Summary Of the Markets Today:

- The Dow closed up 338 points or 1.12%,

- Nasdaq closed up 0.9%,

- S&P 500 up 1.14%,

- Gold $1656 down $7.80,

- WTI crude oil settled at $83 down $2.37,

- 10-year U.S. Treasury 3.996% down 0.019%,

- USD index $112.03 little changed,

- Bitcoin $19,373 down $275

Today’s Economic Releases:

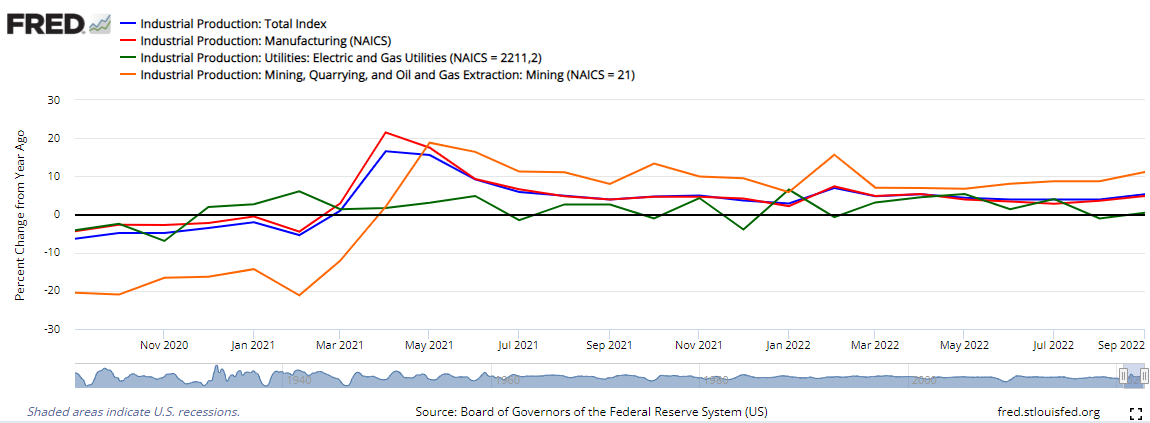

September 2022 Industrial production increased 5.3% year-over-year with the components: manufacturing up 4.8% year-over-year; mining up 11.1% year-over-year; and utilities up 0.5% year-over-year. All components improved over the previous month.

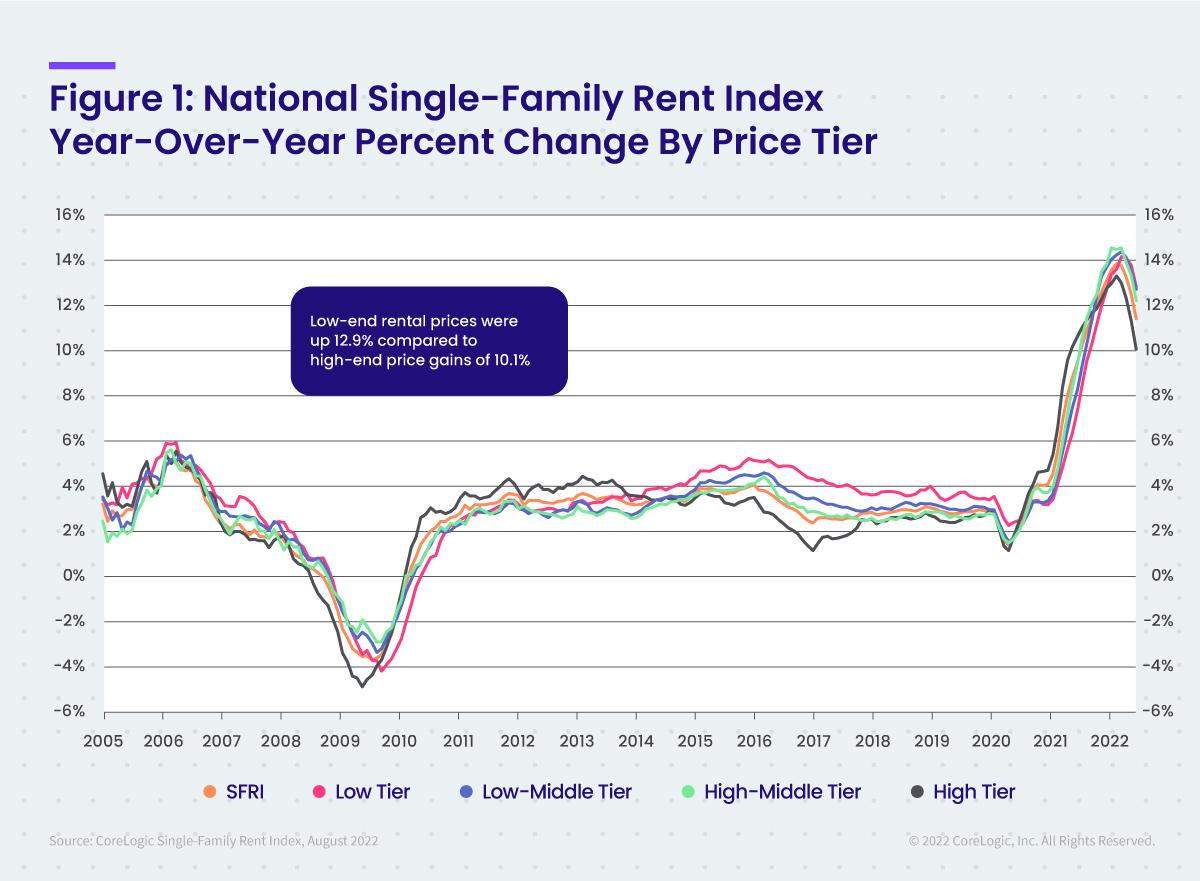

U.S. single-family home rental costs posted an 11.4% year-over-year increase in August 2022, marking the fourth straight month of annual deceleration. Even so, rental costs remained elevated, with annual growth running at about five times the rate than in August 2020 in the midst of the COVID-19 pandemic. A shortage of available rental units continues to fuel price growth, although inflation and worries over a looming recession should begin to temper increases. CoreLogic’s detailed view by rental prices:

- Lower-priced (75% or less than the regional median): 12.9%, up from 7.4% in August 2021

- Lower-middle priced (75% to 100% of the regional median): 12.8%, up from 8.3% in August 2021

- Higher-middle priced (100% to 125% of the regional median): 12.3%, up from 9.4% in August 2021

- Higher-priced (125% or more than the regional median): 10.1%, down from 10.7% in August 2021

A summary of headlines we are reading today:

- Chinese Steel Manufacturers On The Brink Of Bankruptcy

- Rio Tinto Warns Commodity Boom Is Coming To An End As Downside Risks Emerge

- Is The Global Semiconductor Supply Squeeze Finally Coming To An End?

- Oil Prices Continue to Fall To Levels Not Seen In Weeks

- Homebuilder sentiment drops to half of what it was six months ago

- Is Wind Energy Becoming Too Expensive?

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Chinese Steel Manufacturers On The Brink Of BankruptcyVia AG Metal Miner Is it all doom and gloom for Chinese steel manufacturing? Its hard to tell at the moment. Indeed, China finds itself in a precarious place financially. Whats more, a sizable section of global financial and stock analysts have predicted the crises will only get worse as the country prepares to face its toughest winter yet. But that is only half the story. A financial downward spiral hit the Chinese economy hard. Among the most widely hit industries are its steel and iron ore sectors. The present crisis started about Read more at: https://oilprice.com/Metals/Commodities/Chinese-Steel-Manufacturers-On-The-Brink-Of-Bankruptcy.html |

|

Rio Tinto Warns Commodity Boom Is Coming To An End As Downside Risks EmergeIron ore demand will be weighed down by a global slowdown in commodity markets, driven by Covid-19 clampdowns in China and a looming recession across developed Western economies warned Rio Tinto. In a gloomy third-quarter trading update, the Anglo-Australian miner feared that the commodities boom was finally coming to an end this year, with prices expected to keep falling as downside risks to demand emerge. The price of iron ore contracts in Singapore has fallen more than 46 percent from its most recent peak in March. Prices slid Read more at: https://oilprice.com/Metals/Commodities/Rio-Tinto-Warns-Commodity-Boom-Is-Finally-Coming-To-An-End.html |

|

Is The Global Semiconductor Supply Squeeze Finally Coming To An End?The historic slowdown in the personal computers market has led to one of the biggest declines in semiconductor lead times in years, a sign the chip crunch could be set to ease. Bloomberg cited a new report from Susquehanna Financial Group that outlines semiconductor lead times, the gap between when a chip is ordered and when it is delivered, declined four days in September to 26.3 weeks. The month prior, lead times were around 27 weeks. Source: Bloomberg Susquehanna analyst Christopher Rolland wrote in a research note that all Read more at: https://oilprice.com/Energy/Energy-General/Is-The-Global-Semiconductor-Supply-Squeeze-Finally-Coming-To-An-End.html |

|

Oil Prices Continue to Fall To Levels Not Seen In WeeksCrude oil prices continued their fall on Tuesday, with WTI now dipping to levels not seen since before the OPEC+ meeting. The November contract for WTI crude fell to $83.22 per barrel on Tuesday afternoon sliding 2.64% from Monday. The last time WTI was this low was days before OPEC+ met, when the group decided to cut 2 million barrels per day from its production targets starting in November. The price dip is in part attributed to talks about releasing more barrels from the U.S. Strategic Petroleum Reserves. Initial reports suggested that Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Continue-to-Fall-To-Levels-Not-Seen-In-Weeks.html |

|

Will Bioenergy Ever Be Competitive?A study led by researchers at the Center for Advanced Bioenergy and Bioproducts Innovation (CABBI) improves understanding of leaf functional relationships and provides valuable new information for scientists modeling the productivity of C4 bioenergy crops. The research team found that miscanthus and sorghum both C4 plant species occupy a distinct niche of the leaf economics spectrum (LES), with greater photosynthetic rates and nitrogen use efficiency than more common C3 plants. The study, published in Plant, Cell & Environment, Read more at: https://oilprice.com/Alternative-Energy/Biofuels/Will-Bioenergy-Ever-Be-Competitive.html |

|

Brent Crude Drops Below $90 On Recession FearsWTI crude has fallen back to pre-OPEC cut announcement levels, with Brent crude falling back below $90 per barrel on global recession fears.Chart of the WeekU.S. to Confront Higher Power Prices- Electricity prices along the Atlantic coast of the United States are set to increase 50-60% year-on-year as gas supplies become squeezed to meet winter heating and generation needs.- Whilst New England on-peak power prices have averaged slightly below $80/MWh in September, forward electricity prices for December 2022 have been trending Read more at: https://oilprice.com/Energy/Crude-Oil/Brent-Crude-Drops-Below-90-On-Recession-Fears.html |

|

Netflix crushes expectations across the board, adds 2.41 million subscribersNetflix reported third-quarter earnings after the bell. Here are the results. Read more at: https://www.cnbc.com/2022/10/18/netflix-nflx-earnings-q3-2022.html |

|

Homebuilder sentiment drops to half of what it was six months agoConfidence among builders in the single-family home market is at the lowest level since August 2012, with the exception of a drop at the start of the pandemic. Read more at: https://www.cnbc.com/2022/10/18/homebuilder-sentiment-drops-to-half-of-what-it-was-six-months-ago.html |

|

NFL Black Friday game coming to Amazon in 2023The NFL’s first Black Friday game is set to stream on Amazon in 2023. That day is usually associated with Christmas shopping deals at stores. Read more at: https://www.cnbc.com/2022/10/18/nfl-black-friday-game-coming-to-amazon-in-2023.html |

|

Rolls-Royce says it already has hundreds of U.S. orders for its $413,000 Spectre electric vehicleMore than 300 buyers put down deposits for Rolls-Royce’s first electric vehicle prior to its unveiling, the luxury automaker’s CEO told CNBC. Read more at: https://www.cnbc.com/2022/10/18/rolls-royce-has-over-300-orders-for-its-413000-spectre-electric-vehicle.html |

|

Hasbro profit misses the mark as toy maker faces high inventory and inflationHasbro reported Q3 earnings that missed expectations and revenue that matched Wall Street projections. Read more at: https://www.cnbc.com/2022/10/18/hasbro-has-reports-q3-earnings.html |

|

McDonald’s to sell Krispy Kreme doughnuts at 9 locations in latest menu experimentMcDonald’s will sell Krispy Kreme doughnuts at nine locations in Kentucky, starting Oct. 26, as part of an operational test. Read more at: https://www.cnbc.com/2022/10/18/mcdonalds-to-sell-krispy-kreme-doughnuts-in-latest-menu-experiment.html |

|

Bill Gates says investment in innovation is the important part of ESGGates said there is a modest number of companies that will drive down the cost of choosing clean technology over alternatives that emit more greenhouse gases. Read more at: https://www.cnbc.com/2022/10/18/bill-gates-on-esg-investing-in-innovation-the-important-part.html |

|

Relativity Space adds 150 acres at NASA’s Mississippi center to test its reusable rockets3D-printing rocket specialist Relativity Space signed an expansion deal with NASA’s Stennis space center in Mississippi. Read more at: https://www.cnbc.com/2022/10/18/relativity-space-expansion-at-nasas-stennis-for-rocket-engine-testing.html |

|

Peloton extends refund period for recalled Tread+ for another yearPeloton agreed to extend a refund period for its recalled Tread+ for another year, the company and the U.S. Consumer Product Safety Commission announced. Read more at: https://www.cnbc.com/2022/10/18/peloton-extends-refund-period-for-recalled-tread-for-another-year.html |

|

J&J stock dip after earnings beat reflects 2022 outperformance rather than the resultsIt was a solid quarter for Johnson & Johnson, but the strong dollar is and will remain a headwind for the foreseeable future. Read more at: https://www.cnbc.com/2022/10/18/jj-stock-dip-after-earnings-beat-reflects-2022-outperformance-rather-than-the-results.html |

|

Flooding in Nigeria kills more than 600 people, officials sayRising temperatures have prompted more evaporation in the atmosphere, leading to more frequent and intense precipitation events and drought conditions.. Read more at: https://www.cnbc.com/2022/10/18/flooding-in-nigeria-kills-more-than-600-people-officials-say-.html |

|

3 takeaways from our daily meeting: Banks as market leaders, 3 trades and keeping CRMThe Investing Club holds its “Morning Meeting” every weekday at 10:20 a.m ET. Read more at: https://www.cnbc.com/2022/10/18/3-takeaways-from-our-daily-meeting-banks-as-leaders-3-trades-keeping-crm.html |

|

IKEA teams with self-driving truck startup Kodiak Robotics to test deliveries in TexasSemitrucks equipped with Kodiak Robotics’ prototype self-driving system will make deliveries from Houston to Dallas for IKEA. Read more at: https://www.cnbc.com/2022/10/18/ikea-kodiak-robotics-test-driverless-trucks-in-texas.html |

|

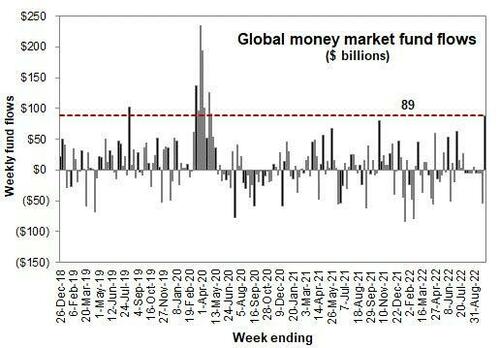

Hartnett Reveals Latest FMS Results: Macro, Investor Capitulation Is Here; Policy Capitulation Starting… The “Big Rally” Hits In H1 2023One week ago, Goldman trader Scott Rubner made a bold prediction: when looking at the latest fund flows, and especially the huge spike in money market funds (a proxy for risk selling)…

… Rubner concluded that “Retail Has Finally Blinked. Capitulation Is Near.” Well, as so often happens, Goldman’s flow guru was well ahead of the curve as usual, and as BofA’s Michael Hartnett (who explained in his latest note “The Bear Hug” why he sees stocks sliding with occasional bear markets until early 2023) writes in the bank’s latest monthly global Fund Manager Survey (available to pro subs in the usual pl … Read more at: https://www.zerohedge.com/markets/hartnett-reveals-latest-fms-results-macro-and-investor-capitulation-triggers-policy |

|

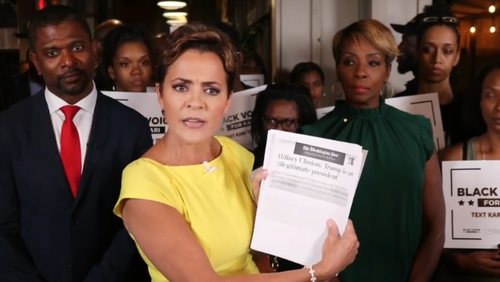

Receipts: Kari Lake Calls Out ‘Election Denier’ Democrats And Their Media LickspittlesRepublican Arizona gubernatorial candidate Kari Lake – whose opponent is too petrified to debate – spent two minutes slamming the press for demonizing Trump supporters as ‘election deniers’ when the left has an extensive history of doing just that. After being handed a stack of evidence compiled by a 20-year-old named Anthony (for which Lake thinked him – saying “You did better research than half these people”), the Republican candidate went to town on Democrats and their media lickspittles. “Let’s talk about election deniers, here’s 150 examples of Democrats denying election results,” said Lake, showing the papers to the cameras. “Oh wow, look at this, this is from Joe Biden’s press secretary: ‘reminder, Brian Kemp stole the gubernatorial election from Georgians and Stacey Abrams,’ a Democrat saying that, an election denier!” “Oh look at this, … Read more at: https://www.zerohedge.com/political/receipts-kari-lake-calls-out-election-denier-democrats-and-journalist-lickspittles |

|

Market Tumbles On Report Apple Cutting iPhone 14 Plus ProductionThree weeks ago Apple reportedly backed off its plans to increase iPhone production. As Bloomberg reported at the time, Apple is backing off plans to increase production of its new iPhones this year after an anticipated surge in demand failed to materialize.

Today, it appears that demand continues to worsen as The Information reports that Apple is cutting production of the iPhone 14 Plus less than two weeks after its debut, … Read more at: https://www.zerohedge.com/markets/market-tumbles-report-apple-cutting-iphone-14-plus-production |

|

Is Wind Energy Becoming Too Expensive?Authored by Felicity Bradstock via OilPrice.com, General Electric (GE) plans to make major job cuts in its U.S. wind operations and will consider its other markets too as windfarms are proving to be a major expense in the wake of Covid and the Russian invasion of Ukraine. Continued supply chain disruption and the high cost of wind turbines are deterring companies from investing in wind energy, as they look for cheaper alternatives. It’s a question that has been being asked for years – are wind and solar power more expensive and less reliable? The two renewable energy sources have been repeatedly criticised for their intermittent power provision. Meanwhile, as the prices of steel and other materials continue to rise, solar and wind farms are proving to be more expensive to construct than previously hoped. Read more at: https://www.zerohedge.com/energy/wind-energy-becoming-too-expensive |

|

RMT union announces November rail strike datesThere will be fresh Network Rail strikes on 3, 5 and 7 November as part of a dispute over pay Read more at: https://www.bbc.co.uk/news/business-63307427?at_medium=RSS&at_campaign=KARANGA |

|

UK’s mini-budget U-turn welcomed by IMFThe reversal of the government’s tax cuts will help the UK fight soaring inflation, the IMF says. Read more at: https://www.bbc.co.uk/news/business-63300745?at_medium=RSS&at_campaign=KARANGA |

|

Cement firm Lafarge pleads guilty to supporting ISCement giant Holcim’s Lafarge pleaded guilty in the US over its payments to Islamic State. Read more at: https://www.bbc.co.uk/news/business-63305371?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty charts show positive momentum in the near term. What investors should do on Wednesday“Support-based buying was seen at crucial support zones of 17,442 and held the index at higher zones. Now, it has to hold above 17,442 zones for an up move towards 17650 and 17,777 zones whereas supports are placed at 17,350 and 17,250 zones,” said Chandan Taparia of Motilal Oswal. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-charts-show-positive-momentum-in-the-near-term-what-investors-should-do-on-wednesday/articleshow/94944726.cms |

|

Are FIIs predicting the peak of US Fed’s quantitative tightening cycle?However, incremental sharp outflows from EMs like India going ahead could indicate that the current expectation of a terminal interest rate of 4.5-5% for the US will be breached on the upside going forward and remains a key risk, the analysts said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/are-fiis-predicting-the-peak-of-us-feds-quantitative-tightening-cycle/articleshow/94940242.cms |

|

Despite soaring staff costs & looming growth risks, can Wipro turn D-St pessimists to optimists?The management said that margins in the current quarter will see the impact of two additional months of salary increment, though it expects it to be partially offset by likely improvement of utilization and price realization. Attrition has been a key factor contributing to the rise in staff cost and hurting margin. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/despite-soaring-staff-costs-looming-growth-risks-can-wipro-turn-d-st-pessimists-to-optimists/articleshow/94933123.cms |

|

Commodities Corner: Why you can’t count on another SPR oil release to cut gasoline prices at the pumpSpeculation that the Biden administration will soon announce the release of more oil from the U.S. Strategic Petroleum Reserve put pressure on oil prices Tuesday, but analysts don’t expect such a move to lead to a significant fall in gasoline prices at the pump. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-713C-2C90A9027950%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil settles at a more than 2 week low on talk of another U.S. SPR releaseOil futures end sharply lower on Tuesday, with talk of another release of crude from the U.S. Strategic Petroleum Reserve combining with ongoing fears of a recession that could slow energy demand to push prices to their lowest levels in more than two weeks. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-713B-B58BB3D1C21D%7D&siteid=rss&rss=1 |

|

How to avoid being scammed when you apply for student-loan forgivenessThe application process is going ahead even as lawsuits challenge the Biden administration forgiveness order. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-713C-06B16AE1714E%7D&siteid=rss&rss=1 |