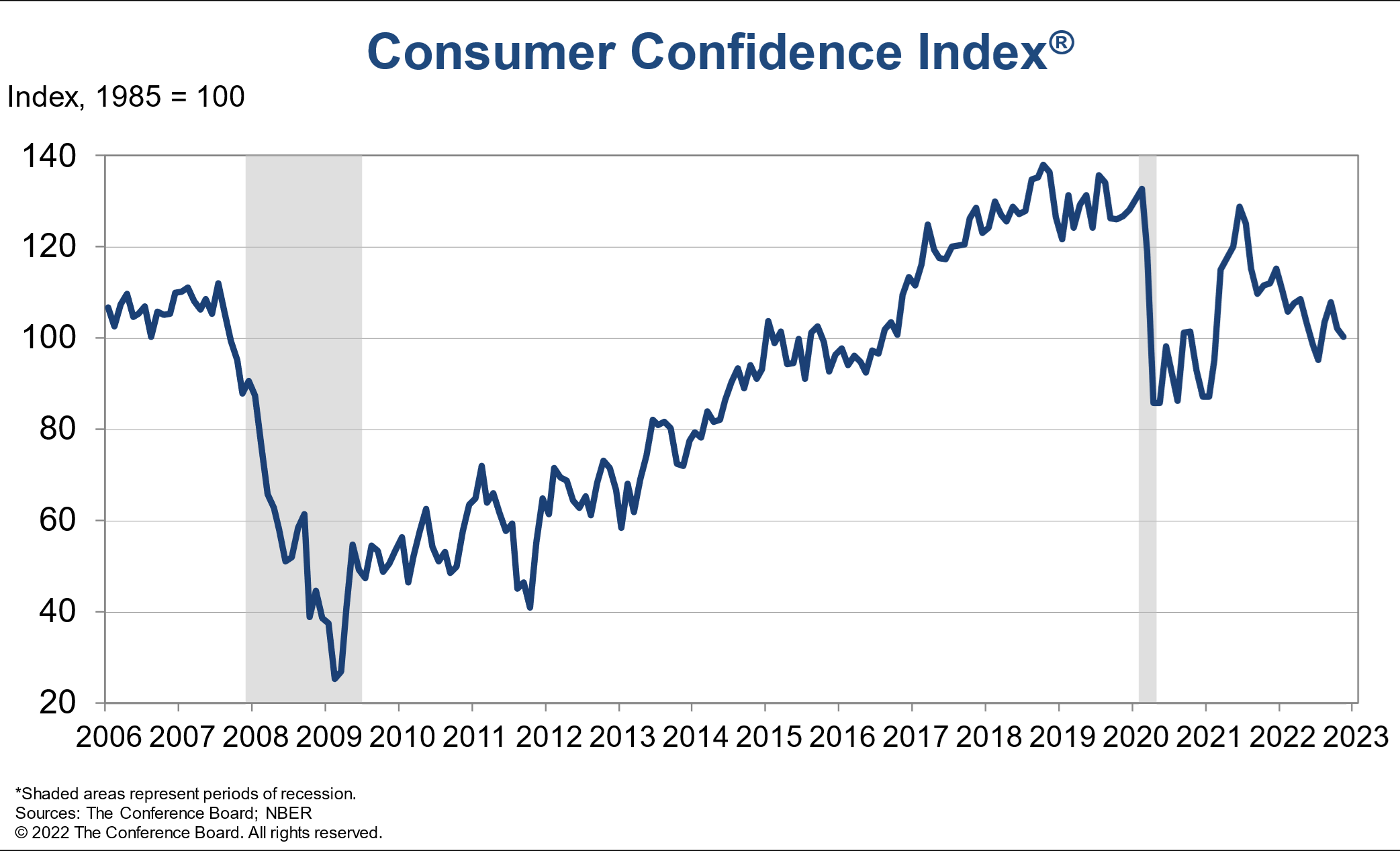

The Conference Board Consumer Confidence Index decreased in November after also losing ground in October. Said Lynn Franco, Senior Director of Economic Indicators at The Conference Board:

Consumer confidence declined again in November, most likely prompted by the recent rise in gas prices. The Present Situation Index moderated further and continues to suggest the economy has lost momentum as the year winds down. Consumers’ expectations regarding the short-term outlook remained gloomy. Inflation expectations increased to their highest level since July, with both gas and food prices as the main culprits. Intentions to purchase homes, automobiles, and big-ticket appliances all cooled. The combination of inflation and interest rate hikes will continue to pose challenges to confidence and economic growth into early 2023.

A summary of headlines we are reading today:

- White House Changes Plan To Refill SPR At $70 Per Barrel

- Russia’s Pipeline Oil Exports To China Flat So Far This Year

- Volatile Metal Prices To Persist As China Grapples With Covid Spike

- Amazon used AWS on a satellite in orbit to speed up data analysis in ‘first-of-its kind’ experiment

- Stocks Cower Ahead Of Powell’s Speech Tomorrow But It Is The Blackout Period Right After That Matters More

- Unions Furious As Biden, Pelosi Push Bill To Avert Rail Strike

- A Fed rate-hike cycle never hit stocks this hard before. Here’s what’s different this time.

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Xi’s Zero-Covid Policy Sparks Largest Protests Since 1989The apparent failure by Beijing to determine new ways to handle the COVID-19 pandemic, given what many consider the largest mass protests since the student movement of 1989, has exposed the limited abilities of the new Chinese Communist Party (CCP) leadership to handle unexpected events despite its extensive security and surveillance apparatus. CCP General Secretary Xi Jinping, who gained near-total control of the party apparatus at the 20th Party Congress late last month, is nowhere to be seen after tens of thousands of students on at least 50 Read more at: https://oilprice.com/Geopolitics/International/Xis-Zero-Covid-Policy-Sparks-Largest-Protests-Since-1989.html |

|

EasyJet Reports 300% Revenue Rise, But Fuel Costs Are Eating Away At ProfitsBudget airline EasyJet has shrunk its losses as it braces for a 50 percent rise in the price of fuel next year as passenger levels fly. The loss-making airline, like most, had been struck hard by pandemic restrictions but is now battling against soaring inflation. EasyJet reported a pre-tax loss of 208m in the 12 months to the end of September, which includes around 78m associated with continued travel disruption. The airline has shrunk down a more than 1bn cavity from the year before. However, fuel costs are expected to eat Read more at: https://oilprice.com/Latest-Energy-News/World-News/EasyJet-Reports-300-Revenue-Rise-But-Fuel-Costs-Are-Eating-Away-At-Profits.html |

|

The Oilprice Guide To Cutting Energy Costs This WinterThe global energy crisis is just getting started. The International Energy Agency (IEA), not one for hyperbole, announced in its annual energy outlook that were in the midst of a global energy crisis of unprecedented depth and complexity, and that there is no going back to the way things were before Russias illegal invasion of Ukraine and the resulting restructuring of global energy trade. In the short term, this is a nasty bit of news for consumers, who can expect market volatility to hit them hard at Read more at: https://oilprice.com/Energy/Energy-General/The-Oilprice-Guide-To-Cutting-Energy-Costs-This-Winter.html |

|

White House Changes Plan To Refill SPR At $70 Per BarrelU.S. Energy Security Advisor Amos Hochstein said on Tuesday that the White House would look to refill the nations Strategic Petroleum Reserves when oil prices were consistently at $70 per barrel, Bloomberg said. In mid-October, the White House released a fact sheet that outlined the administration’s intention to refill the SPR when oil prices were between $67 and $72 per barrel, following the Presidents release of 180 million barrels from the SPR to help bring down the price of oil. According to the White House statement Read more at: https://oilprice.com/Latest-Energy-News/World-News/White-House-Changes-Plan-To-Refill-SPR-At-70-Per-Barrel.html |

|

Russia’s Pipeline Oil Exports To China Flat So Far This YearRussia’s pipeline oil exports to China via the Eastern SiberiaPacific Ocean (ESPO) oil pipeline were flat between January and October compared to the same period of 2021, according to China National Petroleum Corporations (CNPC) Vice President Huang Yongzhang. Russia sent 33.26 million tons of oil to China via pipeline in the first ten months of this year, Huang was quoted as saying by Russian news agency TASS at a Russia-China energy forum. While pipeline oil deliveries were basically unchanged this year, China has significantly Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Pipeline-Oil-Exports-To-China-Flat-So-Far-This-Year.html |

|

Volatile Metal Prices To Persist As China Grapples With Covid SpikeVia AG Metal Miner There have been a number of dynamics driving metals prices this year. Theyve ranged from the strength of the USD to the war in Ukraine to the still-ongoing energy crisis. However, as with the past two decades, the primary recurring theme remains Chinese demand. As both producer and consumer of most of the worlds major and minor metals, China is the driving force in supply. In short: when China sneezes, the entire metal market catches a cold. COVID-19 Continues to Affect Chinese Consumption Many investors Read more at: https://oilprice.com/Metals/Commodities/Volatile-Metal-Prices-To-Persist-As-China-Grapples-With-Covid-Spike.html |

|

Tesla still dominant, but its US market share is eroding as cheaper EVs arriveS&P Global Mobility forecasts Tesla’s market share will decline to less than 20% by 2025, as EV models grow from 48 today to 159 by then. Read more at: https://www.cnbc.com/2022/11/29/teslas-dominance-of-evs-is-eroding-as-cheaper-cars-hit-the-market.html |

|

Shopper turnout hit record high over Black Friday weekend, retail trade group saysA record number of holiday shoppers turned out from Thanksgiving Day to Cyber Monday, according to the National Retail Federation. Read more at: https://www.cnbc.com/2022/11/29/shopper-turnout-hit-record-over-black-friday-weekend-trade-group-says.html |

|

AMC Networks plans significant layoffs as CEO steps down after less than three monthsAMC Networks CEO Christina Spade is suddenly exiting the company after less than three months in the role. Read more at: https://www.cnbc.com/2022/11/29/amc-networks-ceo-stepping-down-after-less-than-three-months-.html |

|

‘Glass Onion’ could have made $200 million, but Netflix only let it play in theaters for a weekNetflix probably left hundreds of millions of dollars on the table by not keeping Rian Johnson’s “Glass Onion” in theaters. Read more at: https://www.cnbc.com/2022/11/29/netflix-glass-onion-misses-out-millions-box-office.html |

|

These are shaping up to be the best and worst luxury real estate markets for 2023Even the strongest luxury markets are expected to cool next year, as interest rates rise and economies slow. Read more at: https://www.cnbc.com/2022/11/29/dubai-miami-top-list-of-best-luxury-real-estate-markets-for-2023.html |

|

It’s been a volatile year for the market: These are the key things to know before rebalancing your portfolioAfter a volatile year for the stock and bond markets, it may be time to rebalance your portfolio. Here’s what to consider before making changes. Read more at: https://www.cnbc.com/2022/11/29/what-to-know-before-rebalancing-your-investment-portfolio.html |

|

Amazon used AWS on a satellite in orbit to speed up data analysis in ‘first-of-its kind’ experimentAmazon’s cloud computing division successfully ran a software suite on a satellite in orbit, the company announced on Tuesday. Read more at: https://www.cnbc.com/2022/11/29/amazon-aws-experiment-satellite-orbit.html |

|

Disney CEO Bob Iger addresses ‘Don’t Say Gay’ fallout, importance of LGBTQ inclusion in storiesDisney CEO Bob Iger said inclusion and acceptance are among the core values of the company’s storytelling during a town hall with employees. Read more at: https://www.cnbc.com/2022/11/28/disney-ceo-bob-iger-talks-dont-say-gay-lgbtq-inclusion-at-town-hall.html |

|

Shares of Lordstown Motors rise as company begins electric truck deliveriesLordstown said it received final regulatory approval to sell its Endurance EV pickup. It started shipping the first trucks from a planned batch of 500. Read more at: https://www.cnbc.com/2022/11/29/shares-of-lordstown-ride-rise-as-company-begins-deliveries.html |

|

Disney hiring freeze will stay in place, CEO Bob Iger tells employeesDisney CEO Bob Iger said he won’t remove the company’s hiring freeze and that he will reassess its cost structure. Read more at: https://www.cnbc.com/2022/11/28/disney-hiring-freeze-will-stay-in-place-ceo-iger-tells-employees.html |

|

Tech companies begin rerouting critical chip supplies to trucks with rail strike loomingSemiconductor chip suppliers are among companies starting to send more cargo to trucks ahead of a potential freight railroad strike. Read more at: https://www.cnbc.com/2022/11/28/with-rail-strike-looming-tech-companies-reroute-chips-to-trucking-.html |

|

Disney is the biggest winner — and loser — at the Thanksgiving box officeThis year’s Thanksgiving box office was both feast and famine for Walt Disney. Read more at: https://www.cnbc.com/2022/11/27/disney-is-the-biggest-winner-and-loser-at-the-thanksgiving-box-office.html |

|

Adidas employees raised concerns about Ye’s conduct for years, report saysThe CEO and other senior leaders at Adidas discussed the potential fallout from its relationship with Kanye West as far back as four years ago, one report said. Read more at: https://www.cnbc.com/2022/11/27/adidas-employees-raised-concerns-about-yes-conduct-for-years-report-says.html |

|

Fidelity Begins Opening Retail Bitcoin Trading AccountsAuthored by ‘BTCCasey’ via BitcoinMagazine.com, Fidelity, one of the world’s largest financial services providers, has officially started opening retail bitcoin trading accounts.

The development comes after their announcement of a wait list previously this month. According to a report by The Block, certain users, presumably those on the wait list, received an email detailing the release, which stated that “The wait is over.” Fidelity has been active in the bitcoin industry for some time — according to the company website, it began mining bitcoin in 2014. In addition, it Read more at: https://www.zerohedge.com/crypto/fidelity-begins-opening-retail-bitcoin-trading-accounts |

|

Stocks Cower Ahead Of Powell’s Speech Tomorrow But It Is The Blackout Period Right After That Matters MoreIn the data-packed week, it is tomorrow’s speech by Fed chair Powell at Brookings titled “Economic Outlook and the Labor Market” (at 1:30pm) that is captivating markets. As Goldman notes, it is the risk that Powell will once again unleash a market beatdown that is keeping sentiment depressed. As Goldman puts it “keep an eye on Powell speech wed for more verbal Financial Conditions tightening”. The Fed chair will discuss the economy and labor market; echoing the language in the post-meeting statement, FOMC participants argued that the level of the policy rate, the uncertain lags with which monetary policy affects activity, and the incoming data would all be important factors for the future path of monetary policy. Powell speech comes just days after a more dovish than expected FOMC Minutes helped push stocks above 4,000, however briefly, as gains then vaporized amid the Covid zero drama and with Powell’s own speech looming. On Monday morning, Goldman trader Rich Privorotsky said to “expect the market to trade weak into the event…” and although there is little that he can say to make Fed not be data dependent (NFP and CPI pre Dec FOMC still matter) “he can start to shape the reaction function.” As Privorotsky concludes, “the message will be hawkish, an attempt to reiterate that even if it looks like inflation is falling this Fed will keep real rates higher for longer to ensure inflation expectations come down to their objective (2%).” To be sure, markets a … Read more at: https://www.zerohedge.com/markets/stocks-cower-ahead-powells-speech-tomorrow-it-blackout-period-right-after-matters-most |

|

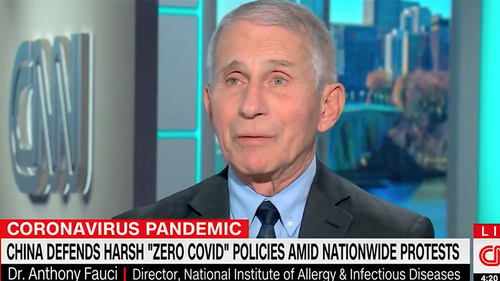

Watch: Fauci Again Defends Chinese LockdownsAuthored by Steve Watson via Summit News, Anthony Fauci once again defended brutal Chinese lockdowns, admitting that the Communist government is forcefully locking people inside buildings but adding that if it means people get vaccinated then he is “okay” with it.

“China’s official news agency today published an op-ed asserting that the country’s strict COVID measure are scientific and effective. Are they?” host CNN host Jake Tapper asked. “Well when you want to shut down in order to interrupt immediately a process that’s going on like the spread of infection, there should be a purpose to it like you want to make sure you get enough ventilators or enough PPE or you want to get your population vaccinated,” Fauci responded. “The comment that I made about their severe actions that they’ve taken is that you have to have an endgame, … Read more at: https://www.zerohedge.com/covid-19/watch-fauci-again-defends-chinese-lockdowns |

|

Unions Furious As Biden, Pelosi Push Bill To Avert Rail StrikeUnder pressure from President Biden, Speaker Pelosi said that House lawmakers will take up legislation on Wednesday to stop a nationwide strike by railroad workers by imposing a proposed contract that members at four railroad unions had rejected, saying Congress needs to intervene to prevent devastating job losses.

Both sides in the negotiations had agreed to a cooling-off period until Dec. 9 with the sticking points involving work schedules and paid sick time. Read more at: https://www.zerohedge.com/political/unions-furious-biden-pelosi-push-bill-avert-rail-strike |

|

Train strikes: Pub boss warns walkouts could ruin Christmas plansThe Fuller’s boss says festive parties could be cancelled without a speedy resolution to the dispute. Read more at: https://www.bbc.co.uk/news/business-63791844?at_medium=RSS&at_campaign=KARANGA |

|

Octopus takeover of Bulb challenged by rival firmsOctopus Energy’s acquisition of collapsed energy firm Bulb could be delayed by a legal fight. Read more at: https://www.bbc.co.uk/news/business-63800602?at_medium=RSS&at_campaign=KARANGA |

|

Bird flu: Free range turkey supplies hit by bird fluAbout 600,000 birds have been culled or have died in the UK’s worst avian flu outbreak. Read more at: https://www.bbc.co.uk/news/science-environment-63797896?at_medium=RSS&at_campaign=KARANGA |

|

Nearly half of Nifty50 stocks emerge stronger than index from June lowsThe month of November was not good but for many of its index constituents, as 9 stocks, including M&M, SBI, Bharti Airtel, L&T, and ICICI Bank scaled their respective lifetime highs. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nearly-half-of-nifty50-stocks-emerge-stronger-than-index-from-june-lows/articleshow/95847872.cms |

|

This Adar Poonawalla-backed NBFC becomes D-Street’s ‘darling’; can the tag last long?The number of mutual funds holding the stock in their portfolio has doubled since May, data on Trendlyne showed. Aditya Birla Sun Life Small Cap Fund was the highest buyer of the shares of the NBFC in October. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/this-adar-poonawalla-backed-nbfc-becomes-d-streets-darling-can-the-tag-last-long/articleshow/95848568.cms |

|

Gautam Adani steals the show again! Pips Ambani to become richest Indian in 2022Despite the year seeing a sharp depreciation in the rupee amid the weak global macroeconomic conditions, the combined wealth of India’s 100 richest people grew $25 billion to touch $800 billion in 2022, according to Forbes India Read more at: https://economictimes.indiatimes.com/markets/stocks/news/gautam-adani-creates-history-pips-ambani-to-become-richest-indian-in-2022/articleshow/95861180.cms |

|

Five Questions With: Why Biden’s a ‘great bet’ for 2024, according to this expert on political gamblingAn anthropologist focused on betting markets talks about how to wager on the 2024 presidential race and how those markets botched the 2022 midterm elections. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-715D-41C81677D300%7D&siteid=rss&rss=1 |

|

The Ratings Game: Private-prison stock hits two-year high as analysts cite potential for more detention beds, detention alternativesShares of private-prison operator GEO Group Inc. jumped to their highest level in roughly two years on Tuesday after Wedbush analysts upgraded the stock. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-715E-46B2D1B523C6%7D&siteid=rss&rss=1 |

|

The Tell: A Fed rate-hike cycle never hit stocks this hard before. Here’s what’s different this time.The stock market’s slide since the Fed began hiking interest rates is the steepest of any rate-hike cycle on record, says Deutsche Bank. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-715E-3148F3A764B6%7D&siteid=rss&rss=1 |