Summary Of the Markets Today:

- The Dow closed up 547 points or 1.88%,

- Nasdaq closed up 2.05%,

- S&P 500 up 1.96%,

- WTI crude oil settled at $82 up $3.51,

- USD $112.75 down $1.36,

- Gold $1661 up $32,

- Bitcoin $19,543 up 2.69% – Session Low $18,505,

- 10-year U.S. Treasury 3.707% down 0.256%

*Stock data, cryptocurrency, commodity prices as of the market close.

Today’s Economic Releases:

As one would expect higher mortgage rates to affect home sales – pending home sales declined for the third straight month in August 2022. Pending homes sales is a forward-looking indicator of home sales based on contract signings, which fell 2.0% month-over-month and fell 24.2% year-over-year.

7,201,572 single- and multifamily residences in Hurricane Ian’s path with high flash flood risk:

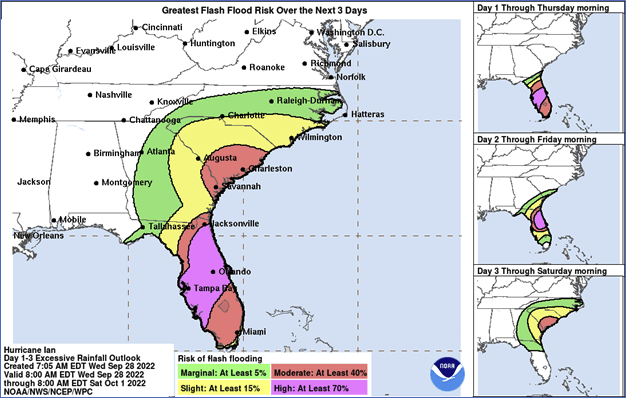

- The National Hurricane Center (NHC) currently forecasts that the entire state of Florida is at some level of flash flood risk due to heavy rainfall from Hurricane Ian. Most of the state is at moderate (40%) or greater risk. The cities of Tampa Bay and Orlando have a 70% chance of flash flooding (Figure 1).

- CoreLogic estimates that 7,201,572 single- and multifamily residences (SFRs and MFRs) with a combined total reconstruction value (RCV) of $1.6 trillion are within the “moderate” and “high” flash flood risk bands, as forecasted by NHC (Figure 1). Note, this does not indicate that every single home within these bands will flood, nor that any flooded home will sustain 100% damage up to its full RCV. This estimate accounts for flash flooding only and excludes homes that at risk to riverine and coastal flooding.

Figure 1: Hurricane Ian 1 to 3-day flash flood risk valid September 28 – October 1.

A summary of headlines we are reading today:

- Inflation Reduction Act Is Both Good And Bad News For U.S Biofuels

- Dallas Fed Survey Sees Activity Increasing At Solid Pace In U.S. Oil And Gas

- Oil Jumps 4% On Inventory Draw, Hurricane Outages

- Mortgage refinancing drops to a 22-year low as interest rates surge even higher

- The Big Short Squeeze Is Coming

- Market Extra: Did something break? What stock-market investors need to know about mounting global financial stresses

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

UK Food Inflation Swells To Highest Rate Ever RecordedFood inflation surged to its highest rate on record since the index started in 2005, according to freshly published data. According to the British Retail Consortium (BRC) and NielsenIQ shop price index, food inflation hit 10.6 percent in September, up from 9.3 percent in August. For fresh food, inflation swelled to 12.1 percent, up from 10.5 percent in August, also the highest rate in the category ever recorded. Prices of animal feed, fertiliser and vegetable oil were amped up further this month due to the war in Ukraine, Helen Dickinson OBE, BRC Read more at: https://oilprice.com/Energy/Energy-General/UK-Food-Inflation-Swells-To-Highest-Rate-Ever-Recorded.html |

|

Inflation Reduction Act Is Both Good And Bad News For U.S BiofuelsThere is great optimism over the expansion of America’s renewable energy sector, beyond just wind and solar power, particularly following the approval of the Inflation Reduction Act (IRA) this summer. In addition to more well-known energy sources, such as hydro power, experts are now seeing great potential for lesser-known green energy sources like biofuels in Americas future. But as the U.S. government introduces new policies in support of biofuel production some worry about the potential for fraud. Biofuels are liquid fuels Read more at: https://oilprice.com/Alternative-Energy/Biofuels/Inflation-Reduction-Act-Is-Both-Good-And-Bad-News-For-US-Biofuels.html |

|

Dallas Fed Survey Sees Activity Increasing At Solid Pace In U.S. Oil And GasDespite falling oil prices, a Dallas Fed report surveying oil and gas executives show activity in the oil and gas sector expanded at a robust clip in the third quarter, suggesting the pace of expansion remains solid even after a slight slowdown. The Business Activity Index looks at the broadest measure of conditions facing Eleventh District energy firms. The Dallas Fed also noted that costs continued to increase for a seventh straight quarter, with the indexes now near historical highs. Among oilfield services firms, the index for input Read more at: https://oilprice.com/Latest-Energy-News/World-News/Dallas-Fed-Survey-Sees-Activity-Increasing-At-Solid-Pace-In-US-Oil-And-Gas.html |

|

German Manufacturers Struggle As Energy Crisis PersistsVia AG Metal Miner An attention-grabbing headline in the Financial Times perfectly illustrates the dire predicament in which Germany’s manufacturing industry finds itself. The title, Energy crisis leaves Germany’s Toilet Paper Makers Struggling to Clean Up conjures up all kinds of images. Unfortunately, sky-high power costs continue to deprive Germans of more than sanitary products. From heat and light to jobs, many German citizens are watching their lifestyles go down the tubes. Indeed, the high cost of Read more at: https://oilprice.com/Energy/Energy-General/German-Manufacturers-Struggle-As-Energy-Crisis-Persists.html |

|

Oil Jumps 4% On Inventory Draw, Hurricane OutagesOil prices surged on Wednesday, with Brent up over 3% and WTI up nearly 4% shortly after the Energy Information Administration (EIA) reported surprise draws in U.S. crude oil inventory and natural gas stocks. Also contributing to the surge in oil prices was a U.S. dollar giving up some of its recent gains and some 11% of output shuttered in the Gulf of Mexico as Hurricane Ian made its way toward the Florida coast. At 1:45 p.m. EST Wednesday, Brent crude was trading at $88.92 per barrel, up $2.65 (+3.07%) on the day, while WTI was trading Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Jumps-4-On-Inventory-Draw-Hurricane-Outages.html |

|

Biden To U.S. Oil Industry: Don’t Use Hurricane As Excuse For Price GougingDoubling down on the current U.S. administration’s previous warnings to oil and gas companies to discontinue what it considers to be their price-gouging ways, President Biden cautioned U.S. oil and gas companies against using Hurricane Ian as an excuse to engage in price-gouging. “Do not let me repeat, do not. Do not use this as an excuse to raise gasoline prices or gouge the American people,” President Joe Biden said on Wednesday at the White House Conference on Hunger, Nutrition, and Health. “This small temporary storm impact on oil production Read more at: https://oilprice.com/Latest-Energy-News/World-News/Biden-To-US-Oil-Industry-Dont-Use-Hurricane-As-Excuse-For-Price-Gouging.html |

|

Mortgage refinancing drops to a 22-year low as interest rates surge even higherMortgage rates drove higher last week after the Federal Reserve signaled it would continue its aggressive action to cool inflation. That hurt mortgage demand. Read more at: https://www.cnbc.com/2022/09/28/mortgage-refinancing-drops-to-a-22-year-low-.html |

|

Lionsgate leaning toward spinning off its studio business instead of StarzLionsgate hasn’t given up on also selling a minority stake in Starz, but there’s more investor interest in the studio business. Read more at: https://www.cnbc.com/2022/09/28/lionsgate-leans-toward-spinning-off-studio-business-instead-of-starz.html |

|

Cathie Wood’s Ark is buying stock in space SPAC Rocket LabCathie Wood’s Ark Invest is dipping back into a space SPAC, with two of the firm’s funds buying up stock in Rocket Lab the past two days. Read more at: https://www.cnbc.com/2022/09/28/cathie-woods-ark-buying-rocket-lab-stock-a-space-spac.html |

|

LeBron James is a pickleball fan. And now he’s buying a teamLeBron James, the king of basketball courts, is one of the newest owners of a professional pickleball team. Read more at: https://www.cnbc.com/2022/09/28/lebron-james-is-a-pickleball-fan-and-player-now-hes-buying-a-team.html |

|

Lego sales jump 17% in first half of 2022, boosted by Star Wars and Harry Potter setsLego revenue jumped 17% during the first six months of 2022, boosted by top-selling building set tie-ins with Star Wars and Harry Potter. Read more at: https://www.cnbc.com/2022/09/28/lego-earnings-revenue-jumps-17percent-in-first-half-of-2022.html |

|

Here’s why Biogen’s promising Alzheimer’s drug data is also good news for Eli LillyWe don’t own Eli Lilly exclusively for its potential Alzheimer’s treatment. However, we still find Biogen’s topline data to be very encouraging for Lilly. Read more at: https://www.cnbc.com/2022/09/28/heres-why-biogens-promising-alzheimers-drug-data-is-also-good-news-for-eli-lilly-.html |

|

A single dose of monkeypox vaccine provides some protection against infection, CDC saysThese are the first real-world findings on how well the vaccine is working in the current outbreak Read more at: https://www.cnbc.com/2022/09/28/a-single-dose-of-monkeypox-vaccine-provides-some-protection-against-infection-cdc-says.html |

|

Hurricane Ian makes landfall in southwest Florida, bringing destructive floods and windRainfall could top more than 18 inches, and storm surges could push as much as 18 feet of water over nearly 100 miles of coast. Read more at: https://www.cnbc.com/2022/09/28/hurricane-ian-making-landfall-near-sanibel-captiva-islands-florida.html |

|

GM delays return-to-office mandate after employee backlashThe company on Friday said corporate workers would be required to return to physical locations at least three days a week, beginning later this year. Read more at: https://www.cnbc.com/2022/09/27/gm-delays-return-to-office-mandate-after-employee-backlash.html |

|

Hugh Jackman is back as Wolverine in Ryan Reynolds’ ‘Deadpool 3’Hugh Jackman will enter the Marvel Cinematic Universe alongside Ryan Reynolds in “Deadpool 3,” due out in theaters Sept. 6, 2024. Read more at: https://www.cnbc.com/2022/09/27/hugh-jackman-is-back-as-wolverine-in-ryan-reynolds-deadpool-3.html |

|

One-way economy flights from Moscow to Dubai are nearly $5,000 as Russians flee mobilization callThe roughly five-hour flight cost around $350 one week before Putin’s mobilization announcement on Sept. 21. Read more at: https://www.cnbc.com/2022/09/28/economy-flights-from-moscow-to-dubai-hitting-5000-as-russians-flee-.html |

|

Artemis moon mission likely delayed until November as NASA moves rocket out of hurricane’s pathNASA rolled back the SLS rocket into the mammoth Vehicle Assembly Building for protection at Kennedy Space Center ahead of potential impact from Hurricane Ian. Read more at: https://www.cnbc.com/2022/09/27/nasas-artemis-1-moon-mission-likely-delayed-to-november.html |

|

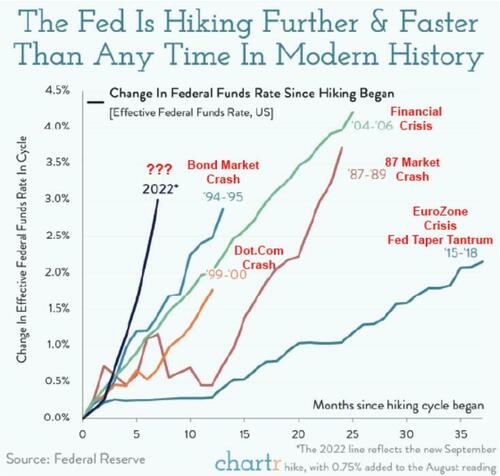

The Big Short Squeeze Is ComingAuthored by Lance Roberts via RealInvestmentAdvice.com, The latest rate hike announcement by the Fed sent stocks tumbling to the year’s lows. While last week’s market action was brutal, the good news is the markets are set up for a rather significant short squeeze higher. It is quite likely the Fed has already tightened more than the economy can withstand. However, given the lag time of policy changes to show up in the data, we won’t know for sure for several more months. However, with the Fed removing liquidity from the markets at a most aggressive pace, the risk of a policy mistake is higher than most appreciate. I added some annotations to a recent graphic from Chartr.

With the Fed now hiking rates, seemingly intent on doing so at every meeting in 2022, has the correction priced in the “bad news?” The issue, of course, is that we never know where we are within the current cycle until it is often too late. An excellent ex … Read more at: https://www.zerohedge.com/markets/big-short-squeeze-coming |

|

Xi Reemerges In 1st Public Appearance After ‘Coup’ RumorsSo much for the “coup in China” and “Xi is missing” rumor mill of the past week, which at one point saw Chinese President Xi Jinping’s name trending high on Twitter… “Chinese President Xi Jinping visited an exhibition in Beijing on Tuesday, according to state television, in his first public appearance since returning to China from an official trip to Central Asia in mid-September – dispelling unverified rumors that he was under house arrest.” He had arrived in Samarkand, Uzbekistan on September 15 – and attended the days-long Shanghai Cooperation Organization (SCO) summit – where he met with Russian President Vladimir Putin, among others.

Read more at: https://www.zerohedge.com/geopolitical/xi-reemerges-1st-public-appearance-after-coup-rumors |

|

El-Erian: The Cost Of The Fed’s Challenged CredibilityAuthored by Mohamed El-Erian via Project Syndicate, After previously eschewing interest-rate hikes, the US Federal Reserve has been tightening monetary policy at an unprecedented rate. But the current market turmoil and the central bank’s own revised projections show that a great deal of damage has already been done.

Financial markets’ reaction to the US Federal Reserve’s latest policy move was reminiscent more of developing countries than of the world’s most powerful economy. Given that the Fed is the world’s most systemically important central bank, this is more than just a curiosity. It has implications for America’s economic well-being – and that of the rest of the world. On September 21, the Fed Read more at: https://www.zerohedge.com/markets/el-erian-cost-feds-challenged-credibility |

|

White House Says US Welcomes Russians Seeking AsylumWhite House Press Secretary Karine Jean-Pierre said on Tuesday that the United States is ready to welcome Russians currently fleeing Putin’s “unpopular” war and can grant them asylum. “We believe that regardless of their nationality, they may apply for asylum in the United States and have their claim educated on a case-by-case basis,” she said. This is as there are continued reports of “total chaos” at some key border crossings leaving Russia, particularly at the Georgian border.

Read more at: https://www.zerohedge.com/geopolitical/white-house-says-us-welcomes-any-russian-seeking-asylum |

|

Bank emergency move driven by pension fund fearsThe tax-cutting plans in Friday’s mini-budget sparked turmoil for the UK economy. Read more at: https://www.bbc.co.uk/news/business-63065415?at_medium=RSS&at_campaign=KARANGA |

|

Treasury rejects U-turn on mini-budget despite turmoilGovernment departments are also being told to find cuts to help reduce spending, the BBC is told. Read more at: https://www.bbc.co.uk/news/uk-politics-63067163?at_medium=RSS&at_campaign=KARANGA |

|

Bank of England steps in to calm marketsThe Bank says it will buy government bonds to prevent a “material risk to UK financial stability”. Read more at: https://www.bbc.co.uk/news/business-63061614?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty bulls fail to guard 200-DMA. What investors should do on ThursdayThe momentum oscillator RSI was in a bearish crossover. “The trend is likely to remain weak as long as it remains below the 17,000 level. On the lower end, 16,800-16,830 levels will likely remain key support points. On the higher end, resistance is visible at 17,000,” said Rupak De, Senior Technical Analyst at LKP Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-bulls-fail-to-guard-200-dma-what-investors-should-do-on-thursday/articleshow/94512631.cms |

|

Nifty Bank: Key levels to watch out for on ThursdayOn the daily charts, it formed a bearish candle and has been making lower highs and lower lows for the last six sessions. The index has support at 37,300 levels, while resistance is at 38,500 levels. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nifty-bank-key-levels-to-watch-out-for-on-thursday/articleshow/94512029.cms |

|

Up to 1,560% returns! These 130 stocks turned multibaggers in Sept quarterAccording to the data available from Ace Equity, at least 130 stocks turned multibaggers during the July to September period and delivered up to 1,560% returns on a quarter-to-date basis (QTD). Among them, 15 stocks zoomed more than 300%, whereas another dozen counters have jumped between 200-300%. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/up-to-1560-returns-these-130-stocks-turned-multibaggers-in-sept-quarter/articleshow/94499189.cms |

|

Market Extra: Did something break? What stock-market investors need to know about mounting global financial stressesFinancial disorder forced the Bank of England to take extraordinary action Wednesday. Here’s what it means for U.S. investors wary of a market breakdown. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-712B-ACE0EFD98623%7D&siteid=rss&rss=1 |

|

The Ratings Game: UiPath disappoints Wall Street with forecast as stock nears 80% plunge from IPO priceUiPath Inc. disappointed Wall Street with its path forward in an analyst day, sending shares down more than 5% in Wednesday trading for a company that has seen its stock fall nearly 80% since its initial public offering. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-712B-DDE9E963E0A4%7D&siteid=rss&rss=1 |

|

Key Words: Kyrie Irving says he lost at least $100 million for deciding not to get vaccinated‘I didn’t appreciate how me being unvaccinated all of a sudden came to be a stigma within my career,’ the NBA star said. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-712B-BE267AEEABE7%7D&siteid=rss&rss=1 |

Xi is “back”…image via state media screenshotImportantly, it had been his first foreign trip in two years. Xi had not traveled outside of the country since before the Covid-19 pandemi …

Xi is “back”…image via state media screenshotImportantly, it had been his first foreign trip in two years. Xi had not traveled outside of the country since before the Covid-19 pandemi …

Screenshot via CBS News”In the four days since the announcement of Russia’s first mobilization since World War II, about 260,000 men of military age have left the country, independent media outlet Novaya Gazeta Europe

Screenshot via CBS News”In the four days since the announcement of Russia’s first mobilization since World War II, about 260,000 men of military age have left the country, independent media outlet Novaya Gazeta Europe