Summary Of the Markets Today:

- The Dow closed down 495 points or 1.70%,

- Nasdaq closed down 1.51%,

- S&P 500 down 1.45%,

- Gold $1669 up $0.50,

- WTI crude oil settled at $80 down $1.56,

- 10-year U.S. Treasury 3.821% up 0.072%,

- USD index $112.15 weakening 0.1%,

- Bitcoin $19,439 down $154,

- Baker Hughes Rig Count: U.S. +1 to 765 rigs

Today’s Economic Releases:

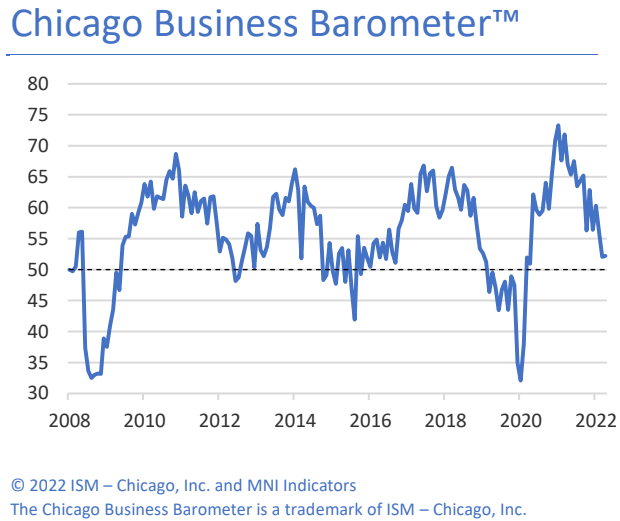

Chicago Business Barometer stabilized in August. The indicator inched up 0.1 points to 52.2. The only sub-indicators to fall were employment and supplier deliveries, while price paid was unchanged from previous month.

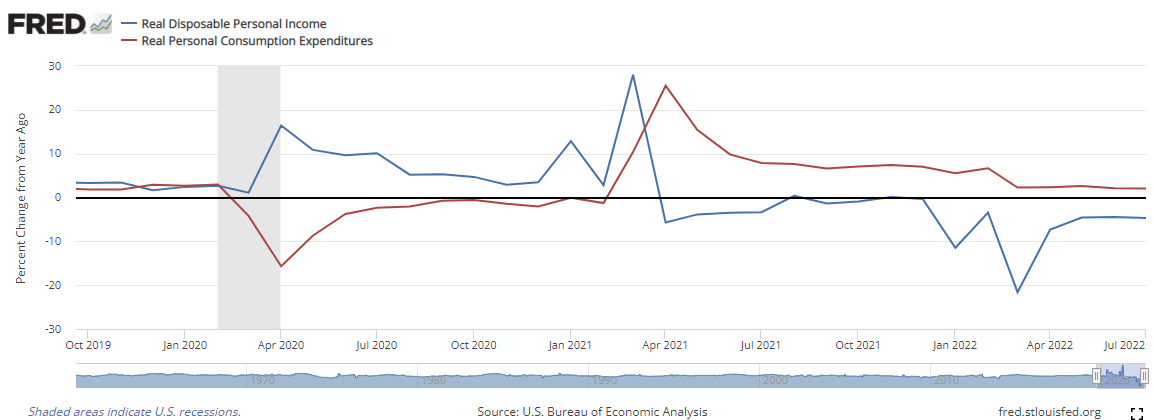

Personal income increased 0.3% at a monthly rate with consumer spending increasing 0.4% in August 2022. When these numbers are adjusted for inflation personal consumption year-over-year growth is up 2.1% whilst income remains in contraction at -4.7% (see graph below). It is interesting that consumption seems to keep on humming whilst income remains underwater.

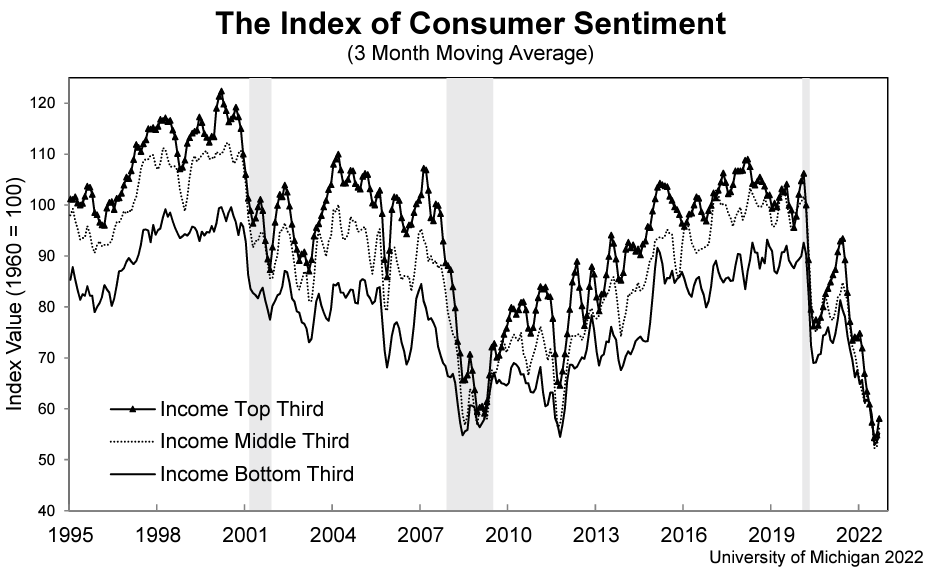

Michigan Consumer sentiment confirmed the preliminary reading earlier this month and was essentially unchanged from the month prior, at less than one index point above August. Buying conditions for durables and the one-year economic outlook continued lifting from the extremely low readings earlier in the summer, but these gains were largely offset by modest declines in the long run outlook for business conditions. As seen in the chart, sentiment for consumers across the income distribution has declined in a remarkably close fashion for the last 6 months, reflecting shared concerns over the impact of inflation, even among higher-income consumers who have historically generated the lion’s share of spending.

A summary of headlines we are reading today:

- Russia Claims EU Sanctions Are Preventing TurkStream Pipeline Maintenance

- OPEC Raises Oil Production To Highest Level In Years

- U.S. Only Lifted Oil Production By 12,000 Bpd In July

- NASA is working with SpaceX to explore a private mission to extend the life of the Hubble telescope

- “Panic Seems To Be In The Air”

- Thousands Stuck On Cruise Ships After Hurricane Shuttered Florida Ports

- Russia Is Flaring Less And Keeping Natural Gas In The Ground

These and other headlines and news summaries moving the markets today are included below.

| Here are the headlines moving the markets. | |

|

Russia Claims EU Sanctions Are Preventing TurkStream Pipeline MaintenanceThe Russian operator of a pipeline that supplies Turkey and the Balkans with natural gas said it would suspend some maintenance and repair work, citing European Union sanctions, a move that threatens to deepen Europe’s energy crisis. Oleg Aksyutin , the director of South Stream Transport B.V., sent a note earlier this month to division managers informing them that Netherlands import and export authority would be revoking its export license as of September 17. South Stream Transport is the Dutch-unit of the Kremlin-controlled natural Read more at: https://oilprice.com/Energy/Energy-General/Russia-Claims-EU-Sanctions-Are-Preventing-TurkStream-Pipeline-Maintenance.html |

|

Gas Stations in France Running On Empty As Strikes Enter Fourth DayDiesel and petrol stations in France are running out of fuel, according to an industry union, as a refining strike takes its toll. Stations around the le Havre and Lyon have been affected, according to the GCT union. France was already battling a shortage of refined products, with Russia’s exports to Europe falling in recent months. But then French refinery strikes initially took half of the nations refining capacity offline, hoping to resolve a dispute over pay. The strike, which among others, took Totals 240,000 bpd Gonfreville Read more at: https://oilprice.com/Latest-Energy-News/World-News/Gas-Stations-in-France-Running-On-Empty-As-Strikes-Enter-Fourth-Day.html |

|

Researchers Take A Deep Dive Into Solar Cell EfficiencyResearchers from Shanghai Polytechnic University, Shanghai Engineering Research Center of Advanced Thermal Functional Materials, and Shanghai Solar Energy Research Center Co. Ltd explored how different shade conditions impact performance of single solar cells and two-cell systems connected in series and parallel. The results have been published by the American Institute of Physics Journal of Renewable and Sustainable Energy. Large obstacles, like clouds and buildings, can block sunlight from reaching solar cells and even small objects, such as Read more at: https://oilprice.com/Energy/Energy-General/Researchers-Take-A-Deep-Dive-Into-Solar-Cell-Efficiency.html |

|

OPEC Raises Oil Production To Highest Level In YearsOPEC raised its September crude oil production to the highest level since 2020, a Reuters survey found on Friday yet failed to meet its September quota. OPECs production for September came in below its specified quota for the month, although the month on month increase in production was higher than the promised 64,000 bpd hike. The survey found that OPECs September production reached 29.81 million bpda 210,000 bpd increase over August. For its 10 participating members in the OPEC cut, September’s production was Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Raises-Oil-Production-To-Highest-Level-In-Years.html |

|

Another Disappointing Week For U.S. Oil RigsThe number of total active drilling rigs in the United States rose by 1 this week, according to new data from Baker Hughes published on Friday. The total rig count rose to 765 this week237 rigs higher than the rig count this time in 2021. Oil rigs in the United States rose by 2 this week, to 604. Gas rigs slipped 1, to 159. Miscellaneous rigs stayed the same at 2. The rig count in the Permian Basin stayed the same at 344 this week. Rigs in the Eagle Ford also stayed the same, at 72. Oil and gas rigs in the Permian are 81 above where they Read more at: https://oilprice.com/Energy/Energy-General/Another-Disappointing-Week-For-US-Oil-Rigs.html |

|

U.S. Only Lifted Oil Production By 12,000 Bpd In JulyThe United States increased its crude oil production in July by an average of just 12,000 barrels per day, according to the latest monthly data published by the Energy Information Administration. The United States produced 365.8 million barrels of crude oil in July, an average of 11.8 million bpd. The data showed that the largest increase was seen in Texas, which boosted its crude oil output by 43,000 bpd. New Mexico saw the second largest gains at 38,000 bpd. Those larger gains were partially offset by losses in California (-5,000 bpd), Colorado Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Only-Lifted-Oil-Production-By-12000-Bpd-In-July.html |

|

Unions could face a big obstacle in 2023 if the economy falls into a recessionWorking conditions during the pandemic pushed many workers to organize — but fears about a potential recession could curb the union boom. Read more at: https://www.cnbc.com/2022/09/30/unions-could-face-obstacle-in-2023-if-economy-falls-into-recession.html |

|

Ford’s stock is up more than 70% since Jim Farley became CEO – but he still has a ton of work to doFord’s stock achieved decades-high prices of more than $25 a share under CEO Jim Farley, but it’s fallen in recent months. Read more at: https://www.cnbc.com/2022/09/30/ford-stock-up-70percent-since-jim-farley-became-ceo.html |

|

American homebuyers are finding UK bargains, discounted by a weaker poundPrices in London are down nearly 20% over the past year as a result of price declines and currency impact, according to global consulting group Knight Frank. Read more at: https://www.cnbc.com/2022/09/30/american-homebuyers-find-uk-bargains-discounted-by-a-weaker-pound.html |

|

Carnival shares shed 20% on ballooning costs, dragging cruise stocks lowerShares of Carnival fell below their pandemic lows Friday after the cruising company posted third-quarter earnings that revealed higher costs. Read more at: https://www.cnbc.com/2022/09/30/carnival-shares-fall-on-ballooning-costs-dragging-cruise-stocks-lower.html |

|

Nike shares fall as overstocked inventory weighs on earningsNike said its revenue rose in its fiscal first-quarter despite supply-chain volatility, while swollen inventories weighed on its profit. Read more at: https://www.cnbc.com/2022/09/29/nike-nke-earnings-q1-2023.html |

|

How Gautam Adani became the world’s fourth richest person while billionaires like Jeff Bezos lost tens of billionsIn 2021, Gautam Adani was not on the top 10 list of the world’s richest people. But in 2022, the Indian billionaire settled in behind Jeff Bezos and Bernard Arnault as No. 4. Read more at: https://www.cnbc.com/2022/09/30/gautam-adani-how-asias-richest-person-gave-bezos-a-run-for-his-money.html |

|

What Nike’s earnings report tells us about 3 consumer stocks in our portfolioA warning from Nike provides valuable insights for Club stocks Apple, Starbucks and TJX Companies. Read more at: https://www.cnbc.com/2022/09/30/what-nikes-earnings-report-tells-us-about-3-consumer-stocks-in-our-portfolio.html |

|

Ohio reports third U.S. death of person with monkeypox who had underlying health conditionsThe CDC has warned that people with severely compromised immune systems are higher risk for severe disease from monkeypox. Read more at: https://www.cnbc.com/2022/09/30/ohio-reports-third-us-death-of-person-with-monkeypox.html |

|

NASA is working with SpaceX to explore a private mission to extend the life of the Hubble telescopeSpaceX and billionaire astronaut Jared Isaacman is teaming up with NASA to examine whether a private mission could extend the life of the Hubble telescope. Read more at: https://www.cnbc.com/2022/09/29/nasa-spacex-jared-isaacman-studying-hubble-telescope-extension.html |

|

These are the best ways to give to charity for the ‘vast majority of people.’ Here’s how to pick the most tax-efficient strategyIf you’re planning a charitable gift for 2022, here’s how to decide on the most tax-efficient strategy. Read more at: https://www.cnbc.com/2022/09/30/heres-how-to-pick-the-best-charitable-giving-strategy.html |

|

Silicon Valley billionaires square off over support for Trump and the MAGA movementBusiness executives deploying millions of dollars in political donations to shape midterm results Read more at: https://www.cnbc.com/2022/09/30/silicon-valley-billionaires-duel-over-trump-midterm-elections.html |

|

Stocks making the biggest moves midday: Nike, Rent-A-Center, Carnival CruiseThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/09/30/stocks-making-the-biggest-moves-midday-nike-rent-a-center-carnival-cruise.html |

|

3 takeaways from our daily meeting: Still oversold, picking at chip stocks, Club names in the newsThe Investing Club holds its ‘Morning Meeting’ every weekday at 10:20 a.m. ET. Read more at: https://www.cnbc.com/2022/09/30/3-takeaways-from-thursdays-morning-meeting-sticking-by-the-2-year-treasury-picking-at-chip-stocks-and-club-names-in-the-news.html |

|

“Panic Seems To Be In The Air”By Ven Ram, Bloomberg Markets Live reporter and strategist After a Midsummer Night’s Dream in July, US stocks are convulsing all over again. With speaker after Fed speaker hammering home the message of higher rates, the reality of higher discount rates is weighing on sentiment. The Fed’s dot plot shows us that a pause from rate hikes may not come before the benchmark reaches 4.6%, but of course that’s not a guarantee. But is it all really down to just the Fed pushing rates higher? All that rate volatility stemming from the UK can have a bigger domino effect on assets as pension fund managers — stung by the fiasco of policymakers unveiling fiscal stimulus at a time when inflation is already running rife and wrecking their P&L — turning uber cautious with the other assets in their portfolio. Front and intermediate bond yields in the UK — which don’t enjoy the Bank of England’s backstop in its current emergency operations — are still climbing higher. Meanwhile, Prime Minister Liz Truss and Chancellor Kwasi Kwarteng will reportedly hold emergency talks with the head of the Office of Budget Responsibility before being presented with a first draft of full forecasts from the fiscal watchdog next week. Still, it may make serve well to calibrate the sense of optimism that we have seen overnight in the pound. Amid all this, the Fed must be hoping that all this tumult doesn’t impinge on US financial markets. However, it’s perhaps not entirely a coincidence that US investors are parking record amounts of cash with the Fed. Panic seems to be in the air. As Larry Summers allud … Read more at: https://www.zerohedge.com/markets/panic-seems-be-air |

|

Thousands Stuck On Cruise Ships After Hurricane Shuttered Florida PortsTravel website “The Points Guy” reported that thousands of cruise ship passengers are stuck at sea this week because Hurricane Ian wreaked havoc across southwestern and central Florida, forcing some ports across the state to close temporarily. Cruise ships that departed from Florida before Hurricane Ian made landfall on Wednesday had to extend their schedules because some ports remain closed. Three major ones — Port Canaveral, Jacksonville Port Authority, and Port Tampa Bay, remain temporarily closed or have disruptions, preventing cruise ships from docking.

|

|

Russia Is Flaring Less And Keeping Natural Gas In The GroundBy Tsvetana Paraskova of OilPrice.com When the breakup between Russia and the European Union began earlier this year, one of the reasons for the severity of the EU’s response to Russia’s invasion of Ukraine was the assumption that Russia could not afford for its gas exports to drop.

The assumption was an enduring one for oil and gas both. A number of analysts toured the media, arguing that if production at an oil or gas field is suspended, this field eventually risks becoming unproductive forever. While this is a valid argument overall, Gazprom appears to have found a way to avoid permanent loss of gas production, and it’s not flaring, either. In fact, flaring in Russia—a major “flarer”—is down. This is ac … Read more at: https://www.zerohedge.com/commodities/russia-flaring-less-and-keeping-natural-gas-ground |

|

Nomura: When Does The Fed “Blink”?The velocity of “things breaking” around the world (Yen, Yuan, Euro, Sterling, SONIA, Gilts, MBS, Lev Loan deals, the entirety of the UK LDI / Pension complex) is obviously a “neon swan” telling us that we are clearly now in the “market accident” stage from the tightening surge.

And, as Nomura’s Charlie McElligott notes, let’s be fair…all of these things are happening for completely rational reasons, particularly for the USD vs lack of viable global alternatives, as the US economy remains the “cleanest dirty shirt” by-far, while rest of world is running increasingly “incongruent” monetary vs fiscal policy on structural issues. Again, looking at the below generic UK / Europe type set-up, McElligott points out a laundry-list of messy inputs (h/t Jordan Rochester): Collapsing terms of trade / trade-deficits largely due to energy imports Manu / Industrial growth slowin … Read more at: https://www.zerohedge.com/markets/nomura-when-does-fed-blink |

|

Liz Truss resists calls for earlier tax plans assessmentSome Tories believe publishing the forecast sooner would reassure markets following a turbulent week. Read more at: https://www.bbc.co.uk/news/uk-politics-63089314?at_medium=RSS&at_campaign=KARANGA |

|

UK not in recession, new figures suggestThe economy grew in the second quarter of this year, but it remains smaller than pre-Covid levels. Read more at: https://www.bbc.co.uk/news/business-63086562?at_medium=RSS&at_campaign=KARANGA |

|

Price cap to cushion blow of soaring energy costsA two-year government-set cap means price rises taking effect on Saturday are lower than expected. Read more at: https://www.bbc.co.uk/news/business-63073978?at_medium=RSS&at_campaign=KARANGA |

|

9 firms see over 20% sales, profit growth in Q2 of last 2 yrs; 7 stocks double in valueAs September quarter results are about to start flowing in over the next few days. ETMarkets found nine companies that have posted at least 20% sales and profit growth in the September quarter of the last two years. These companies have also maintained EBIDTA margins over 20%. Interestingly, 7 out of 9 stocks have over doubled the investors’ wealth in the last 2-year timeframe. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/9-firms-see-over-20-sales-profit-growth-in-q2-of-last-2-yrs-7-stocks-double-in-value/taking-stock/articleshow/94564288.cms |

|

Tech View: Nifty trading range between 16,500-17,600. What investors should do on MondayOn the weekly chart, the index formed a small negative candle with a long lower shadow, which suggests the formation of a bullish hammer-type candle pattern at the lows. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-trading-range-between-16500-17600-what-investors-should-do-on-monday/articleshow/94565417.cms |

|

This Warren Buffett favourite is also the only multibagger among Berkshire’s top stocksThe scrip has jumped 98% year-to-date (YTD) and delivered 104.5% returns to investors in the past year. It also has a better 1-year return, compared to Tesla, Apple, Amazon, Microsoft, Alphabet, and Netflix at a time of complete chaos in the markets. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/this-warren-buffett-favourite-is-also-the-only-multibagger-among-berkshires-top-stocks/articleshow/94552972.cms |

|

Market Snapshot: Dow drops 350 points in afternoon trade as a brutal month draws to a closeU.S. stocks edge lower as investors weigh another round of hotter-than-expected inflation data as September draws to a close. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-712E-2A1B5E17AB3A%7D&siteid=rss&rss=1 |

|

Market Extra: Short U.S. stocks and short-term Treasurys until Halloween, Bank of America strategist saysShort U.S. stocks as well as short-term bonds until Halloween, a Bank of America strategist advises. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-712E-2D9A2B335653%7D&siteid=rss&rss=1 |

|

The Ratings Game: ‘This is worse than 2019’: Micron faces ‘unprecedented’ supply issues and analysts are split on if it has hit bottomMicron Technology Inc. shares rose Friday after analysts agreed the forecast from the memory chip maker was not good but had different ideas about when oversupply in the market could be worked out of the system. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-712E-99DD44CCA30F%7D&siteid=rss&rss=1 |