Summary Of the Markets Today:

- The Dow closed down 172 points or 0.50%,

- Nasdaq closed down 1.25%,

- S&P 500 down 0.72%,

- WTI crude oil settled at $88 up 1.63%,

- USD $106.65 up 0.14%,

- Gold $1778 down 0.63%,

- Bitcoin $23,391 down 1.96%,

- 10-year U.S. Treasury 2.9% little changed

Today’s Economic Releases:

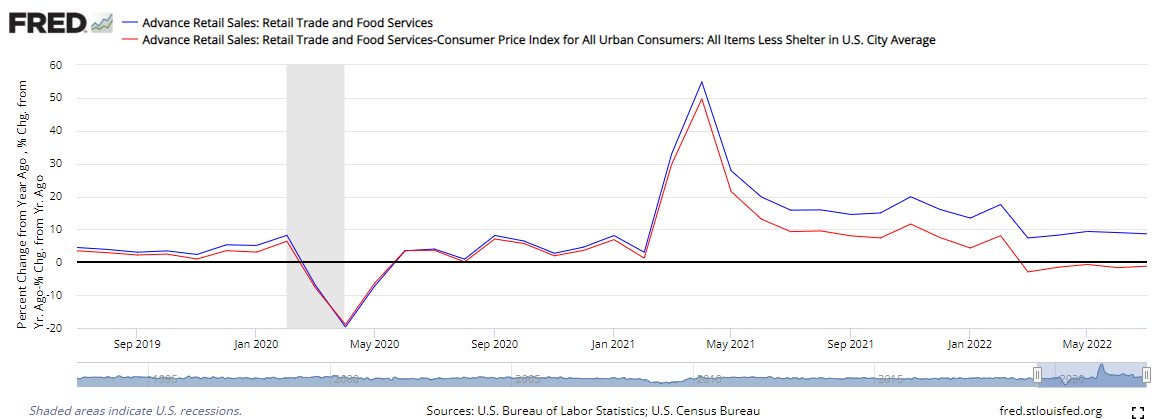

According to the US Census release, advance estimates of retail and food services sales for July 2022, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were virtually unchanged from the previous month, but 10.3 percent (±0.7 percent) above July 2021. But when adjusted for inflation (red line on graph below), retail/food services have been in contraction year-over-year since March 2022.

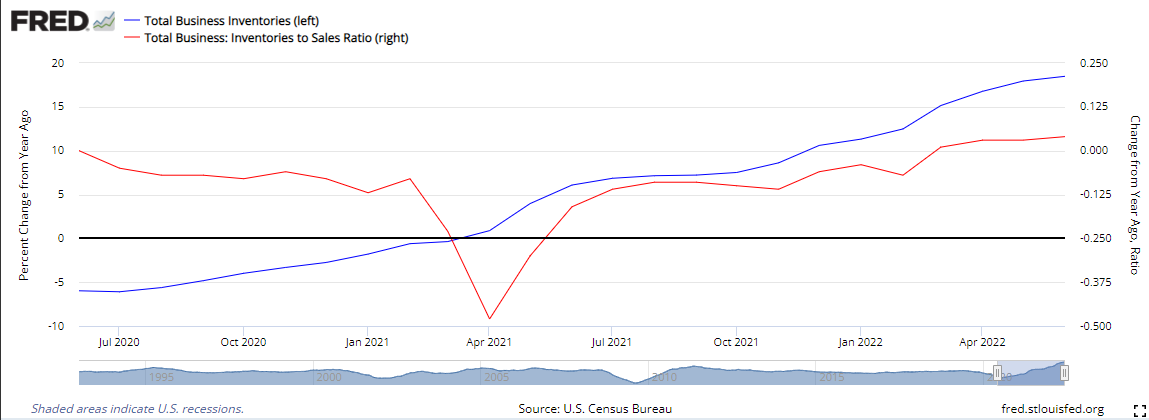

Manufacturers and trade inventories for June, adjusted for seasonal and trading day differences but not for price changes, were estimated at an end-of-month level of $2,419.5 billion, up 1.4 percent (±0.1 percent) from May 2022 and were up 18.5 percent (±0.5 percent) from June 2021 – their numbers are not inflation adjusted. However, inventory/sales ratios do not need inflation adjustments and the total business inventories/sales ratio was 1.30. The June 2021 ratio was 1.26. This implies that inventory levels are modestly rising but within levels seen at times of economic expansion.

Today, the Federal Reserve released the minutes for the July 26/27 meeting of the Federal Open Market Committee and the Board of Governors of the Federal Reserve System. We saw no clues in these minutes on the size of the next federal funds rate increase. Highlights include:

- Participants noted that consumer expenditures, housing activity, business investment, and manufacturing production had all decelerated from the robust rates of growth seen in 2021. The labor market, however, remained strong.

- Participants anticipated that U.S. real GDP would expand in the second half of the year, but many expected that growth in economic activity would be at a below-trend pace, as the period ahead would likely see the response of aggregate demand to tighter financial conditions become stronger and more broad-based. Participants noted that a period of below-trend GDP growth would help reduce inflationary pressures and set the stage for the sustained achievement of the Committee’s objectives of maximum employment and price stability.

- Participants noted that indicators of spending and production pointed to less underlying strength in economic activity than was suggested by indicators of labor market activity. With employment growth still strong, the weakening in spending data implied unusually large negative readings on labor productivity growth for the year so far. Participants remarked that the strength of the labor market suggested that economic activity may be stronger than implied by the current GDP data, with several participants raising the possibility that the discrepancy might ultimately be resolved by GDP being revised upward

- Participants remarked that, although recent declines in gasoline prices would likely help produce lower headline inflation rates in the short term, declines in the prices of oil and some other commodities could not be relied on as providing a basis for sustained lower inflation, as these prices could quickly rebound.

- Participants judged that, as the stance of monetary policy tightened further, it likely would become appropriate at some point to slow the pace of policy rate increases while assessing the effects of cumulative policy adjustments on economic activity and inflation. Some participants indicated that, once the policy rate had reached a sufficiently restrictive level, it likely would be appropriate to maintain that level for some time to ensure that inflation was firmly on a path back to 2 percent.

A summary of headlines we are reading today:

- Iran Set To Boost Oil Exports In August

- Target’s earnings take a huge hit as retailer sells off unwanted inventory

- CDC Director Walensky to reorganize agency after admitting Covid pandemic response fell short

- Walmart CEO Doug McMillon says even wealthier families are penny-pinching

- Stocks & Bonds Dump As Short-Squeeze Ammo Runs Dry At Critical Technical Level

- Judge Orders Twitter To Provide Elon Musk With Executive Documents On Fake Accounts

- Bond Report: 2-year Treasury yield hits two-month high after Fed minutes point to risk of central bank tightening ‘by more than necessary’

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

How High Will European Gas Prices Go?In recent weeks, there has been increasing mainstream coverage of the impending energy crisis in the UK and across Europe. While this issue is not news to those who are regularly engaged with energy markets, the looming impact on domestic utility bills is steadily being given more press coverage. In April 2022, regulator Ofgem increased the UK Energy Price Cap by 54% from 1,277 per year to 1,971 per year, based on typical use. In May, Ofgem stated this would rise again up to 2800 per year in October, however, it is widely Read more at: https://oilprice.com/Energy/Energy-General/How-High-Will-European-Gas-Prices-Go.html |

|

Iran Set To Boost Oil Exports In AugustIran could increase its oil exports in August as its crude is now estimated to be much cheaper than Russia’s in China, the key oil customer for both exporters, oil flows tracking firms told Reuters on Wednesday. Iran, as well as Russia, offer their crude at discounts to China, but the discount of Iranian crude to Russia’s Urals grade has doubled in recent weeks, which could prompt China to buy more oil from Iran, traders and analysts told Reuters. Iran’s crude for August is now being offered at around $8 a barrel below the price Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iran-Set-To-Boost-Oil-Exports-In-August.html |

|

How The EU Plans To Cut Natural Gas Consumption By 15%Last week, European Union ministers accepted major gas cuts across Europe in the face of gas shortage worries going into the winter. So what are countries around the world doing to curb their energy usage as they see shortages and rising prices? Several governments are now introducing measures to ensure they maintain their energy security as the flow of Russian gas begins to slow. Last week, the European Commission proposed a 15 percent cut in gas usage across member states, starting in August and ending in March 2023 to ease worries of energy Read more at: https://oilprice.com/Energy/Natural-Gas/How-The-EU-Plans-To-Cut-Natural-Gas-Consumption-By-15.html |

|

Gulf of Mexico Oil Leases Up in the Air Amid Another Court RulingA U.S. court of appeals has ruled that President Joe Bidens pause on oil and gas leases on public land can be reinstated, just days after the passage of a landmark Inflation Reduction Act that calls for hastening fossil fuel production on federal lands. The 5th Circuit Court of Appeals on Wednesday ruled against an injunction that had stopped the Biden administrations pause on new oil and gas leasing. The injunction will now be sent back to a lower court for more proceedings. The appeals court decision was based on what it called Read more at: https://oilprice.com/Latest-Energy-News/World-News/Gulf-of-Mexico-Oil-Leases-Up-in-the-Air-Amid-Another-Court-Ruling.html |

|

Germany Will Have Less Than 3 Months Of Gas If Russia Halts SupplyDespite faster storage builds than usual, Germany will only have enough natural gas to cover two and a half months of consumption this winter if Russia completely suspends deliveries, Klaus Mller, the president of Germany’s energy regulator, the Federal Network Agency, told Bloomberg this week. Germany targets storage to be 85% full by the beginning of October and 95% full gas storage sites by the start of November. Even at 95% full storage by November, Europe’s biggest economy will have two and a half months to cover heating, power, and Read more at: https://oilprice.com/Energy/Natural-Gas/Germany-Will-Have-Less-Than-3-Months-Of-Gas-If-Russia-Halts-Supply.html |

|

German Uniper Says Its Facing Insolvency Amid $12 Billion LossGiant German utility Uniper has reported first-half 2022 losses of some $12.5 billion amid a mounting energy crisis that has seen natural gas supplies from Russia decline significantly over the past few months. According to Uniper, the losses were incurred due to the necessity of buying natural gas on the spot market as Russia cut flows to Germany. Uniper said the losses were related to anticipated future gas shortages. Uniper has, for months, been playing a crucial role in stabilizing Germanys gas supply at the Read more at: https://oilprice.com/Latest-Energy-News/World-News/German-Uniper-Says-Its-Facing-Insolvency-Amid-12-Billion-Loss.html |

|

‘Flash’ star Ezra Miller’s apology is not a get-out-of-jail-free card, experts sayEzra Miller has apologized and announced they are undergoing mental health treatment as Warner Bros. grapples with how to handle the release of “The Flash.” Read more at: https://www.cnbc.com/2022/08/17/flash-star-ezra-miller-apology-not-enough.html |

|

Target’s earnings take a huge hit as retailer sells off unwanted inventoryThe big-box retailer cut its profit outlook in June, saying it would take a hit as it marked down unwanted goods and canceled merchandise orders. Read more at: https://www.cnbc.com/2022/08/17/target-tgt-q2-2022-earnings.html |

|

Mortgage demand fell last week even as rates declined slightlyA small drop in mortgage rates was not enough to fuel any kind of recovery in consumer demand for home loans. Read more at: https://www.cnbc.com/2022/08/17/mortgage-demand-fell-last-week-even-as-rates-declined-slightly.html |

|

Lowe’s reports mixed second-quarter results, citing shortened spring that hurt salesLowe’s said improved operations offset lower-than-expected sales that were hurt by a shortened spring. Read more at: https://www.cnbc.com/2022/08/17/lowes-low-earnings-q2-2022.html |

|

Best Buy to sell over-the-counter hearing devices this fall following change in FDA regulationBest Buy will begin selling over-the-counter hearing devices as early as mid-October following a new FDA rule. Read more at: https://www.cnbc.com/2022/08/17/best-buy-to-sell-otc-hearing-aid-devices-after-fda-regulation.html |

|

LeBron James agrees to 2-year, $97.1 million contract extension with the Lakers, reports sayLeBron James reportedly agrees to a two-year $97.1 million contract extension. Read more at: https://www.cnbc.com/2022/08/17/lebron-james-agrees-to-97-million-contract-extension-with-lakers.html |

|

CDC Director Walensky to reorganize agency after admitting Covid pandemic response fell shortThe organizational changes are focused on sharing data more quickly and making public health guidance easier for people to understand. Read more at: https://www.cnbc.com/2022/08/17/cdc-admits-covid-response-fell-short-launches-reorganization.html |

|

4 takeaways from the Investing Club’s ‘Morning Meeting’ on WednesdayThe Investing Club hosts its “Morning Meeting” every weekday at 10:20 a.m. ET. Read more at: https://www.cnbc.com/2022/08/17/4-takeaways-from-the-investing-clubs-morning-meeting-on-wednesday.html |

|

Stocks making the biggest moves midday: Bed Bath & Beyond, Krispy Kreme, Target and moreThese are the stocks posting the largest moves midday. Read more at: https://www.cnbc.com/2022/08/17/stocks-making-the-biggest-moves-midday-bed-bath-beyond-krispy-kreme-target-and-more.html |

|

Walmart CEO Doug McMillon says even wealthier families are penny-pinchingInflation is rising at the fastest rate in decades and groceries, one of the retailer’s key categories, have especially jumped in price. Read more at: https://www.cnbc.com/2022/08/16/walmart-ceo-doug-mcmillon-says-even-wealthier-families-are-penny-pinching-.html |

|

Dodge’s first electrified vehicle will be a new crossover called the HornetThe first electrified vehicle for Stellantis’ Dodge brand will be a plug-in hybrid crossover called the Hornet, a resurrected name of a 1970s station wagon. Read more at: https://www.cnbc.com/2022/08/16/2023-hornet-this-is-dodges-first-electrified-vehicle.html |

|

Homebuyers are backing out of more deals as high mortgage rates persist and recession fears lingerHomebuilder cancellation rates have more than doubled since April, according to surveys by John Burns Real Estate Consulting. Read more at: https://www.cnbc.com/2022/08/16/homebuyers-are-backing-out-of-more-deals-as-recession-fears-linger.html |

|

Trump-linked SPAC Digital World Acquisition postpones earnings report after seeking to delay mergerDigital World Acquisition Group, the SPAC that plans to merge with Trump Media and Technology Group, requested a delay in its earnings report. Read more at: https://www.cnbc.com/2022/08/16/trump-spac-postpones-earnings-report-as-it-seeks-to-delay-merger-deadline.html |

|

An Inauspicious Anniversary: Nixon Slams Shut The Gold WindowAuthored by Michael Maharrey via SchiffGold.com, Fifty-one years ago this week, President Richard Nixon slammed shut the “gold window” and eliminated the last vestige of the gold standard.

Nixon ordered Treasury Secretary John Connally to uncouple gold from its fixed $35 price and suspended the ability of foreign banks to directly exchange dollars for gold. During a national television address, on Aug. 15, 1971, Nixon promised the action would be temporary in order to “defend the dollar against the speculators,” but this turned out to be a lie. The president’s move permanently and completely severed the dollar from gold and turned it into a pure fiat currency. The First Steps Toward FiatNixon’s order was the end of a p … Read more at: https://www.zerohedge.com/markets/inauspicious-anniversary-nixon-slams-shut-gold-window |

|

Stocks & Bonds Dump As Short-Squeeze Ammo Runs Dry At Critical Technical LevelAfter an ugly overnight session turned uglier at the cash equity open, the US majors all spiked on the FOMC Minutes – for no good reason – then puked it all back into the close to end the day down relatively hard. Small Caps were the worst with the Dow the prettiest horse in the glue factory (but still lower on the day)…

The S&P 500 tagged its 200DMA today and reversed…

And for those wh … Read more at: https://www.zerohedge.com/markets/stocks-bonds-dump-short-squeeze-ammo-runs-dry-key-technical-level |

|

“The West Is Really In Deep Trouble On Many Fronts – Many Self-Inflicted”By Michael Every of Rabobank Byron, Shelley, and Churchill We have some wildly bullish markets out there right now. US equities have to be beaten back whack-a-mole style, it seems, as regardless of what happens it is ‘always time to buy stocks’. Especially when “important indicators” say it is; until “important voices” say it isn’t. Moreover, and running counter to that enthusiasm, natural gas prices just hit new 14-year highs in the US and close to record levels in Europe, as other energy sources literally dry up in the summer heat. After a lag, that will drag up other energy with it because of substitution, and then everything else will get dragged up too as a result. For example, zinc surged too yesterday after one of Europe’s largest smelters announced it would halt production in September due to higher energy costs. And lots of things use zinc. The West is in trouble on the most fundamental level with Europe at the epicentre – as explored in ‘An unfolding gas crisis in Europe’, which concludes: “It it is all but certain that the European economy will face some hardship this winter.” And not only Europe. We also have wildly bearish takes on such matters, however, among which the recent missive from Pepe Escobar, ‘The Second Coming of the Heartland’, takes th … Read more at: https://www.zerohedge.com/markets/west-really-deep-trouble-many-fronts-many-self-inflicted |

|

Judge Orders Twitter To Provide Elon Musk With Executive Documents On Fake AccountsUnder a recent court order, Twitter is now required to provide Elon Musk with access to documents compiled by a former executive that Musk says is a key figure in calculating the number of fake accounts that permeate the platform.

The executive, former General Manager of Consumer Product Kayvon Beykpour, quickly disappeared from the halls of Twitter in April of this year when it was announced that Musk would be seeking to purchase the company. Beykpour was described in Musk’s court filings as one of the executives “most intimately involved with” determining the amount of spam and bot accounts on Twitter. Though the court denied Musk access to 21 other people involved in the company, it would appear that the battle over the social media giant is just beginning. Musk has accused Twitter of misrepresenting their user numbers, which they c … Read more at: https://www.zerohedge.com/markets/judge-orders-twitter-provide-elon-musk-executive-documents-fake-accounts |

|

Ofgem director Christine Farnish resigns over price cap changeA director of the UK’s energy watchdog quits over the way the energy price cap will be set. Read more at: https://www.bbc.co.uk/news/business-62578614?at_medium=RSS&at_campaign=KARANGA |

|

Royal Mail workers vote for further strikesMembers of the Communication Workers Union at the Royal Mail voted to strike over terms and conditions. Read more at: https://www.bbc.co.uk/news/business-62582240?at_medium=RSS&at_campaign=KARANGA |

|

UK inflation: Food costs push price rises to new 40-year highPrices climb 10.1% in the year to July as the cost of food, household goods and holidays soars. Read more at: https://www.bbc.co.uk/news/business-62562025?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty50 in overbought zone, but there are no signs of weakness. Here’s why“Intraday weakness can be seen below 17,833 with initial targets placed in the zone of 17,764 and 17,724 levels. However, traders are advised to remain cautious about creating fresh long positions as some momentum oscillators on daily as well as weekly charts are in overbought zones,” Mohammad said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-in-overbought-zone-but-there-are-no-signs-of-weakness-heres-why/articleshow/93619086.cms |

|

Dogecoin surges 50% in three weeks. Look, what sparked the rally!Dogecoin is technologically becoming competitive with Ethereum due to the launch of Dogechain, said Sathvik Vishwanath, Co-Founder, and CEO, of Unocoin. The blockchain use cases such as DeFi (decentralised finance) and NFTs (non-fungible tokens) can be built on this. Read more at: https://economictimes.indiatimes.com/markets/cryptocurrency/dogecoin-surges-50-in-three-weeks-look-what-sparked-the-rally/articleshow/93618243.cms |

|

FPIs stock holding slips 14% to $523 bn in Jun quarter: Report“During the quarter ended June 2022, the value of FPI investments in Indian equities fell by 14 percent to USD 523 billion from USD 612 billion recorded in the previous quarter,” the report noted. As of June 2021, the value of FPI investments in Indian equities was USD 592 billion.FPIs’ contribution to Indian equity market capitalization also fell during the quarter under review to 16.9 percent from 17.8 percent in the March quarter. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/fpis-stock-holding-slips-14-to-523-bn-in-jun-quarter-report/articleshow/93613782.cms |

|

Bond Report: 2-year Treasury yield hits two-month high after Fed minutes point to risk of central bank tightening ‘by more than necessary’U.S. bond yields are higher across the board on Wednesday as investors scan the minutes from the Federal Reserve’s July rate-setting meeting. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7110-6C1019D99719%7D&siteid=rss&rss=1 |

|

Market Extra: Subtle shift in financial markets points to view U.S. economy may be able to handle higher ratesSigns of a sentiment shift are evident in the rates market, where traders have mostly priced out the chances of a Fed rate cut next year. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7110-A5442E4C641A%7D&siteid=rss&rss=1 |

|

The Tell: Stock-market rally faces key challenge at S&P 500’s 200-day moving averageStocks have roared back from their mid-June lows but have run into stiff resistance at a key moving average for the S&P 500. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7110-C471EC8439FA%7D&siteid=rss&rss=1 |