Summary Of the Markets Today:

- The Dow closed down 28 points or 0.10%,

- Nasdaq closed down 0.09%,

- S&P 500 down 0.33%,

- WTI crude oil settled at $87 down $1.57,

- USD $113.31 up $0.01,

- Gold $1682 down $3.80,

- Bitcoin $19,140 up 1.71% – Session Low 19,003,

- 10-year U.S. Treasury 3.898% down 0.041%

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

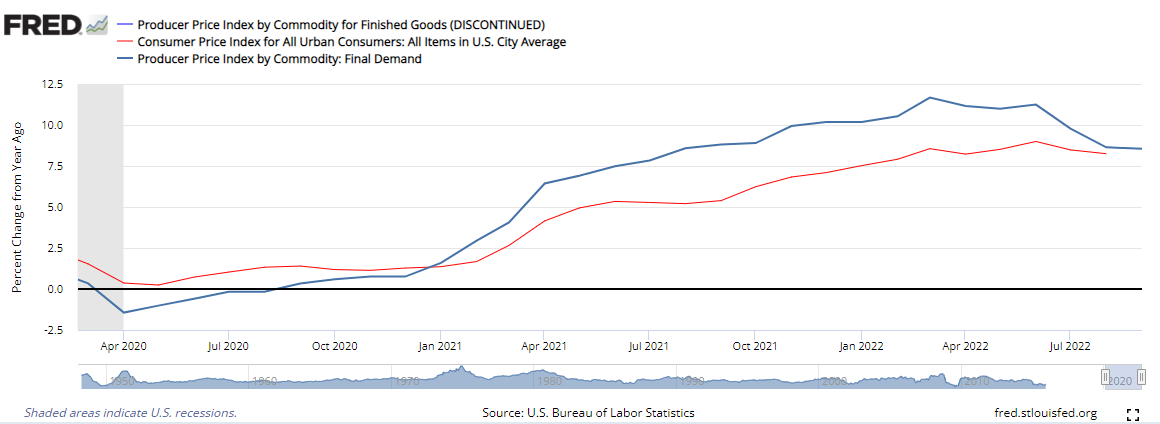

The Producer Price Index for final demand increased by 0.4% in September 2022. The index for final demand advanced 8.5% for the 12 months that ended in September. This would suggest that the CPI will come in near 8% (see graph below).

The Federal Reserve released the Minutes of the Federal Open Market Committee which was held on September 20-21, 2022. The bottom line was that the existing policy of aggressively raising the federal funds rate to stop inflation by slowing the economy would continue. Some interesting highlights:

…In discussing potential policy actions at upcoming meetings, participants continued to anticipate that ongoing increases in the target range for the federal funds rate would be appropriate to achieve the Committee’s objectives.

… Participants observed that inflation remained unacceptably high and well above the Committee’s longer-run goal of 2 percent. Participants commented that recent inflation data generally had come in above expectations and that, correspondingly, inflation was declining more slowly than they had previously been anticipating. Price pressures had remained elevated and had persisted across a broad array of product categories.

… Participants noted that, in keeping with the Committee’s Plans for Reducing the Size of the Federal Reserve’s Balance Sheet, balance sheet runoff had moved up to its maximum planned pace in September and would continue at that pace. They further observed that a significant reduction in the Committee’s holdings of securities was in progress and that this process was contributing to the move to a restrictive policy stance.

… They noted also that inflation had not yet responded appreciably to policy tightening and that a significant reduction in inflation would likely lag that of aggregate demand. Participants observed that a period of real GDP growth below its trend rate, very likely accompanied by some softening in labor market conditions, was required.

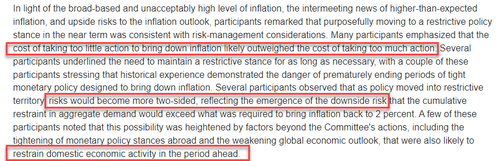

… participants remarked that purposefully moving to a restrictive policy stance in the near term was consistent with risk-management considerations. Many participants emphasized that the cost of taking too little action to bring down inflation likely outweighed the cost of taking too much action. Several participants underlined the need to maintain a restrictive stance for as long as necessary, with a couple of these participants stressing that historical experience demonstrated the danger of prematurely ending periods of tight monetary policy designed to bring down inflation.

Home Prices: How Much Trouble Are YOU In? Elliott Wave International just released a NEW report that shows you the dangers — and opportunities — unfolding now in key property markets around the world. If you own a home — or are thinking about buying one — you need to read this report. Get it FREE for a limited time at elliottwave.com now ($29 value).

A summary of headlines we are reading today:

- Trans-Pacific Shipping Rates Nosedive As Demand Dries Up

- Global Nickel Supply Shifts Into Surplus

- AMC Entertainment struggles with falling stock, high debt load, and light blockbuster schedule

- Nike moves to curb sneaker-buying bots and resale market with penalties

- PepsiCo hikes forecast after higher pricing helps boost revenue

- Demand for riskier home loans is high as interest rates soar

- Financial Crisis-Era Warning Bell Chimes For S&P 500

- FOMC Minutes Show Hawkish Fed Warn “Cost Of Doing Too Little Outweigh Cost Of Doing Too Much”

- Investors nervous as market sell-off intensifies

- Bond Report: Treasury yields drop by most in a week after Fed’s September meeting minutes

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Central Asian Countries Reinforce Cooperation In 2022Central Asia took its first steps toward regional integration soon after independence in the region in 1991. Yet, for several reasons, this integration failed. Even so, with the change in leadership in Uzbekistan in 2016, attempts to improve regional cooperation have been revived, this time through the mechanism of annual consultative meetings of Central Asian leaders. The fourth such meeting took place in Kyrgyzstan at the end of July 2022. In 1993, Kazakhstan, Kyrgyzstan, and Uzbekistan created the Central Asian Union (CAU) to foster deeper economic Read more at: https://oilprice.com/Energy/Energy-General/Central-Asian-Countries-Reinforce-Cooperation-In-2022.html |

|

New Wind Harvester Can Generate Power From A Gentle BreezeNanyang Technological University scientists have developed a low-cost device that can harness energy from wind as gentle as a light breeze and store it as electricity. When exposed to winds with a velocity as low as two meters per second (m/s), the device can produce a voltage of three volts and generate electrical power of up to 290 microwatts, which is sufficient to power a commercial sensor device and for it to also send the data to a mobile phone or a computer. The teams study paper has been published in the scientific peer-reviewed Read more at: https://oilprice.com/Alternative-Energy/Wind-Power/New-Wind-Harvester-Can-Generate-Power-From-A-Gentle-Breeze.html |

|

Trans-Pacific Shipping Rates Nosedive As Demand Dries UpThe problem with price inflation is that it often makes it impossible to track the true health of consumer demand. For example, in August of this year, Walmart reported a jump in overall sales, but also a decline in profits. How is this possible? Spiking inflation in most goods means people have to pay more for the same amount of stuff they usually buy. But, Walmart also has to deal with higher wholesale prices and declining customer purchases as people start to make cuts to their retail budgets. In other words, inflation makes it seem like sales Read more at: https://oilprice.com/Energy/Energy-General/Trans-Pacific-Shipping-Rates-Nosedive-As-Demand-Dries-Up.html |

|

Global Nickel Supply Shifts Into SurplusVia AG Metal Miner The Stainless Steel Monthly Metals Index (MMI) rose 3.35% from September to October. Last month, nickel prices traded up with a strong rebound during the first three weeks. However, prices soon fell back within range. These declines continued until the opening days of October, with prices mainly remaining consolidated since July. For the long term, these movements offer no clear price direction. This means the market will have to wait until there is a meaningful break out to the upside or downside. Stainless Steel Market Overview Read more at: https://oilprice.com/Latest-Energy-News/World-News/Global-Nickel-Supply-Shifts-Into-Surplus.html |

|

Putin Suggests Creation Of European Gas Hub In TurkeyPresident Vladimir Putin has suggested that Russia redirect natural gas supplies intended for the damaged Nord Stream pipelines to the Black Sea and the creation of a European gas hub in Turkey. The newest development in the European gas sector comes shortly after three leaks–one in the Swedish zone and two in the Danish zone–were discovered in Nord Stream 1 and 2 pipelines designed to ship natural gas to Germany. While initial Scandinavian investigations have determined sabotage, Russia has suggested that the U.S. stood Read more at: https://oilprice.com/Latest-Energy-News/World-News/Putin-Suggests-Creation-Of-European-Gas-Hub-In-Turkey.html |

|

Glencore Slows Zinc Smelting As Energy Prices StingVia AG Metal Miner Glencore plans to place the zinc smelting line at its Nordenham plant in northern Germany on care and maintenance starting November 1. This represents yet another major blow to European metal manufacturing, which continues to see shutdowns amid the continent-wide energy crisis. In an October 5 memo, the London and Johannesburg-listed company’s supervisory board chairman, Koen Demesmaeker stated that the cessation of production is a reaction to various external factors affecting the business and wider European industry. Read more at: https://oilprice.com/Metals/Commodities/Glencore-Slows-Zinc-Smelting-As-Energy-Prices-Sting.html |

|

Polestar unveils a new $84,000 electric SUV it’s hoping will help cement its foothold in the U.S.The new Polestar 3 is a five-passenger electric performance SUV that will be built in both the U.S. and China. Deliveries start next fall. Read more at: https://www.cnbc.com/2022/10/12/polestar-unveils-84000-electric-suv-polestar-3-to-cement-us-foothold.html |

|

AMC Entertainment struggles with falling stock, high debt load and light blockbuster scheduleAMC hit a new 52-week low as the movie theater company contends with a massive debt load, dilution of its stock, and a film schedule short on blockbusters. Read more at: https://www.cnbc.com/2022/10/12/amc-entertainment-stock-falls-to-52-week-low.html |

|

GM reveals 2024 Chevrolet Trax crossover with new tech and design — at a lower priceThe compact crossover is key to attracting and retaining cost-conscious buyers, as interest rates rise and prices of new vehicles continue to break records. Read more at: https://www.cnbc.com/2022/10/12/gms-chevrolet-trax-crossover-comes-with-new-tech-design-lower-price.html |

|

NASA aims for mid-November launch of delayed Artemis moon missionNASA hopes to launch the Artemis I moon mission in mid-November, the space agency announced on Wednesday. Read more at: https://www.cnbc.com/2022/10/12/nasa-aims-for-mid-november-launch-of-artemis-i-moon-mission.html |

|

Nike moves to curb sneaker-buying bots and resale market with penaltiesNike is taking steps to curb the proliferation of sneaker-buying bots and resellers. Read more at: https://www.cnbc.com/2022/10/12/nike-moves-to-curb-automated-bots-and-resale-market-with-penalties.html |

|

Delta and Starbucks link their loyalty programs in a bid for repeat customersThe airline and the country’s largest coffee chain say consumers can earn rewards on each other’s program. Read more at: https://www.cnbc.com/2022/10/12/delta-starbucks-link-loyalty-programs-in-bid-for-repeat-customers.html |

|

Young, wealthy investors are flocking to alternative investments, study shows. What to know before adding to your portfolioMany younger, wealthy investors are looking beyond the stock market for above-average returns, with 80% turning to alternative investments. Read more at: https://www.cnbc.com/2022/10/12/young-wealthy-investors-are-turning-to-alternative-investments.html |

|

Space tourism pioneer Dennis Tito books private moon trip on SpaceX’s StarshipDennis Tito and his wife Akiko purchased seats on a private flight of SpaceX’s Starship rocket, the third such flight Elon Musk’s venture has announced to date. Read more at: https://www.cnbc.com/2022/10/12/spacex-starship-seats-space-tourism-pioneer-dennis-tito-books-private-moon-trip.html |

|

United adds new trans-Atlantic flights for summer 2023 in bet on travel recoveryUnited said it will serve 37 destinations in Europe, Africa, India and the Middle East during the next summer travel season. Read more at: https://www.cnbc.com/2022/10/12/united-airlines-grows-summer-europe-travel-schedule.html |

|

PepsiCo hikes forecast after higher pricing helps boost revenuePepsiCo reported earnings Wednesday morning that beat analyst expectations. Read more at: https://www.cnbc.com/2022/10/12/pepsico-pep-reports-q3-earnings.html |

|

Tom Brady and Kim Clijsters are Major League Pickleball’s newest team ownersMajor League Pickleball has attracted new investments from Tom Brady and Kim Clijsters as the sport soars in popularity. Read more at: https://www.cnbc.com/2022/10/12/tom-brady-kim-clijsters-major-league-pickleball-owners.html |

|

Luxury EV maker Lucid confirms it’s on track to meet conservative 2022 production targetsLucid said it still expects to meet its 2022 guidance for production after making more than 2,200 Air sedans in the third quarter. Read more at: https://www.cnbc.com/2022/10/12/lucid-ev-production-on-track-to-meet-2022-guidance.html |

|

Demand for riskier home loans is high as interest rates soarMortgage demand dropped again last week as rates climbed higher, but one type of loan is seeing more interest. Read more at: https://www.cnbc.com/2022/10/12/demand-for-riskier-home-loans-is-high-as-interest-rates-soar.html |

|

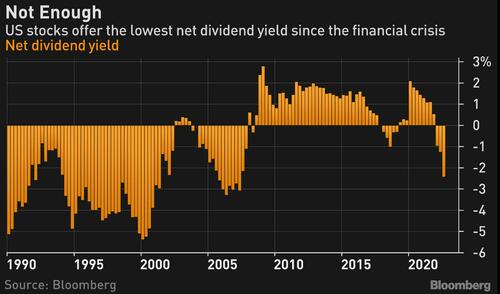

Financial Crisis-Era Warning Bell Chimes For S&P 500By Ven Ram, Bloomberg Markets Live reporter and commentator A warning bell that was heard before the financial crisis is ringing again on Wall Street: dividends on US stocks adjusted for the safest yields investors can buy are the most negative in years. The dividend yield on the S&P 500 Index is a negative 240 basis points after adjusting for two-year Treasury rates, suggesting that there isn’t a persuasive case to invest in stocks just yet. That is eerily similar to the situation that prevailed in 2006 and 2007, before stocks slumped 38% the following year.

While it may be tempting to attribute the plunge in stocks that we saw in 2008 to the impact of the financial crisis, history suggests that the anemic performance of the S&P wasn’t a one-off occurrence. Stocks were similarly pricey in 1992 and continually from 1994 through 2001, and the table below captures the subsequent period returns of both stocks and Treasuries: Read more at: https://www.zerohedge.com/markets/financial-crisis-era-warning-bell-chimes-sp-500 |

|

NYT Fluffs Biden, Says Lies Are “Folksy”It seemed like there wasn’t a day that went by during the last administration that an army of MSM fact-checkers scrutinized every syllable uttered by Donald Trump in search of ammunition for their latest hit-piece. When it comes to Biden – a serial liar and plagiarist, who for decades lied about a drunk driver killing his first wife and daughter – the New York Times would like you to know it’s nothing more than ‘folksy’ rhetoric with ‘factual edges shaved off.’

|

|

US Dismisses As “Posturing” Russia’s Offer Of Talks At G20Authored by Dave DeCamp via AntiWar.com, Russian Foreign Minister Sergey Lavrov on Tuesday said that Moscow was open to talks with Western powers as Turkey is looking to broker negotiations. Lavrov also said that Russia would consider a meeting between Russian President Vladimir Putin and President Biden if one was proposed. “We have repeatedly said that we never refuse meetings. If there is a proposal, then we will consider it,” he said.

A potential venue for talks between Biden and Putin could be the sidelines of the upcoming summit of G20 leaders that will be held in mid-November in Indonesia. But according to Lavrov, Russia has not received any serious proposals from the US to negotiate. The US was quick to dismiss Lavrov’s comments, accusing h … Read more at: https://www.zerohedge.com/geopolitical/us-dismisses-posturing-russias-offer-talks-g20 |

|

FOMC Minutes Show Hawkish Fed Warn “Cost Of Doing Too Little Outweigh Cost Of Doing Too Much”FOMC Minutes confirmed the hawkish FedSpeak of the last week or so – Fed will push rates higher until something breaks:

Mohamed El-Erian sees the Minutes this way: “The text is as expected to a little hawkish on inflation versus growth/jobs; and just a passing reference to liquidity conditions” * * * Since the September 21st 75bps rate-hike by The Fed, stocks and bonds have been clubbed a baby seal while the dollar rallied and gold is flat… Read more at: https://www.zerohedge.com/markets/fomc-minutes-1 |

|

Investors nervous as market sell-off intensifiesThe cost of government borrowing over 10 years briefly hit its highest level since 2008. Read more at: https://www.bbc.co.uk/news/business-63230008?at_medium=RSS&at_campaign=KARANGA |

|

Jacob Rees-Mogg says market turmoil not due to mini-budgetThe business secretary blames market turmoil on the UK’s failure to raise interest rates fast enough. Read more at: https://www.bbc.co.uk/news/business-63230001?at_medium=RSS&at_campaign=KARANGA |

|

How safe is my pension?The recent turmoil sparked by the mini-budget led to fears about the stability of pension funds. Read more at: https://www.bbc.co.uk/news/business-63231132?at_medium=RSS&at_campaign=KARANGA |

|

Nifty finds support at 200-DMA for second day. What investors should do on ThursdayAnalysts said the overall structure shows that the index is likely to witness consolidation and short-term buying in the range of 17,000-17,300. “Now it has to hold above 17071 zones for an up move towards 17,250 and 17,333 zones whereas supports are placed at 16,950 and 16,888 zones,” said Chandan Taparia of Motilal Oswal. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nifty-finds-support-at-200-dma-for-second-day-what-investors-should-do-on-thursday/articleshow/94814913.cms |

|

With m-cap now below Rs 1 lakh crore, these 7 stocks have up to 30% upside potentialFrom the BSE pack, the market cap of seven companies dropped below Rs 1 lakh crore mark. However, these companies started the year above those levels. The stock fell between 10 per cent and 50 per cent (Data Source: ACE Equity). However, on SWOT analysis, all these companies have more strengths than weaknesses, and have an upside potential of around 30 per cent, according to trendlyne data. Most of them are either debt-free or low-debt companies. Take a look: Read more at: https://economictimes.indiatimes.com/markets/stocks/news/with-m-cap-now-below-rs-1-lakh-crore-these-7-stocks-have-up-to-30-upside-potential/taking-stock/articleshow/94811040.cms |

|

White elephants! Over 89% large-cap MFs are underperformers: S&P Dow Jones IndicesThe beginning of the year was particularly tough for Indian equity large-cap managers, with 87.5% funds in the category underperforming in H1 2022 Read more at: https://economictimes.indiatimes.com/markets/stocks/news/white-elephants-over-89-large-cap-mfs-are-underperformers-sp-dow-jones-indices/articleshow/94816386.cms |

|

Market Extra: Why questions are swirling about who will buy most of the U.S.’s $31 trillion in debt — and at what priceU.S. national debt is above $31 trillion for the first time as the Federal Reserve is in retreat from buying it and foreign investors’ interest is waning. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7136-66D3CAAE83C0%7D&siteid=rss&rss=1 |

|

The Human Cost: ‘The best I can do is email you’: When this Native American family’s high-speed data ran out, their kids’ remote schooling came firstIndigenous communities are underserved by broadband internet providers, research shows. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7136-4669B1177E67%7D&siteid=rss&rss=1 |

|

Bond Report: Treasury yields drop by most in a week after Fed’s September meeting minutesTwo-, 10- and 30-year yields fall after the Federal Reserve’s September minutes, which offered little new insight into the path of future rate hikes. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7137-466426FF4CFD%7D&siteid=rss&rss=1 |