Summary Of the Markets Today:

- The Dow closed down 86 points or 0.26%,

- Nasdaq closed up 0.41%,

- S&P 500 down 0.08%,

- WTI crude oil settled at $88 down 2.90%,

- USD $105.93 down 0.42%,

- Gold $1793 down 0.54%,

- Bitcoin $22,525 down 3.84% – Session Low 22,469,

- 10-year U.S. Treasury 2.663% down 0.085%

Today’s Economic Releases:

Tomorrow the BLS will issue the employment report for July 2022. Small businesses across the country continue to raise wages to keep employees and fill a historically high level of open positions, according to NFIB’s monthly jobs report. Seasonally adjusted, 49% of all owners reported job openings they could not fill in the current period, down one point from June and down two points from May’s 48-year record high. NFIB Chief Economist Bill Dunkelberg says:

Hiring has never been harder for small business owners. The labor shortage remains frustrating for many small business owners as they continue to manage inflation and other economic headwinds. Owners are adjusting business operations where they can to help mitigate lost sales opportunities due to staffing shortages.

The U.S. monthly international trade deficit decreased in June 2022. Exports increased whilst imports decreased. In normal times, slowing imports suggests a slowing economy.

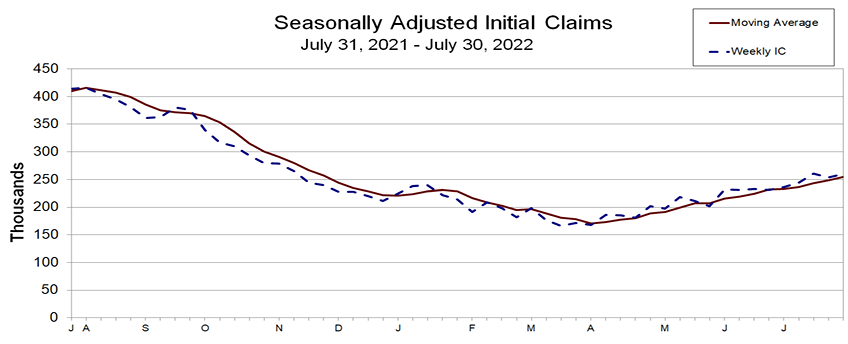

The 4-week moving average of initial unemployment insurance weekly claims increased from the previous week’s revised average – and continues to moderately increase.

U.S.-based employers announced 25,810 cuts in July, a 20.6% decrease from the 32,517 cuts announced in June. It is 36.3% higher than the 18,942 cuts announced in the same month last year, according to a report released Thursday from global outplacement and business and executive coaching firm Challenger, Gray & Christmas, Inc.

A summary of headlines we are reading today:

- Prices At The Pump Continue To Plunge, But Stronger Demand Could Halt The Trend

- Burger King parent says more customers are redeeming coupons and loyalty rewards

- Nikola’s revenue tops expectations on the delivery of 48 electric trucks

- Restaurant Brands International earnings top estimates, fueled by stronger Tim Hortons, Burger King sales

- Walmart lays off corporate employees after slashing forecast

- Indian investors hunt for value in US stocks amid rate hikes

- From food to fuel: What sparked the transformation in the sugar industry?

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

NATO Chief: Russia Must Not Win Its War In UkraineNATO Secretary-General Jens Stoltenberg says Russia must not be permitted to win in the war it launched against Ukraine, which has given rise to the most dangerous moment for Europe since World War II. Speaking in Norway on August 4, Stoltenberg said the alliance and its member countries may have to continue to support Ukraine with arms and other assistance for a long time in order to keep Russia from succeeding after it launched its unprovoked invasion of Ukraine on February 24. “It’s in our interest that this type of aggressive policy does not Read more at: https://oilprice.com/Energy/Energy-General/NATO-Chief-Russia-Must-Not-Win-Its-War-In-Ukraine.html |

|

UK Looks To Ramp Up Rare Earths ProductionRare earths have seen a surge in demand all around the world. After all, these minerals are key components of everything from solar panels to electric car batteries to defense equipment. And with Russia’s invasion of Ukraine disrupting much of the supply chain, the need for rare earths has become even more dire. A Rare Earths Plan of Action For the first time ever, the United Kingdom (UK) Government has released a Critical Minerals Strategy. The policy spells out the country’s game plan for developing a more Read more at: https://oilprice.com/Metals/Commodities/UK-Looks-To-Ramp-Up-Rare-Earths-Production.html |

|

Can The World Really Adapt To Climate Change?Climate change deniers have had to adjust their story in recent years as the effects of climate change have become more and more apparent to people who live all around the world. The first iteration was that climate change is good. It will make winters milder and it will help “fertilize” crops with additional carbon dioxide which all plants need to manufacture the food they live on. While the “greening” effect of rising carbon dioxide concentrations is real, there is a limit to how much it will help plants. As for milder winters, they may Read more at: https://oilprice.com/Energy/Energy-General/Can-The-World-Really-Adapt-To-Climate-Change.html |

|

Prices At The Pump Continue To Plunge, But Stronger Demand Could Halt The TrendThe national average for a gallon of gas at the pump in the United States fell to $4.139 on Thursday, the 51st consecutive day the country has seen a price drop for gasoline, according to AAA. The month-ago average for American drivers was $4.807, representing a 16% reduction at the pump over the past 30 days and a sustained break in the upward trend that saw prices peak at $5.02 on June 14th. Whether the downward price trend will continue will depend on the demand situation, says AAA, noting that the steady drop in gasoline prices Read more at: https://oilprice.com/Latest-Energy-News/World-News/Prices-At-The-Pump-Continue-To-Plunge-But-Stronger-Demand-Could-Halt-The-Trend.html |

|

G7 Pledges $600 Billion Investment To Support Emerging Market InfrastructureAmid rising inflation and debt levels in emerging markets, G7 leaders pledged in June to raise $600bn in private and public funds over five years to finance infrastructure in developing countries and counterbalance the influence of China’s sweeping Belt and Road Initiative (BRI). The Partnership for Global Infrastructure and Investment (PGII) seeks to address many of the long-term global challenges related to climate change, energy, and food security, ICT, health, and gender equity. Led by the US, which has pledged $200bn, or one-third of the Read more at: https://oilprice.com/Energy/Energy-General/G7-Pledges-600-Billion-Investment-To-Support-Emerging-Market-Infrastructure.html |

|

Permians Natural Gas Takeaway Capacity Set To RiseU.S. pipeline operators and developers have recently announced five natural gas pipeline projects which are expected to increase the takeaway capacity from the Permian basin to demand centers near the U.S. Gulf Coast, the Energy Information Administration (EIA) said on Thursday. Four newly announced projects and one optimization project under construction are set to boost takeaway capacity out of the Permian Basin by a combined 4.18 billion cubic feet per day (Bcf/d) over the next two years if they are completed as planned. Of the four newly announced Read more at: https://oilprice.com/Latest-Energy-News/World-News/Permians-Natural-Gas-Takeaway-Capacity-Set-To-Rise.html |

|

Investors are looking to Warner Bros Discovery for a streaming strategy — it already gave us a big hintInvestors got a big hint into Warner Bros. Discovery’s strategy earlier this week when it announced it would shelve its straight-to-streaming DC film “Batgirl.” Read more at: https://www.cnbc.com/2022/08/04/warner-bros-discovery-streaming-strategy-in-focus-for-q2-earnings.html |

|

Burger King parent says more customers are redeeming coupons and loyalty rewardsMore customers at Burger King and its sister brands are redeeming coupons and loyalty program rewards as inflation pushes menu prices higher. Read more at: https://www.cnbc.com/2022/08/04/burger-king-parent-says-more-customers-are-redeeming-coupons-and-loyalty-rewards.html |

|

Altice USA targeting private equity infrastructure funds in early Suddenlink sale negotiations, sources sayAltice may look to draft off potential sale of WideOpenWest to get a higher valuation for Suddenlink cable assets, sources say. Read more at: https://www.cnbc.com/2022/08/04/altice-usa-targeting-private-equity-infrastructure-funds-in-early-suddenlink-sale-negotiations-sources-say.html |

|

Lordstown Motors expects limited production and deliveries of electric pickup in 2022Lordstown said production of its Endurance electric pickup will be slow and largely reliant on capital availability. Read more at: https://www.cnbc.com/2022/08/04/lordstown-motors-ride-q2-2022-earnings-and-production.html |

|

Nikola’s revenue tops expectations on the delivery of 48 electric trucksNikola’s second-quarter revenue beat Wall Street’s expectations as it shipped 48 trucks and confirmed its full-year guidance Read more at: https://www.cnbc.com/2022/08/04/nikola-nkla-q2-2022-earnings.html |

|

Restaurant Brands International earnings top estimates, fueled by stronger Tim Hortons, Burger King salesRestaurant Brands International’s global same-store sales increased 9% in the quarter, fueled by the performance of Tim Hortons and Burger King. Read more at: https://www.cnbc.com/2022/08/04/restaurant-brands-international-qsr-q2-2022-earnings.html |

|

Biden administration declares the monkeypox outbreak a public health emergency in the U.S.The U.S. has confirmed more than 6,000 monkeypox cases over the past two months, more than any country in the world. Read more at: https://www.cnbc.com/2022/08/04/biden-administration-will-declare-monkeypox-outbreak-a-public-health-emergency-in-the-us.html |

|

We’re adding four stocks to our Bullpen, including Starbucks and AirbnbAs the baseball metaphor suggests, the Bullpen consists of stocks in reserve that we might consider buying and adding to our portfolio. Read more at: https://www.cnbc.com/2022/08/04/investing-club-were-adding-four-stocks-to-our-bullpen-including-starbucks-and-airbnb.html |

|

Stocks making the biggest moves midday: Coinbase, AMTD Digital, Restaurant Brands, Alibaba, and moreThese are the stocks posting the largest moves midday. Read more at: https://www.cnbc.com/2022/08/04/stocks-making-the-biggest-moves-midday-coinbase-amtd-digital-restaurant-brands-alibaba-and-more.html |

|

Walmart lays off corporate employees after slashing forecastThe layoffs come about a week after the company slashed its profit outlook and warned that consumers had pulled back on discretionary spending due to inflation. Read more at: https://www.cnbc.com/2022/08/03/walmart-lays-off-corporate-employees-after-slashing-forecast.html |

|

Transportation Department proposes stricter rules for airline refunds after complaints surgeThe DOT logged a surge in complaints about airline refunds since the Covid-19 pandemic began. Read more at: https://www.cnbc.com/2022/08/03/transportation-department-proposes-stricter-rules-for-airline-refunds-after-complaints-surge.html |

|

EV maker Lucid again cuts production targets as logistics challenges cripple outputSupply chain and logistics challenges mean demand for Lucid’s EVs far outpaces its output. Read more at: https://www.cnbc.com/2022/08/03/lucid-lcid-q2-2022-earnings-and-production-forecast.html |

|

Mickelson, DeChambeau, and other LIV golfers file antitrust lawsuit against PGA Tour over suspensionsEleven LIV golfers filed an antitrust lawsuit against the PGA Tour Wednesday after being suspended from the tour. Read more at: https://www.cnbc.com/2022/08/03/mickelson-liv-golfers-sue-pga-tour-over-suspensions.html |

|

Bank of England warns the UK will fall into recession this yearThe Bank of England raises rates as it warns inflation will rise over 13% and the UK faces a long recession. Read more at: https://www.bbc.co.uk/news/business-62405037?at_medium=RSS&at_campaign=KARANGA |

|

UK interest rates: How does a rise affect me?Interest rates are one of the main tools used to keep the UK economy growing steadily. Read more at: https://www.bbc.co.uk/news/business-57764601?at_medium=RSS&at_campaign=KARANGA |

|

‘Interest rates rise means I owe £250 a month more on loans’Four people explain the change in their circumstances due to the rise in interest rates. Read more at: https://www.bbc.co.uk/news/business-62408868?at_medium=RSS&at_campaign=KARANGA |

|

Indian investors hunt for value in US stocks amid rate hikesMarket participants remain wary of high rates of inflation and are expecting further rate hikes by the US Federal Reserve, which will push up the cost of borrowing and dampen corporate investments. Despite the upbeat performance, analysts tracking the global markets remain cautious over stocks over the management commentary and brokerage review over the select stocks. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/indian-investors-hunt-for-value-in-us-stocks-amid-rate-hikes/articleshow/93353696.cms |

|

From food to fuel: What sparked the transformation in sugar industry?The sugar sector is undergoing a massive revolution and has emerged as a powerful driver of clean energy, accelerating India’s transition towards renewable energy. The industry, which was mainly perceived to be within the food ecosystem, is now also considered one of the core drivers of the clean energy initiative. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/from-food-to-fuel-what-sparked-the-transformation-in-sugar-industry/articleshow/93345544.cms |

|

CDSL becomes the first depository to have 7 crore active Demat accountsCDSL, facilitates the holding and transacting in securities in the electronic form and facilitates the settlement of trades on stock exchanges. The Demat accounts are serviced by CDSL’s more than 580 depository participants (DPs) from over 20,700 locations.“Our goal is to empower every investor to be self-sufficient – an Atmanirbhar Niveshak through our digital services,” he said in a statement. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/cdsl-becomes-first-depository-to-have-7-crore-active-demat-accounts/articleshow/93353855.cms |