Summary Of the Markets Today:

- The Dow closed down 522 points or 1.70%,

- Nasdaq closed down 1.79%,

- S&P 500 down 1.71%,

- WTI crude oil settled at $83 down 1.12%,

- USD $111.00 weakening $1.26,

- Gold $1683 up $11.30,

- Bitcoin $19,006 up 0.41% – Session Low 18,815,

- 10-year U.S. Treasury 3.526 little changed

Today’s Economic Releases:

Existing-home sales declined for the seventh consecutive month. Total existing-home sales contracted 0.4% month-over-month in August 2022. Year-over-year, sales declined 19.9%. Sales are now at levels seen in 2012/2013. The median existing-home price for all housing types in August was up 7.7% year-over-year.

The Federal Reserve raised the federal funds rate by 75 bps to 3%-3.25% today, the third straight three-quarter point increase and pushing borrowing costs to the highest since 2008. The FOMC statement said in part:

Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures. Russia’s war against Ukraine is causing tremendous human and economic hardship. The war and related events are creating additional upward pressure on inflation and are weighing on global economic activity. The Committee is highly attentive to inflation risks. The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run … and anticipates that ongoing increases in the target range will be appropriate.

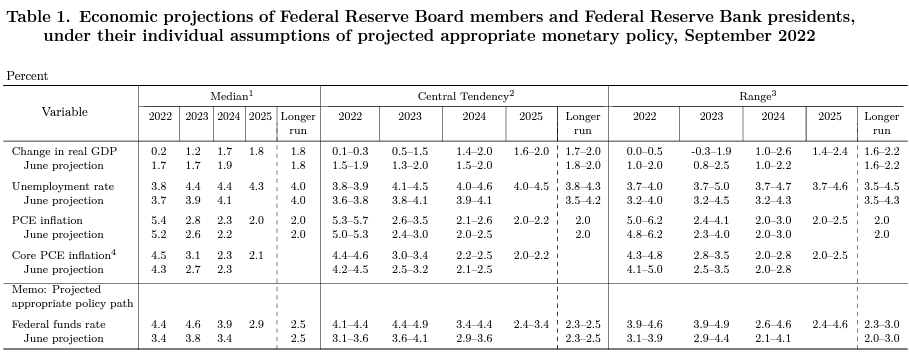

At the same time, the Federal Reserve Board / FOMC released their economic projections which shows a significantly worsening economy since their June 2022 projections. However, there was no forecasted recession in these projections.

- The U.S. Dollar Is Showing Strength As A Safe Haven Asset

- FedEx’s bleak warning could reflect the global economy − and the company’s own shortcomings

- Existing home sales fall in August, and prices soften significantly

- The Fed just raised interest rates by another 0.75%, putting the Main Street economy ‘dangerously close’ to the edge of a lending cliff

- Benchmark bond yields are ‘bad news’ for investors as the Fed hikes rates by 0.75%. What it means for your portfolio

- GOP attorneys general call on credit card companies to drop plans for gun store code

- “Maybe 4-5% Inflation Is The New Normal” – Wall Street Reacts To Powell’s Hawkish Surprise

- US interest rates hit a 14-year high in inflation battle

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

The U.S. Dollar Is Showing Strength As A Safe Haven AssetInvestors have had an insatiable appetite for US dollars this year. According to the Wall Street Journal’s dollar index, which measures the greenback against a basket of some of the world’s top currencies, the dollar is its strongest for over a decade. One dollar will buy you the greatest amount of Japanese yen since the early 1990s. The pound recently collapsed to its lowest level against the dollar in nearly 40 years. The pound has tumbled to historic lows against the US dollar this year Source: CNBC While Wall Street has suffered Read more at: https://oilprice.com/Finance/the-Markets/The-US-Dollar-Is-Showing-Strength-As-A-Safe-Haven-Asset.html |

|

Putin Orders First Russian Troop Mobilization Since World War IIFollowing military setbacks as Ukraine succeeded in retaking swathes of Russian-occupied territory last week, Russian President Vladimir Putin has ordered a partial mobilization of troops that could signal an escalation of the war. Until now, Putin has avoided the mobilization of troops, which would take the conflict beyond what Moscow has consistently referred to only as a special operation. A troop mobilization is a declaration of war, and the partial mobilization involves 300,000 military reservists, according to the Read more at: https://oilprice.com/Latest-Energy-News/World-News/Putin-Orders-First-Russian-Troop-Mobilization-Since-World-War-II.html |

|

The Single Largest Energy Market Intervention In EU HistoryThe EU Commission on 14 September proposed a plan that would pull in 142 billion in windfall profits earned by power and fossil fuel companies and redistribute it to hard-pressed consumers who have seen their power costs multiply in recent months. At the same time, the European Union aims to cut power use through a mandatory 5% reduction in peak-hour demand. The overall target is a 10% cut in total electricity demand until 31 March 2023. In Rystad Energy’s view, these temporary measures should go a long way in helping the EUs Read more at: https://oilprice.com/Energy/Energy-General/The-Single-Largest-Energy-Market-Intervention-In-EU-History.html |

|

Workers Evacuate Following Gas Pipeline Explosion In MexicoA gas pipeline run by Mexico’s state-owned oil firm Pemex exploded in the Mexican state of Tabasco late on Tuesday, causing a fire and leading to the evacuation of all workers at the Paredn Hydrocarbon Separation Station. There have been no reports of injuries or damage to properties located in the vicinity of the plant, local media report. According to Mexico’s civil protection authorities, the cause of the explosion is unknown yet, and an investigation is underway. Pemex said in a statement that an excavator accidentally hit Read more at: https://oilprice.com/Latest-Energy-News/World-News/Workers-Evacuate-Following-Gas-Pipeline-Explosion-In-Mexico.html |

|

Oil Prices Fall After Fed Raises RatesOil prices continued to slide on Wednesday afternoon after the Federal Reserve announced it would hike rates by 75 basis points. Fed Chair Jerome Powell acknowledged last month that rate hikes would cause pain pain intended to bring about demand destruction necessary for bringing down inflation. The rate hike was expected heading into the meeting, with most analysts foreseeing a rate hike of 75 basis points, while a few analysts were anticipating a 100 basis point hike. Oil prices were already trending down prior to the meeting. The Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Prices-Fall-After-Fed-Raises-Rates.html |

|

Emerging Tech Could Create A Greener Global Shipping IndustryWith fossil fuels still powering roughly 99% of global shipping, the sector is seeking to reduce emissions through cleaner fuel sources including methanol, ammonia and wind that could soon see increased use. Last month Breakthrough Energy Ventures, a coalition of private investors founded by US tech entrepreneur Bill Gates, helped Danish start-up Blue World Technologies raise $37m to scale up production of a technological system that extracts hydrogen from methanol and runs it through a fuel cell, generating fuel savings of up to Read more at: https://oilprice.com/Energy/Energy-General/Emerging-Tech-Could-Create-A-Greener-Global-Shipping-Industry.html |

|

FedEx’s bleak warning could reflect the global economy − and the company’s own shortcomingsCEO Raj Subramaniam warned of a “worldwide recession” after FedEx missed earnings expectations, but analysts say the company’s shortcomings likely contributed. Read more at: https://www.cnbc.com/2022/09/21/fedexs-warning-reflects-both-global-economy-and-internal-shortcomings.html |

|

Phoenix Suns and Mercury owner Robert Sarver to sell teams after damning harassment reportThe NBA had suspended Phoenix Suns and Mercury owner Robert Sarver for using racist and sexist language and harassing employees in the workplace. Read more at: https://www.cnbc.com/2022/09/21/phoenix-suns-and-mercury-owner-robert-sarver-starts-process-to-sell-teams-after-damning-harassment-report.html |

|

Existing home sales fall in August, and prices soften significantlySales of previously owned homes fell 0.4% in August from July to a seasonally adjusted annualized rate of 4.80 million units, according to the National Association of Realtors. Read more at: https://www.cnbc.com/2022/09/21/existing-home-sales-fall-in-august-and-prices-soften-significantly.html |

|

Tom Rutledge, who turned Charter into a cable powerhouse, to step down as CEOCharter CEO Tom Rutledge will step down on Dec. 1 after a decade leading the company. He will remain executive chairman until November 2023. Read more at: https://www.cnbc.com/2022/09/21/tom-rutledge-to-step-down-as-charter-communications-ceo.html |

|

Planet prepares to launch another line of imagery satellites to expand data-gathering operationsPlanet is adding another type of imagery satellite to its product line, in the latest expansion of the data the company gathers from its networks in orbit. Read more at: https://www.cnbc.com/2022/09/21/planet-prepares-to-launch-hyperspectral-satellites-called-tanager.html |

|

‘Venom’ actor Tom Hardy is now a champion fighter after a surprise entry at a UK Brazilian Jiu-Jitsu competitionThe 45-year-old actor made a surprise appearance at the 2022 Brazilian Jiu-Jitsu Open Championship in Milton Keynes Read more at: https://www.cnbc.com/2022/09/21/tom-hardy-just-won-gold-at-a-brazilian-jiu-jitsu-competition.html |

|

Patagonia’s bold move to donate the entire company to fight climate change only works if it stays competitive in business, CEO says“What people fail to understand about Patagonia … is that we are unapologetically a for-profit business,” CEO Ryan Gellert told CNBC on Wednesday. Read more at: https://www.cnbc.com/2022/09/21/patagonia-must-remain-competitive-for-climate-change-donation-ceo.html |

|

Here’s what changed in the new Fed statementThis is a comparison of Wednesday’s Federal Open Market Committee statement with the one issued after the Fed’s previous policymaking meeting on July 27. Read more at: https://www.cnbc.com/2022/09/21/heres-what-changed-in-the-new-fed-statement-redline-for-september.html |

|

The Fed just raised interest rates by another 0.75%, putting Main Street economy ‘dangerously close’ to edge of lending cliffMany small business owners are facing lending costs they’ve never before experienced, just as the economy and consumer demand weakens. Read more at: https://www.cnbc.com/2022/09/21/what-the-fed-raising-rates-by-0point75percent-means-for-main-street-economy.html |

|

Benchmark bond yields are ‘bad news’ for investors as the Fed hikes rates by 0.75%. What it means for your portfolioAn inverted yield curve between the 2-year and 10-year Treasurys may signal a future economic downturn. Here’s what investors need to know. Read more at: https://www.cnbc.com/2022/09/21/what-the-inverted-yield-curve-means-for-your-portfolio-.html |

|

Elon Musk says ‘patents are for the weak’ as he talks Starship rocket, tours SpaceX Starbase with Jay LenoThe 50-year-old entrepreneur will make an appearance on “Jay Leno’s Garage” Wednesday night. Read more at: https://www.cnbc.com/2022/09/21/why-elon-musk-says-patents-are-for-the-weak.html |

|

Car buyers pay 10% above the sticker price, on average — or more if you want a Jeep or PorscheWith inventory limited, some sought-after cars, including the Jeep Wrangler, Ford Bronco and Porsche Macan, are selling for at least 20% above the MSRP. Read more at: https://www.cnbc.com/2022/09/21/new-car-prices-buyers-are-paying-well-above-sticker.html |

|

GOP attorneys general call on credit card companies to drop plans for gun store codeTwo dozen Republican attorneys general are urging Visa, MasterCard, and American Express to drop their plans for a new store code for gun retailers. Read more at: https://www.cnbc.com/2022/09/21/gop-attorneys-general-ask-credit-card-companies-to-drop-gun-store-code-.html |

|

Fed Rate-Hikes Will Add Trillions To National DebtAuthored by Michael Maharrey via SchiffGold.com, Federal Reserve rate hikes will add trillions to the national debt, according to an analysis by the Committee for a Responsible Federal Budget. The Fed delivered another 75-basis point rate hike during its September FOMC meeting this afternoon and made it clear that rates will be ‘higher for longer’ to fight persistently high inflation. According to the Committee for a Responsible Budget (CFRB), rate hikes will add another $2.1 trillion to the national debt over the next decade.

The current debt stands at $30.9 trillion. Every increase in interest rate raises the federal government’s interest expense. Read more at: https://www.zerohedge.com/markets/fed-rate-hikes-will-add-trillions-national-debt |

|

“Powell Would Throw Millions Of Americans Out Of Work”: Liz Warren Slams Powell, As Dems Launch Scapegoat CampaignExactly two months ago we predicted that with the economy in shambles as a result of two years of MMT idiocy, inflation soaring, unemployment about to explode, markets crashing, Biden clueless what year it is, and so on, that “Democrats Prepare To Unleash Hell On Fed Chair Powell For The Coming Recession”. And moments ago the most outspoken Indian among the Democrats proved us right, when Lizzie Warren threw the first tomahawk at the Marriner Eccles building: “Chair Powell just announced another extreme interest rate hike while forecasting higher unemployment. I’ve been warning that Chair Powell’s Fed would throw millions of Americans out of work — and I fear he’s already on the path to doing so.”

We won’t dwell on the specifics – readers can go back to our o … Read more at: https://www.zerohedge.com/markets/powell-would-throw-millions-americans-out-work-liz-warren-slams-powell-dems-launch |

|

“Maybe 4-5% Inflation Is The New Normal” – Wall Street Reacts To Powell’s Hawkish SurprisePerhaps they were spooked by the initial kneejerk reaction lower in stocks, despite what every self-respecting trader knows, namely to always fade the first post-FOMC reaction…

… but the early reaction to the FOMC minutes by Wall Street traders, analysts and strategists – who were polled during the sharp drop lower – suggests that the mood on Wall Street was about as dire as it can be. That said, we expect that if the same poll were taken now that stocks are surging higher, the answers would be vastly different… Here’s what investors and market-watchers had to say, courtesy of Bloomberg: Eric Winograd, senior US economist at AllianceBernstein:

|

|

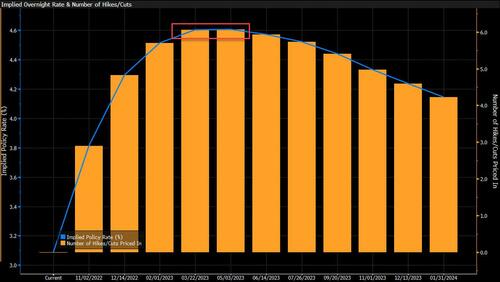

About That Median 2022 Dot… Or Will The Fed Really Hike 75bps One Week Before The MidtermsAs noted moments ago, the market convulsed and tumbled when after the Fed hiked by a somewhat dovish 75bps (the market was pricing in a 25% chance of a 100bps), attention turned to the median 2023 dot which came in very hot, with the median at 4.6%, above the Goldman “hawkish” range of 4.25%-4.50%, and suggesting that the Fed will power on with even more rate hikes than some of the biggest hawks had expected in 2023, until such time ostensbily as the economy is in a deep recession. And sure enough, the implied odds immediately shifted to reflect the latest dots with both March and May now showing 4.6%…

… with the market pricing in an almost certain 75bps in November. But a closer look at the latest dots reveals something curious: while we are fairly confident that the recession will be on deck long before the Fed can hike to 4.6% in early/mid 2023, and in fact just weeks after the midterms we expect the BLS to “unexpectedly” reveal just how ugly the labor market is, a look at the 2022 dots… Read more at: https://www.zerohedge.com/markets/about-median-2022-dot-or-will-fed-really-hike-75bps-one-week-midterms |

|

Tax cut ‘gamble’ will make debt unsustainable, says IFSThe Institute for Fiscal Studies says UK borrowing is on an “unsustainable” path. Read more at: https://www.bbc.co.uk/news/business-62984023?at_medium=RSS&at_campaign=KARANGA |

|

US interest rates hit a 14-year high in inflation battleThe US unveils another sharp rate rise as it fights to bring soaring prices under control. Read more at: https://www.bbc.co.uk/news/business-62973376?at_medium=RSS&at_campaign=KARANGA |

|

Business energy prices to be cut by half expected levelsUK government to cap gas and electricity costs for businesses, charities and public sector from October. Read more at: https://www.bbc.co.uk/news/business-62969427?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty forms small-bodied candle ahead of US Fed outcome; what should investors do on Thursday?“Markets across the globe were trading with considerable volatility ahead of the Fed policy announcement. A 75 bps hike by Fed was factored in by the markets, while reports of mobilizing Russian forces in Ukraine has escalated geopolitical tension and fears of rising inflation,” said Vinod Nair, Head of Research at Geojit Financial Services. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-small-bodied-candle-ahead-of-us-fed-outcome-what-should-investors-do-on-thursday/articleshow/94353732.cms |

|

Nifty Bank: Key levels to watch out for on ThursdayNifty Bank index continued to face resistance at a higher level where 42,000 will act as a hurdle. The index is stuck in a broad range between 40,500-42,000 and a break on either side will decide the trend for the index. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nifty-bank-key-levels-to-watch-out-for-on-thursday/articleshow/94356483.cms |

|

Multibagger Returns! 7 companies with strong sales growth rally over 100% in a yearIt’s always good for investors to invest in a company which is growing or improving over time. Revenue growth rate can help investors identify the catalyst for such growth. Investors should also look at the growth over the several quarters and how consistent it is. Today, we analyse companies which have posted sales growth of over 20 per cent in the last four quarters and have excluded companies that have posted net losses in any of the last four quarters. The stock price performance also matters and hence we considered only companies that have given over 100% return in the last one year. From the BSE 500 list of stocks, seven stocks have met both sales growth and multibagger performance criteria. (Source: ACE Equity) Take a look. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/multibagger-returns-7-companies-with-strong-sales-growth-rally-over-100-in-a-year/strong-financial-performance/articleshow/94345768.cms |

|

Ray Dalio says U.S. more polarized today than during Civil Rights era in the 1960sBridgewater Associates founder Ray Dalio said Wednesday that the U.S. is suffering from the worst political polarization in more than a century. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7127-0B51E3BE42AC%7D&siteid=rss&rss=1 |

|

Bond Report: 2-year Treasury yield touches 4.1%, carves out nearly 15-year high after Fed raises rates by another 75 basis pointsOne- to three-year yields are higher on Wednesday after the Federal Reserve’s policy announcement. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7126-B94F19B4F471%7D&siteid=rss&rss=1 |

|

Brace yourself: The Fed is about to inflict ‘some pain’ with a 75-basis-point rate hike. How to prepare your wallet and your portfolio.This mark’s the Federal Reserve third 75-basis-point rate hike this year. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7126-A6F198FADF02%7D&siteid=rss&rss=1 |