Summary Of the Markets Today:

- The Dow closed down 505 points or 1.55%,

- Nasdaq closed down 3.36%,

- S&P 500 down 2.5%,

- WTI crude oil settled at $89 up $0.98,

- USD $112.11 up $0.63,

- Gold $1638 down $11.80,

- Bitcoin $20,175 down $305,

- 10-year U.S. Treasury 4.082% down 0.063

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

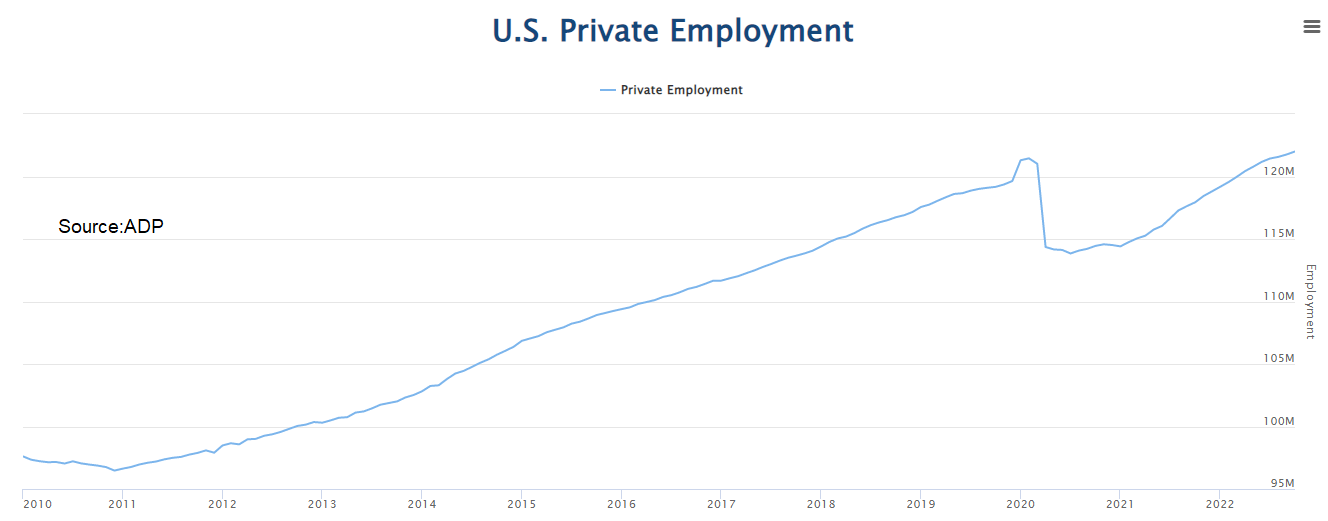

According to ADP’s Employment Report, employers created 239,000 jobs in October, up from a revised 192,000 in September as restaurants, retailers and the travel sector ramped up hiring in advance of the year-end holidays. This continues to show employment is strong.

The Federal Reserve (FOMC) as expected raised the federal funds rate 75 basis points (3/4%) to the range of 3-3/4 to 4%, and stated in part:

The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that were issued in May. The Committee is strongly committed to returning inflation to its 2 percent objective.

The bold sentence in the FOMC statement is what many consider as intent to reduce the federal funds rate increases in the future as there is a lag between raising the funds rate and its impact on inflation.

A summary of headlines we are reading today:

- Biden Unveils $13.5 Billion Package To Ease Home Energy Costs

- World’s Second-Largest Container Carrier Sees Global Trade Slowing

- European Manufacturing Sector Has Tipped Into Recession

- Ford’s October sales slide 10% amid supply chain issues

- Strong dollar weighs on Yum Brands even as sales rise at KFC and Taco Bell

- Here’s the key change in the Fed’s statement that’s moving markets

- Gold Is Best Place To Be, S&P The Worst As Fed Hikes

- The Fed hikes US interest rates to fresh 14-year high

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Rising Interest Rates Weigh On Renewable GrowthRenewable energy stocks are having a hard time, even in the middle of Europe’s energy crisis. It seems that the sector needs central banks to take their foot off the gas in hiking interest rates, but it may have to wait a little longer. The European Renewables Index has lost most of its summer outperformance over the wider Stoxx Europe 600 Index. Since a year-to-date peak in August, renewable stocks have fallen 20%, and only real estate has performed worse. They’ve recovered a bit since Oct. 12 thanks to expectations for a change Read more at: https://oilprice.com/Energy/Energy-General/Rising-Interest-Rates-Weigh-On-Renewable-Growth.html |

|

Biden Unveils $13.5 Billion Package To Ease Home Energy CostsU.S. President Joe Biden has announced plans to shell out $13.5 billion to help reduce energy costs for low- and moderate-income households. The vice president will highlight how President Biden’s economic plan will help households afford energy-efficient equipment when they need to make home repairs, so they can save money on their utility bills for years to come, the White House said on Wednesday. Vice President Kamala Harris will formally present the new steps during a stopover at a Boston union hall and training facility. Read more at: https://oilprice.com/Latest-Energy-News/World-News/Biden-Unveils-135-Billion-Package-To-Ease-Home-Energy-Costs.html |

|

The UK Looks To Repurpose Natural Gas Infrastructure For HydrogenAs the hype around green hydrogen intensifies, several energy firms and governments are exploring the potential for transforming existing natural gas infrastructure to be used to transport hydrogen as the world transitions away from fossil fuels. Now, the U.K. has announced a new development, trialing a hydrogen-gas project to see if this vision can become a reality. The U.K. will trial using existing gas infrastructure with hydrogen to see whether it is possible to transform this infrastructure to be used in renewable energy projects, rather Read more at: https://oilprice.com/Energy/Energy-General/The-UK-Looks-To-Repurpose-Natural-Gas-Infrastructure-For-Hydrogen.html |

|

World’s Second-Largest Container Carrier Sees Global Trade SlowingEurope is nearing a recession, and the U.S. may be right on its heels, the world’s second-largest container carrier told Bloomberg TV on Wednesday. Recession fears have put a cap on oil prices as analysts mull just how deeply a recession would cut into the demand for the commodity that is stealing the political limelight in Russia, OPEC countries, and the United States. And A.P. Moller-Maersk A/S which controls one-sixth of the worlds container trade sees global trade slowing between 2% and 4% in a stark warning for not Read more at: https://oilprice.com/Latest-Energy-News/World-News/Worlds-Second-Largest-Container-Carrier-Sees-Global-Trade-Slowing.html |

|

German Tech Firm To Launch $25,000 Solar Car Next YearFirst, there were electric vehicles (EVs), and then there were hydrogen fuel cell vehicles (HFCVs), could the next innovation be solar-powered vehicles? According to one German company, solar cars are just around the corner with a release date set for 2023. While powering a car with the sun has long been talked about, Sono Motors appears to be the nearest to making this dream a reality, and at an affordable price. German automotive firm Sono Motors expects to release its first commercially available solar-powered EV, the Sion, in Europe Read more at: https://oilprice.com/Energy/Energy-General/German-Tech-Firm-To-Launch-25000-Solar-Car-Next-Year.html |

|

European Manufacturing Sector Has Tipped Into RecessionThe eurozone manufacturing sector has tumbled into recession, driven by customers slashing spending in response to soaring prices and higher interest rates, a closely watched survey out today suggests. S&P Globals’ final manufacturing purchasing managers index (PMI) for the 19 countries using the euro fell to 46.4 last month, down from 48.4 in September. The reading was revised down from an earlier estimate and came in below analysts’ expectations. It also signaled eurozone factory output is shrinking quickly. The PMI has Read more at: https://oilprice.com/Latest-Energy-News/World-News/European-Manufacturing-Sector-Has-Tipped-Into-Recession.html |

|

Washington Commanders owner Dan Snyder hires Bank of America to explore possible saleWashington Commanders owner Daniel Snyder has hired Bank of America to help facilitate a potential sale of the team. Read more at: https://www.cnbc.com/2022/11/02/washington-commanders-owner-dan-snyder-hires-bank-of-america-to-explore-potential-transactions.html |

|

Ford’s October sales slide 10% amid supply chain issuesFord Motor’s U.S. sales last month declined by 10% as the automaker battled through supply chain issues that delayed shipments to dealers. Read more at: https://www.cnbc.com/2022/11/02/fords-october-sales-slide-10percent-amid-supply-chain-issues.html |

|

Boeing forecasts jump in aircraft deliveries, up to $5 billion in free cash flow next yearBoeing is planning to ramp up production and deliveries of new aircraft, propping up its forecast for higher cash in 2023. Read more at: https://www.cnbc.com/2022/11/02/boeing-plans-to-ramp-up-airplane-production.html |

|

Strong dollar weighs on Yum Brands even as sales rise at KFC and Taco BellYum Brands missed Wall Street’s earnings estimates but beat quarterly revenue expectations. Read more at: https://www.cnbc.com/2022/11/02/yum-brands-yum-q3-2022-earnings.html |

|

CVS Health raises outlook as third-quarter results beat estimatesCVS Health beat Wall Street’s expectations in its third-quarter earnings report. The company also announced an opioid settlement. Read more at: https://www.cnbc.com/2022/11/02/cvs-health-reports-q3-earnings.html |

|

We still see Estee Lauder shares as a buy on weakness despite downbeat guidanceFor Estee Lauder (EL), it’s all about China; and we believe it’s better to be opportunistic ahead of any change in Covid restrictions there. Read more at: https://www.cnbc.com/2022/11/02/we-still-see-estee-lauder-shares-as-a-buy-on-weakness-despite-downbeat-guidance.html |

|

Wells Fargo, Ford, and Apple are in the news. Here’s our take on the Club stocksThere were some noteworthy updates on Wells Fargo (WFC), Ford (F) and Apple (APPL) on Wednesday. Here are the headlines and our take, too. Read more at: https://www.cnbc.com/2022/11/02/wells-fargo-ford-and-apple-in-the-news-the-club-take-.html |

|

Here’s the key change in the Fed’s statement that’s moving marketsThis is a comparison of Wednesday’s Federal Open Market Committee statement with the one issued after the Fed’s previous policymaking meeting on Sept. 21. Read more at: https://www.cnbc.com/2022/11/02/heres-what-changed-in-the-latest-federal-reserve-statement.html |

|

We’re impressed with health insurer Humana’s solid quarter and rosy outlook for next yearWe continue to like Humana shares, especially into an economic slowdown as health care is an especially sticky sector in terms spending. Read more at: https://www.cnbc.com/2022/11/02/were-impressed-with-health-insurer-humanas-solid-quarter-and-rosy-outlook-for-next-year.html |

|

American Airlines pilots’ union rejects new contract proposalNegotiations for new pilot contract have been difficult across the industry. Read more at: https://www.cnbc.com/2022/11/02/american-airlines-pilots-union-rejects-new-contract-proposal.html |

|

2 takeaways from our daily meeting: Stocks await Fed decision, Club earnings recapThe Investing Club holds its “Morning Meeting” every weekday at 10:20 a.m. ET. Read more at: https://www.cnbc.com/2022/11/02/takeaways-from-daily-meeting-stocks-await-fed-club-earnings-.html |

|

Paramount Global shares sink as results miss and TV revenue fallsParamount Global missed revenue estimates as revenue declined for its TV networks and advertising. Read more at: https://www.cnbc.com/2022/11/02/paramount-global-para-earnings-tv-revenue-falls-.html |

|

Ferrari raises its 2022 guidance again on red-hot demand for sports carsFerrari raised its full-year guidance for the second time in 2022, after its third-quarter revenue and profit beat Wall Street’s estimates. Read more at: https://www.cnbc.com/2022/11/02/ferrari-race-q3-2022-earnings-beat-estimates-automaker-raises-guidance.html |

|

A (Long Overdue) Great Rotation From Tech Into EnergyHeading into today’s trading session, Goldman traders John Flood and Michael Nocerino made an interesting observation: while stocks continue to squeeze higher (on hopes the Fed is done destroying the economy, containing the inflation it spawned and generally breaking markets), or slide lower (following every Fed jawbone session vowing to keep hiking the global economy into a depression until Putin somehow unleashes commodity supplies again), inside the market there is a distinct rotation out of tech and into energy. First, here is Nocerinio (full note available to pro subs in the usual place):

And here is Nocerino’s recount of Tuesday’s desk activity:

|

|

‘Democracy Dies In Darkness’ – Unless You Want Pelosi Video ReleasedUpdate (1450ET): The Washington Post – which carries the slogan “Democracy Dies in Darkness” – is now suggesting that people who want to see video of the Pelosi attack are stoking conspiracy theories. In a Wednesday article, columnist Philip Bump draws a line from 2020 election deniers, to QAnon, to people who think there’s something fishy about last week’s attack on the Pelosis’ San Francisco house by a mentally ill homeless man who was living at a house with a BLM flag, and who back-dated posts on one of his websites after registering it in September. Bump writes;

|

|

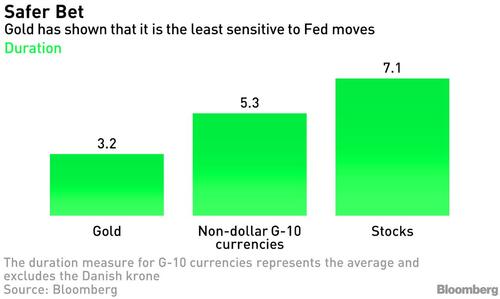

Gold Is Best Place To Be, S&P The Worst As Fed HikesBy Ven Ram, Bloomberg Markets Live reporter and strategist Gold is the most resilient asset to own if the Federal Reserve continues to raise rates, while stocks are the worst place to be, with non-dollar currencies falling between the two. Gold has had an empirical duration of just over three years in the current Fed cycle, compared with stocks at 7.1 years. The non-dollar currencies that make up the G-10 have seen a duration of 5.3 years. Duration measures the percentage change of an asset in reaction to a 1 percentage point shift in interest rates.

Gold is still hovering near its low for this cycle of $1,615 an ounce, a 12% decline since the start of the year that has come as the Fed raised its benchmark interest rate by 300 basis points, with another 75 basis points priced in from this week’s policy review. Non-dollar G-10 currencies have seen an average duration of 5.3 years in the current cycle, highlighting their sensitivity to any perceptible shift in interest-rate differentials. … Read more at: https://www.zerohedge.com/markets/gold-best-place-be-sp-worst-fed-hikes |

|

“It Makes Sense To Slow Down” – Wall Street Reacts To The Fed’s Unexpected “Soft Pivot”While the range of outcomes and market reactions to today’s FOMC statement ran the gamut from +10% to -8% (according to JPM), the prevailing consensus was more “autopilot” from the Fed, and any potential dovishness would come in Powell’s presser, certainly not codified in the actual statement. However, as noted earlier, it was with Powell explicitly adding language warning about the “cumulative” effect of monetary policy, which works with a “lag.” The immediate impact was to send futures surging, and the dollar and yields tumbling. Below we have compiled several reactions from Wall Street strategists and traders, sharing their post-FOMC take. Ian Lyngen at BMO Capital Markets: “‘Cumulative tightening’ and ‘lagged impact’ suggest that this will be the last 75 bp hike and in December the move will most likely be 50 bp. We’re somewhat surprised to see the ‘soft pivot’ in the statement itself and we expect that Powell will double down on this narrative at the press conference. Therefore, the bullish move has more room to run.” Eric Winograd, AllianceBernstein “The statement is clear that they would like to slow the pace of hikes. In addition to looking at the data and looking at markets, they are also now considering the cumulative impact of what they have already done. And the lag with that will hit the economy. Most estimates are that it takes 9-12 months for rate hikes to be felt, and 12-18 months for the maximum effect. We are on … Read more at: https://www.zerohedge.com/markets/it-makes-sense-slow-down-wall-street-reacts-feds-unexpected-soft-pivot |

|

The Fed hikes US interest rates to fresh 14-year highThe Federal Reserve is steering borrowing costs higher at the fastest rate in decades. Read more at: https://www.bbc.co.uk/news/business-63488472?at_medium=RSS&at_campaign=KARANGA |

|

Warning of fewer rental properties as landlords squeezedDifficulties for some landlords to secure mortgages could mean less choice for tenants, MPs are told. Read more at: https://www.bbc.co.uk/news/business-63486784?at_medium=RSS&at_campaign=KARANGA |

|

UK battery firm staff agree to November pay cutAbout 300 staff at Britishvolt have agreed to take a temporary pay cut as the company battles to stay afloat. Read more at: https://www.bbc.co.uk/news/business-63483666?at_medium=RSS&at_campaign=KARANGA |

|

Thursday’s RBI meet a non-event for D-Street as no rate action expectedThe central bank’s meeting is primarily to discuss and draft an explanation to the government on the failure to adhere to the inflation target for three consecutive quarters. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/thursdays-rbi-meet-a-non-event-for-d-street-as-no-rate-action-expected/articleshow/95261484.cms |

|

Tech View: Nifty forms bearish engulfing top as 18K turns make-or-break level. What traders should do on ThursdayIndicators such as MACD and RSI were slightly skewed on the negative side. Analysts say that the physiologically-important level of 18,000 is now becoming a make-or-break zone for the index.Options data suggests a broader trading range between 17,600 to 18,600 zones, while an immediate trading range in between 17,900 to 18,300 zones. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-bearish-engulfing-top-as-18k-turns-make-or-break-level-what-traders-should-do-on-thursday/articleshow/95254937.cms |

|

6 stocks that look set for a strong rally in the near termThe headline indices have moved above the previous swing high, say market analysts. They believe select stocks are ready to deliver solid returns in the near term. Based on their recommendations, here are six stocks that can showcase a strong ral Read more at: https://economictimes.indiatimes.com/markets/stocks/news/torrent-power-bharat-forge-among-6-stocks-set-for-a-strong-rally-in-the-near-term/money-making-ideas/articleshow/95250514.cms |

|

The Margin: Vecna’s house on ‘Stranger Things’ is selling for $1.5 million — and it comes with a cast-iron urinalThe creepy ‘Creel House’ last sold for $350,000 in 2019. The listers joke that the previous resident, the evil demon Vecna, ‘has since been relocated.’ Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7149-A96770A6C0E1%7D&siteid=rss&rss=1 |

|

The Tell: These ETFs point to ‘microcosm’ of 2022 performance trends as Nasdaq appears at ‘inflection point’ relative to S&P 500, says BespokeExchange-traded funds tracking U.S. equity benchmarks have highlighted a split in the market created by struggling technology stocks, with the Nasdaq at a potential inflection point relative to the S&P 500, according to Bespoke Investment Group. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7149-81B2436E569E%7D&siteid=rss&rss=1 |

|

The MarketWatch 50: Morgan Housel turned lessons he learned as a hotel valet into a breakthrough personal-finance book that’s sold 2.2 million copies in 2 yearsPublishers said ‘The Psychology of Money’ would never work. Now, Morgan Housel is on the MarketWatch 50 list of the most influential people in markets. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-713E-5EDFA09F60D2%7D&siteid=rss&rss=1 |