Summary Of the Markets Today:

- The Dow closed up 194 points or 0.61%,

- Nasdaq closed down 1.63%,

- S&P 500 down 0.61%,

- WTI crude oil settled at $89 up $0.78,

- USD $110.89 up $0.88,

- Gold $1666 down $3.60,

- Bitcoin $20,404 down 1.57% – Session Low 20,370,

- 10-year U.S. Treasury 3.906% down 0.093%

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

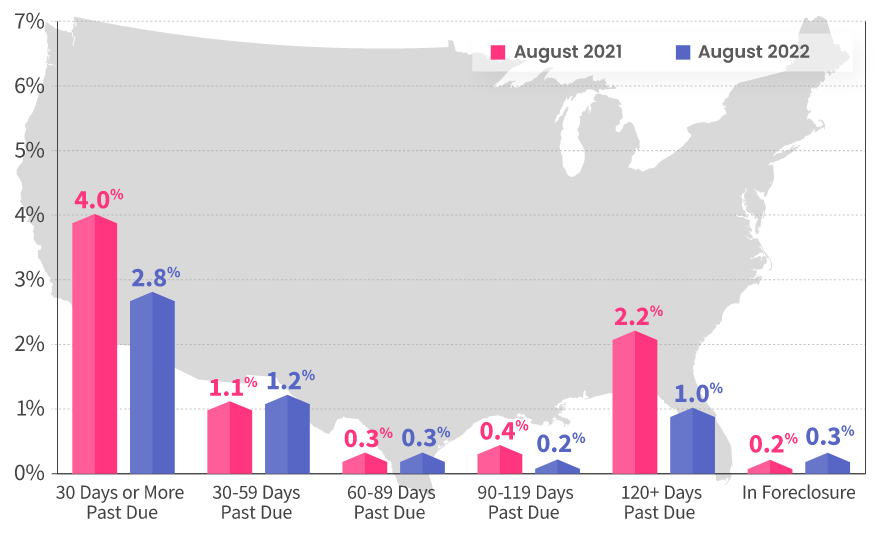

The number of borrowers classified as seriously delinquent (90 or more days late) on their mortgage payments in August 2022 dropped to the lowest level recorded since April 2020, while the overall delinquency rate remained near a record low. Molly Boesel, Principal Economist for CoreLogic stated:

The share of U.S. borrowers who are six months or more late on their mortgage payments fell to a two-year low in August and was less than one-third of the pandemic high recorded in February 2021. Furthermore, the foreclosure rate remained near an all-time low, which indicates that borrowers who were moving out of late-stage delinquencies found alternatives to defaulting on their mortgages.

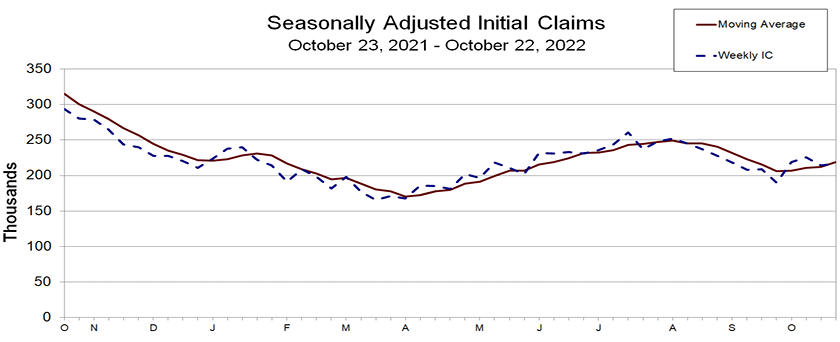

In the week ending October 22, the 4-week unemployment insurance weekly initial claims moving average was 217,000, an increase of from the previous week’s unrevised average of 212,250.

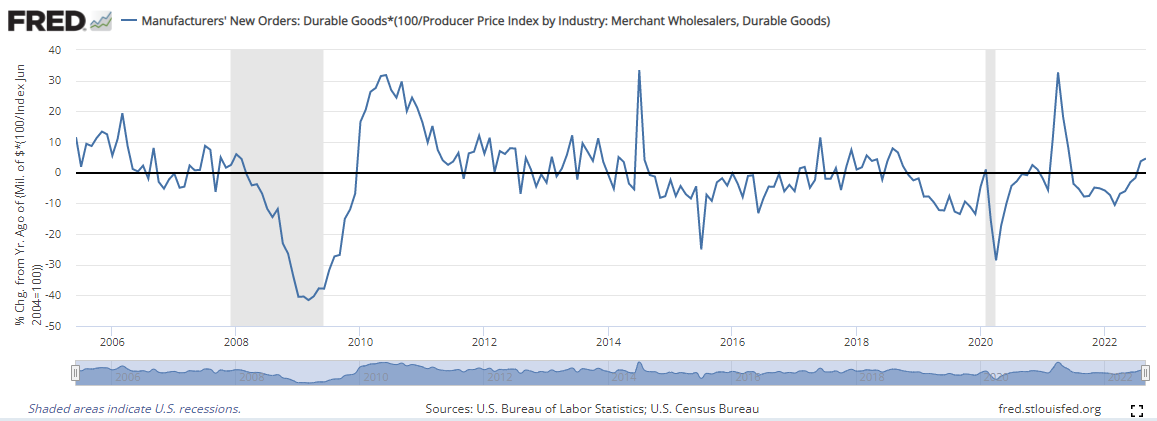

New orders for manufactured durable goods in September 2022 increased 11.3% year-over-year. Even after adjusting for inflation, durable goods improved 4.6% year-over-year. At this point it is obvious the economy is modestly improving even with high inflation.

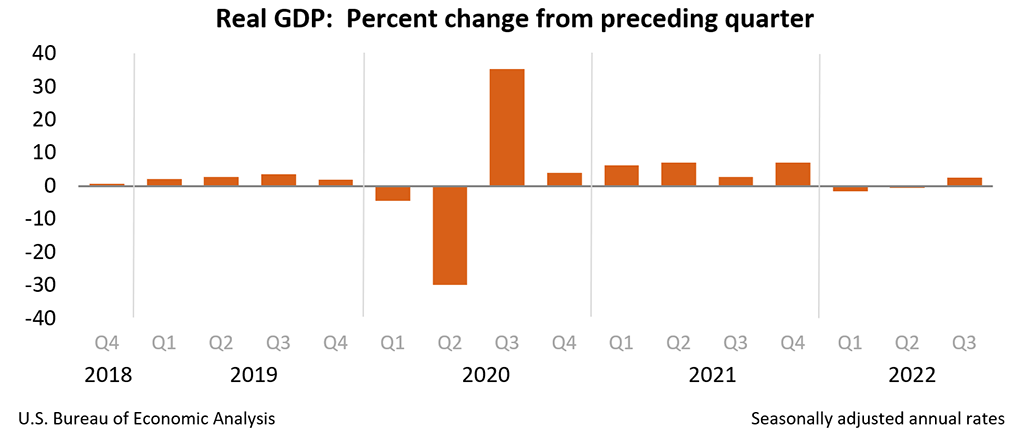

The advance estimate of real gross domestic product (GDP) shows the economy increased at an annual rate of 2.6% in 3Q2022. In the second quarter, real GDP decreased 0.6%. Advance estimates historically have been subject to significant change – but it continues the story line that the economy is modestly improving.

A summary of headlines we are reading today:

- Freight Industry Braces For Ugly Fourth Quarter

- PetroChina Records 60% Profit Jump Despite Lower Demand

- Ford Completes Its Withdrawal From Russia

- McDonald’s earnings beat as customers return despite higher prices

- Comcast tops expectations as it squeezes out a small gain in broadband subscribers

- Credit Suisse Crashes Most Ever After Admitting It Suffered A Bank Run And Breached Liquidity Requirements

- Tech’s biggest companies are sending worrying signals about the US economy

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Freight Industry Braces For Ugly Fourth QuarterPeak season, an annual event in the freight industry, serves as the most important season in the calendar for many transportation firms. Depending on the mode, peak season kicks off at different points on the calendar, mostly based on the role in the supply chain that a freight provider plays in ensuring that retail goods are on the shelves for the holidays. Peak season by mode: Ocean container: July through September Trucking and rail intermodal: October through December 15th Parcel: Black Friday through December 24th With the Read more at: https://oilprice.com/Energy/Energy-General/Freight-Industry-Braces-For-Ugly-Fourth-Quarter.html |

|

Kupperman Sees Further Upside For Oil, UraniumThis is the latest from Harris Kupperman, founder of Praetorian Capital, a hedge fund focused on using macro trends to guide stock selection. Mr. Kupperman is also the chief adventurer at Adventures in Capitalism, a website that details his investments and travels. I published recent thoughts from Harris just days ago, in a post outlining his thoughts on why the Fed has backed itself into a corner they can’t get out of. Harris is one of my favorite Twitter follows and I find his opinions – especially on macro and commodities – Read more at: https://oilprice.com/Energy/Energy-General/Kupperman-Sees-Further-Upside-For-Oil-Uranium.html |

|

PetroChina Records 60% Profit Jump Despite Lower DemandState-run PetroChina, Asia’s largest oil and gas producer and China’s second-largest refiner, is reporting $16.66 billion in profits from January to September, for a 60% jump year-on-year, Reuters reports. The significant jump in profits comes despite zero-COVID policies that have chipped away at domestic demand for fuel, according to PetroChina. Despite pandemic lockdowns across the nations, PetroChina saw its domestic crude oil output rise by 2.7% and its domestic gas output rise by 5.1% from January to September. Read more at: https://oilprice.com/Latest-Energy-News/World-News/PetroChina-Records-60-Profit-Jump-Despite-Lower-Demand.html |

|

Is Saudi Arabia’s Neom Project Too Ambitious?Earlier this year, Saudi Arabia announced plans to dedicate an $80 billion fund to develop the Neom megaproject, aimed at establishing a futuristic living space in the northwest of the country. This forms part of Saudi Arabia’s Vision 2030, which aims to diversify the national economy and make the country less reliant on its oil revenues. Saudi Arabia plans to develop Neom as a mega clean-energy city on a plot of land the size of Belgium. The space is expected to eventually become self-sufficient and provide a return on investment of between Read more at: https://oilprice.com/Geopolitics/International/Is-Saudi-Arabias-Neom-Project-Too-Ambitious.html |

|

Ford Completes Its Withdrawal From RussiaU.S. automaker Ford has completed its withdrawal from the Russian market with the sale of its 49 percent stake in the Russian-based Sollers Ford joint venture. Ford said on October 26 that it had finalized the deal to sell its stake in Sollers Ford for a “nominal” undisclosed price. Ford secured an option to buy back the shares within a five-year period “should the global situation” change in the coming years, the company said. The joint venture with Russian company Sollers was established in 2011. Ford suspended its business operations in Russia Read more at: https://oilprice.com/Latest-Energy-News/World-News/Ford-Completes-Its-Withdrawal-From-Russia.html |

|

Georgia Looks To Restart Deep Sea MegaprojectWith international transit demand rising as a result of the Ukraine war, the Georgian government has revived discussions about constructing the controversial Anaklia deep sea port project. Georgia, the only South Caucasus country with access to the Black Sea, does not have a deep sea port that would allow it to reach its full transit potential. The multibillion-dollar Anaklia mega port project was supposed to fill that gap, but the government withdrew from the project in early 2020, citing the failure of the project to attract investment. Read more at: https://oilprice.com/Geopolitics/International/Georgia-Looks-To-Restart-Deep-Sea-Megaproject.html |

|

New York Post says employee posted racist, violent and sexist headlines targeting politiciansThe New York Post said it fired an employee who posted stories with racist, sexist and violent headlines. Read more at: https://www.cnbc.com/2022/10/27/new-york-post-website-hacked-racist-sexist-headlines-target-politicians.html |

|

American Airlines offers pilots higher raises in new contract proposalThe biggest U.S. carriers have been in negotiations for new contracts for months. Read more at: https://www.cnbc.com/2022/10/27/american-airlines-offers-pilots-higher-raises-in-new-contract-proposal.html |

|

NASA says its annual economic output is triple the agency’s budgetThe report found that NASA’s work in the fiscal year 2021 generated an economic output of over $71 billion. Read more at: https://www.cnbc.com/2022/10/27/nasa-annual-economic-output-is-triple-its-budget-study.html |

|

Restaurant operating hours are still shorter compared to 2019, report findsEateries have trimmed their weekly operating hours by 7.5%, or 6.4 hours, compared with pre-pandemic schedules, according to a report from Datassential. Read more at: https://www.cnbc.com/2022/10/27/restaurant-operating-hours-are-still-shorter-compared-to-2019.html |

|

Auto dealer stocks rally despite Wall Street’s ‘demand destruction’ theoryShares of AutoNation, Group 1, and other auto dealers rallied Thursday following strong third-quarter earnings and optimistic outlooks regarding consumer demand. Read more at: https://www.cnbc.com/2022/10/27/autonation-lithia-rally-despite-wall-streets-demand-destruction-theory.html |

|

McDonald’s earnings beat as customers return despite higher pricesThe fast-food giant said traffic to its U.S. restaurants is growing despite higher menu prices. Read more at: https://www.cnbc.com/2022/10/27/mcdonalds-mcd-earnings-q3-2022.html |

|

Beer is on pace to lose its leading share of the U.S. alcohol market as spirits surgeBeer is taking up less of the American booze market as beverage companies flood the market with buzzy new drink categories including ready-to-drink cocktails. Read more at: https://www.cnbc.com/2022/10/27/beer-is-on-pace-to-lose-its-leading-share-of-the-us-alcohol-market.html |

|

Investing in Space: Rockets are only the beginningFive U.S. rocket builders have successfully reached orbit in the past two decades. Read more at: https://www.cnbc.com/2022/10/27/investing-in-space-rockets-are-only-the-beginning.html |

|

Buffalo Bills unveil first design images of their new $1.4 billion stadiumThe Buffalo Bills’ new stadium, controversial due to its hefty bill for taxpayers, is expected to open in 2026. Read more at: https://www.cnbc.com/2022/10/27/buffalo-bills-unveil-first-design-images-of-their-new-1point4-billion-stadium.html |

|

Comcast tops expectations as it squeezes out a small gain in broadband subscribersComcast added 14,000 new broadband customers, a slight rebound from the previous quarter, when it didn’t add any broadband subscribers for the first time ever. Read more at: https://www.cnbc.com/2022/10/27/comcast-cmcsa-earnings-q3-2022.html |

|

Altria quarterly earnings miss estimates as cigarette maker’s revenue fallsCigarette maker Altria Group narrowed its earnings guidance for the year as it reported third-quarter earnings and revenue that missed Wall Street estimates. Read more at: https://www.cnbc.com/2022/10/27/altria-mo-q3-2022-earnings.html |

|

Ye escorted out of Skechers office in Los Angeles after he showed up unannouncedYe, formerly known as Kanye West, was escorted out of the Los Angeles office of shoe company Skechers, the company said. Read more at: https://www.cnbc.com/2022/10/26/ye-escorted-out-of-skechers-office-in-los-angeles-after-he-showed-up-unannounced.html |

|

CNN chief Chris Licht has big ideas, but employees are nervous, and more job cuts are comingCNN CEO Chris Licht speaks about his challenge to change the network and restore a brand he says has been tarnished. Read more at: https://www.cnbc.com/2022/10/26/cnn-chief-chris-licht-business-review-job-cuts.html |

|

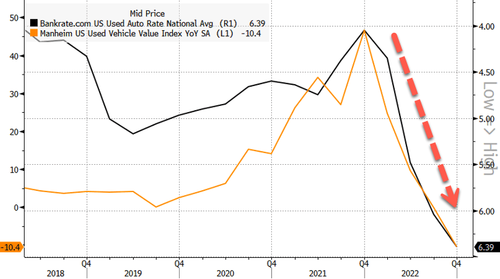

AutoNation’s CEO Warns About Used-Car Bubble PoppingAfter pointing out “Used Car Prices Record First Annual Drop In Two Years” and “Used-Car Prices Record Largest YoY Decline Since Financial Crisis” this month alone — warning signs mount the used car market bubble deflates. The latest sign that wholesale used car prices are in free-fall is from the largest US chain of car dealerships, AutoNation, whose CEO, Mike Manley, warned soaring interest rates are curbing car demand, resulting in price drops.

“We’re beginning to see used-car prices mitigate with faster depreciation” among mainstream and budget cars, Manley said in a Bloomberg interview. “We benefit from the mix of … Read more at: https://www.zerohedge.com/markets/autonations-ceo-warns-about-used-car-bubble-popping |

|

The “Ableist” Delusion And The Downfall Of John FettermanSubmitted by QTR’s Fringe Finance The worst part about what happened to Pennsylvania Senate candidate John Fetterman two nights ago publicly at his debate versus Dr. Oz is that it could have, and should have, been completely avoided. And the purpose of this post is in no way to rag on Fetterman, but rather to bring up the question of how anybody could have let what transpired Tuesday night happen in the first place. Read more at: https://www.zerohedge.com/markets/abelist-delusion-and-downfall-john-fetterman |

|

Credit Suisse Crashes Most Ever After Admitting It Suffered A Bank Run And Breached Liquidity RequirementsTwo weeks ago, the NYT mocked “amateur investors” for piling up in a historic, “meme” short bet against the troubled Swiss bank Credit Suisse, which it argued was nowhere near as distressed as rumors suggested and when discussing the violent plunge in the stock price said that “the timing puzzled the bank’s analysts, major investors and risk managers. Credit Suisse had longstanding problems, but no sudden crisis or looming bankruptcy.” Well, in retrospect it did, because as today’s shocking “radical overhaul” by Credit Suisse – which included massive layoffs, new equity injection, a strategic outside investors (apparently Saudi money talks and fake woke anger about Jamal Khashoggi walks), and a complete business restructuring – showed, the second largest Swiss Bank was indeed on the brink. And it wasn’t just on the brink of insolvency: as Bloomberg today also reports, the (former) Swiss banking giant, was this close to a liquidity crisis too! On Thursday, Credit Suisse said one or more of its units breached liquidity requirements this month when depositors pulled their money amid speculation about the lender’s turnaround plan. Translation: the bank admits it suffered a bank run, something which the NYT should have been reporting on instead of mocking all those who were shorting the bank to oblivion… and as we now learn, with justification. According to a bank statement, the withdrawals were triggered by “negative press and social media coverage … Read more at: https://www.zerohedge.com/markets/credit-suisse-crashes-most-ever-after-admitting-it-suffered-bank-run-and-breached-liquidity |

|

Rand Paul Demands Answers Over Vax Company PR Firm’s “Embedded Staff Within CDC To Promote Vaccines”Authored by Steve Watson via Summit News, Senator Rand Paul called for answers Monday in a letter to CDC director Rochelle Walensky detailing how the agency contracted PR firm Weber Shandwick, which also represents Pfizer and Moderna, to carry out research for the National Center for Immunization and Respiratory Diseases.

In the letter, Paul demands the CDC release nonredacted documents detailing the company’s work with the NCIRD. Read more at: https://www.zerohedge.com/political/rand-paul-demands-answers-over-vax-company-pr-firms-embedded-staff-within-cdc-promote |

|

Shell pays no UK windfall tax despite profits jumpThe energy giant reports $9.5bn in profits, its second-highest quarterly earnings on record. Read more at: https://www.bbc.co.uk/news/business-63409687?at_medium=RSS&at_campaign=KARANGA |

|

Elon Musk claims he’s buying Twitter to ‘help humanity’The billionaire, who says he is not buying the firm to make money, faces court if he walks away. Read more at: https://www.bbc.co.uk/news/business-63408384?at_medium=RSS&at_campaign=KARANGA |

|

Why are so many workers going on strike?Hundreds of thousands of workers have walked out, or threatened to, causing widespread disruption. Read more at: https://www.bbc.co.uk/news/business-62134314?at_medium=RSS&at_campaign=KARANGA |

|

Nifty ends October series with an Inside Bar. What traders should do on Friday“Structurally, the index is likely to trade sideways to bearish bias in the short term. As long as the Nifty stays below 17800 on a closing basis it is likely to test 17500 in the short term,” said Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nifty-ends-october-series-with-an-inside-bar-what-traders-should-do-on-friday/articleshow/95125527.cms |

|

These 5 stocks gain over 10% in each of last 4 months, turn multibaggersWhen the markets are uncertain, it is always interesting to see some consistent stock performance trends. ET Markets found five stocks from the BSE universe that have consistently given at least double-digit returns in each of the last four months. In fact, 4 out of 5 stocks have turned multi-baggers in less than four months time frame. We considered only stocks with a market cap of Rs 500 crore, (Data Source: ACE Equity). Take a look at the key strong points of the stocks on SWOT analysis, according to Trendlyne.com. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/these-5-stocks-gain-over-10-in-each-of-last-4-months-turn-multibaggers/double-digit-returns/articleshow/95121525.cms |

|

Tech’s biggest companies are sending worrying signals about the US economyTech companies led the way for the U.S. economy over the past decade and buoyed the stock market during the worst days of the coronavirus pandemic. Now, amid stubborn inflation and rising interest rates, even the biggest giants of Silicon Valley are signaling that tough days may be ahead. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/techs-biggest-companies-are-sending-worrying-signals-about-the-us-economy/articleshow/95120940.cms |

|

Futures Movers: Oil climbs for a third straight session, with global crude prices settling at a nearly 3-week highOil rises for a third straight session, with global benchmark crude prices settling at their highest in almost three weeks, buoyed in part by third-quarter growth in the U.S. economy. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7144-58B8A66EC484%7D&siteid=rss&rss=1 |

|

‘Living paycheck-to-paycheck has become the norm’: Inflation takes its toll on American finances as emergency funds run dry‘Americans’ monthly expenses have outpaced their personal income growth,” one expert said. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7144-30405259CB71%7D&siteid=rss&rss=1 |

|

MarketWatch Options Trader: A seasonal stock market trade that tends to be reliable begins ThursdayPlus, an options play on Kimberly-Clark. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7144-BB99E1703590%7D&siteid=rss&rss=1 |