Summary Of the Markets Today:

- The Dow closed down 404 points or 1.34%,

- Nasdaq closed down 3.08%,

- S&P 500 down 2.37%,

- WTI crude oil settled at $86 down $3.42,

- USD $113. little changed,

- Gold $1648 down $28.90,

- Bitcoin $19,230 down 0.73% – Session Low 19,154,

- 10-year U.S. Treasury 4.006% up 0.052%

- Baker Hughes Rig Count: U.S. +7 to 769 Canada +1 to 216

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

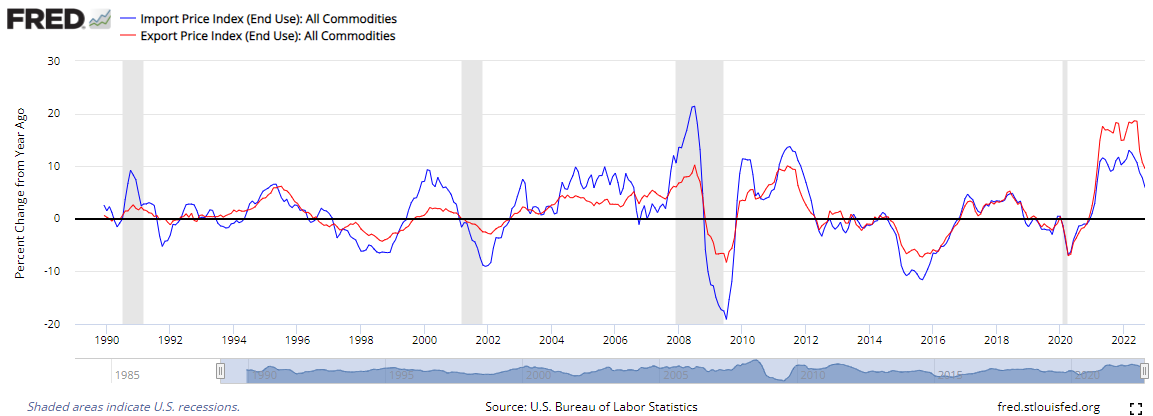

U.S. import price growth fell to 6.0% year-over-year in September 2022 from 7.8% in August – lead by lower fuel and nonfuel prices. Price growth for U.S. exports fell to 9.5% in September from 10.7% in August.

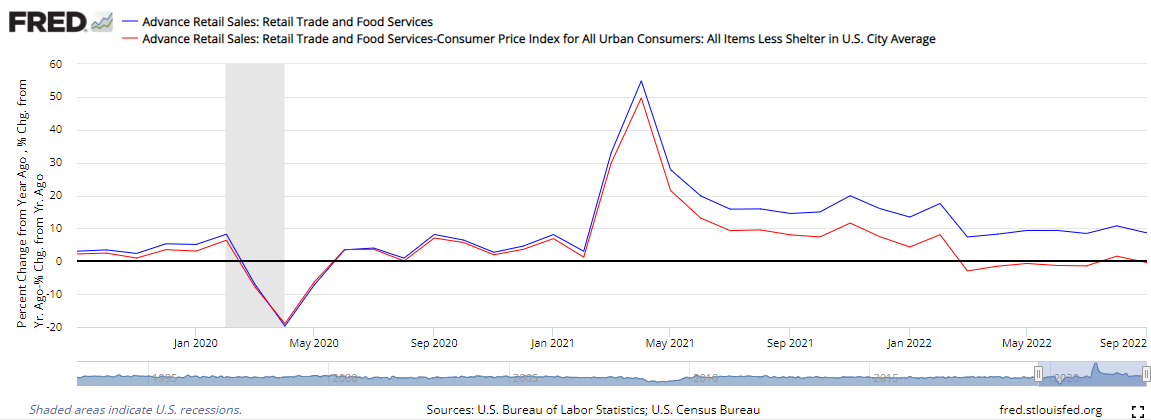

Advance estimates of U.S. retail and food services sales for September 2022 was up 8.2% above September 2021 (blue line on graph below). Total sales for the July 2022 through September 2022 period were up 9.2% from the same period a year ago. Unfortunately, when adjusted for inflation – retail sales fell 0.4% year-over-year (red line on graph below).

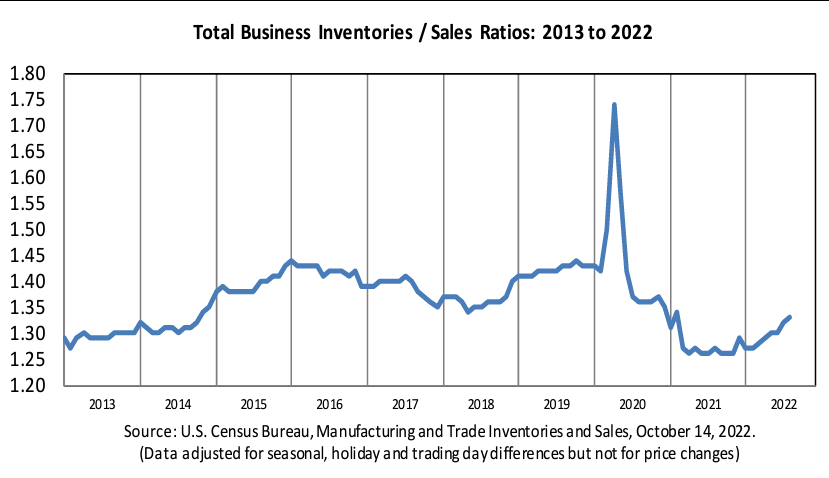

The total business inventories/sales ratio based on seasonally adjusted data at the end of August 2022 was 1.33. The August 2021 ratio was 1.27. Generally speaking, a rising ratio (like what is happening now) is a sign of a slowing economy – but with all the issues in the supply chain – not sure this normally good indicator is saying anything.

A summary of headlines we are reading today:

- U.S. Refiners Are Preparing For A Potential Fuel Export Ban

- U.S. Oil Rig Count Jumps Amid Selloff In Crude

- U.S. Energy Bills See Largest Rise In Decades – More Pain To Come

- Kroger agrees to buy rival grocery company Albertsons for $24.6 billion

- Series I bond interest is expected to fall to roughly 6.48% in November. But that’s still a ‘really good rate,’ experts say

- 3 takeaways from our daily meeting: New market leaders, banks report, Club stocks next week

- Consumer spending was flat in September and below expectations as inflation takes toll

- Americans Are Getting Poorer: Price Inflation Grew Faster Than Wages Again In September

- Market Extra: ‘Growing wealth gap and rising inflation … hurt the global economy at almost every turn,’ Jamie Dimon tells MarketWatch on its anniversary

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

U.S. Refiners Are Preparing For A Potential Fuel Export BanU.S. refineries are preparing themselves for the possibility that President Biden could impose a ban on fuel exports after the White House dangled the threat of the ban in front of refiners. No action has been taken to date, but with the mid-terms coming up and fuel prices continuing to rise, this could soon change. Earlier this month, the White House requested that the U.S. Department of Energy (DoE) assess the potential impact of banning fuel exports including gasoline, diesel, and other refined petroleum products. The move suggested Read more at: https://oilprice.com/Energy/Crude-Oil/US-Refiners-Are-Preparing-For-A-Potential-Fuel-Export-Ban.html |

|

Russian Diplomat Says Moscow May Not Renew Grain DealMoscow is prepared to reject the renewal of an agreement on grain exports from Black Sea ports unless its demands are addressed, Russia’s UN ambassador in Geneva has told Reuters. Moscow has submitted a list of complaints about the agreement, brokered by the United Nations and Turkey in July, to the United Nations, said Gennady Gatilov in an interview with Reuters published on October 13. The agreement paved the way for Ukraine to resume grain exports from Black Sea ports that had been under a Russian naval blockade since Moscow invaded Ukraine Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Diplomat-Says-Moscow-May-Not-Renew-Grain-Deal.html |

|

Chevron CEO Blames Climate Policies For Global Energy CrisisThe chairman and CEO of energy company Chevron warned the global energy crisis had been exacerbated by Western governments “doubling down” on green energy policies that will only cause “more volatility, more unpredictability, and more chaos.” If people want to stop driving, stop flying… that’s a choice for society, he said. I don’t think most people want to move backwards in terms of their quality of their life… our products enable that. CEO Mike Wirth told Financial Times in an interview this week Read more at: https://oilprice.com/Energy/Energy-General/Chevron-CEO-Blames-Climate-Policies-For-Global-Energy-Crisis.html |

|

U.S. Oil Rig Count Jumps Amid Selloff In CrudeThe number of total active drilling rigs in the United States rose by 7 this week, according to new data from Baker Hughes published on Friday. The total rig count rose to 769 this week226 rigs higher than the rig count this time in 2021. Oil rigs in the United States rose by 8 this week, to 610. Gas rigs slipped by 1, to 157. Miscellaneous rigs stayed the same at 2. The rig count in the Permian Basin rose by 1 to 346 this week. Rigs in the Eagle Ford slipped by 1 to 71. Oil and gas rigs in the Permian are 79 above where they were this time Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Rig-Count-Jumps-Amid-Selloff-In-Crude.html |

|

New President And PM-Designate Spark Unrest Concerns In IraqIraq, OPEC’s second-largest producer, elected a new president on Thursday after months of political deadlock, protests, and violent clashes among various militias both in Baghdad’s Green Zone and oil-rich Basra. Iraqi lawmakers elected Kurdish politician Abdul Latif Rashid as the country’s new president following two rounds of voting in parliament against the backdrop of rocket attacks. Rashid won 160 votes, defeating another Kurdish politician, Barham Saleh, who won 99 votes, according to Al Jazeera. While parliament was in session, Read more at: https://oilprice.com/Latest-Energy-News/World-News/New-President-And-PM-Designate-Spark-Unrest-Concerns-In-Iraq.html |

|

U.S. Energy Bills See Largest Rise In DecadesMore Pain To ComeIf it seems like your energy bills have fell victim to price creep, you’re right. Data from the U.S. Bureau of Labor Statistics and the Energy Information Administration suggest that U.S. consumers have seen the largest increase in natural gas and electricity bills in decades. For starters, the U.S. Bureau of Labor Statistics said that nat gas bills in September were 33% higher than last September. While natural gas bills are often confusing and filled with a barrage of surcharges and taxes, such as gas recovery and distribution charges as Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Energy-Bills-See-Largest-Rise-In-DecadesMore-Pain-To-Come.html |

|

Kroger has to win over Wall Street and Washington on its Albertsons deal – here’s how it plans to do thatKroger and Albertsons must persuade federal regulators, investors, and shoppers that the deal is beneficial. Read more at: https://www.cnbc.com/2022/10/14/albertsons-deal-how-kroger-plans-to-win-over-regulators-investors.html |

|

Beyond Meat to cut 19% of its workforce as sales, stock struggleBeyond Meat plans to cut 19% of its workforce or about 200 employees, the company said in a regulatory filing. Read more at: https://www.cnbc.com/2022/10/14/beyond-meat-to-cut-19percent-of-its-workforce-as-sales-stock-struggle.html |

|

NFL Sunday Ticket still up for grabs as Apple pushes for flexibility with game rightsApple’s negotiations for Sunday Ticket have gotten complicated because of existing restrictions around the package, sources say. Read more at: https://www.cnbc.com/2022/10/14/nfl-apple-are-at-odds-sunday-ticket-talks.html |

|

Medieval Times sues performers’ union over trademark infringementMedieval Times filed a suit Thursday claiming that its employees’ union is infringing on its trademark. Read more at: https://www.cnbc.com/2022/10/14/medieval-times-sues-union-over-trademark-infringement.html |

|

Kroger agrees to buy rival grocery company Albertsons for $24.6 billionKroger is the second-largest grocer by market share in the United States, behind Walmart, and Albertsons is fourth, after Costco. Read more at: https://www.cnbc.com/2022/10/14/kroger-agrees-to-buy-albertsons-for-24point6-billion.html |

|

Series I bond interest expected to fall to roughly 6.48% in November. But that’s still a ‘really good rate,’ experts saySeries I bonds, an inflation-protected and nearly risk-free investment, may reduce annual rates to roughly 6.48% in November, experts say. Read more at: https://www.cnbc.com/2022/10/14/series-i-bond-rate-expected-to-fall-to-roughly-6point48percent-in-november.html |

|

Beyond Meat exec Doug Ramsey leaves company after arrest for allegedly biting man’s nose, punching SubaruDoug Ramsey, who was Beyond Meat’s operating chief, was arrested for allegedly biting a man’s nose after a college football game. Read more at: https://www.cnbc.com/2022/10/14/beyond-meat-exec-doug-ramsey-leaves-company-following-arrest-for-allegedly-biting-mans-nose.html |

|

Stocks making the biggest moves midday: JPMorgan Chase, Albertsons, Tesla, Beyond Meat, Delta and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/10/14/stocks-making-the-biggest-moves-midday-jpmorgan-chase-albertsons-tesla-beyond-meat-delta-and-more.html |

|

Netflix to get Nielsen ratings as streaming giant rolls out ad-supported planNetflix shows on its ad-supported tier will be rated by Nielsen starting sometime next year. Read more at: https://www.cnbc.com/2022/10/13/netflix-shows-on-ad-supported-plan-to-get-nielsen-ratings-in-2023.html |

|

3 takeaways from our daily meeting: New market leaders, banks report, Club stocks next weekThe Investing Club holds its Morning Meeting every weekday at 10:20 a.m. ET. Read more at: https://www.cnbc.com/2022/10/14/takeaways-from-our-daily-meeting-market-leaders-banks-club-stocks-.html |

|

California approves desalination plant as historic drought hits water suppliesThe Doheny Ocean Desalination Project in Southern California could be functioning within the next five years and supply water for thousands of people. Read more at: https://www.cnbc.com/2022/10/14/california-approves-desalination-plant-as-drought-hits-water-supplies.html |

|

Watch SpaceX splashdown the Crew-4 astronauts for NASA after a six-month stay at the space stationSpaceX is set to return its fourth operational crew mission from the International Space Station on Friday. Read more at: https://www.cnbc.com/2022/10/14/spacex-crew-4-splashdown-live-stream-nasa-astronauts-return-to-earth.html |

|

Consumer spending was flat in September and below expectations as inflation takes tollRetail and food services sales in total were little changed for the month after rising 0.4% in August. Read more at: https://www.cnbc.com/2022/10/14/retail-sales-september-2022.html |

|

What If Everyone’s Wrong (Just Long Enough To Blow Up Their Account)?Authored by Charles Hugh Smith via OfTwoMinds blog, Trying to restore a system that is spiraling away from equilibrium with new extremes of obsolete, misguided policies only accelerates the swings from apparent stability to cascading chaos.

The conventional view of the market is there are two sides to every trade and one is right and the other is wrong. The punters who correctly read the tea leaves and who were right scored gains on their trade and those punters whose forecast was wrong lost their bet. But what if this market isn’t binary, but rather a crushing machine that pulverizes every forecast and position in a disorderly process in which every forecast/position is crushed to rubble and then the market moves on to another forecast/position and crushes that, and so on until every forecast/position has been pulverized and every once-confiden … Read more at: https://www.zerohedge.com/markets/what-if-everyones-wrong-just-long-enough-blow-their-account |

|

Atlanta Fed President Reveals Five Years Of Trading Violations; Claims He “Didn’t Understand” Disclosure ObligationsOne year after the Fed was rocked by a trading scandal which cost the jobs of three Fed henchmen, including Dallas and Boston Fed presidents, Kaplan and Rosengren, and Fed vice-chair Richard Clarida (who couldn’t wait to be sacked for cause or otherwise just to get back to Pimco) after financial disclosures showed they had been trading extensively in individual stocks in 2020 during a period in which the Fed engaged in extraordinary market interventions as a result of the coronavirus pandemic, moments ago Atlanta Fed president Raphael Bostic joined the club of inglorious Fed traders when he revealed he had improperly disclosed financial transactions for the past five years because he incorrectly interpreted policies governing personal investments. As the WSJ reports, according to amended disclosures filed Friday, dozens of sales or purchases of mutual funds and other investment vehicles by Bostic hadn’t previously been disclosed. Adding insult to injury, more than 150 of those transactions had settled on dates when they weren’t allowed because they were during blackout periods before and after Fed policy meetings. And the cherry on top: last year Bostic also held more than $50,000 in Treasury securities, exceeding the then-permitted limit on such holdings for Fed officials. In other words, the first black and openly gay president of the Atlanta Fed was violating pretty mu … Read more at: https://www.zerohedge.com/markets/atlanta-fed-president-reveals-five-years-trading-violations-claims-he-didnt-understand |

|

US Heating Costs Expected To Surge This WinterA colder-than-average winter forecast and high energy prices will quite significantly raise heating costs for many U.S. consumers this winter, the Energy Information Administration reports in its Winter Fuels Outlook released Thursday. As the invasion of Ukraine and embargoes against Russian energy products have caused turmoil on global markets, oil price fluctuations are being more immediately passed on to consumers, for example through gasoline or heating oil prices rising quickly. Previously, heating oil consumers had experienced a big dip in cost due to the Covid-19 pandemic slashing global oil demand. In the case of gas and electricity, longer-running wholesale contracts are delaying price swings hitting consumers with full force, even though quickly rising prices in the spot market (where providers can buy energy on short notice) have also caused prices to tick up. As Statista’s Katharina Buchholz notes, the forecast expects households that heat with oil or gas to experience an increase in cost of 27 percent and 28 percent, respectively, compared to 2021/22. Read more at: https://www.zerohedge.com/energy/us-heating-costs-expected-surge-winter |

|

Americans Are Getting Poorer: Price Inflation Grew Faster Than Wages Again In SeptemberAuthored by Ryan McMaken via The Mises Institute, The federal government’s Bureau of Labor Statistics released new price inflation data today, and according to the report, September was yet another month of soaring inflation. According to the BLS, Consumer Price Index (CPI) inflation rose 8.2 percent year over year during September, before seasonal adjustment. That’s the nineteenth month in a row of inflation above the Fed’s arbitrary 2 percent inflation target, and it’s seven months in a row of price inflation above 8 percent.

Month-over-month inflation rose as well, with the CPI rising 0.2 percent from August to September. September’s month-over-month growth also shows some acceleration in monthly price inflation growth. Month-to-month growth had been approximately zero in July and August following nineteenth months of monthly growth. < … Read more at: https://www.zerohedge.com/personal-finance/americans-are-getting-poorer-price-inflation-grew-faster-wages-again-september |

|

Government borrowing costs rise after PM’s U-turnBorrowing costs climbed as some economists questioned whether the corporation tax U-turn went far enough. Read more at: https://www.bbc.co.uk/news/business-63243918?at_medium=RSS&at_campaign=KARANGA |

|

Who is Kwasi Kwarteng? The chancellor out after 38 daysHe had been seen as Liz Truss’s political soulmate when he was appointed to the role. Read more at: https://www.bbc.co.uk/news/business-62796213?at_medium=RSS&at_campaign=KARANGA |

|

Royal Mail to axe up to 10,000 jobs as losses riseThe postal service blames strike action and widening losses for the mass redundancies. Read more at: https://www.bbc.co.uk/news/uk-63253687?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty forms positive candle on weekly chart. What investors should do on MondayNifty is currently placed near the strong weekly support of around 16,800 levels, which is an intermediate ascending trend line and also horizontal line support as per change in polarity, analysts said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-positive-candle-on-weekly-chart-what-investors-should-do-on-monday/articleshow/94865161.cms |

|

Telecom Q2 Preview: Cos to shrug off seasonality factor on higher Arpu, subscriber growthHigher number of days in the last quarter, lower spectrum usage charges, tariff hikes, and lower fuel costs are seen lifting sector majors Bharti Airtel and Reliance Jio Infocomm’s earnings in Q2, according to analysts Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/telecom-q2-preview-cos-to-shrug-off-seasonality-factor-on-higher-arpu-subscriber-growth/articleshow/94857425.cms |

|

Can Infosys buyback offer trigger rally in the stock? History may have a clueThe first buyback of Infosys was announced on 16 Aug 2017. The stock gave negative returns of 8.40% a week after the buyback was announced. In 2019, the stock was higher by 8.4% a week after the announcement while 2021 left it with a loss of 3.3% after a week. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/can-infosys-buyback-offer-trigger-rally-in-the-stock-history-may-have-a-clue/articleshow/94855597.cms |

|

Market Extra: ‘Growing wealth gap and rising inflation … hurt the global economy at almost every turn,’ Jamie Dimon tells MarketWatch on its anniversaryWhat a difference 25 years makes. The world is a markedly changed place from the one into which MarketWatch was launched in October 1997. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-713A-04A92A989D60%7D&siteid=rss&rss=1 |

|

Retire Better: Seniors are getting a big Social Security raise — here’s why it may not be enoughEvery last penny of that 8.7% hike is needed Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7138-938CDA309989%7D&siteid=rss&rss=1 |

|

Brett Arends’s ROI: Invest in a UK rebound with these 2 ETFsThis is an opportunity for any U.S. investors looking to take the long view in their 401(k) plans Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7138-9E444007AD9E%7D&siteid=rss&rss=1 |