Summary Of the Markets Today:

- The Dow closed down 486 points or 1.62%,

- Nasdaq closed down 1.80%,

- S&P 500 down 1.72%,

- WTI crude oil settled at $79 down 5.60%,

- USD $113.05 weakening 1.44%,

- Gold $1643 down $29,

- Bitcoin $18,739 down 3.43% – Session Low 18,588,

- 10-year U.S. Treasury 3.681 little changed,

- Baker Hughes Rig Count: U.S. +1 to 764 Canada +4 to 215

Today’s Economic Releases:

A summary of headlines we are reading today:

- Kazakhstan Closes Trucking Loophole Which Allowed Russia To Dodge Sanctions

- Precious Metal Miner Polymetal Plummets After Scrapping Dividend

- Oil Rig Count Sees Small Jump Amid Crash In Crude Prices

- Debt-loaded cruise lines’ shares fall as Fed hikes rate and recession fears grow

- Risk Of Global Recession In 2023 Rises Amid Simultaneous Rate Hikes

- Stocks Tumble To Session Lows The Moment Powell Opens His Mouth At Today’s Fed LIstens Event

- Market Snapshot: Dow sinks 550 points as rising bond yields hammer stocks after Fed rate hike

- Futures Movers: U.S. oil prices drop below $80 a barrel to their lowest finish since January on recession fears

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

The Global Water Crisis Could Crush The Energy IndustryFor years, the energy sector, and almost every other sector, has taken water for granted, viewing it as an abundant resource. But as we move into a new era of renewable energy, the vast amounts of water required to power green energy operations may not be so easy to find. And it’s not just renewables that are under threat from water scarcity, as it also hinders fossil fuel production and threatens food security. In recent months, we have seen extreme droughts across Europe and the U.S., which are finally making people realize the significance Read more at: https://oilprice.com/Energy/Energy-General/The-Global-Water-Crisis-Could-Crush-The-Energy-Industry.html |

|

Blinken: EU Must Stand Up To Putin’s Diabolical Annexation SchemeU.S. Secretary of State Antony Blinken called on UN Security Council members to stand up to Russian President Vladimir Putin, warning that the Kremlin leader’s invasion of Ukraine and attempts to annex more of its territory were threatening to destroy the international order. Putin is pushing four Kremlin-controlled territories of Ukraine to hold disputed votes for annexation into the Russian Federation beginning on September 23 amid the biggest conflict in Europe since World War II. The very international order that we have gathered Read more at: https://oilprice.com/Geopolitics/International/Blinken-EU-Must-Stand-Up-To-Putins-Diabolical-Annexation-Scheme.html |

|

Kazakhstan Closes Trucking Loophole Which Allowed Russia To Dodge SanctionsAstana has closed a loophole that was allowing Russian and Belarusian truckers to bring European Union cargo across Russia to Kazakhstan without the correct paperwork. The clampdown comes as Kazakhstan continues efforts to comply with international sanctions against Russia and Belarus fellow partners in the Eurasian Economic Union (EAEU), a free trade zone to avoid Western countries targeting Kazakhstan with secondary sanctions. Kazakh customs officials have halted on the border at least eight Russian articulated trucks carrying Read more at: https://oilprice.com/Latest-Energy-News/World-News/Kazakhstan-Closes-Trucking-Loophole-Which-Allowed-Russia-To-Dodge-Sanctions.html |

|

Precious Metal Miner Polymetal Plummets After Scrapping DividendPolymetal shares fell 11.5 percent today after the Anglo-Russian precious metals mining company announced it was scrapping the full-year 2021 dividend due to dwindling cash flows and a lack of new sales channels. It also suggested canceling the interim 2022 dividends to allow the Group to strengthen its cash position and enhance its resilience in a highly volatile environment. Future dividends will hinge on Polymetal’s capacity to free the 22 percent of blocked shares currently stored by the Russian National Settlement Read more at: https://oilprice.com/Latest-Energy-News/World-News/Precious-Metal-Miner-Polymetal-Plummets-After-Scrapping-Dividend.html |

|

Oil Rig Count Sees Small Jump Amid Crash In Crude PricesThe number of total active drilling rigs in the United States rose by 1 this week, according to new data from Baker Hughes published on Friday. The total rig count rose to 764 this week243 rigs higher than the rig count this time in 2021. Oil rigs in the United States rose by 3 this week, to 602. Gas rigs slipped 2, to 160. Miscellaneous rigs stayed the same at 2. The rig count in the Permian Basin increased by 1 to 344 this week. Rigs in the Eagle Ford stayed the same at 72. Oil and gas rigs in the Permian are 84 above where they were this Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Rig-Count-Sees-Small-Jump-Amid-Crash-In-Crude-Prices.html |

|

Steel Prices Stagnate Despite Energy Prices Weighing On ProductionVia AG Metal Miner Hot rolled coil steel prices in Western Europe remain largely unchanged since early September. However, as various market participants told MetalMiner, this is despite attempts by at least one steelmaker to increase them According to our sources, multiple factors continue to suppress demand for flat rolled products. These include a slowdown of public works programs throughout Europe. Another culprit is rapidly-rising energy prices and lower consumer purchases in the face of economic uncertainty. Recently, high stock Read more at: https://oilprice.com/Metals/Commodities/Steel-Prices-Stagnate-Despite-Energy-Prices-Weighing-On-Production.html |

|

Ford’s supply chain problems include blue oval badges for F-Series pickupsThe issue is the latest in a yearslong supply chain crisis that has included critical parts such as semiconductor chips, wire harnesses, and raw materials. Read more at: https://www.cnbc.com/2022/09/23/fords-supply-chain-problems-include-blue-oval-badges-for-f-series-pickups.html |

|

Trump-linked Digital World Acquisition Corp shares are now around $16 after hitting $97 earlier this yearShares of Digital World Acquisition Corp. fell this week as the Trump Media merger partner missed a key deadline to hold on to about $1 billion in financing. Read more at: https://www.cnbc.com/2022/09/23/trump-merger-partner-shares-fall-dramatically.html |

|

Inside the $250 million penthouse on ‘Billionaires’ Row’The penthouse in the world’s tallest residential building is listed for $250 million, marking a major test of the ultra-luxury real estate market. Read more at: https://www.cnbc.com/2022/09/23/inside-the-250-million-penthouse-on-billionaires-row.html |

|

Bed Bath & Beyond’s merchandise problems will make it hard to pull off a turnaround this holiday seasonA mountain of debt and strained relationships with merchandise providers could cripple Bed Bath & Beyond’s attempt to bounce back. Read more at: https://www.cnbc.com/2022/09/22/bed-bath-beyond-merchandise-problems-could-cripple-turnaround-plan.html |

|

Latinos are seeing the least amount of growth in corporate board representation, new findings showDespite being the second largest demographic population in the U.S., Latinos have paltry representation on corporate board seats. Read more at: https://www.cnbc.com/2022/09/23/over-60percent-of-fortune-1000-corporate-boards-lack-latino-representation.html |

|

Costco isn’t raising membership fees after earnings beat expectationsCostco isn’t hiking its membership fees after reporting quarterly results that topped expectations. Read more at: https://www.cnbc.com/2022/09/23/costco-maintains-membership-fees-after-earnings-beat-expectations.html |

|

With representation lacking in media, Emilio Estefan urges Latinos to embrace their identitiesA new report finds a lack of Latino representation on the big and small screens. Read more at: https://www.cnbc.com/2022/09/23/emilio-estefan-talks-about-the-challenges-of-latino-representation-in-media.html |

|

Debt-loaded cruise lines’ shares fall as Fed hikes rate and recession fears growHolding billions in debt, cruise companies like Carnival and Royal Caribbean felt the pain of the Federal Reserve’s rate hikes Wednesday. Read more at: https://www.cnbc.com/2022/09/23/cruise-line-stocks-fall-fed-rate-hike-recession-worries.html |

|

Moderna asks FDA to authorize omicron Covid boosters for children as young as 6 years oldModerna has asked the FDA to authorize omicron boosters for adolescents ages 12 to 17 years old and for kids ages 6 to 11 years old. Read more at: https://www.cnbc.com/2022/09/23/moderna-asks-fda-to-authorize-omicron-covid-boosters-for-children-as-young-as-6-years-old.html |

|

JetBlue ground operations workers seek union representationThe International Association of Machinists and Aerospace Workers said it would file an application for a union vote for JetBlue’s ground workers. Read more at: https://www.cnbc.com/2022/09/23/jetblue-fleet-service-workers-seek-union-vote.html |

|

Boston Celtics suspend head coach Ime Udoka for the upcoming season for violating team policiesBoston Celtics coach Ime Udoka reportedly had a consensual relationship with a woman working for the team. Read more at: https://www.cnbc.com/2022/09/23/boston-celtics-suspend-head-coach-ime-udoka-for-upcoming-season.html |

|

Ford to restructure supply chain following $1 billion in unexpected quarterly costsThe restructuring will be led on an interim basis by Ford CFO John Lawler until a chief supply chain officer is selected, Ford said. Read more at: https://www.cnbc.com/2022/09/22/ford-to-restructure-supply-chain-after-1-billion-in-unexpected-costs.html |

|

Boeing to pay $200 million to settle charges over misleading investors after 737 Max crashesBoeing’s ex-CEO Dennis Muilenburg will pay $1 million to settle the charges, the SEC said. Read more at: https://www.cnbc.com/2022/09/22/boeing-to-pay-200-million-to-settle-sec-charges-on-misleading-investors-after-deadly-737-max-crashes.html |

|

Risk Of Global Recession In 2023 Rises Amid Simultaneous Rate HikesAuthored by Mike Shedlock via MishTalk.com, Central banks cut in unison in response to Covid. They are now hiking in unison. What can go wrong?…

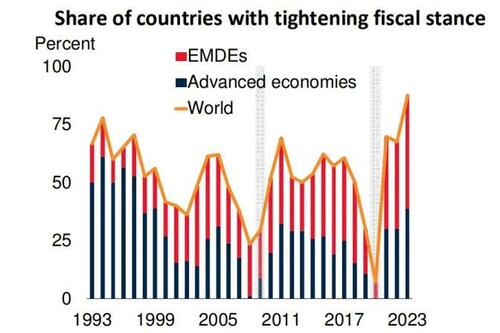

World Bank chart on tightening fiscal stance Super Thursday ActionsThe Wall Street Journal reports Interest-Rate Hikes Come Thick and Fast Switzerland: Raised rates by 0.75 point to 0.5%, making it one of the last central banks to exit negative territory. U.K.: The Bank of England raised its key rate by 0.5 point to 2.25%, and will start selling some of its bond holdings. Norway: Increased rates by 0.5 point to 2.25%. … Read more at: https://www.zerohedge.com/geopolitical/risk-global-recession-2023-rises-amid-simultaneous-rate-hikes |

|

Raytheon Wins Billion Dollar Contract To Develop Hypersonic Attack Cruise MissilesThe Pentagon awarded Raytheon Technologies a $985 million contract to design, develop and produce a new hypersonic weapon for the US Air Force. Raytheon won the contract to develop and demonstrate scramjet-powered hypersonic cruise missiles. It moves the Hypersonic Attack Cruise Missile, or HACM program, out of the prototyping phase and into becoming an operational weapon. It takes the number of companies aiming to build the new weapon from three to one.

HCAM will become USAF’s second hypersonic missile after Lockheed’s AGM-183A Air-launched Rapid Response Weapon, or ARRW, a hypersonic weapon launched from a B-52 bomber then glides to its target at super-fast speeds in an unpredictable path.

|

|

Ex-CIA Ray McGovern: Conditioned For War With RussiaAuthored by Ray McGovern via Consortium News, Thanks to Establishment media, the sorcerer apprentices advising President Joe Biden — I refer to Secretary of State Antony Blinken, National Security Advisor Jacob Sullivan and China specialist Kurt Campbell – will have no trouble rallying Americans for the widest war in 77 years, starting in Ukraine, and maybe spreading to China. And, shockingly, under false pretenses. Most Americans are oblivious to the reality that Western media are owned and operated by the same corporations that make massive profits by helping to stoke small wars and then peddling the necessary weapons. Corporate leaders and Ivy-mantled elites, educated to believe in U.S. “exceptionalism,” find the lucre and the luster too lucrative to be able to think straight. They deceive themselves into thinking that (a) the U.S. cannot lose a war; (b) escalation can be calibrated and wider war can be limited to Europe; and (c) China can be expected to just sit on the sidelines. The attitude, consciously or unconsciously, “Not to worry. And, in any case, the lucre and luster are worth the risk.” The media also know they can always trot out died-in-the-wool Russophobes to “explain,” for example, why the Russians are “almost genetically driven” to do evil (James Clapper, former national intelligence director and now hired savant on CNN); or Fiona Hill (former national intelligence officer for Russia), who Read more at: https://www.zerohedge.com/geopolitical/ex-cia-ray-mcgovern-conditioned-war-russia |

|

Stocks Tumble To Session Lows The Moment Powell Opens His Mouth At Today’s Fed LIstens EventS&P futures, now clearly in widespread panic liquidation mode and searching for any excuse to sell off more, found one just after 2 pm when Fed Chair Jerome Powell said that the US economy may be entering a “new normal” following disruptions from the Covid-19 pandemic. “We continue to deal with an exceptionally unusual set of disruptions,” Powell told business and community leaders Friday at a Fed Listens event in Washington, Bloomberg reported. Algos immediately took this as confirmation that the supply chain chaos that defined the post-Covid world is still prevalent in the Fed’s thinking, and since it is inflationary, it means even more rate hikes on deck.

In his brief welcoming marks, Powell didn’t discuss the outlook for interest rates or offer more specifics on the economic outlook, but to algos even his briefest remarks were sufficient to trigger yet another liquidation cascade, with the TICK puking near session lows. US consumer prices rose 8.3% … Read more at: https://www.zerohedge.com/markets/stocks-tumble-session-lows-moment-powell-opens-his-mouth-todays-fed-listens-event |

|

Pound sinks as investors question huge tax cutsMarkets worry over the outlook for government finances following the biggest tax cutting moves in 50 years. Read more at: https://www.bbc.co.uk/news/business-63009173?at_medium=RSS&at_campaign=KARANGA |

|

Mini-budget: What it means for you and your financesChancellor Kwasi Kwarteng has delivered what the government calls a “fiscal event”. Here is how it affects you. Read more at: https://www.bbc.co.uk/news/business-63001463?at_medium=RSS&at_campaign=KARANGA |

|

‘We’ll be lucky to keep our heads above water’The BBC talked to households and businesses to get their reactions to the mini-budget. Read more at: https://www.bbc.co.uk/news/business-63007990?at_medium=RSS&at_campaign=KARANGA |

|

Nifty proves vulnerable to global selloff. What investors should do on MondayVolumes on the NSE were the lowest since September 12. Technically, the Nifty has formed a lower top formation on daily charts and a long bearish candle on daily charts, which is broadly negative. 17,166 is the next support for the Nifty post, which a sharper fall could ensue. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nifty-proves-vulnerable-to-global-selloff-what-investors-should-do-on-monday/articleshow/94401298.cms |

|

Nifty Bank: Key levels to watch out for on MondayThe index breached the crucial support of 40,000 and closed below it, confirming the breakdown and activating the sell-on-rise mode. The index remains in a sell-on-rise mode with hurdles at 40,500 and the next support is visible at 39,000. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nifty-bank-key-levels-to-watch-out-for-on-monday/articleshow/94403291.cms |

|

Top-rated Indian companies issue bonds at near-govt borrowing ratesEven as the economy recovered, corporate bond issuances were down by more than a fifth between April and August this year compared to the same period before the pandemic, in 2019. This resulted in higher-rated corporates being able to raise funds at close to the borrowing rates for government debt, the safest asset on the Indian market. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/top-rated-indian-companies-issue-bonds-at-near-govt-borrowing-rates/articleshow/94394010.cms |

|

Market Snapshot: Dow sinks 550 points as rising bond yields hammer stocks after Fed rate hikeU.S. stocks are down sharply Friday afternoon, with the S&P 500 trading around its 2022 closing low reached in June, as major benchmarks head for weekly losses after bond yields and the dollar rose in the wake of the Federal Reserve’s interest rate hike. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7128-777708507FF5%7D&siteid=rss&rss=1 |

|

‘No wonder consumer confidence has been falling’: Women’s financial well-being sinks to five-year low, study findsOnly 14% of women say they’re prepared for a recession, compared with 30% of men, according to a survey by Ellevest, a women’s investing platform. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7128-F63697E10596%7D&siteid=rss&rss=1 |

|

Futures Movers: U.S. oil prices drop below $80 a barrel to their lowest finish since January on recession fearsOil drops sharply Friday, with U.S. prices below $80 a barrel to mark their lowest finish since January, as recession fears grip financial markets, sinking global stock markets and contributing to a further rise by the U.S. dollar. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7128-81D61C7FA196%7D&siteid=rss&rss=1 |