Summary Of the Markets Today:

- The Dow closed up 60 points or 0.18%,

- Nasdaq closed up 0.41%,

- S&P 500 up 0.29%,

- WTI crude oil settled at $95 up 9.39% for the week,

- USD $108.65 up 0.13%,

- Gold $1765 up 0.24%,

- Bitcoin $21,695 up 0.72% – Session Low 21,172,

- 10-year U.S. Treasury 3.111% unchanged

Today’s Economic Releases:

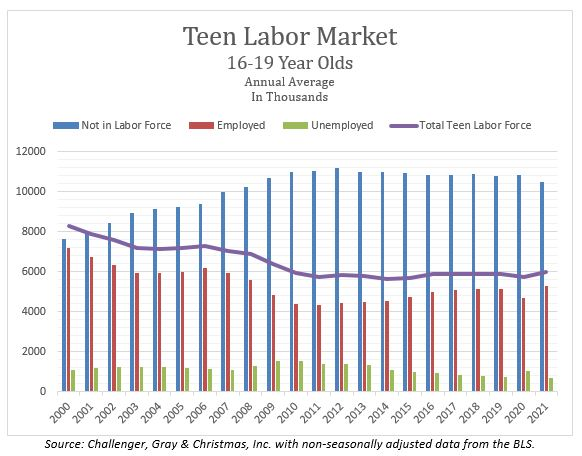

The fact that fewer jobs were added for this cohort this summer than the previous summer indicates establishments that employ teen workers either had enough staff going into the summer or were planning for a downturn that would stifle demand, opting not to add positions.

A summary of headlines we are reading today:

- U.S. Diesel Prices Climb For First Time In Two Months

- North Sea Gas Production Increases 26%

- Pending home sales slip 1% in July, but Realtors say the market may be ‘at or close to the bottom’

- Nordstrom cuts full-year forecast, citing slowing customer demand

- How Starlink Changes Bitcoin Mining And Improves Decentralization

- California to unveil rules to ban sales of gas-powered new vehicles by 2035

- Bond Report: Treasury yields climb to highest since June after hawkish remarks by Fed’s Kashkari

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Can Booming LNG Exports Rescue Egypt’s Economy?Egypt’s financial future and stability could be in jeopardy if the country fails to secure a loan from the International Monetary Fund (IMF) very soon. At present, Cairo’s financial reserves are being depleted very rapidly, even while the country’s oil and gas sector is booming as a result of high oil and natural gas prices. The europes energy crisis, the continuation of the Russian invasion of Ukraine, and global shortages of natural gas and other energy commodities have pushed hydrocarbon revenues in Egypt to record Read more at: https://oilprice.com/Energy/Natural-Gas/Can-Booming-LNG-Exports-Rescue-Egypts-Economy.html |

|

U.S. Diesel Prices Climb For First Time In Two MonthsAfter an impressive run that saw U.S. diesel prices fall for 62 consecutive days, diesel prices at the pump rose overnight on Tuesday, snapping the longest losing streak in two years thanks to farmers stockpiling fuel for use during the harvest season. U.S. national average diesel prices have climbed to $4.977 per gallon, marking the first time they have done so since peaking at $5.816 in mid-June according to AAA data. However, the latest turnaround in pump prices comes as little surprise considering that diesel futures contracts have jumped more Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Diesel-Prices-Climb-For-First-Time-In-Two-Months.html |

|

North Sea Gas Production Increases 26%The UK’s North Sea produced 26 percent more natural gas in the first half of this year than it did this time last year as the UK tries to wean itself off of Russian natural gas. The UK Office for National Statistics (ONS) showed that the UK produced 3.5 billion cubic meters more gas in H1, with much of the increase attributed to new gas fields in the North Sea (Harbours Tolmount and IOGs Saturn Banks), and fewer shutdowns due to planned maintenance. The decrease in shutdown activity was made possible in part by the flurry of Read more at: https://oilprice.com/Latest-Energy-News/World-News/North-Sea-Gas-Production-Increases-26.html |

|

Mozambique Eyes $100 Billion LNG Windfall As It Prepares To Ship Its First CargoFor years, Mozambique, the world’s 3rd poorest nation, has been eagerly looking forward to reaping the windfall from the discovery of mammoth natural gas reserves off its west coast nearly a decade ago. Last year, experts estimated that the southeast African nation could generate $12bn annually by exporting 30 million tons from its three existing LNG projects by European energy giants. Mind you, back then, LNG prices were hovering around $8.50 per million British thermal units, a fraction of the current $29.35 per million British thermal Read more at: https://oilprice.com/Energy/Natural-Gas/Mozambique-Eyes-100-Billion-LNG-Windfall-As-It-Prepares-To-Ship-Its-First-Cargo.html |

|

UK Records Zero Fuel Imports From Russia For First Time EverThe UK did not import any fuels from Russia in June, for the first time since records began, the UK Office for National Statistics (ONS) said on Wednesday, meaning that Britain managed to phase out oil and gas purchases from Russia as it had pledged in the early days of the Russian invasion of Ukraine six months ago. Days after Vladimir Putin ordered the invasion of Ukraine, the UK said that it would phase out Russian oil imports by the end of this year and that Russian gas accounts for less than 4 percent of Britain’s supply. Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Records-Zero-Fuel-Imports-From-Russia-For-First-Time-Ever.html |

|

Belgium PM: Next 5-10 Winters Will Be Difficult As Energy Crisis PersistsBelgian Prime Minister Alexander De Croo might have spilled the beans about the duration of Europe’s energy crisis. He told reporters Monday, “the next 5 to 10 winters will be difficult.” “The development of the situation is very difficult throughout Europe,” De Croo told Belgium broadcaster VRT. “In a number of sectors, it is really difficult to deal with those high energy prices. We are monitoring this closely, but we must be transparent: the coming months will be difficult, the coming winters will be difficult,” he said. The Read more at: https://oilprice.com/Energy/Energy-General/Belgium-PM-Next-5-10-Winters-Will-Be-Difficult-As-Energy-Crisis-Persists.html |

|

PGA Tour bolsters prizes, benefits as it competes with LIV Golf for player loyaltyThe PGA Tour announced increased prizes, new player benefits, and player commitments. Read more at: https://www.cnbc.com/2022/08/24/pga-tour-bolsters-prizes-in-competition-for-loyalty-with-liv-golf-.html |

|

Pending home sales slip 1% in July, but Realtors say the market may be ‘at or close to the bottom’Pending home sales, a measure of signed contracts on existing homes, dropped 1% from June to July, according to the National Association of Realtors. Read more at: https://www.cnbc.com/2022/08/24/pending-home-sales-drop-1percent-in-july.html |

|

Peloton strikes a deal to sell fitness equipment and apparel on AmazonPeloton is working with Amazon in a bid to broaden its customer base and sell more products in the United States. Read more at: https://www.cnbc.com/2022/08/24/peloton-to-sell-fitness-equipment-apparel-on-amazon.html |

|

Home prices fell for the first time in 3 years last month – and it was the biggest decline since 2011The sharp and fast rise in mortgage rates this year caused an already pricey housing market to become even less affordable. Read more at: https://www.cnbc.com/2022/08/24/home-prices-fall-for-the-first-time-in-three-years-biggest-drop-since-2011.html |

|

First-time buyers show more demand for mortgages, even as interest rates riseMortgage demand from first-time buyers rose despite a sharp increase in mortgage interest rates. Read more at: https://www.cnbc.com/2022/08/24/mortgage-demand-from-first-time-buyers-makes-a-comeback.html |

|

We’re starting a new position in a stock that will benefit from retail’s inventory glutExcess inventory has been a common theme throughout earning season. Read more at: https://www.cnbc.com/2022/08/24/investing-club-were-starting-a-new-position-in-a-stock-that-will-benefit-from-retails-inventory-glut.html |

|

3 takeaways from the Investing Club’s ‘Morning Meeting’ on WednesdayThis off-price retailer is firmly on Jim Cramer’s radar. He’s also paying close attention to where the 10-year Treasury yield goes from here. Read more at: https://www.cnbc.com/2022/08/24/3-takeaways-from-the-investing-clubs-morning-meeting-on-wednesday.html |

|

3 things Gap needs to fix to turn its struggling business aroundIn July, Gap CEO Sonia Syngal abruptly stepped down from her post. The company has yet to name her permanent replacement. Read more at: https://www.cnbc.com/2022/08/24/3-things-gap-needs-to-fix-to-turn-its-struggling-business-around.html |

|

Vacation rental company Vacasa picks protege of Uber CEO to be next chief executiveVacasa picked Rob Greyber, who led Expedia’s Egencia division from 2009 to 2020, to succeed current Chief Executive Matt Roberts. Read more at: https://www.cnbc.com/2022/08/24/vacasa-picks-rob-greyber-protege-of-uber-ceo-to-be-next-chief-executive.html |

|

Nordstrom cuts full-year forecast, citing slowing customer demandNordstrom slashed its financial forecast for the full year as the department store chain faces slowing sales and a glut of inventory. Read more at: https://www.cnbc.com/2022/08/23/nordstrom-jwn-reports-q2-2022-results.html |

|

Apartment rents are finally easing after an incredible run. Here’s how to play itRent growth for apartments looks to have peaked after a tremendous run in 2021, and that could boost some real estate stocks. Read more at: https://www.cnbc.com/2022/08/23/apartment-rents-are-finally-easing-after-an-incredible-run-heres-how-to-play-it.html |

|

5 things to know before the stock market opens WednesdayHere are the most important news items that investors need to start their trading day. Read more at: https://www.cnbc.com/2022/08/24/5-things-to-know-before-the-stock-market-opens-wednesday-august-24.html |

|

Japan just signaled a big shift in its post-Fukushima futureJapan is targeting carbon neutrality by the year 2050. Read more at: https://www.cnbc.com/2022/08/24/japan-just-signaled-a-big-shift-in-its-post-fukushima-future.html |

|

Peter Schiff: Somebody Has To Pay For Student Loan ForgivenessVia SchiffGold.com, President Biden is expected to announce student loan forgiveness on Wednesday (Aug. 24). The plan will reportedly cancel $10,000 in student loan debt for anybody making less than $125,000 per year.

A lot of people think this is like waving a magic wand — poof — the debt is gone. But somebody has to pay and that somebody is the American taxpayer. Nothing the government does is free. Ultimately, student loan debt forgiveness will add to the already massive budget deficit. That means Uncle Sam will have to borrow more money that taxpayers will have to repay, either in higher taxes or inflation … Read more at: https://www.zerohedge.com/personal-finance/peter-schiff-somebody-has-pay-student-loan-forgiveness |

|

Watch Live: Biden To Announce Student Loan Relief Which Will Mostly Benefit Top EarnersPresident Biden on Wednesday is expected to announce the cancellation of up to $10,000 in student debt for millions of American borrowers who earn less than $125,000 per year, and $20,000 in debt for Pell grant recipients, according to Bloomberg, citing people familiar with the matter. The administration will also pause student loan payments for four more months through Dec. 31, with sources indicating that it would be the “final pause” backed by Biden (the 7th since the Covid-19 pandemic began in March 2020) – just in time for midterms.

Read more at: https://www.zerohedge.com/political/watch-live-biden-announces-10000-student-loan-relief |

|

Biden Orders Airstrikes On ‘Iran-Backed’ Groups In SyriaThe Pentagon has confirmed that President Biden ordered airstrikes on Iran-backed groups in Syria on Tuesday, following a series of reported attacks on a remote US base in eastern Syria and which appeared to also target ground allies being trained by American special forces. “At President Biden’s direction, US military forces conducted precision airstrikes in Deir ez-Zor Syria today. These precision strikes are intended to defend and protect US forces from attacks like the ones on August 15 against US personnel by Iran-backed groups,” a CENTCOM statement said. Read more at: https://www.zerohedge.com/geopolitical/biden-orders-airstrikes-iran-backed-groups-syria |

|

How Starlink Changes Bitcoin Mining And Improves DecentralizationAuthored by ‘El Sultan Bitcoin’ via BitcoinMagazine.com, Starlink may be the missing piece for mining decentralization to reach the far ends of the Earth where energy is cheap but internet access is lacking…

HOW MINING DECENTRALIZATION CAN BE INCENTIVIZEDOver a year has elapsed since the great bitcoin mining migration began, when the network experienced a 60%-plus reduction in hash rate due to the Chinese Communist Party’s attack on bitcoin mining. The aftermath of China’s mining ban equated to the United States absorbing a greater part of the hash power that used to be located in mainland China. Hash rate recovered and reached all-time highs again. No questions arise regarding Bitcoin’s resilience here. However, one may ask how network and mining decentralization can be fostered to limit the impact of similar att … Read more at: https://www.zerohedge.com/crypto/how-starlink-changes-bitcoin-mining-and-improves-decentralization |

|

Germany approves energy-saving measures for winterThe measures include turning down heating in public buildings as Germany tries to wean itself of Russian gas. Read more at: https://www.bbc.co.uk/news/business-62659247?at_medium=RSS&at_campaign=KARANGA |

|

Ukraine war: UK imports no fuel from Russia for first time on recordImports of goods from Russia fell to £33m in June, the lowest level since 1997, official figures show. Read more at: https://www.bbc.co.uk/news/business-62659391?at_medium=RSS&at_campaign=KARANGA |

|

Train commuter rewards scheme to end this monthAn industry rewards scheme to revive train passenger numbers after the pandemic will stop next month. Read more at: https://www.bbc.co.uk/news/business-62659246?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty50 may stay rangebound; 17,350 to offer supportA small positive candle that is placed beside the long positive candle of the previous session indicates a range-bound movement in the market after a pullback rally. This also reflects a lack of selling interest in the last couple of sessions after a sharp reversal on the downside on August 19 and August 22, said Nagaraj Shetti, Technical Research Analyst, HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-may-stay-rangebound-17350-to-offer-support/articleshow/93757237.cms |

|

After 20% rise in a month, this Kacholia stock can rally up to 55%! Here’s whyThe company is planning to expand its capacity and is likely to gain incremental market share. Furthermore, the company’s likely expansion into Borosilicate glass provides a further avenue of growth. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/after-20-rise-in-a-month-this-kacholia-stock-can-rally-up-to-55-heres-why/articleshow/93749796.cms |

|

GRMs of OMCs to decline from the highs of Q1: Fitch RatingsFitch also expects OMCs to incur large marketing losses in FY23 with continuing negative marketing margins as we expect crude oil prices to remain elevated until geopolitical tensions ease while rising inflationary pressure would prevent the OMCs from increasing fuel prices in the near term. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/grms-of-omcs-to-decline-from-the-highs-of-q1-fitch-ratings/articleshow/93750519.cms |

|

California to unveil rules to ban sales of gas-powered new vehicles by 2035California is expected to unveil its plan to ban sales of new gasoline-powered vehicles by 2035, the New York Times reported Wednesday, saying that the new rules would come as early as Thursday. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7115-70865A451BEF%7D&siteid=rss&rss=1 |

|

Bond Report: Treasury yields climb to highest since June after hawkish remarks by Fed’s KashkariTwo, 10- and 30-year Treasury yields advance to two-month highs on Wednesday, as investors digest comments from regional central-bank official Neel Kashkari. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7115-0CE3EC7A1EED%7D&siteid=rss&rss=1 |

|

The Ratings Game: Verizon’s dividend yield at ‘by far’ its highest level in a decade, and a hike could be imminentThe pullback in Verizon Communications Inc.’s stock this year has brought its dividend yield to “by far” its highest level in 10 years at 5.8%, and Morgan Stanley analyst Simon Flannery expects that the company will increase its dividend payout shortly. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7115-4A67A762085D%7D&siteid=rss&rss=1 |