Summary Of the Markets Today:

- The Dow closed up 151 points or 0.45%,

- Nasdaq closed up 0.62%,

- S&P 500 up 0.40%,

- WTI crude oil settled at $89 down 3.25%,

- USD $106.53 up 0.82%,

- Gold $1778 down 0.45%,

- Bitcoin $23,996 down 1.24% – Session Low 23,937,

- 10-year U.S. Treasury 2.802% down 0.047%

Today’s Economic Releases:

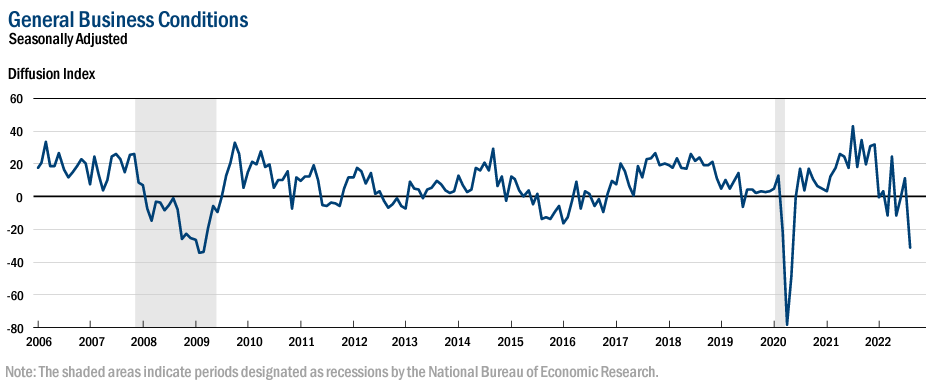

Business activity declined sharply in the August 2022 Empire State Manufacturing Survey. The headline general business conditions index plummeted forty-two points to -31.3. This is definitely a sign of a slowing economy, but one terrible month of data does not a recession make.

Elliott Wave International is bringing you a hands-on lesson in Elliott waves from an active trader who has moved around some serious money. Imre Gams is a multi-asset class trader, with thousands of trades logged across commodities, foreign exchange, equities, fixed income, and cryptocurrencies. As a professional trader, he’s helped manage a $1 billion portfolio using the Wave Principle. Free, watch Imre Gams’ illuminating presentation now >>

A summary of headlines we are reading today:

- What Does Chinas Dismal Economic Report Mean For Commodities?

- Walmart strikes exclusive streaming deal to give Paramount+ to Walmart+ subscribers

- Stores and suppliers clash over price hikes as shoppers hit by sticker shock

- Homebuilders say the U.S. is in a ‘housing recession’ as sentiment turns negative

- Investors flock to green energy funds as Congress passes climate bill. What to know as assets reach ‘new territory’

- U.S. freight shipping rates have likely peaked, according to new Cass Freight Index data, in another sign that inflation is easing

- The “Big Short” Michael Burry Liquidates Entire Portfolio, Holds Just One Stock At End Of Q2

- Futures Movers: Oil settles with a 3% loss as China growth worries dominate

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

U.S. Utilities Embark On Huge Spending Spree, But There’s A CatchElectric utility managers run in herds so to speak. Decades ago they decided to build nuclear-generating stations and almost every utility company that could do it. Financial meltdown followed caused by runaway cost escalations made even worse by rampant inflation. (Most of the plants eventually operated but the builder’s finances tanked and both equity and fixed income investors suffered.) Then the herd decided to diversify into varied industries: real estate, mining, paper, lending, and one company even processed spent Read more at: https://oilprice.com/Energy/Energy-General/US-Utilities-Embark-On-Huge-Spending-Spree-But-Theres-A-Catch.html |

|

California Might Keep One Nuclear Plant OpenAnticipating electricity supply shortages well into 2026, California Governor Gavin Newsom has proposed allowing the states last-remaining nuclear power plant to continue operations beyond its 2025 planned shutdown. The package of legislation, which included aggressive action against climate change, must be passed by the end of August or be sidelined, according to ArsTechnica. Governor Newsom is proposing that the last nuclear plant be allowed to operate for an additional five to 10 years beyond 2025, arguing that it would Read more at: https://oilprice.com/Latest-Energy-News/World-News/California-Might-Keep-One-Nuclear-Plant-Open.html |

|

What Does China’s Dismal Economic Report Mean For Commodities?US equity futures stocks were mixed and commodities from oil to iron ore tumbled as the latest round of terrible data from China further clouded the outlook for the global economy, an unexpected rate cut from the PBOC notwithstanding. Contracts on both the S&P 500 and Nasdaq 100 were lower by about 0.5% following gains last week that sent the tech-heavy index up 22% from June to the highest since April, suggesting a four-week stocks rally – the longest since November 2020 – may stall at least until the $13Bn in daily buying from systematic funds Read more at: https://oilprice.com/Energy/Energy-General/What-Does-Chinas-Dismal-Economic-Report-Mean-For-Commodities.html |

|

German Households Will Foot The Bill For New Gas TaxA new natural gas tax designed to keep importers afloat amid an energy crisis prompted by Russia’s invasion of Ukraine is set to cost German families, who will have to foot the bill for the tax, an extra $500 a year. Starting on October 1st and running through April 2024, according to Reuters, the new natural gas tax aims to help German utilities, most notably Uniper, recoup costs related to replacing supplies from Russia. The tax will reportedly cover approximately 90% of new costs faced by providers. On Monday, Trading Hub Europe, Read more at: https://oilprice.com/Latest-Energy-News/World-News/German-Households-Will-Foot-The-Bill-For-New-Gas-Tax.html |

|

Switzerland Considers Switching To Oil For Power PlantsAmid a looming energy crisis, Switzerland could turn to oil for electricity production in the winter in case of an emergency, Swiss Energy Minister Simonetta Sommaruga told local newspaper SonntagsZeitung this weekend. Sommaruga, who has backed more renewable energy use in Switzerland, admitted that the country might have to resort to using oil for electricity generation this winter as Europe faces low Russian natural gas supply, which could be cut even further or cut off altogether. Switzerland has an experimental power plant that has been used Read more at: https://oilprice.com/Latest-Energy-News/World-News/Switzerland-Considers-Switching-To-Oil-For-Power-Plants.html |

|

Irans Top Automaker Looks To Secure Russian InvestmentsIran’s leading automaker is seeking to grab a share of the Russian market after Western producers halted output or exited the market following sanctions. Iran Khodro CEO Mehdi Khatibi made the announcement on August 14 as he unveiled the company’s latest model — the crossover Rira. “We are going to pay special attention to the Russian market, and we are also thinking of partnering with Russian investors,” he said. “The Russian market, with its capacities, will be one of our important markets,” Khatibi added. Iran Khodro will begin exporting to Read more at: https://oilprice.com/Energy/Energy-General/Irans-Top-Automaker-Looks-To-Secure-Russian-Investments.html |

|

Walmart strikes exclusive streaming deal to give Paramount+ to Walmart+ subscribersWalmart has reached a deal with Paramount Global to offer its streaming service as a perk of the retailer’s subscription service, Walmart+. Read more at: https://www.cnbc.com/2022/08/15/walmart-strikes-streaming-deal-with-paramount.html |

|

Stores and suppliers clash over price hikes as shoppers hit by sticker shockSuppliers and retailers must walk a tightrope of keeping prices high enough to drive profits and low enough to attract and retain customers. Read more at: https://www.cnbc.com/2022/08/15/stores-suppliers-fight-over-price-hikes-as-inflation-squeezes-shoppers.html |

|

HBO Max cuts 14% of staff, or 70 employees, mainly in casting, acquisitions, and reality TV divisionsThe cuts are part of a larger Warner Bros. Discovery effort to reduce costs. Read more at: https://www.cnbc.com/2022/08/15/hbo-max-cuts-14percent-of-staff-mainly-in-casting-acquisitions-and-reality-tv.html |

|

Homebuilders say the U.S. is in a ‘housing recession’ as sentiment turns negativeThe National Association of Home Builders/Wells Fargo Housing Market Index has declined for eight straight months. Read more at: https://www.cnbc.com/2022/08/15/us-is-in-housing-recession-homebuilders-say.html |

|

Starbucks asks labor board to suspend mail-in ballot union elections, alleging misconduct in voting processStarbucks is asking the federal labor board to suspend all main-in ballot union elections nationwide. Read more at: https://www.cnbc.com/2022/08/15/starbucks-asks-labor-board-to-suspend-mail-in-ballot-union-elections-alleging-misconduct-in-voting-process.html |

|

Bill Gates’ company TerraPower raises $750 million for nuclear energy and medicine innovationTerraPower, the nuclear innovation company founded by Bill Gates, announced a $750 million funding raise co-led by Gates himself and SK Group from South Korea. Read more at: https://www.cnbc.com/2022/08/15/bill-gates-nuclear-company-terrapower-raises-750-million.html |

|

Business travel spending might not return to pre-pandemic levels until 2026Business travel spending won’t recover to pre-pandemic levels until 2026, two years later than previously expected, according to a new forecast. Read more at: https://www.cnbc.com/2022/08/15/business-travel-spending-might-not-return-to-pre-covid-levels-until-2026.html |

|

Drivers are paying an average $702 monthly for new cars: Here’s why that record high was ‘inevitable,’ says analystWith interest rates rising and the average transaction price on a new car just below $46,000, consumers may want to explore ways to keep costs down. Read more at: https://www.cnbc.com/2022/08/15/financing-pushes-monthly-cost-of-new-cars-to-record-high.html |

|

Investors flock to green energy funds as Congress passes climate bill. What to know as assets reach ‘new territory’There’s been a surge of interest in green energy funds as Congress allocates $369 billion for climate change funding. Here’s what investors need to know. Read more at: https://www.cnbc.com/2022/08/15/investors-flock-to-green-energy-funds-as-congress-passes-climate-bill.html |

|

Dollar General hit with nearly $1.3 million in fines for worker safety violations at Georgia storesDollar General was hit with $1.3 million in penalties after visits by federal workplace safety inspectors. Read more at: https://www.cnbc.com/2022/08/15/dollar-general-fined-nearly-1point3-million-for-worker-safety-violations.html |

|

U.S. freight shipping rates have likely peaked, according to new Cass Freight Index data, in another sign that inflation is easingU.S. freight rates are still up year over year, but declined in July, according to the Cass Freight Index, signaling a peak for one more inflation indicator. Read more at: https://www.cnbc.com/2022/08/15/us-freight-rates-have-peaked-another-signal-inflation-is-easing.html |

|

People are spending lots of money on makeup and beauty, and retailers are cashing inAs shoppers pull back in other discretionary categories, they have continued to splurge on fragrances, makeup, and more. Read more at: https://www.cnbc.com/2022/08/14/-the-lipstick-index-is-back-and-retailers-are-trying-to-cash-in-.html |

|

The Motor City is moving south as EVs change the automotive industryAutomakers are investing in towns across the American South. The new plants bring tax and workforce advantages as the industry moves toward EVs. Read more at: https://www.cnbc.com/2022/08/14/automakers-investing-in-the-south-as-evs-change-the-auto-industry.html |

|

The “Big Short” Michael Burry Liquidates Entire Portfolio, Holds Just One Stock At End Of Q2At least the Big Short puts his money where his mouth is… or rather pulls his money as the case may be. After blasting the latest stock market meltup as “silliness” and claiming – correctly – that the US economy is facing a gruesome crash in tweets which he then promptly deletes (conveniently, another account snapshots his tweets for posterity)…

… Michael Burry – who runs the smallish Scion Capital hedge fund – has done something few of his peers would consider doing: he has traded in line with his statement, and according to his just released 13F, the famed investor has liquidated his entire portfolio which as of March 31, had a notional value of just over $200 million (including $35 million in AAPL put notional), and instead held on to just one stock: private jail operator GEO Group, which he had previously invested in but had dumped all of his holdings at the end of 2021 only to sport a modest $3.3 million, or 501K share position, as of June 30. More notably, and as shown in the chart below, this was the only security he held on to … Read more at: https://www.zerohedge.com/markets/big-short-michael-burry-liquidates-entire-portfolio-holds-just-one-stock-end-q2 |

|

Top US Cruise Lines Cancel Sailings Amid Labor ShortageLike the airline industry, cruise ships are faced with a shortage of workers industrywide, resulting in a slew of cancellations through fall. Bloomberg reported that several top cruise lines, such as Carnival Corp. and Norwegian Cruise Line Holdings Ltd., are canceling sailings or reducing passenger capacity due to labor shortages. Carnival Corp.’s Princess Cruises canceled eleven sailings on its Diamond Princess for the fall season, indicating it couldn’t provide exceptional customer service amid labor shortages affecting almost every major cruise operator.

Another large cruise operator, Norwegian Cruise Line, reduced passenger capacity because of staffing woes.

Also, P&O Cruises, a Carnival division, said seven sailings earlier this summer were canceled due to st … Read more at: https://www.zerohedge.com/markets/crew-shortage-cruise-ships-leads-canceled-trips |

|

Why Is The UN Promoting A Kind Of Food Production Proven To Reduce Yields, Raise Prices, And Topple Governments?By Michael Shellenberger U.N. War On Fertilizer Began in Sri Lanka The United Nations Environment Programme (UNEP) describes itself as “the global authority that sets the environmental agenda… and serves as an authoritative advocate for the global environment.” Through its “Economics of Ecosystems and Biodiversity for Agriculture and Food” program launched in 2014, the UNEP advocates that nations “steer away from the prevailing focus on per hectare productivity.”

But today the world is in its worst food crisis since 2008. The number of people suffering acute food insecurity Read more at: https://www.zerohedge.com/markets/why-united-nations-promoting-kind-food-production-proven-reduce-yields-raise-prices-and |

|

Zimbabwe Hails Success Of Gold Coin Issuance – Lower Denominations ComingDeclaring its July launch of one-ounce gold coins a success, Zimbabwe’s central bank says it will begin issuing and selling coins in smaller gold denominations this fall. “Following the successful launch of the gold coins on 25 July 2022 and in response to public demand, the bank shall introduce and release into the market gold coins in units of a tenth ounce, quarter ounce and half an ounce The coins, which can be purchased from approved banks, were introduced to combat rampant inflation driven by locals exchanging Zimbabwean dollars for US dollars. In July, Zimbabwe’s price inflation rate was over 250%. The coins have “liquid asset status,” according to the Zimbabwe central bank. That is, they’re “capable of being easily converted to cash and [are] tradable locally and internationally…[and] may also be used for transactional purposes.” However, with one-ounce coins currently worth about $1,800, they’re out of reach for typical citizens. The average civil servant in the country makes just $2,600 a year, according to the BBC. The one-ounce coins are called “Mosi-oa-Tunya.” Th … Read more at: https://www.zerohedge.com/economics/zimbabwe-hails-success-gold-coin-issuance-lower-denominations-coming |

|

German households face levy of hundreds of pounds on gas billsThe surcharge will help energy companies cover the cost of replacing Russian supplies. Read more at: https://www.bbc.co.uk/news/business-62554464?at_medium=RSS&at_campaign=KARANGA |

|

Heathrow Airport extends cap on passengers to end of OctoberIt means a daily limit on departing passengers will now apply until after the October half-term holidays. Read more at: https://www.bbc.co.uk/news/business-62550600?at_medium=RSS&at_campaign=KARANGA |

|

‘Starbucks fired me for being three minutes late’Starbucks is fighting efforts by workers in the US to unionize. Is it winning? Read more at: https://www.bbc.co.uk/news/business-62426940?at_medium=RSS&at_campaign=KARANGA |

|

Weekly Option Strategy: Go for Nifty ladder spread to reduce time cost of buy Call OptionNifty futures open interest remained low near 1 crore shares and only marginal additions of long positions were seen last week. With subdued OI, a sharp move seems unlikely. On the other hand, banking space has seen significant long accumulation which has been the driver of recent up move in Nifty. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/weekly-option-strategy-go-for-nifty-ladder-spread-to-reduce-time-cost-of-buy-call-option/articleshow/93570105.cms |

|

NSE tracks insider trading rules compliance“NSE has sought a confirmation of compliance from companies-probably to ensure whether companies have been maintaining information in a duly compliant manner. The current move seems to be in line with Sebi’s objective of curbing insider trading and to review the compliance status of databases maintained by listed entities,” said Moin Ladha, partner at the law firm Khaitan & Co. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nse-tracks-insider-trading-rules-compliance/articleshow/93566101.cms |

|

Rakesh Jhunjhunwala and Radhakishan Damani, the Jai and Veeru of Dalal Street“One of the reasons why I say that life is God’s grace and elders blessing for all is because nobody introduced him to Radhakishan Damani. We met on the streets of the Bombay Stock Exchange,” he had said, adding that he treats him as his mentor because he has learnt a lot about markets as well as personal life from the DMart founder. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/rakesh-jhunjhunwala-and-radhakishan-damani-the-jai-and-veeru-of-dalal-street/articleshow/93567261.cms |

|

Next Avenue: ‘I don’t have many people visiting me’—You may be surprised to learn that your neighbor is going hungryMany middle-class and affluent people are unaware that some of their neighbors, including millions of older adults, grapple with food insecurity Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-710D-5F0FF7929B57%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil settles with a 3% loss as China growth worries dominateOil futures settle with a loss of around 3% on Monday as weak economic data from China raise fears that a slowing global economy will reduce demand for energy products. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-710E-D47622CA6F6F%7D&siteid=rss&rss=1 |

|

TaxWatch: Yes, the IRS is hiring criminal investigators empowered to use deadly force — but here’s some important contextThe IRS would be poised to get $80 billion over a decade if the Inflation Reduction Act passes. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-710D-3A58B334C4D6%7D&siteid=rss&rss=1 |