Summary Of the Markets Today:

- The Dow closed down 173 points or 0.56%,

- Nasdaq closed down 1.43%,

- S&P 500 down 1.13%,

- WTI crude oil settled at $85 down 3.77%,

- USD $109.75 weakened 0.06%,

- Gold $1673 down 2.14%,

- Bitcoin $19.844 down 2.00% – Session Low 19,612,

- 10-year U.S. Treasury 3.449% Unchanged,

Today’s Economic Releases:

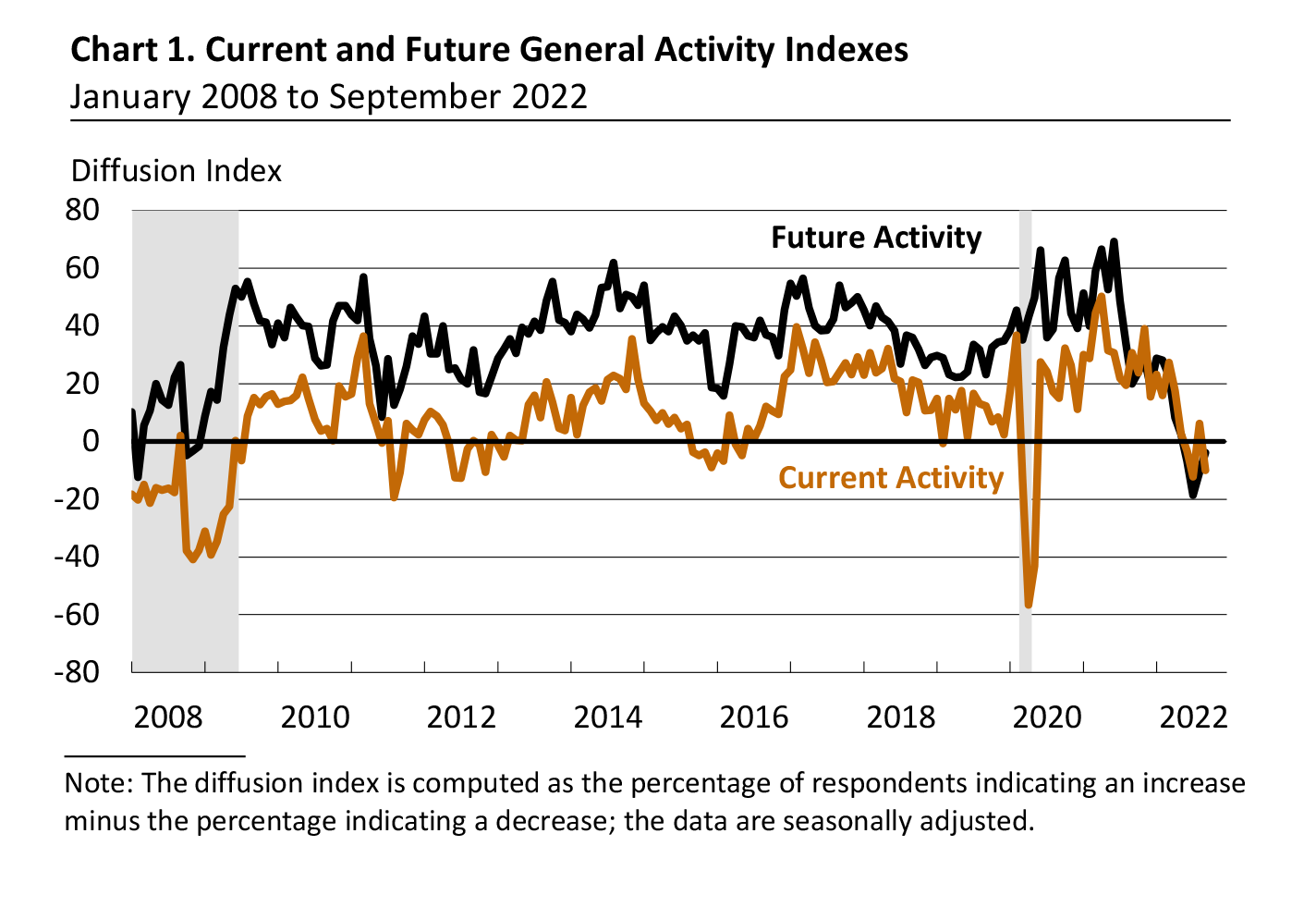

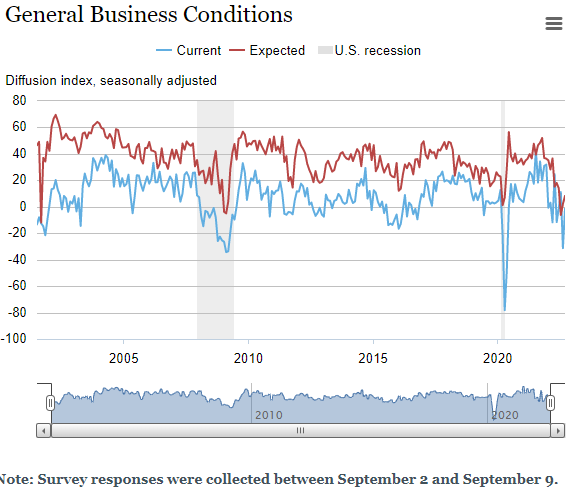

The Philly Fed Manufacturing Index declined in September 2022. The index for returned to negative territory, falling from 6.2 in August to -9.9 this month. The new orders index remained negative, and the shipments index declined but remained positive. This index is showing a weakly growing economy.

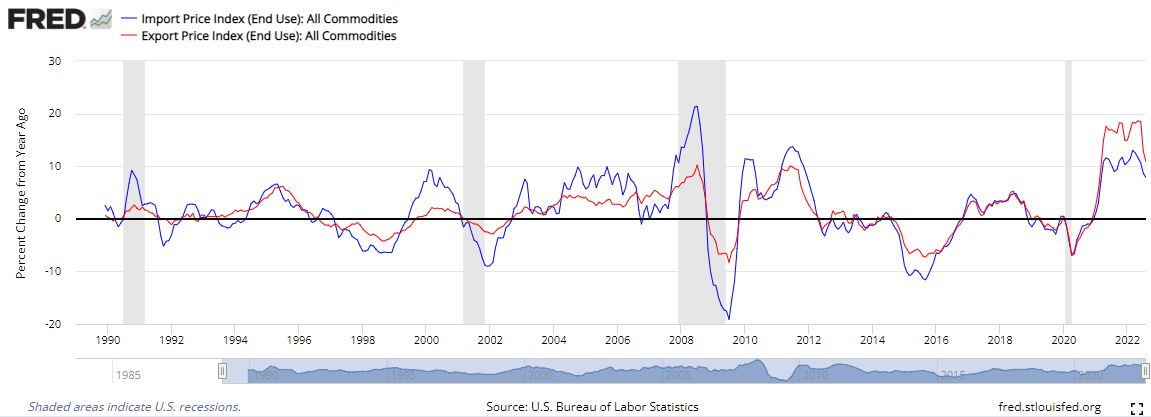

Prices for U.S. imports grew 7.8% year-over-year in August following a 8.7% YoY in July whilst U.S. export prices grew 10.8% in August after growing 12.9% the previous month. The trend of inflation is this sector continues to modestly abate.

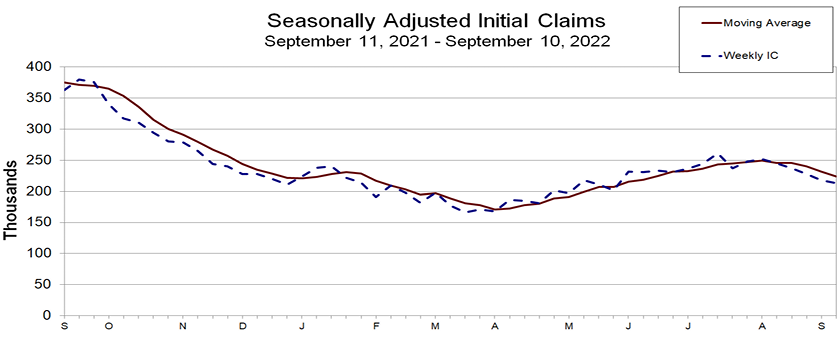

In the week ending September 10, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 224,000, a decrease of 8,000 from the previous week’s revised average. The previous week’s average was revised down by 1,000 from 233,000 to 232,000. New unemployment claims continues to modestly improve which is a sign of an improving economy.

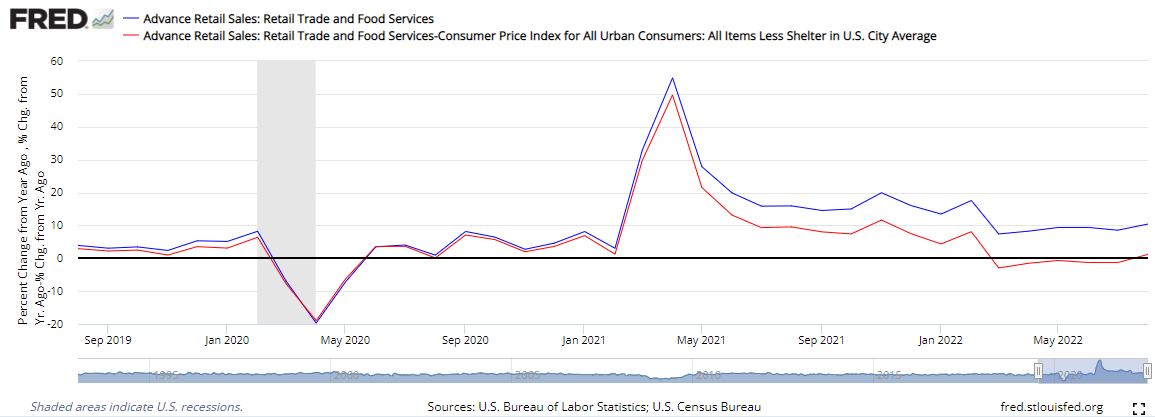

Advance estimates of U.S. retail and food services sales for August 2022, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were 9.1% above August 2021. This is the first month since March 2022 where the inflation-adjusted YoY growth returned to positive territory (1.2% – red line on the graph below). This implies the economy is modestly growing in August.

the September 2022 Empire State Manufacturing Survey index climbed thirty points to -1.5. New orders edged higher, and shipments increased sharply. This index is implying a modest decline in manufacturing.

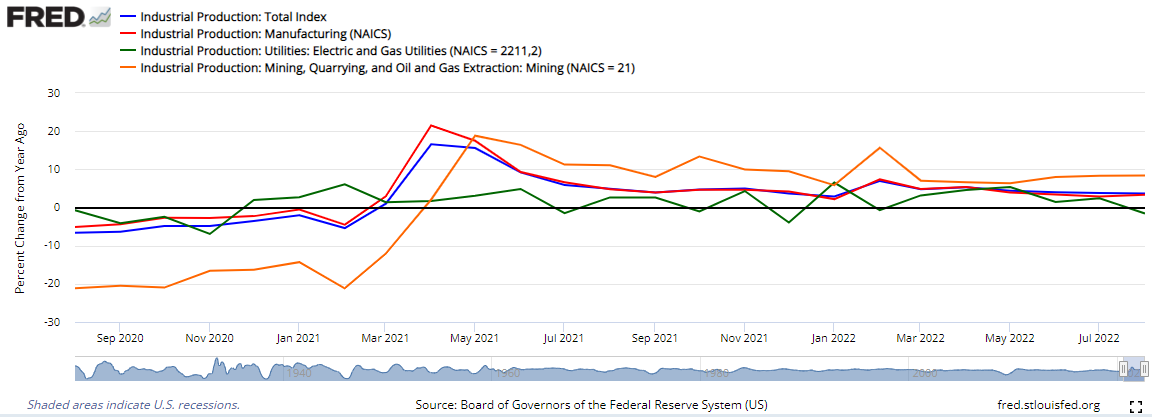

According to the Federal Reserve, industrial production decreased 0.2% in August. However, year-over-year growth has been holding quite steady at 3.7%. In fact, all elements of industrial production remain in positive territory EXCEPT utilities which show a 1.6% YoY contraction. This data set is indicating the economy is expanding at a healthy rate.

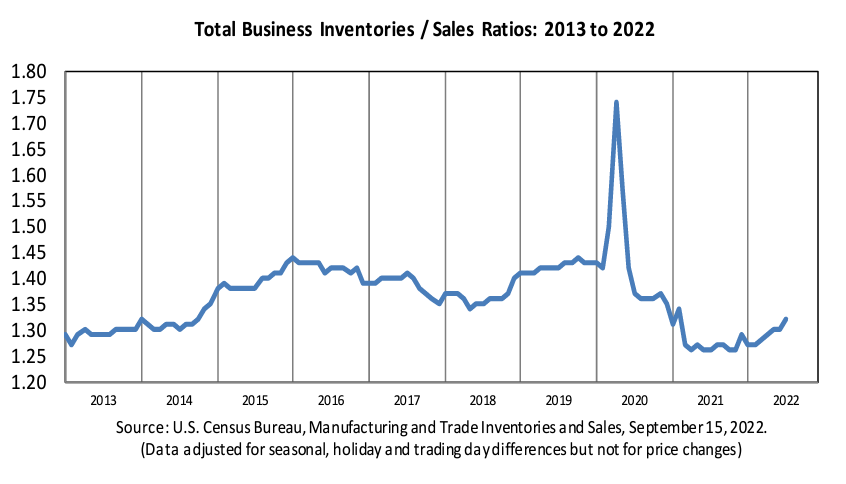

The combined value of distributive trade sales and manufacturers’ shipments for July, adjusted for seasonal and trading day differences but not for price changes, was up 12.5% from July 2021. Inventories Manufacturers’ and trade inventories for July were up 18.4% from July 2021. The key indicator of the health of this sector is the total business inventories/sales ratio which was 1.32. The July 2021 ratio was 1.26. These numbers indicate that inventories are growing with respect to sales – but remain in the range seen in the last 10 years [it could be just the supply chain catching up].

Learn how to spot a price pattern and create a step-by-step trading plan in Elliott Wave International’s course, “The Wave Principle Applied.” This $99 course is FREE for a limited time. Start learning now — Free.

- Germanys Tesla Plant Is Facing Yet Another Hurdle

- U.S. Natural Gas Prices Plummet On Rail Deal, Storage Build

- Railroads and labor unions reach tentative deal to avert strike

- Frontier Airlines recently held talks with SpaceX about adding Starlink Wi-Fi

- Greenpeace Intensifies Campaign Against Bitcoin Following Ethereum’s Merge

- Greenpeace Intensifies Campaign Against Bitcoin Following Ethereum’s Merge

- US mortgage rates hit 14-year high as inflation soars

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

The Oil Market Isn’t Broken, It’s Just Responding To A Supply SurplusAs oil prices continue to plunge, with the latest selloff triggered by a surprise crude build and another release from the Strategic Petroleum Reserve, commodity analysts at Standard Chartered say the oil market is not fundamentally broken but is rather merely responding to a surplus. In its latest commodities market update on Thursday, StanChart says that the global oil market is currently in excess supply, with the U.S. transferring an average of 0.83 million barrels per day (mb/d) into commercial inventories in the third quarter. StanChart Read more at: https://oilprice.com/Energy/Oil-Prices/The-Oil-Market-Isnt-Broken-Its-Just-Responding-To-A-Supply-Surplus.html |

|

Here’s Why Toyota Isn’t Going All-In On Electric VehiclesWhile many automakers have committed billions of dollars in recent years to develop all-electric vehicles, Toyota has approached the technology with far more caution – opting instead to continue investing in a portfolio of hybrid “electrified” vehicles, such as the Prius. And while the Japanese automaker was a darling of US environmentalists and ‘eco-conscious’ consumers when the Prius came out two decades ago, given that it was among the cleanest and most fuel-efficient vehicles ever produced – Toyota has fallen out of favor with the ‘green’ crowd Read more at: https://oilprice.com/Energy/Energy-General/Heres-Why-Toyota-Isnt-Going-All-In-On-Electric-Vehicles.html |

|

Could Nuclear Power Help Poland Kick Coal?3.8 million people in Poland depend on coal to keep their homes heated through harsh northern winters. Last month when the European Union slapped sanctions on Russian coal, Poles flocked to local coal mines, queueing for days in the late August heat and sleeping in their cars in hopes of securing enough coal to make it through the winter. While Poland is the third biggest coal-producing nation in Europe (after Germany and Russia), the nation has grown increasingly reliant on cheap Russian coal imports in recent years, rendering them vulnerable Read more at: https://oilprice.com/Energy/Coal/Could-Nuclear-Power-Help-Poland-Kick-Coal.html |

|

Germany’s Tesla Plant Is Facing Yet Another HurdleA vote on the expansion of Tesla’s German factory in Grnheide has been delayed, according to reports from German Media. A planned discussion about the plants development that was planned for a September council meeting will no longer take place, according to translated versions of the report, which cites the mayor of Grnheide, Arne Christiani. Tesla is seeking to expand its 300-hectare factory by another 100 hectares, the report notes, in order to build a freight depot and expand production capabilities. Christiani Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germanys-Tesla-Plant-Is-Facing-Yet-Another-Hurdle.html |

|

U.S. Natural Gas Prices Plummet On Rail Deal, Storage BuildU.S. natural gas futures fell 8% on Thursday as the rail union reached a temporary labor agreement with its workers. Henry Hub natural gas futures (NGV2) fell $0.728 MBtu (-7.99%) to $8.397 on the railway deal, without which would have increased the demand for natural gas in an already tight market. A rail industry disruption would have disrupted the flow of coal. A larger than anticipated storage build for natural gas also weighed on prices, which were trading near record highs due to the tight market. On Thursday, the Energy Information Administrations Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Natural-Gas-Prices-Plummet-On-Rail-Deal-Storage-Build.html |

|

European Oil Giant Warns Windfall Tax Could BackfireThe chief executive of Austrian multinational integrated oil, gas, and petrochemical company OMV (OTCPK: OMVJF) Alfred Stern has warned that the EU’s planned windfall levy could have a huge impact, and criticized basing the proposal on profits over the last three years, pointing out that they were not normal times. “We will keep an eye on that, as it can already have a massive impact,” Stern has told journalists. However, Stern says its difficult to assess the exact impact of the levy considering that specifics of the proposal have not yet Read more at: https://oilprice.com/Energy/Crude-Oil/European-Oil-Giant-Warns-Windfall-Tax-Could-Backfire.html |

|

Star Wars spinoff ‘Rogue Squadron’ is officially off calendar as Disney shores up film slateOn Thursday, Disney officially removed “Rogue Squadron” from its film calendar. Read more at: https://www.cnbc.com/2022/09/15/star-wars-spinoff-rogue-squadron-off-calendar-as-disney-shores-up-film-slate.html |

|

Bed Bath & Beyond is closing about 150 stores. Here’s a map of ones on the list so farThe struggling retailer announced the closures as part of a plan to stabilize its finances. Read more at: https://www.cnbc.com/2022/09/15/bed-bath-beyond-closing-150-stores-map-of-ones-on-the-list-so-far.html |

|

Railroads and labor unions reach tentative deal to avert strikeThe last-minute railroad labor deal avoids massive disruptions to the flow of key goods and commodities around the country. Read more at: https://www.cnbc.com/2022/09/15/president-joe-biden-says-tentative-railway-labor-agreement-reached.html |

|

Walmart unveils virtual fitting room to push shoppers to buy more clothesWalmart is launching the tool as some shoppers trim back purchases of discretionary purchases like clothing. Read more at: https://www.cnbc.com/2022/09/15/walmart-unveils-virtual-fitting-room-to-push-shoppers-to-buy-more-clothes.html |

|

Disney CEO Bob Chapek says he’d like to own all of Hulu ‘tomorrow’ but says chances of an early deal are slimDisney CEO Bob Chapek said he’d love to own Comcast’s 33% stake in Hulu “tomorrow” but acknowledged the chances of an early deal are “less and less.” Read more at: https://www.cnbc.com/2022/09/15/disney-ceo-bob-chapek-wants-to-own-all-of-hulu-says-chances-of-early-deal-are-slim.html |

|

Danaher’s decision to spin off its water business is a win-win for long-term investorsThe medical diagnostics and health tech firm has a great track record for creating shareholder value through organic investments and mergers and divestitures. Read more at: https://www.cnbc.com/2022/09/15/danahers-decision-to-spin-off-water-unit-a-win-win-for-long-term-investors.html |

|

Here’s how we’re positioned in four sectors and some of the stocks we like in eachCNBC’s Jim Cramer gave investors advice on how to build a strong portfolio during the Federal Reserve’s struggle to reduce inflation. Read more at: https://www.cnbc.com/2022/09/15/heres-how-were-positioned-in-four-sectors-and-some-of-the-stocks-we-like-in-each.html |

|

Biden pushed railways, unions to ‘be creative’ and ‘flexible’ to reach a deal and avoid a shutdown, White House saysPresident Joe Biden urged railway executives and union leaders to be creative and flexible in finding a compromise to avoid a shutdown. Read more at: https://www.cnbc.com/2022/09/15/biden-pushed-railways-unions-to-be-creative-white-house-says.html |

|

Frontier Airlines recently held talks with SpaceX about adding Starlink Wi-FiFrontier Airlines “recently” held discussions with SpaceX about adding its Starlink satellite internet to its planes. Read more at: https://www.cnbc.com/2022/09/15/frontier-airlines-recently-held-talks-with-spacex-about-adding-starlink-wi-fi.html |

|

Kanye West’s Yeezy says it’s terminating deal with Gap: ‘A king can’t live in someone else’s castle’Kanye West, who goes by Ye, said in a letter to Gap that he is terminating the contract between his company Yeezy and the retailer. Read more at: https://www.cnbc.com/2022/09/15/kanye-west-ye-yeezy-terminates-deal-with-gap-over-alleged-contract-violations.html |

|

Roger Federer, Swiss tennis great, announces he’s leaving the sportTennis legend Roger Federer is retiring from the sport after a 24-year career. The Swiss player made the announcement on Thursday in a letter posted to Twitter. Read more at: https://www.cnbc.com/2022/09/15/roger-federer-swiss-tennis-great-announces-hes-leaving-the-sport.html |

|

Video platform Rumble to go public after successful SPAC voteShareholders of Cantor Fitzgerald Acquisition Corp. VI, a special purpose acquisition company, voted Thursday to take Rumble public. Read more at: https://www.cnbc.com/2022/09/15/video-platform-rumble-to-go-public-after-successful-spac-vote.html |

|

Disney CEO Bob Chapek says ESPN will never take betsDisney Chief Executive Bob Chapek said Thursday that the company’s sports network ESPN is looking for a partner to help it step into sports gambling. Read more at: https://www.cnbc.com/2022/09/15/disney-ceo-bob-chapek-says-espn-will-never-take-bets-.html |

|

Greenpeace Intensifies Campaign Against Bitcoin Following Ethereum’s MergeAuthored by Shawn Amick via BitcoinMagazine.com, In addition to a $1 million ad budget, climate groups want to influence institutions such as Fidelity and BlackRock to push Bitcoin to switch from PoW to PoS. Greenpeace and the Environmental Working Group have launched a $1 million smear campaign against Bitcoin following Ethereum’s Merge to PoS. The campaign has a petition urging Fidelity, BlackRock, and others to move Bitcoin away from PoW. Opponents of Bitcoin need to understand how it actually works. Greenpeace and the Environmental Working Group have intensified their attack against Bitcoin’s proof-of-work (PoW) with a $1 million ad campaign, per a press release.

Read more at: https://www.zerohedge.com/crypto/greenpeace-intensifies-campaign-against-bitcoin-following-ethereums-merge |

|

The “Economy Is Braking Hard” – Billionaire Investor Warns Aggressive Fed Is Causing “Cracks Everywhere”“Echoing Jim Cramer’s infamous 2007 “they know nothing” rant, a far more calm and eloquent Barry Sternlicht, Chairman and CEO of Starwood Capital, warned the co-anchors on CNBC this morning that if the Fed doesn’t pump the brakes on its rate hikes, the US economy is facing a serious downturn.

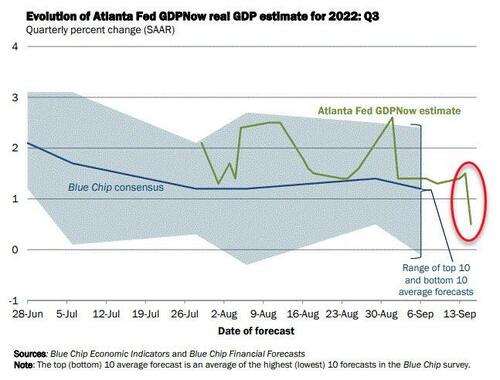

He was proved right very quickly as The Atlanta Fed cut its GDP forecast for Q3 to just +0.5%…

The billionaire investor … Read more at: https://www.zerohedge.com/markets/economy-braking-hard-bilionaire-investor-warns-aggressive-fed-causing-cracks-everywhere |

|

Taiwan Hosts Dozens Of Foreign Lawmakers In D.C. To Lobby For China SanctionsAuthored by Dave DeCamp via AntiWar.com, Taiwan’s de facto ambassador to the US hosted dozens of foreign lawmakers in Washington DC to push for more sanctions on China, Reuters reported this week. The Taiwanese official, Hsiao Bi-khim, hosted the gathering of about 60 lawmakers from Europe, Asia, and Africa at Taipei’s diplomatic mansion in Washington, known as Twin Oaks.

Read more at: https://www.zerohedge.com/geopolitical/taiwan-hosts-dozens-foreign-lawmakers-dc-lobby-china-sanctions |

|

Are CTAs Buying Or Selling Here? The Latest SummaryAfter getting stopped out on their short one week ago, then watching stocks meltdown just as they got long this week, CTA heads are spinning – or would, if the algos that run momentum-chasing CTA programs had heads – and leaving other investors to ask if they are buying or selling here. Courtesy of Goldman’s John Flood, here is an update on the latest CTA positioning after Tuesday’s drawdown: This community is now short -$50bn in global equities (-$17.5bn S&P / -$3.5bn NDX / -$4bn R2K) With S&P closing @ 3932 on Tursday night, all 3 Momentum Thresholds flipped from positive to negative territory: ST 4052 / MT 4127 / LT 4091 (i.e., from long back to short) . The one-line summary is “this community is still a buyer of equities in most scenarios but MUCH smaller post yesterday (massive 1 day swing).” For direct comparison purposes today’s refreshed CTA estimates in bold and the pre-CPI crash data in italics: Over next 1 week… flat tape: $11.8b of global equities to buy (-$1.3b S&P for sale) flat tape: $44b of global equities to buy ($13b S&P) Up 2 SD tape: $40b of global equities to buy ($3b S&P) Up 2 SD tape: $66b of global equities to buy ($20b S&P) D … Read more at: https://www.zerohedge.com/markets/are-ctas-buying-or-selling-here-latest-summary |

|

Supermarket petrol stations to close for Queen’s funeralTesco, Sainsbury’s, Asda, and Morrisons will shut forecourts before some reopen in the evening. Read more at: https://www.bbc.co.uk/news/business-62916831?at_medium=RSS&at_campaign=KARANGA |

|

Queen’s funeral: Heathrow cancels flights on MondayThe UK’s biggest airport said it is altering its schedule to ensure the skies over London fall quiet during the proceedings. Read more at: https://www.bbc.co.uk/news/business-62916830?at_medium=RSS&at_campaign=KARANGA |

|

US mortgage rates hit 14-year high as inflation soarsFor families hoping to buy a home, the moves compound affordability problems. Read more at: https://www.bbc.co.uk/news/business-62918085?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty50 forms a bearish candle; what should investors do on Friday?“The Nifty50 index failed to hold above the previous day’s high and slowly drifted down towards 17,860 zones. It formed a Bearish candle on a daily scale and closed near its day’s low,” Chandan Taparia, Vice President and Analyst-Derivatives at Motilal Oswal Financial Services Limited, said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-forms-a-bearish-candle-what-should-investors-do-on-friday/articleshow/94225322.cms |

|

Merger Mania: Crypto community goes gaga after Ethereum completes the ‘Merge’Ethereum developers say the upgrade will make the network – which houses a $60 billion ecosystem of crypto exchanges, lending companies, non-fungible token (NFT) marketplaces and other apps – more secure and scalable. Read more at: https://economictimes.indiatimes.com/markets/cryptocurrency/crypto-community-goes-gaga-after-ethereum-completes-the-merge/articleshow/94227377.cms |

|

Nifty Bank: Key levels to watch out for on FridayThe banking barometer plunged sharply on Thursday, about 631 points from its new peak of 41,840.15 but did not breach the 41,000-mark. For the day, the bank index closed at 41,209.20, dropping 196.2 points or 0.47 percent from its previous close. Here’s how analysts read the Nifty Bank pulse. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nifty-bank-key-levels-to-watch-out-for-on-friday/articleshow/94224656.cms |

|

The Moneyist: My son asked me to set up a 529 plan for my 5-year-old granddaughter. But she says, ‘Who’s nana?’ Should I set up a college trust fund for a child who does not even know who I am?‘I have ducked and waffled on my answer.’ Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-711E-4A2C9939E361%7D&siteid=rss&rss=1 |

|

Distributed Ledger: The Ethereum Merge is completed. What’s next? Here are three things you should watchA weekly look at the most important moves and news in crypto and what’s on the horizon in digital assets. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7123-475349117E5F%7D&siteid=rss&rss=1 |

|

ETF Wrap: This interest rate hedge ETF has soared 60% this year as stocks, bonds sink in market carnageThis week’s ETF Wrap looks at an interest rate hedge ETF that is producing massive gains amid the carnage of 2022, along with other funds that investors might consider amid concerns over elevated inflation and “roller coaster” markets. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7123-15EC5C347A83%7D&siteid=rss&rss=1 |

17-acre estate of Twin Oaks, via Wiki CommonsThe meeting was attended by two representatives from Ukraine, who were welcomed by Hsiao. “We certainly hope that as the international community stands with Ukraine, that the international commu …

17-acre estate of Twin Oaks, via Wiki CommonsThe meeting was attended by two representatives from Ukraine, who were welcomed by Hsiao. “We certainly hope that as the international community stands with Ukraine, that the international commu …