Summary Of the Markets Today:

- The Dow closed down 90 points or 0.30%,

- Nasdaq closed down 0.61%,

- S&P 500 down 0.80%,

- WTI crude oil settled at 85 down $1.04,

- USD $112.88 down $0.01,

- Gold $1617 down $21.60,

- Bitcoin $19,066 down 0.70% – Session Low 18,943,

- 10-year U.S. Treasury 4.237% up 0.108%

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

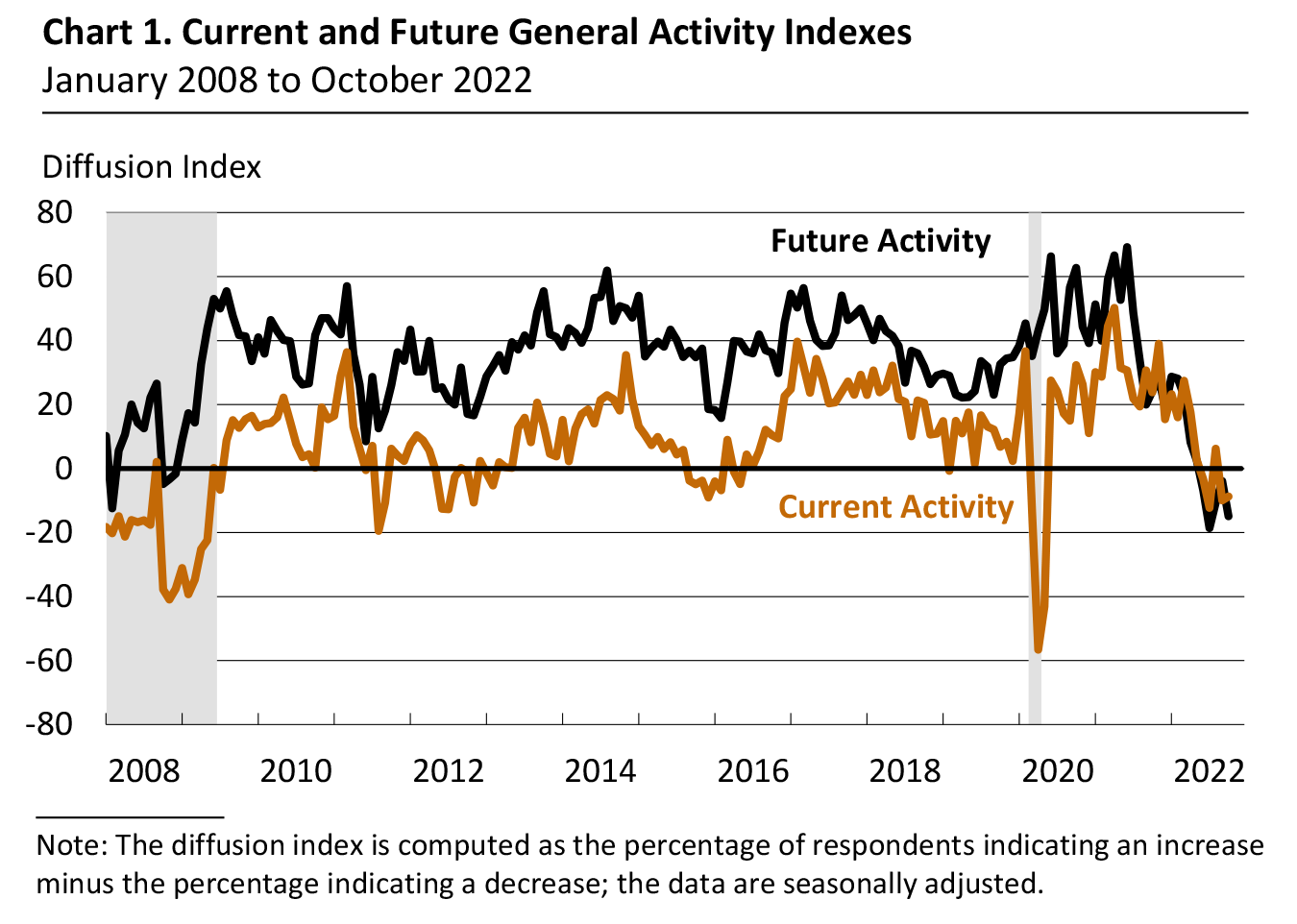

Manufacturing activity in the Philly Fed region continued to decline overall this month. The survey’s indicators for general activity and new orders remained negative, and the shipments index was little changed at a low but positive reading. The survey’s future general activity indexes suggest that the surveyed firms expect declines overall over the next six months. Another indication that the manufacturing sector of the U.S. is slowing.

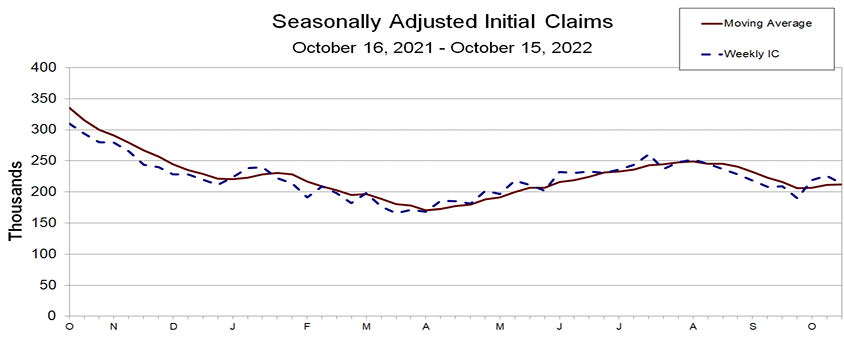

In the week ending October 15, the advance figure for Unemployment Insurance Weekly Claims seasonally adjusted 4 week moving average was 212,250, an increase of 1,250 from the previous week’s revised average. The previous week’s average was revised down by 500 from 211,500 to 211,000. It is expected that the economic slowing as a result of the Fed fighting inflation will cause an increase in initial claims.

September 2022 existing-home sales slowed for the eighth consecutive month to a decline of 23.8% year-over-year. The median existing-home sales price is up 8.4% from one year ago. The inventory of unsold existing homes declined for the second straight month to the equivalent of 3.2 months’ supply at the current monthly sales pace.

Imports into the USA generally indicate how the economy is doing. The Ports of Los Angeles and Long Beach handle 40% of the USA container traffic and is a good indicator of the economy. Imports were down 18% YoY in September, and exports were up 2% YoY. The tea leaves are saying that the economy is slowing.

A summary of headlines we are reading today:

- Falling Metal Prices Could Be A Boon For Manufacturers

- Asian Buyers Are Scooping Up Gold At Low Prices

- Here’s why it’s so hard to find cheap airfare this year — and why 2023 isn’t looking much better

- Big bargains will dominate the holiday season, but shoppers may not be sold

- Renewed threat of rail strike has supply chain managers ramping up contingency plans

- Existing home sales fall to a 10-year low in September, as mortgage rates soar

- Estimating Downside Market Risk

- Fed’s Inflation ‘Nowcast’ Tracker Suggests Price Pressures Increasing

- Market Snapshot: Dow down over 100 points in the final hour of trade despite strong earnings as Treasury yields grind higher

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

How The Diesel Crisis Became An Inflationary Time BombFor all the drama surrounding Biden’s latest Strategic Petroleum Reserve fiasco and his admin’s ridiculous idea to “stimulate” US energy producers to pump more oil because, you see, Biden promises to buy oil at some unknown point in the future (he may or may not, but right now he is certainly draining a million barrels of emergency US energy lifeblood just to buy a few midterm votes, assuring energy producers have zero incentive to produce more), the real crisis is not oil or gas, but diesel. The problem is that as we repeatedly warned over the Read more at: https://oilprice.com/Energy/Energy-General/How-The-Diesel-Crisis-Became-An-Inflationary-Time-Bomb.html |

|

German Government May Have To Inject Another $39 Billion In Energy Giant UniperThe German government may have to pour another up to $39 billion (40 billion euros) in saving the country’s largest natural gas importer, Uniper, on top of a multi-billion euro rescue package and nationalization, German business daily Handelsblatt reported on Thursday, quoting financial and government sources. Last month, the German government, Uniper, and the company’s majority shareholder, Finland-based firm Fortum, agreed on a plan to nationalize the energy giant, aimed at preventing a collapse of the German energy and gas Read more at: https://oilprice.com/Latest-Energy-News/World-News/German-Government-May-Have-To-Inject-Another-39-Billion-In-Energy-Giant-Uniper.html |

|

Falling Metal Prices Could Be A Boon For ManufacturersVia AG Metal Miner Most metal prices experienced considerable drops from price levels seen just a year ago. Indeed, excluding lead, all non-ferrous and ferrous metal prices appear considerably below the price levels seen in 2021. Most suppliers continue to stay quest amidst this decline, opting to place the onus of cost reductions on procurement. That said, detailed should-cost models for semi-finished materials can help drive double-digit cost savings for carbon steel, aluminum, and stainless steel. 2023 will be the first in several years Read more at: https://oilprice.com/Metals/Commodities/Falling-Metal-Prices-Could-Be-A-Boon-For-Manufacturers.html |

|

Crypto Miners Accused Of Exploiting Kazakhstan-Backed IT Startup HubWould-be IT startups based out of a government-backed technopark in Kazakhstan’s capital, Astana, have been mining cryptocurrencies and availing themselves of tax benefits in the process, state auditors have said. The Audit Committee, a government agency that monitors state spending and answers only to the president, noted in a statement last week that poor oversight by the Ministry of Digital Development, Innovation and Aerospace Industry has led to crypto-miners turning the Astana Hub into a financial offshore platform. The Read more at: https://oilprice.com/Latest-Energy-News/World-News/Crypto-Miners-Accused-Of-Exploited-Kazakhstan-Backed-IT-Startup-Hub.html |

|

Asian Buyers Are Scooping Up Gold At Low PricesAs Bloomberg described it, many western investors particularly at the institutional level are dumping bullion. Meanwhile, Asian buyers are taking advantage of lower prices to snap up less expensive jewelry, coins, and bars. According to the Bloomberg report, large volumes of metal are being drawn out of vaults in financial centers like New York and heading east to meet demand in Shanghai’s gold market or Istanbul’s Grand Bazaar. In fact, Asian suppliers are having a difficult time getting enough bullion Read more at: https://oilprice.com/Metals/Gold/Asian-Buyers-Are-Scooping-Up-Gold-At-Low-Prices.html |

|

EU Leaders Set To Meet To Discuss Energy, Ukraine SecurityEuropean Union leaders are due to meet in Brussels on October 20 for the second time in two weeks to try to bring down energy prices despite persistent divisions between the 27 members of the bloc. Discussing ways to reduce gas prices is expected to be a bone of contention after a recent European Commission proposal fell short of detailing how a gas price cap could work. A group of 15 countries including France and Poland favors some form of a cap, but they face strong opposition from Germany and the Netherlands — respectively Europe’s biggest Read more at: https://oilprice.com/Energy/Energy-General/EU-Leaders-Set-To-Meet-To-Discuss-Energy-Ukraine-Security.html |

|

Here’s why it’s so hard to find cheap airfare this year — and why 2023 isn’t looking much betterAirline executives have said consumer demand has remained resilient despite higher fares. Read more at: https://www.cnbc.com/2022/10/20/airfare-stays-high-despite-economic-weakness.html |

|

Big bargains will dominate the holiday season, but shoppers may not be soldRetailers are discounting computers, toys, and more to try to sell off excess inventory and encourage budget-conscious shoppers to spend. Read more at: https://www.cnbc.com/2022/10/20/inflation-weary-shoppers-see-more-holiday-sales-2022.html |

|

Movie theaters want more from Netflix, but the streaming giant isn’t ready to budge on its release modelNetflix is finally embracing ads, leading some to question if it should start releasing more of its movies in theaters for longer runs. Read more at: https://www.cnbc.com/2022/10/20/netflix-knives-out-sequel-glass-onion-limited-release.html |

|

Renewed threat of rail strike has supply chain managers ramping up contingency plansLogistics companies are preparing for the worst as the railroads and unions move closer to a nationwide freight rail strike again. Read more at: https://www.cnbc.com/2022/10/20/threat-of-rail-strike-has-supply-chain-ramping-up-contingency-plans.html |

|

The Rock’s ‘Black Adam’ is a bland, ‘color-by-numbers’ DC Comics superhero movie, critics sayNot even Dwayne “The Rock” Johnson could salvage the Warner Bros.’ latest entrant into the DC Extended Universe, “Black Adam.” Read more at: https://www.cnbc.com/2022/10/20/black-adam-reviews-the-rock-bland-predictable.html |

|

Chess grandmaster Hans Niemann sues champion Magnus Carlsen, others for $100 million over cheating claimChess grandmaster Hans Niemann sued world champion Magnus Carlsen and others over their claims that he cheated in competition. Read more at: https://www.cnbc.com/2022/10/20/chess-grandmaster-hans-niemann-files-100-million-defamation-suit-over-cheating-accusation.html |

|

Here’s how much you can earn and still pay 0% capital gains taxes in 2023The IRS has increased the taxable income thresholds for the 0%, 15%, and 20% long-term capital gains brackets for 2023. Here’s what investors need to know. Read more at: https://www.cnbc.com/2022/10/20/irs-how-much-income-you-can-have-for-0percent-capital-gains-taxes-in-2023.html |

|

Caesars and developer SL Green pitch Times Square casino planCaesars Entertainment and developer SL Green have announced a joint bid for a casino located in New York’s Times Square. Read more at: https://www.cnbc.com/2022/10/20/times-square-casino-caesars-developer-sl-green-join-forces.html |

|

Anti-Defamation League urges Adidas to sever ties with Ye’s YeezyThe rapper and designer has in recent weeks made several degrading remarks about Jewish people and targeted his business partners with public threats. Read more at: https://www.cnbc.com/2022/10/20/anti-defamation-league-to-adidas-sever-ties-with-kanye-wests-yeezy.html |

|

Existing home sales fall to a 10-year low in September, as mortgage rates soarSales of previously owned homes fell 1.5% in September from August to a seasonally adjusted annual rate of 4.71 million units. Read more at: https://www.cnbc.com/2022/10/20/existing-home-sales-fall-to-a-10-year-low-in-september.html |

|

American Airlines expects fourth-quarter profit thanks to strong travel demandAmerican’s revenue rose to a record $13.46 billion in the three months that ended Sept. 30, up 13% from 2019 despite flying nearly 10% less. Read more at: https://www.cnbc.com/2022/10/20/american-airlines-aal-3q-2022.html |

|

Wall Street eyes auto industry earnings for signs of ‘demand destruction’Wall Street will be watching the auto industry’s earnings results for signs of weakening consumer demand amid recessionary fears. Read more at: https://www.cnbc.com/2022/10/19/wall-street-eyes-auto-industry-earnings-for-signs-of-demand-destruction-.html |

|

Kevin Durant is the latest athlete to buy a Major League Pickleball teamKevin Durant and Rich Kleiman are the latest athletes to buy a Major League Pickleball team. Read more at: https://www.cnbc.com/2022/10/20/kevin-durant-is-latest-athlete-to-buy-into-major-league-pickleball.html |

|

Goldman Calls “Whistleblower” Suing For $23 Million “Cynical” And “Lamentable”A self-proclaimed ‘whistleblower’ from Goldman Sachs is suing the investment bank for more than $23 million, alleging he was unfairly dismissed from the company. Goldman calls the claims “cynical” and “lamentable”, according to a Wednesday morning report by Reuters. Former EMEA head of synthetic swap sales Thomas Doyle is the ex-employee now suing the company. Goldman says his allegations are “scarcely believable”. In filings with a London employment tribunal, Goldman wrote: “This is not so much a schedule of loss as a schedule of avarice.” Doyle worked for Goldman between 2018 and 2021 and alleges that he was dismissed with a “woeful” lack of proper procedure, the report says. He attributes his dismissal to making “multiple whistleblowing reports” to his managers.

As a result, he says he had to deal with “vile and bullying language”. He then claims he was fired in 2021 witho … Read more at: https://www.zerohedge.com/markets/goldman-calls-whistleblower-suing-23-million-cynical-and-lamentable |

|

Estimating Downside Market RiskExcerpted from John Hussman’s Market Comment,

At the beginning of 2022, our most reliable stock market valuation measures stood at record levels, beyond even their 1929 and 2000 extremes. The 10-year Treasury yield was at 1.5%, the 30-year Treasury bond yield was at 1.9%, and Treasury bill yields were just 0.06%. By our estimates, that combination produced the most negative expected return for a c … Read more at: https://www.zerohedge.com/markets/estimating-downside-market-risk |

|

GA Smashes Turnout Record – Abrams Says “Voter Suppression Alive And Well”Is this what voter suppression looks like? On the first day of early voting for the 2022 midterms, Georgia positively smashed the previous Day One turnout record. More than 130,000 Georgians cast their ballot on Monday — a jaw-dropping 85% gain over the first day of the 2018 midterm. Nonetheless, in a Monday night debate, Democratic gubernatorial candidate Stacey Abrams doubled down on her claims that incumbent Governor Brian Kemp has relentlessly worked to prevent Georgians from participating in elections:

Juiced by the high-profile governor’s race and a spicy Senate race pitting Herschel Walker against incumbent Democrat Raphael Warnock, the remarkable turnout kept rolling on Tuesday — with even more voters turning out for Day 2 than on the second day of voting for the 2020 presidential election. Tha … Read more at: https://www.zerohedge.com/political/ga-smashes-turnout-record-abrams-says-voter-suppression-alive-and-well |

|

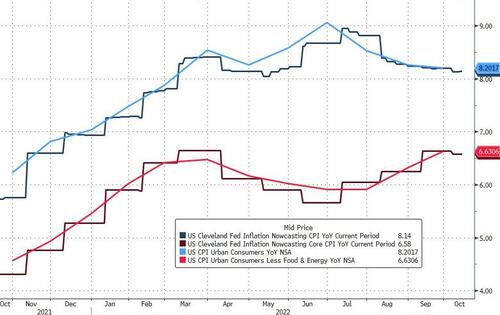

Fed’s Inflation ‘Nowcast’ Tracker Suggests Price Pressures IncreasingAuthored by Naveen Anthrapully via The Epoch Times, The trend of high inflation rates over the past few months looks all set to continue through October, according to a recent estimate by the Federal Reserve Bank of Cleveland. October’s Consumer Price Index (CPI), a measure of inflation, is predicted to be up by more than 0.8 percent from September, the Fed’s “Nowcast” inflation forecast shows. Core CPI, which excludes food and energy, is expected to be up by 0.54 percent. The Fed projects annual CPI to be at 8.14 percent in October, with core CPI at 6.58 percent.

Data from the U.S. Bureau of Labor Statistics show that Read more at: https://www.zerohedge.com/markets/feds-inflation-nowcast-tracker-suggests-price-pressures-increasing |

|

Pound rises as Liz Truss announces resignationSterling initially rose sharply to $1.13 as investors reacted to the news of the prime minister’s departure. Read more at: https://www.bbc.co.uk/news/business-63326809?at_medium=RSS&at_campaign=KARANGA |

|

National Grid raises discounts for off-peak electricity useHouseholds will get a discount of £3 per kWh instead of 52p off bills, National Grid says. Read more at: https://www.bbc.co.uk/news/business-63329233?at_medium=RSS&at_campaign=KARANGA |

|

Mortgage rates hit fresh 14-year highsAverage two- and five-year fixed rates have jumped to 6.65% and 6.51% respectively. Read more at: https://www.bbc.co.uk/news/business-63327553?at_medium=RSS&at_campaign=KARANGA |

|

Nifty could be forming strong base near 17,400. What investors should do on Friday“Now, it has to be above 17,500 zones for an up move towards 17,777 and 17,850 zones, whereas supports are placed at 17,442 and 17,350 zones,” said Chandan Taparia of Motilal Oswal. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-could-be-forming-strong-base-near-17400-what-investors-should-do-on-friday/articleshow/94990903.cms |

|

Midcap stocks from different sectors with upside potential of more than 25%ET screener powered by Refinitiv’s Stock Report Plus lists down quality stocks with high upside potential over the next 12 months, having an average recommendation rating of “buy” or “strong buy”. This predefined screener is only available to ET Prime users. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/midcap-stocks-from-different-sectors-with-upside-potential-of-more-than-25/articleshow/94983362.cms |

|

HUL Q2 Preview: Inflation to take margin downhillBrokerage Kotak Institutional Equities expects continued strength in the home care revenue growth on the back of price hikes in laundry products Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/hul-q2-preview-inflation-to-take-margin-downhill-price-hikes-to-aid-sales-growth/articleshow/94993794.cms |

|

Market Snapshot: Dow down over 100 points in the final hour of trade despite strong earnings as Treasury yields grind higherU.S. stocks trade lower in the final hour of trade on Thursday, reversing some of their gains for the week, despite a strong start to the third-quarter earnings season, as Treasury yields rise to fresh multiyear highs Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-713D-FCEAAC6C5B1A%7D&siteid=rss&rss=1 |

|

The Margin: Kanye West agrees to buy Parler. Here’s everything you need to know about the controversial social media platform.Ye was recently banned from Facebook and Twitter for violating the platform’s policies Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-713A-FA21E57ED52A%7D&siteid=rss&rss=1 |

|

‘Over the hill’ birthday cards are getting old. Wish someone happy birthday with an age-friendly card instead.Meet these stereotype-busting greeting cards that celebrate aging Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-713D-9315D9A70B80%7D&siteid=rss&rss=1 |