Summary Of the Markets Today:

- The Dow closed down 126 points or 0.43%,

- Nasdaq closed up 0.25%,

- S&P 500 down 0.21%,

- WTI crude oil settled at $78 up 2.75%,

- USD $114.25 up $0.14,

- Gold $1635 up $2.00,

- Bitcoin $19,029 down 0.50% – Session Low 18,868,

- 10-year U.S. Treasury 3.988% up 0.108%,

Today’s Economic Releases:

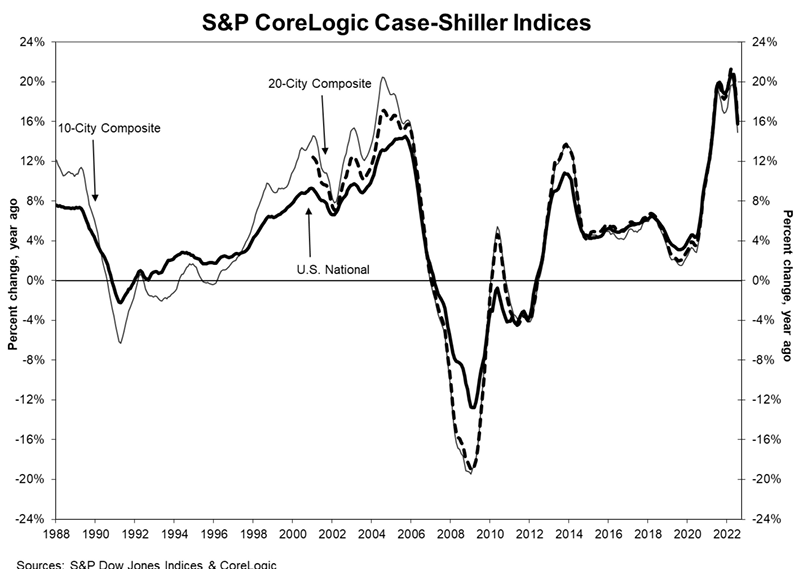

The S&P CoreLogic Case-Shiller 20-City Composite in July 2022 posted a 16.1% year-over-year gain, down from 18.7% in the previous month. CoreLogic Deputy Chief Economist Selma Hepp stated:

In July, the CoreLogic S&P Case-Shiller Index posted an increase of 15.8%, down from a 18.1% gain in June, marking the fourth month of decelerating annual home price appreciation. In addition, month-to-month index turned negative, down 0.3% in July, the first time since late 2018 when the Federal Reserve went through a round of monetary tightening leading to a surge in mortgage rates and subsequent housing market slowdown. Rapid home price deceleration, which is spreading beyond the West Coast markets, was anticipated given the Fed’s actions and will bring home price growth closer in line with income growth. Returning to long-term average of 4-5% annual price growth is closer than initially anticipated – potentially by early 2023.

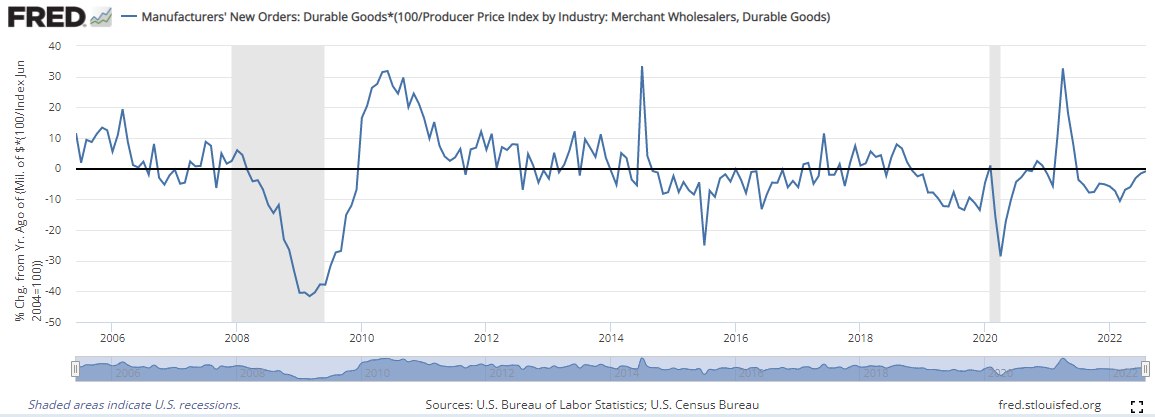

New orders for manufactured durable goods in August 2022, down two consecutive months, decreased 0.2% month-over-month and is up 8.8% year-over-year. Still, when adjusted for inflation, year-over-year growth is down 0.8% (see graph below):

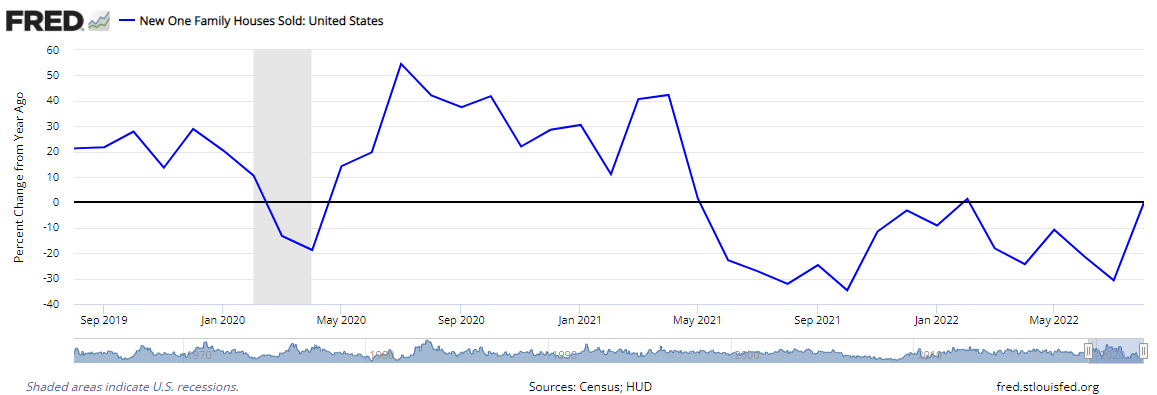

Sales of new single‐amily houses in August 2022 were at a 28.8% above July rate but is 0.1% below August 2021. The median sales price of new houses sold in August 2022 was $436,800. The average sales price was $521,800.

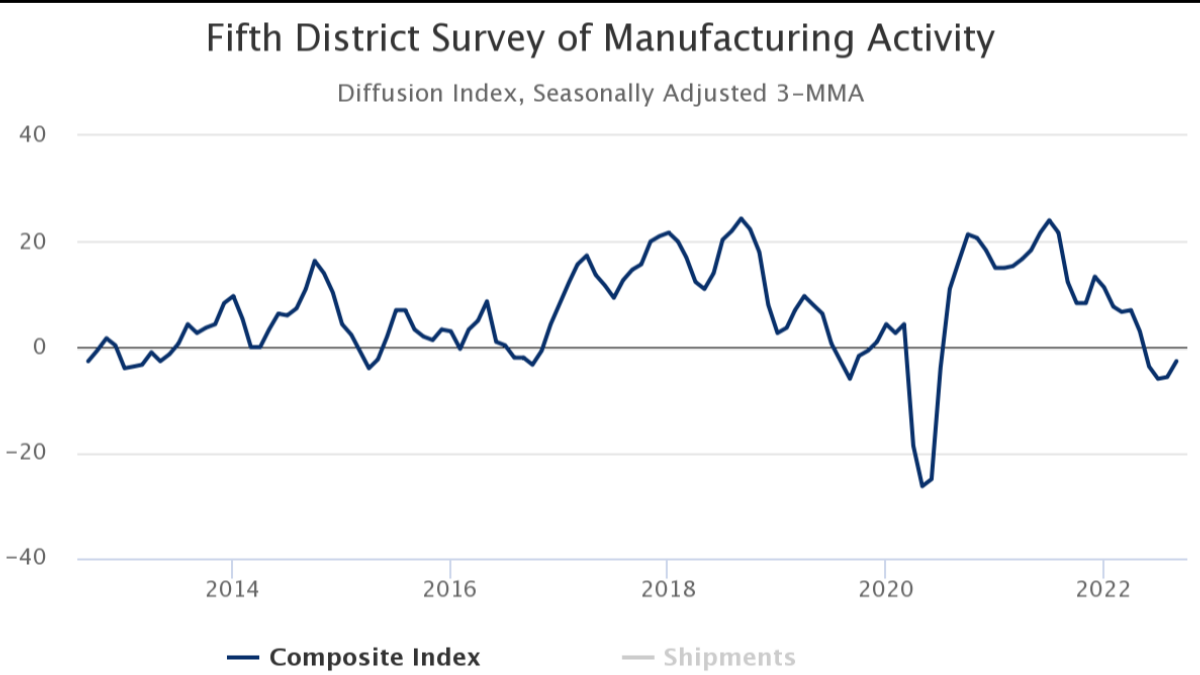

The Federal Reserve Bank of Richmond composite manufacturing index rose fro+m −8 in August to 0 in September, matching its July level.

A summary of headlines we are reading today:

- Strong Dollar Threatens Demand For Industrial Metals

- Solar Cell Breakthrough Could Challenge Silicon Dominance

- Goldman Sachs Drops Oil Price Forecast

- Stock market losses wipe out $9 trillion from Americans’ wealth

- Vanguard To Liquidate And Shutter A U.S. Listed ETF For The First Time In Its History

- CIA Warned Germany Of Possible Nord Stream Pipeline Attack

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Strong Dollar Threatens Demand For Industrial MetalsVia AG Metal Miner Experts agree that a global recession is now a foregone conclusion. Though they continue to argue about the potential extent of the damage and which countries may evade repercussions, few see any way to avoid a downturn. As usual, one of the first markets to react to the growing concern is industrial metals. Back on September 6, the Financial Times was sounding the alarm on industrial metals. At the time, the S&P GSCI had just witnessed a crushing descent from March highs. In fact, the index had largely risen since the beginning Read more at: https://oilprice.com/Metals/Commodities/Strong-Dollar-Threatens-Demand-For-Industrial-Metals.html |

|

Putin Sees Pushback From Russians Following Nuclear Saber-RattlingRussian President Vladimir Putin’s September 21 address to the nation could prove to be one of his most fateful blunders in his disastrous war in Ukraine. In his 15-minute pre-recorded speech, Putin announced support for the referendums in four Ukrainian regions, declared partial mobilization in Russia, accused the West of aggressive Russophobia, and threatened to use nuclear weapons. The Russian leader concluded by expressing confidence in the support of Russian citizens (Nezavisimaya gazeta, September 21). These propositions Read more at: https://oilprice.com/Geopolitics/International/Putin-Sees-Pushback-From-Russians-Following-Nuclear-Saber-Rattling.html |

|

Norway, Germany, Brace For Insecurity After Nordstream ExplosionsNorway will beef up its security at its oil and gas installations after three explosions rocked the Nordstream 1 & 2 pipelines, the country’s oil and energy minister said on Tuesday. Germany’s economy minister also offered words of strength on Tuesday, saying that it knows how to and can defend its infrastructure. This week, both Danish and Swedish authorities reported leaks from both the Nordstream 1 and 2 pipelines in the Baltic Sea. Neither pipeline was operational at the time, but contained gas, which is now leaking Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norway-Germany-Brace-For-Insecurity-After-Nordstream-Explosions.html |

|

Solar Cell Breakthrough Could Challenge Silicon DominanceRice University engineers have shown the manufacture of high-efficiency solar cells with layers of 2D and 3D perovskites may be simplified by solvents that allow solution deposition of one layer without destroying the other. The work solved a long-standing conundrum in making stable, efficient solar panels out of halide perovskites. The effort took finding the right solvent design to apply a 2D top layer of desired composition and thickness without destroying the 3D bottom one (or vice versa). Such a cell would turn more sunlight into electricity Read more at: https://oilprice.com/Alternative-Energy/Solar-Energy/Solar-Cell-Breakthrough-Could-Challenge-Silicon-Dominance.html |

|

EU Plans TO Impose Sanctions On Organizers Of “illegal” Referendums In UkraineThe European Union plans to follow suit with the United Kingdom and others and impose sanctions on the organizers of “illegal, illegitimate referendums” that are being conducted in four regions of Ukraine that are at least partially controlled by Moscow. “There would be consequences for all people who participate in the illegal, illegitimate referendums,” Peter Stano, a spokesman for EU foreign policy chief Josep Borrell, told journalists on September 27, the fifth and final day of voting in the referendums, which many Western governments have Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Plans-TO-Impose-Sanctions-On-Organizers-Of-illegal-Referendums-In-Ukraine.html |

|

Goldman Sachs Drops Oil Price ForecastGoldman Sachs cut its oil price forecast on Tuesday on the deteriorating global economic outlook although it remained bullish on oil. Goldman said it remained bullish, anticipating that oil prices would likely rise from the current levels given the state of the critically tight market. The group cited the strong dollar and weakening demand forecast, which will remain powerful headwinds to prices into year-end. Yet, the structural bullish supply set-up — due to the lack of investment, low spare capacity, and inventories Read more at: https://oilprice.com/Latest-Energy-News/World-News/Goldman-Sachs-Drops-Oil-Price-Forecast.html |

|

Walt Disney World to close parks for two days as Hurricane Ian approaches FloridaDisney’s Animal Kingdom, Hollywood Studios, Epcot, and Magic Kingdom will close on Wednesday and Thursday. Read more at: https://www.cnbc.com/2022/09/27/hurricane-ian-walt-disney-world-to-close-parks-for-two-days.html |

|

GM delays return-to-office mandate after employee backlashThe company on Friday said corporate workers would be required to return to physical locations at least three days a week, beginning later this year. Read more at: https://www.cnbc.com/2022/09/27/gm-delays-return-to-office-mandate-after-employee-backlash.html |

|

Phil Mickelson and three other golfers drop out of antitrust suit against PGA TourPhil Mickelson and three other LIV golfers have dropped out of an antitrust lawsuit against the PGA Tour. Read more at: https://www.cnbc.com/2022/09/27/phil-mickelson-and-other-liv-golfers-drop-out-of-antitrust-suit-against-pga-tour.html |

|

Feds sought to jail father charged in $100 million New Jersey deli scam with Hong Kong-based son at largePeter Coker Sr., 80, was arrested Monday in North Carolina in the alleged deli scheme. His Hong Kong-based son was also charged and remains at large. Read more at: https://www.cnbc.com/2022/09/27/100-million-new-jersey-deli-scam-feds-sought-to-jail-father-while-son-is-at-large.html |

|

Artemis moon mission likely delayed to November as NASA moves rocket out of hurricane’s pathNASA rolled the SLS rocket back into the mammoth Vehicle Assembly Building for protection at Kennedy Space Center ahead of potential impact from Hurricane Ian. Read more at: https://www.cnbc.com/2022/09/27/nasas-artemis-1-moon-mission-likely-delayed-to-november.html |

|

Stock market losses wipe out $9 trillion from Americans’ wealthFalling stock markets have wiped out $9 trillion in wealth from U.S. households, putting pressure on family balance sheets and spending. Read more at: https://www.cnbc.com/2022/09/27/stock-market-losses-wipe-out-9-trillion-from-americans-wealth-.html |

|

Hurricane Ian snarls air travel in western FloridaTampa International Airport said it would suspend operations on Tuesday afternoon. Read more at: https://www.cnbc.com/2022/09/27/hurricane-ian-forces-airlines-to-cancel-flights-tampa-airport-suspend-operations.html |

|

Justice Department’s fight with JetBlue and American Airlines heads to courtAmerican and JetBlue argue the Northeast Alliance allows them to better compete against other airlines serving New York and Boston. Read more at: https://www.cnbc.com/2022/09/27/jetblue-american-airlines-go-to-court-in-justice-department-antitrust-fight.html |

|

Hertz is teaming up with oil giant BP to install thousands of EV chargers in the U.S.BP’s fleet-charging unit will help Hertz manage its growing fleet of EVs, with chargers that will be available to the public as well. Read more at: https://www.cnbc.com/2022/09/27/hertz-and-bp-installing-ev-chargers-in-us.html |

|

Home prices cooled in July at the fastest rate in the history of S&P Case-Shiller IndexJuly’s year-over-year gains in home prices were lower compared with June in each of the cities covered by the index. Read more at: https://www.cnbc.com/2022/09/27/july-sp-case-shiller-index-home-prices-cooled-at-the-fastest-rate-in-index-history.html |

|

Three men charged with fraud in $100 million New Jersey deli schemeThe indictments are the latest shocking twist involving Your Hometown Deli in Paulsboro, New Jersey. Read more at: https://www.cnbc.com/2022/09/26/three-men-charged-with-fraud-in-100-million-new-jersey-deli-scheme.html |

|

Christie’s launches ‘Department X’ as collectible sneakers and street-wear boomChristie’s announced its new “Department X” to capitalize on the booming market for collectible sneakers, streetwear and sports history. Read more at: https://www.cnbc.com/2022/09/26/christies-launches-department-x-as-collectible-sneakers-street-wear-boom.html |

|

Texas AG Ken Paxton fled home with his wife to avoid subpoena in abortion case, court filing saysPaxton was subpoenaed to testify in a civil lawsuit from Texas-based nonprofits that want to resume helping pregnant residents obtain out-of-state abortions. Read more at: https://www.cnbc.com/2022/09/27/texas-ag-paxton-fled-home-with-his-wife-to-avoid-subpoena-in-abortion-case.html |

|

Taibbi: The Washington Post Dabbles In OrwellAuthored by Matt Taibbi via TK News,

A Monday story in the Washington Post entitled “Putin grants citizenship to Edward Snowden, who exposed U.S. surveillance’” began:

The story added:

|

|

Vanguard To Liquidate And Shutter A U.S. Listed ETF For The First Time In Its HistoryMaybe this time, it is different… Vanguard is shutting down and liquidating a U.S. listed exchange-traded fund for the first time in the firm’s history, according to a new report by Bloomberg on Monday. The investment giant is going to be shuttering the $39.7 million Vanguard U.S. Liquidity Factor ETF (ticker VFLQ) in late November, according to the report. It is liquidating the fund because it has “not gained scale since its 2018 debut.” A company press release reads: “We continue to add new products that have investment merit and meet investors’ preferences, change advisors and mandates to improve investor outcomes, and eliminate funds that lack a distinct role in investors’ portfolios.”

“Vanguard continues to believe in the long-term investment case for factor investing. Under the right circumstances, factor products may help investors achieve their financial goals,” the release … Read more at: https://www.zerohedge.com/markets/vanguard-liquidate-and-shutter-us-listed-etf-first-time-its-history |

|

Israeli Investigators Find COVID-19 Vaccines Cause Side Effects: Leaked VideoAuthored by Meiling Lee and Zachary Stieber via The Epoch Times (emphasis ours),

Syringes and vials of the Pfizer-BioNTech COVID-19 vaccine in Netanya, Israel, on Jan. 5, 2022. (Jack Guez/AFP via Getty Images)Israeli researchers found some side effects that occurred after COVID-19 vaccination were caused by Pfizer’s vaccine, according to a leaked video. The Israeli Ministry of Health (MoH) commissioned researchers to analyze adverse event reports submitted by Israelis and the researchers presented findings from the new surveillance system in an internal June 2022 meeting, video of which was obtained by an Israeli jour … Read more at: https://www.zerohedge.com/covid-19/israeli-investigators-find-covid-19-vaccines-cause-side-effects-leaked-video |

|

CIA Warned Germany Of Possible Nord Stream Pipeline AttackUpdate (1445ET): German magazine Spiegel said the US Central Intelligence Agency (CIA) recently warned Berlin about the increasing signs of a possible planned attack on the Nord Stream pipeline system. Spiegel reported, citing unnamed sources, that the CIA tipped off Berlin in the summer about possible attacks on NS1 and NS2.

|

|

Royal Mail workers to hold 19 days of strike actionIt will cover the Christmas build-up, including key shopping days Black Friday and Cyber Monday. Read more at: https://www.bbc.co.uk/news/business-63055394?at_medium=RSS&at_campaign=KARANGA |

|

More mortgage lenders pull deals on rate rise fearsYorkshire Building Society and Santander join others in suspending mortgage offers to new customers. Read more at: https://www.bbc.co.uk/news/business-63041679?at_medium=RSS&at_campaign=KARANGA |

|

Mortgage rates: ‘If we can’t afford higher payments, we lose our home’Some economists predict the Bank of England will raise the interest rate to as much as 5.8% by next spring. Read more at: https://www.bbc.co.uk/news/business-63046919?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Is range-bound Nifty scary? What investors should do on Wednesday“Nifty formed a Bearish candle on the daily scale and has been making lower highs – lower lows from the last five trading sessions. Now, till it remains below 17,166 zones, weakness may be seen towards 16,800 and 16,666 zones whereas hurdles are placed at 17,166 and 17,250 zones,” said Chandan Taparia of Motilal Oswal Financial Services. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-is-range-bound-nifty-scary-what-investors-should-do-on-wednesday/articleshow/94484489.cms |

|

MF favourites: 8 freshly-added stocks in 15 schemesIn Tuesday’s MFs screening, we picked up stocks that are freshly added by most MFs schemes in the month of August 2022 as compared to the previous month. We considered only stocks which are freshly added by over 15 MFs schemes in the month of August (Data Source ACE MF). For investors, it is always interesting to keep watch on mutual fund investment strategy as they are big institutional investors who generally invest heavily with deep research in their stock picks. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/mf-favourites-8-freshly-added-stocks-in-15-schemes/latest-picks/articleshow/94482044.cms |

|

Kotak Realty Fund invests $200 million in Embassy REIT through block dealAlternate assets investment major Kotak Investment Advisors has invested the money from its 12th real estate fund that has recently raised over $590 million and counts sovereign wealth fund Abu Dhabi Investment Authority (ADIA) as a key partner. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/kotak-realty-fund-invests-200-million-in-embassy-reit-through-block-deal/articleshow/94477042.cms |

|

Financial Crime: ‘The motivation was greed, unrestrained greed’: Ex-Nigerian official sentenced to 5 years for stealing from U.S. disaster relief fundsProsecutors say Abidemi Rufai used stolen identities to apply for millions in aid for Covid-19 and Hurricanes Harvey and Irma despite living in Nigeria. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-712B-1D5678140ED3%7D&siteid=rss&rss=1 |

|

War-torn Ukraine sets sights on additional IMF support not tied to its Fund quotaUkraine is working on a long-term program with the IMF, according to the office of Prime Minister Denys Shmyhal. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-712B-1447473D9C3A%7D&siteid=rss&rss=1 |

|

The Ratings Game: CSX, Norfolk Southern stocks sink to near 2-year lows after UBS downgrades, citing a ‘deteriorating’ outlookShares of CSX Corp. and Norfolk Southern Corp. both sank toward the lowest levels in nearly two years, after UBS analyst Thomas Wadewitz backed away from his long-time bullish stances on the railroad operators, citing a “deteriorating” economic outlook. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-712B-00192E6CB8BC%7D&siteid=rss&rss=1 |