Summary Of the Markets Today:

- The Dow closed up 239 points or 0.71%,

- Nasdaq closed down 0.19%,

- S&P 500 up 0.19%,

- WTI crude oil settled at $86 down 3.29%,

- USD $106.47 down 0.07%,

- Gold $1790 down 0.42%,

- Bitcoin $23,930 down 0.70%,

- 10-year U.S. Treasury 2.815% unchanged

Today’s Economic Releases:

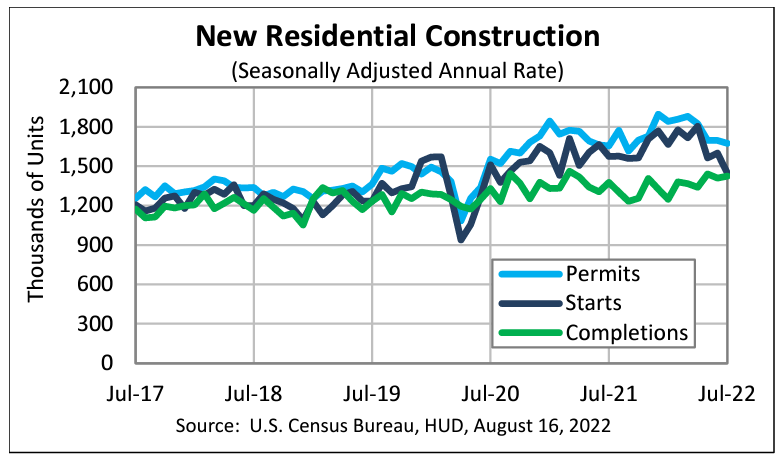

Privately‐owned housing units authorized by building permits in July 2022 were down 1.3% month over-month and 1.1% year-over-year. Housing starts were down 9.6% month-over-month and is 8.1year-over-year. Housing completions were up 1.1% year-over-year and up 3.5% year-over-year. Although the numbers are slowing, they are still above pre-pandemic levels.

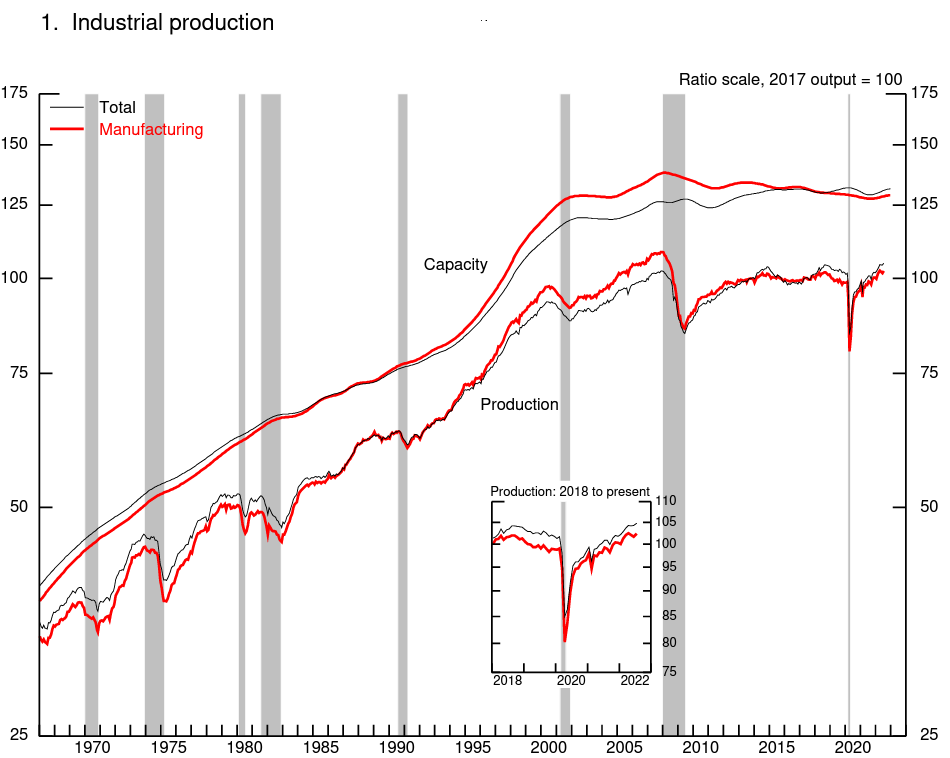

In July 2022 industrial production increased 0.6% month-over-month with manufacturing up 0.7%; mining increased 0.7%; and utilities decreased 0.8%. On a year-over-year basis industrial production was up 3.9% wth manufacturing up 3.2%, mining up 7.9%, and utilities up 2.2%. Capacity utilization is up 1.3% year-over-year.

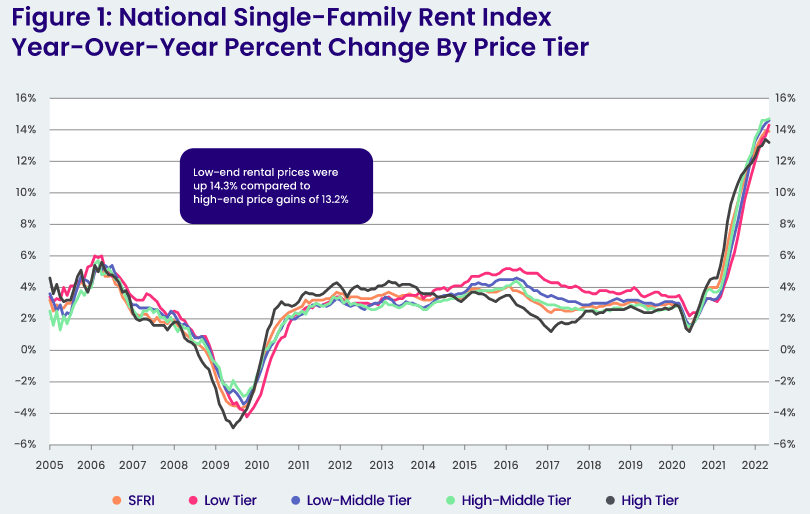

CoreLogic shows that in June 2022, single-family rent prices remained elevated, up 13.4% from one year earlier, but have continued to relax compared to growth seen earlier this year. This deceleration could be partially due to worries over an impending economic slowdown. June also saw trends shift away from pandemic-era preferences as attached rentals growth (13.2%) slightly outpaced detached rentals price growth (12.8%). Molly Boesel, principal economist at CoreLogic stated:

While the annual growth in single-family rents is nearly double that of a year ago and is still near a record level, price growth began decelerating in June. Nationwide, both year-over-year and month-over-month growth were slower in June than they were earlies year, and roughly half of the largest U.S. metro areas experienced a slowdown in annual growth in June.

A summary of headlines we are reading today:

- Nuclear And Hydropower Falter As Droughts Grip Europe

- Hydropower In China Struggles Amid Worst Heatwave In Decades

- WTI Crude Falls To Lowest Level Since January

- Homebuyers are backing out of more deals as high mortgage rates persist and recession fears linger

- Walmart CEO Doug McMillon says even wealthier families are penny-pinching

- Inflation drives fastest fall in real pay on record

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Nuclear And Hydropower Falter As Droughts Grip EuropeAs Europe looks to secure alternative energy sources to Russian gas in light of the war in Ukraine, Statista’s Anna Fleck warns, a new threat to energy security is stirring, this time from droughts. The droughts hitting Europe are impacting everything from food to transportation to the environment. In Italy, the River Po has fallen two meters below its normal levels, seeing rice paddy fields dry out. Meanwhile, Germanys River Rhine has become so shallow that cargo vessels can’t pass through it fully loaded, pushing up shipping costs, Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Nuclear-And-Hydropower-Falter-As-Droughts-Grip-Europe.html |

|

Hydropower In China Struggles Amid Worst Heatwave In DecadesThe southwestern Chinese province of Sichuan is baking in the worst heatwave in six decades, with hydropower generation from the Yangtze River falling and factories closing to ease the pressure on the grids. The heatwave is reducing water levels on the Yangtze River to the lowest on record for this time of the year, threatening crops and power supply in the Sichuan province, which relies on hydropower generation for a large portion of its electricity supply. Sichuan also typically sells hydropower-generated electricity to other provinces. Read more at: https://oilprice.com/Latest-Energy-News/World-News/Hydropower-In-China-Struggles-Amid-Worst-Heatwave-In-Decades.html |

|

Disappointing Chinese Demand Takes Toll On Oil PricesUncertainty about the Iran nuclear deal and disappointing Chinese crude demand and refinery throughput are creating headwinds for crude. Chart of the Week Can the German Economy Fall by the Wayside? – Investor confidence in the German economy has plummeted to the lowest level in at least decade, with market gloom surpassing the impact of COVID-19 as German households face another challenge, a $300 annual gas levy destined to help gas retailers stay afloat. – The large-scale impact of economic headwinds is still yet to be felt – Germanys Read more at: https://oilprice.com/Energy/Energy-General/Disappointing-Chinese-Demand-Takes-Toll-On-Oil-Prices.html |

|

WTI Crude Falls To Lowest Level Since JanuaryCrude oil prices fell further on Tuesday, with WTI falling to its lowest benchmark price since January this year. Crude oil prices began their fall on Monday, dragged down by Chinas disappointing economic data that led to Chinas central bank cutting lending rates. WTI prices fell to $86.13 per barrel by 2:24 pm ET, down $3.28, or 3.67% on the day. Brent crude fell $2.98 (-3.13%) on the day to $92.12 per barrel – the lowest price since February this year. Gasoline prices in the United States have been falling for months now led Read more at: https://oilprice.com/Latest-Energy-News/World-News/WTI-Crude-Falls-To-Lowest-Level-Since-January.html |

|

Europe’s Power Prices Surge To New RecordYear-ahead electricity prices continue to soar in Europe, with German power prices, the European benchmark, jumping to over $508 (500 euro) per megawatt-hour on Tuesday amid low Russian gas supply and a heatwave constraining supply and output from other fuel sources. Over the past year, German power prices have soared by around 500%, according to Bloomberg’s estimates. Power prices in France and the Nordic countries also hit fresh records at the start of this week as nuclear power generation in France is lower than usual, while Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-Power-Prices-Surge-To-New-Record.html |

|

Falling Prices And High Costs Eat Away At Steelmaker MarginsThe Raw Steels Monthly Metals Index (MMI) fell by 8.73% from July to August. All in all, U.S. steel prices continued their descent, leaving cold rolled coil and hot dipped galvanized prices at their lowest point since January 2021. Meanwhile, hot rolled coil prices fell well beneath the $1,000/st mark, reaching their lowest point since December 2020. However, plate prices managed to disrupt two consecutive months of decline, by rising in July. Source: Insights Correlation Declines: Record Spread Between HRC and Plate Steel Prices Source: Chart Read more at: https://oilprice.com/Metals/Commodities/Falling-Prices-And-High-Costs-Eat-Away-At-Steelmaker-Margins.html |

|

Trump-linked SPAC Digital World Acquisition postpones earnings report after seeking to delay mergerDigital World Acquisition Group, the SPAC that plans to merge with Trump Media and Technology Group, requested a delay in its earnings report. Read more at: https://www.cnbc.com/2022/08/16/trump-spac-postpones-earnings-report-as-it-seeks-to-delay-merger-deadline.html |

|

Homebuyers are backing out of more deals as high mortgage rates persist and recession fears lingerHomebuilder cancellation rates have more than doubled since April, according to surveys by John Burns Real Estate Consulting. Read more at: https://www.cnbc.com/2022/08/16/homebuyers-are-backing-out-of-more-deals-as-recession-fears-linger.html |

|

Walmart CEO Doug McMillon says even wealthier families are penny-pinchingInflation is rising at the fastest rate in decades and groceries, one of the retailer’s key categories, have especially jumped in price. Read more at: https://www.cnbc.com/2022/08/16/walmart-ceo-doug-mcmillon-says-even-wealthier-families-are-penny-pinching-.html |

|

American Airlines agrees to buy 20 supersonic planes from BoomAmerican Airlines has agreed to purchase 20 supersonic Overture planes from Boom Supersonic, the second firm order for Boom in the last two years. Read more at: https://www.cnbc.com/2022/08/16/american-airlines-agrees-to-buy-20-supersonic-planes-from-boom.html |

|

Walmart sticks with second-half outlook after earnings beat expectationsThe retailer’s profits are under pressure, as consumers feel pinched by inflation and buy fewer high-margin items, such as apparel and electronics. Read more at: https://www.cnbc.com/2022/08/16/walmart-wmt-earnings-q2-2023.html |

|

Home Depot beats second-quarter earnings expectations, stands by 2022 guidanceHome Depot reported second-quarter earnings and revenue that beat expectations Tuesday morning. Read more at: https://www.cnbc.com/2022/08/16/home-depot-hd-q2-2022-earnings.html |

|

Financing a new car? Here’s how much you can save thanks to a good or excellent credit scoreFor a five-year, new-car loan of $45,000, buyers with excellent credit scores generally can save thousands of dollars by qualifying for lower interest rates. Read more at: https://www.cnbc.com/2022/08/16/financing-a-new-car-how-much-you-can-save-with-excellent-credit-score.html |

|

The Inflation Reduction Act caps costs for Medicare patients on insulin. Where the push for broader relief standsThe Inflation Reduction Act will limit insulin co-pays for Medicare patients to $35 per month. Where efforts to provide similar relief to other patients stand. Read more at: https://www.cnbc.com/2022/08/16/inflation-reduction-act-to-cap-costs-for-medicare-patients-on-insulin.html |

|

Biden signs Inflation Reduction Act into law, setting 15% minimum corporate tax rateAfter more than a year of debate, Biden’s sweeping infrastructure bill is became law — albeit a significantly smaller version of his Build Back Better plan. Read more at: https://www.cnbc.com/2022/08/16/watch-live-biden-to-sign-inflation-reduction-act-into-law-setting-15percent-minimum-corporate-tax-rate.html |

|

IRS interest rates jump to 6% on Oct. 1. Here’s how much money you’ll get for a missing refundIf you’re still waiting on a tax refund, you may be earning interest on your unpaid balance, and the rate jumps to 6% on Oct. 1, according to the IRS. Read more at: https://www.cnbc.com/2022/08/16/irs-interest-jumps-on-oct-1-how-much-youll-get-for-a-missing-refund.html |

|

CNBC Chairman Mark Hoffman to step down in SeptemberCNBC Chairman Mark Hoffman will step down next month after running the network since 2005. Read more at: https://www.cnbc.com/2022/08/16/cnbc-chairman-mark-hoffman-to-step-down-in-september.html |

|

Polestar will launch a hot new electric roadster — but not until 2026Polestar said it will build a version of its popular O2 roadster show car. Production won’t start until 2026, but interested buyers can reserve now. Read more at: https://www.cnbc.com/2022/08/16/polestar-6-roadster-confirmed-for-2026-production.html |

|

Reebok owner Authentic Brands strikes $254 million deal for Ted Baker fashion brandTuesday’s announcement resolves months of speculation around the future of the British fashion moniker, which was forced to put itself up for sale. Read more at: https://www.cnbc.com/2022/08/16/reebok-owner-authentic-brands-strikes-254-million-deal-for-ted-baker.html |

|

“Deadly Conditions” At Rikers Island Cited As 12th Person Under DOC Custody This Year DiesIt isn’t just the streets of New York that are turning into violent hellscapes…it’s also the prisons. This week at Rikers Island, a man awaiting sentencing marked the 12th death of a person in the care of the city’s Department of Correction this year, according to Bloomberg. He was found dead of a “suspected suicide”, the report says. One month ago, in July, he was found guilty of 12 counts of rape, sexual assault and other crimes by a jury. He was also convicted of abuse and manipulation of 6 patients in his care. Department of Correction Commissioner Louis Molina said in a statement on Monday: “I am deeply saddened to learn of the passing of this person in custody. We will conduct a preliminary internal review to determine the circumstances surrounding his death.”

10 other people in the custody of the DOC have died this year and 1 person died “just after release”. The DOC is working with the city on a five-month plan to try and address what are being called “deadly conditions” … Read more at: https://www.zerohedge.com/markets/deadly-conditions-rikers-island-cited-12th-person-under-doc-custody-year-dies |

|

Inflation Makes Everybody Poorer (And It’s Government’s Fault)Authored by André Marques via The Mises Institute, The Consumer Price Index (CPI) in the US was 9.1 percent in June. Taking into account that the government lies about inflation, it is better to consider Shadow Government Statistics’ CPI (based on the 1980s CPI methodology), which was (as of July 13) about 17 percent. The government claims that this high CPI is due to Russia’s invasion of Ukraine (you could argue that, one of the reasons is the sanctions on Russia’s economy, which don’t do much to harm to the Russian government and hurts ordinary people both inside and outside Russia). But this is just an excuse for the government to not admit the blame. It is clear the war has an influence on the CPI, as it eliminates the supply of various goods and services, which ends up increasing prices. However, the CPI Read more at: https://www.zerohedge.com/personal-finance/inflation-makes-everybody-poorer-and-its-governments-fault |

|

Will They Roll Or Won’t They? Nomura Warns Of “Lumpy Gamma” Set To Expire This FridayDecisions have to be made… As Friday’s OpEx looms, Nomura Strategist Charlie McElligott notes that:

This all seems very premature according to the strategist:

But in the near-term…

|

|

Twitter Finally Suspends Person Who Threatened JK Rowling “You’re Next” Following Rushdie AttackAuthored by Steve Watson via Summit News, A person who threatened author JK Rowling with the words “you’re next” following the brutal stabbing attack on Salman Rushdie has finally been suspended from Twitter after the Harry Potter creator appealed to police for help.

Upon hearing of the attack on the Satanic Verses author by a muslim extremist, Rowling tweeted “Horrifying news. Feeling very sick right now. Let him be ok.”

An account under the name Meer Asif Aziz, who identifies in his Twitter bio as a “student, social activist, … Read more at: https://www.zerohedge.com/political/twitter-finally-suspends-person-who-threatened-jk-rowling-youre-next-following-rushdie |

|

Inflation drives fastest fall in real pay on recordWage growth is lagging behind soaring prices as households grapple with the rising living costs. Read more at: https://www.bbc.co.uk/news/business-62550069?at_medium=RSS&at_campaign=KARANGA |

|

Train and tube strikes: What are the dates and where is affected?Thousands of rail workers are striking in August in an ongoing row over pay, jobs and conditions. Read more at: https://www.bbc.co.uk/news/business-61634959?at_medium=RSS&at_campaign=KARANGA |

|

Ted Baker set for £211m takeover by Reebok’s ownerThe bid by Authentic Brands, which also owns Elvis Presley’s image rights, ends months of speculation. Read more at: https://www.bbc.co.uk/news/business-62562021?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty50 rises for 6th day, lacks margin of safety“Many opening upside gaps remained unfilled in the recent past, signaling a continuation of upmove. Nifty50 is now placed at the edge of the significant overhead resistance of the down-sloping trend line around 17,850-17,900 levels. This is a positive indication and suggests that the hurdle could be taken out on the upside soon,” Shetti said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-rises-for-6th-day-lacks-margin-of-safety/articleshow/93596000.cms |

|

Investors await stability on D-St to resume IPO partyEnding the 80-day drought of the primary markets, Syrma SGS Technology launched its IPO on Friday, but no other issue is lined up, with 28 companies already having Sebi’s nod to mop up Rs 45,000 crore via their initial offerings. Market participants said IPOs are being deferred due to various factors, including weakening Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/investors-await-stability-on-d-st-to-resume-ipo-party/articleshow/93592928.cms |

|

Chart Check: 30% in a month! This capital goods stock just gave a breakout from double bottom patternOn the weekly timeframe prices were in a strong uptrend from May 2020, Post September 2021 prices witnessed a pause in the trend. Prices are currently trading at its all-time high level which indicates that prices are in a strong momentum. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/chart-check-30-in-a-month-this-capital-goods-stock-just-gave-a-breakout-from-double-bottom-pattern/articleshow/93585857.cms |

|

In One Chart: Junk bonds sweep to a record summer rallyU.S. corporate bonds with speculative, or ‘junk,’ credit ratings join stocks in what has been a dramatic summer rally. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-710F-D839113CB6B4%7D&siteid=rss&rss=1 |

|

Should Social Security be eliminated as a federal entitlement program? Or would that ‘end the program as you know it’?Republican Sen. Ron Johnson wants to ‘turn everything into discretionary spending’ Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-710F-2B7E73F9BE63%7D&siteid=rss&rss=1 |

|

Futures Movers: U.S. oil prices end at lowest since January; natural-gas futures rally to a 14-year highOil futures decline on Tuesday, as weak economic data out of China weigh on the global economic outlook and developments tied to a draft Iran nuclear deal pull U.S. prices to their lowest settlement since late January. Natural-gas futures settle at their highest since 2008 on tight U.S. and European supplies. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-710F-8D40487E939A%7D&siteid=rss&rss=1 |