Summary Of the Markets Today:

- The Dow closed down 641 points or 1.90%,

- Nasdaq closed down 2.55%,

- S&P 500 down 2.13%,

- WTI crude oil settled at 91 down 0.11%,

- USD $108.94 up 0.77%,

- Gold $1748 down 0.82%,

- Bitcoin $21,032 down 2.17% – Session Low 20,938,

- 10-year U.S. Treasury 3.029 up 0.73

Today’s Economic Releases:

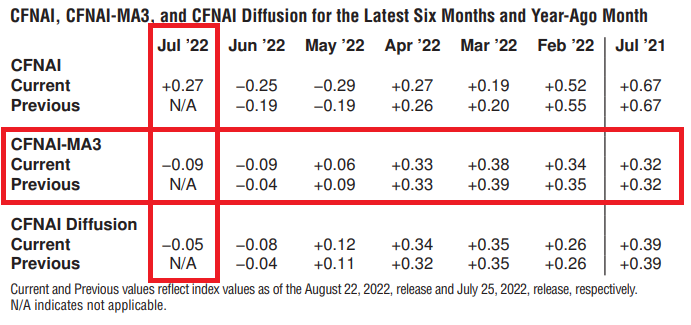

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.27 in July 2022 from –0.25 in June. All four broad categories of indicators used to construct the index made positive contributions in July, and all four categories improved from June. The index’s three-month moving average, CFNAI-MA3, was unchanged at –0.09 in July. Economic forecasting uses the three month average – and this would mean that the economy is expanding slightly below its historical trend (average) rate of growth. The CFNAI is the best coincident indicator of the economy – and it makes sense that this indicator views the economy as slightly soft.

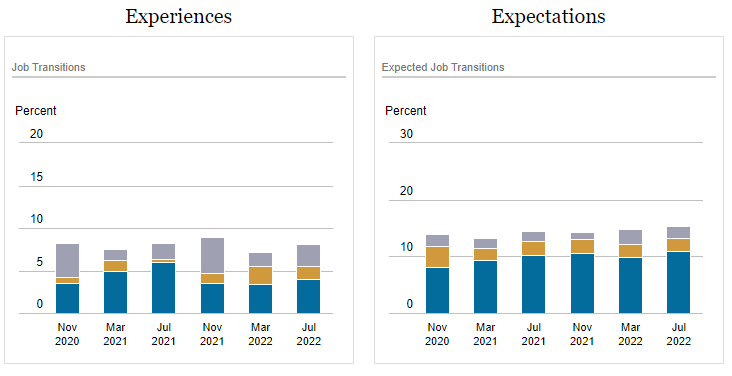

The Federal Reserve Bank of New York’s Center for Microeconomic Data today released the July 2022 SCE Labor Market Survey, which shows a decline in transitions to a different employer, compared to a year ago. Satisfaction with wage compensation at respondents’ current jobs deteriorated, while satisfaction with nonwage benefits and promotion opportunities improved. Regarding expectations, the average expected likelihood of receiving an offer in the next four months declined. The average expected wage offer (conditional on receiving one), as well as the average reservation wage — the lowest wage at which respondents would be willing to accept a new job — increased year-over-year. Expectations regarding job transitions improved.

August 22-29 Elliott Wave International invites you to join their Trader Education Week — a free chance to learn a ton, and very quickly — from just 5 video lessons. They do not want your credit card info. The Week is brought to you by their Trader’s Classroom, a video mentoring service for traders seeking to improve. Your 5 lessons come straight from the editor Jeffrey Kennedy, one of the world’s top technical analysts.

A summary of headlines we are reading today:

- Europe Splurges on Russian Oil As EU Ban Nears

- Chinese Banks Slash Key Interest Rate In Bid To Bolster Stalling Economy

- Ford to eliminate 3,000 jobs in an effort to cut costs

- Single-stock ETFs are ‘way too risky for 99% of investors,’ an advisor says. What to know before adding one to your portfolio

- Nomura Warns “Fed’s Hands Are Tied” For Now As USDollar “Wrecking Ball” Tightens Global Financial Conditions

- Futures Movers: Natural-gas prices surge to their highest level since 2008; oil slips

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Saudi Arabia Is Planning To Build The Worlds Largest Wind Farm In UzbekistanUzbekistan’s president has returned from a trip to Saudi Arabia with $14 billion in promised investments, his office says. Of that, $12 billion is earmarked to address chronic energy shortages. The agreements include a pledge for Saudi firm ACWA Power to build a 1.5 GW wind farm in Karakalpakstan. Uzbekistan’s Energy Ministry says it will be the world’s largest and will power 1.65 million homes. ACWA Power has already begun building two smaller wind farms in the Bukhara region. This is welcome news to Uzbeks still sweating their Read more at: https://oilprice.com/Energy/Energy-General/Saudi-Arabia-Is-Planning-To-Build-The-Worlds-Largest-Wind-Farm-In-Uzbekistan.html |

|

Europe Splurges on Russian Oil As EU Ban NearsAhead of the December 5th implementation of a European Union ban on seaborne imports of Russian crude, European buyers are now said to be buying up more Russian oil than they have in four months. Last week, seaborne exports of Russian crude oil to European buyers rose to their highest level since April, Bloomberg reports, citing vessel-tracking data. For the week ending August 19th, Bloomberg reports that total flows of Russian seaborne crude exports rose from 3.24 million barrels per day to 3.41 million barrels the previous week, and Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europe-Splurges-on-Russian-Oil-As-EU-Ban-Nears.html |

|

Aluminum Smelters Shutter Operations In Europe As Power Prices SoarSecond-round effects from Europe’s astronomical power price increases are coming in hot and heavy. With both French and German 1-year ahead baseload electricity prices hitting levels which mean only a handful of Europeans will be able to afford power in one year (and the rest will soon be short a kidney)…… Europe’s energy crisis has claimed another victim in the power-hungry metals industry after Norsk Hydro said it planned to shutter an aluminum smelter in Slovakia at the end of next month, Bloomberg reports. With Aluminum one of the Read more at: https://oilprice.com/Energy/Energy-General/Aluminum-Smelters-Shutter-Operations-In-Europe-As-Power-Prices-Soar.html |

|

Europes Energy Prices Soar To New Records As Russia Plans Gas CutsEnergy prices in Europe soared on Monday to fresh records after Russia’s Gazprom said on Friday that it would halt all deliveries via Nord Stream to Germany for three days, raising renewed concerns that supply via the pipeline could be further cut or halted altogether after three-day unplanned maintenance at the end of August. Europes benchmark gas prices at the Dutch TTF hub opened trade on Monday morning in Amsterdam, rallying 10% to $270 (269.50 euro) per megawatt hour, which is equivalent to $450 per barrel oil, Ole Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-Energy-Prices-Soar-To-New-Records-As-Russia-Plans-Gas-Cuts.html |

|

Chinese Banks Slash Key Interest Rate In Bid To Bolster Stalling EconomyChina’s banks have slashed a key interest rate in a token gesture to revive the world’s second-largest economy. The country’s central bank said yesterday the one-year loan prime rate offered by banks was cut to 3.65 percent from 3.7 percent, while the five-year rate dropped to 4.3 percent from 4.45 percent. The figures are compiled by the central bank analyzing rates set by some of China’s largest banks. The move comes after China’s central bank unexpectedly slashed its key interest rate by 10 basis points to support Read more at: https://oilprice.com/Energy/Energy-General/Chinese-Banks-Slash-Key-Interest-Rate-In-Bid-To-Bolster-Stalling-Economy.html |

|

China Extends Power Curbs As Heatwave And Drought PersistChina has extended orders for industries to shut down production for five more days as heatwaves and extreme drought in its southwestern regions have boosted electricity demand while reducing hydropower production in the largest hydropower-generating province. The heatwave in the Sichuan province and the rest of southwestern China is now in its 11th day of constant alerts from authorities. In scorching temperatures, residential power demand has soared. But the heatwave and the worst drought in six decades have depleted hydropower reservoirs in Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Extends-Power-Curbs-As-Heatwave-And-Drought-Persist.html |

|

Ford to eliminate 3,000 jobs in an effort to cut costsFord Motor is cutting about 3,000 jobs from its global workforce, a majority of which are in North America. Read more at: https://www.cnbc.com/2022/08/22/ford-to-cut-3000-jobs-primarily-in-north-america.html |

|

$14.9M palatial estate Connecticut priced to break local recordThe brick-and-limestone residence, built in 1929, is the most expensive home for sale in New Canaan with a $14.9 million price tag. Read more at: https://www.cnbc.com/2022/08/22/14point9-million-palatial-estate-priced-to-break-a-local-record-in-ct.html |

|

That mysterious New Jersey deli once owned by a publicly traded company is closed, regulatory filing showsYour Hometown Deli in New Jersey, once the sole asset of a publicly traded company, is closed. Read more at: https://www.cnbc.com/2022/08/22/mystery-new-jersey-deli-closes-makamer-holdings-says-in-sec-filing.html |

|

Trump-linked SPAC warns decline in ex-president’s popularity could hurt his social media companyDigital World Acquisition Corp. set a meeting to vote on delaying the deadline for completing a merger with Trump Media and Technology Group. Read more at: https://www.cnbc.com/2022/08/22/trump-popularity-decline-could-hurt-his-social-media-company-dwac-warns.html |

|

McDonald’s board adds three new directors in shake-upMcDonald’s board is gaining three new members and losing one longtime director. Read more at: https://www.cnbc.com/2022/08/22/mcdonalds-board-adds-three-new-directors-in-shakeup-.html |

|

Trump PAC paid nearly $1 million to defense lawyers in July alone as Georgia and New York probes heated upSince May, former President Donald Trump’s political action committee, Save America, has nearly quintupled spending on defense attorneys. Read more at: https://www.cnbc.com/2022/08/22/trump-pac-paid-lawyers-almost-1-million-amid-georgia-new-york-probes.html |

|

Microsoft and Alaska Airlines are working with this startup to make clean jet fuel from carbon emissionsMost SAF is made out of organic vegetable oils, but Twelve, a chemical technology company based in Berkeley, California, is making fuel out of carbon. Read more at: https://www.cnbc.com/2022/08/22/twelve-makes-jet-fuel-from-co2-signs-deal-with-microsoft-alaska-air.html |

|

Single-stock ETFs are ‘way too risky for 99% of investors,’ advisor says. What to know before adding one to your portfolioIf you’re chasing quick returns, single-stock exchange-traded funds allow leveraged bets on individual assets. Here’s what to know before buying. Read more at: https://www.cnbc.com/2022/08/22/heres-what-investors-need-to-know-about-single-stock-etfs.html |

|

Disney CEO Bob Chapek again distances himself from Bob Iger with Disney+ pricing decisionBob Chapek’s decision to boost Disney+ pricing 38% runs counter to predecessor Bob Iger’s pricing strategy. Read more at: https://www.cnbc.com/2022/08/21/disney-chapek-iger-disney-plus-price-decision.html |

|

4 takeaways from the Investing Club’s ‘Morning Meeting’ on MondayWhile stocks are down big Monday, Club holdings Constellation Brands and Coterra Energy are bright spots in the market. Read more at: https://www.cnbc.com/2022/08/22/investing-club-4-takeaways-from-the-investing-clubs-morning-meeting-on-monday.html |

|

Walmart expands abortion coverage for its employees in the wake of Roe v Wade decisionThe retailer is the nation’s largest employer with about 1.6 million employees. Read more at: https://www.cnbc.com/2022/08/19/walmart-expands-abortion-coverage-for-employees-after-roe-v-wade.html |

|

Here’s what’s at stake for HBO’s ‘House of the Dragon’ and Amazon’s ‘The Rings of Power’Amazon’s “The Rings of Power” and HBO’s “House of the Dragon” serve very different purposes for their respective studios. Read more at: https://www.cnbc.com/2022/08/20/house-of-the-dragon-and-rings-of-power-are-coming-whats-at-stake.html |

|

Motor City meets a new test in the EV transition: Keeping gearheads behind the wheelThe Detroit automakers are going to have to balance traditional muscle car performance with electrification to maintain their most loyal buyers and fans. Read more at: https://www.cnbc.com/2022/08/20/gm-ford-and-dodge-electric-muscle-cars-face-latest-ev-transition-test.html |

|

Nomura Warns “Fed’s Hands Are Tied” For Now As USDollar “Wrecking Ball” Tightens Global Financial ConditionsNomura Warns “Fed’s Hands Are Tied” For Now As USDollar “Wrecking Ball” Tightens Global Financial ConditionsThis morning we warned of the ‘hawk-nado’ that has suddenly taken hold of markets ahead of Friday’s Jackson Hole show from Jay Powell, but while all eyes are on The Fed and the US economy (labor market), the European / UK Energy crisis continues to boil-over yet again. And right on cue, ECB’s Nagel comments in a weekend interview underscore this very point: effectively, that Recession is likely IF the Energy crisis worsens—so the ECB has to continue hiking rates to temper inflation and guarantee a harder growth slowdown (how’s that for a set of bad options) In the meantime, German 1Y fwd baseload electricity is +72% in a week and a half, +129% since the start of July and +514% off the YTD low, all as NordStream 1 preps another “TBD maintenance shutdown” yet again at the end of the month And as UK 1Y fwd inflation swaps are at 12.5% / EUR 1Y fwd inflation swaps are at 8.6%…both at highs—i.e. NOT “past-peak inflation” Read more at: https://www.zerohedge.com/markets/nomura-warns-feds-hands-are-tied-now-usdollar-wrecking-ball-tightens-global-financial |

|

Stimulus Payments & Rebates To Hit US Bank Accounts Next MonthAuthored by Jack Phillips via The Epoch Times, Several states are mailing out stimulus checks or tax rebates in September despite near-historic inflation.

Recent data released by the federal government shows that the Consumer Price Index, a key inflation metric, remained relatively elevated at 8.5 percent in July. Although it was down from 9.1 percent in June, the figures represent highs not seen in about four decades. AlaskaAlaskans can expect payouts of up to $3,200 per person to be deposited into bank accounts on Sept. 20, including a payment of $650 meant to offset higher fuel costs, according to a government Read more at: https://www.zerohedge.com/political/stimulus-payments-rebates-hit-us-bank-accounts-next-month |

|

Russia Says It Shot Down A Drone Over Sevastopol As Crimea Attacks Heat UpComing two days after the Saturday drone attack on Russia’s Black Sea Fleet headquarters in Sevastopol, there’s been another major incident in the skies over Crimea, early reports suggest. Russian, as well as regional reporting, has cited Sevastopol governor Mikhail Razvozhaev who said air defenses surrounding the city were active Monday early evening (local time). Eyewitnesses have further reported multiple explosions over the city, leading to reports that a Ukrainian drone was shot down.

“At 18:15, in the Verkhnesadovoe district, air defenses were activated. The target was hit. At a high altitude, which is why the sound was audible in various parts of the city. Preliminary reports indicate that it was another drone. Keep calm — the city is well-protected,” Razvozhaev announced on Telegram. “According to local media outlets, the sounds shook the walls of a shopping center and shattered win … Read more at: https://www.zerohedge.com/geopolitical/russia-says-it-shot-down-drone-over-sevastopol-crimea-attacks-heat |

|

Blain: What If We’re Looking At All The Wrong Things?Authored by Bill Blain via MorningPorridge.com, “Look not to the Sword waving around to your front, but the Stiletto threatening your kidneys..… “ Everyone is balancing inflation, economic numbers and this week’s Jackson Hole Central Bank schmooze-a-thon to guess markets. What if we are looking at the wrong things – and economic divergence, income and wealth inequality and unraveling domestic politics are the critical factors?

This week will apparently be all about inflation and deciphering new economic data to predict the path of the Global Economy and Stagflation risks. The big event will be the Jackson Hole central bank gabfest – anticipating what Jay Powell will say about the US Economy and the Fed’s perception of the required pace of rate hikes to counter inflation. Hi … Read more at: https://www.zerohedge.com/markets/blain-what-if-were-looking-all-wrong-things |

|

British Airways to cut 10,000 Heathrow flightsThe cancellations are aimed at minimizing disruption to flights over the winter. Read more at: https://www.bbc.co.uk/news/business-62637616?at_medium=RSS&at_campaign=KARANGA |

|

PwC sued by worker over ‘pub golf’ head injuryAn auditor at one of the UK’s largest accountancy firms claims a drinking game left him injured. Read more at: https://www.bbc.co.uk/news/business-62632803?at_medium=RSS&at_campaign=KARANGA |

|

UK inflation could hit 18% next year on rising energy bills, experts warnRising energy bills could push inflation to its highest level for almost 50 years, analysts predict. Read more at: https://www.bbc.co.uk/news/business-62634795?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty50 confirms failed breakout, bears in driving seat“The long bear candle of the last two sessions signals a faster downside retracement of the last 5-6 sessions of upmove. This is a negative indication and signal that bears are in a driver’s seat,” he said.For the day, the index closed at 17,490.70, down 267.75 points or 1.51 percent. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-confirms-failed-breakout-bears-in-driving-seat/articleshow/93711916.cms |

|

Can this footwear stock deliver solid returns after 3x jump in Q1 sales?Ambit Capital has a ‘sell’ rating on the stock, with a price target of Rs 1,312. HDFC Securities sees it at Rs 1,400. Edelweiss Wealth has ‘buy’ on the counter with a target of Rs 2,365. Dalal & Broacha Stock Broking said downside is limited and long-term investors should hold, as it finds the stock Rs 2,001 worthy. Centrum sees it at Rs1,944 while Nirmal Bang Institutional Equities at Rs 2,240. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/can-this-footwear-stock-deliver-solid-returns-after-3x-jump-in-q1-sales/articleshow/93712946.cms |

|

Nifty to cross 20,000-mark by next June: Prabhudas Lilladher“We remain positive on India’s growth story given strong tailwinds and expect steady returns with a stock-specific approach,” Prabhudas analysts Amnish Aggarwal and Anushka Chhajed said, adding that the June quarter saw sales beat of 0.6 percent, while EBITDA and PBT were lower than estimates by 6.5 percent and 9.7 percent, respectively. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nifty-to-cross-20000-mark-by-next-june-prabhudas-lilladher/articleshow/93707365.cms |

|

MemeMoney: Bed Bath & Beyond’s stock tumbles amid meme-stock selloff and cash concernsBed Bath & Beyond is having an eventful few weeks. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7113-C1C8CDBD0703%7D&siteid=rss&rss=1 |

|

Key Words: Apple workers tell CEO Tim Cook: ‘We demand location-flexible work’Petition launched by a group of workers calling itself AppleTogether. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7113-6364DC789855%7D&siteid=rss&rss=1 |

|

Bond Report: 10-year Treasury yield settles above 3% for first time in a monthYields on the 10- and 30-year Treasury notes climbed on Monday to their highest levels in more than a month. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7113-4C94D7409DA4%7D&siteid=rss&rss=1 |