Summary Of the Markets Today:

- The Dow closed up 436 points or 1.37%,

- Nasdaq closed up 4.06%,

- S&P 500 up 2.61%,

- WTI crude oil settled at 98 up 3.07%,

- USD $106.85 down 0.33%,

- Gold $1734 down 0.03%,

- Bitcoin $22,824 up 9.11% – Session Low 20,855,

- 10-year U.S. Treasury 2.787% up 0.02%

Today’s Economic Releases:

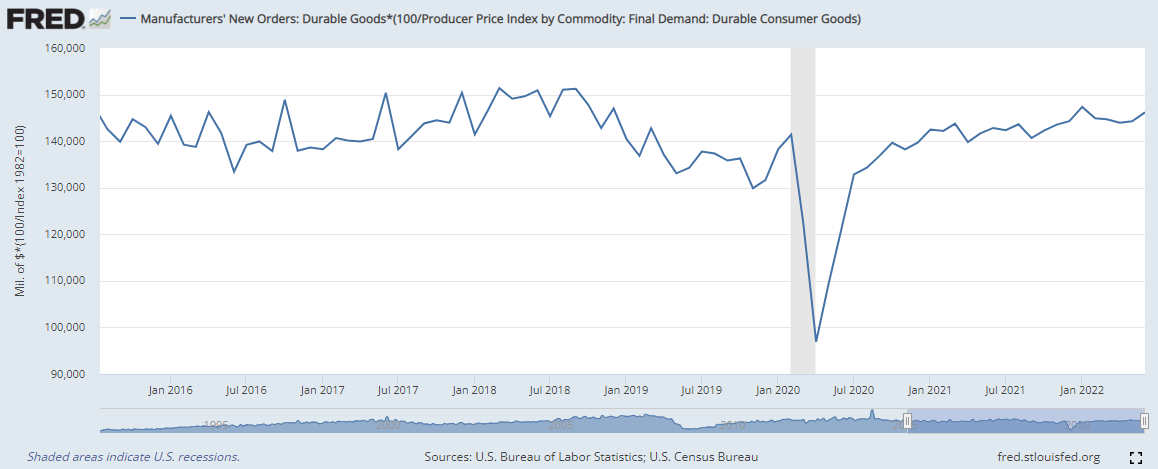

Headlines say new orders for manufactured durable goods in June 2022 increased 1.9% – these numbers are not adjusted for inflation. The good news is that inflation-adjusted durable good has been marginally growing as the inflation-adjusted graph below shows.

The Federal Reserve’s FOMC raised the federal funds rate 75 basis points. This is the fourth rate hike in five months. Their statement reads in part:

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 2-1/4 to 2-1/2 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that were issued in May. The Committee is strongly committed to returning inflation to its 2 percent objective.

Pending home sales (sales based on contract signings) have now shrunk 20.0% year-over-year. NAR Chief Economist Lawrence Yun says:

Contract signings to buy a home will keep tumbling down as long as mortgage rates keep climbing, as has happened this year to date, There are indications that mortgage rates may be topping or very close to a cyclical high in July. If so, pending contracts should also begin to stabilize.

There was an interesting tidbit in the pending home sales release:

According to NAR, buying a home in June was about 80% more expensive than in June 2019. Nearly a quarter of buyers who purchased a home three years ago would be unable to do so now because they no longer earn the qualifying income to buy a median-priced home today.

A summary of headlines we are reading today:

- Oil Prices Rise Following Fed Rate Hike

- McDonald’s and Chipotle say customers are trading down, visiting less often as inflation hits budgets

- Pending home sales fell 20% in June versus a year earlier as mortgage rates soared

- Mortgage demand declines further, even as interest rates drop a bit

- A Storm Of Indicators Show The US Consumer Is Tapped Out

- US makes huge interest rate rise to tame soaring prices

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Gold-To-Silver Ratio Rises To Highest Level Since 1990The United States entered a recession in 1990, which lasted 8 months through March 1991. The end of that recession marked the peak of the gold/silver ratio and as we await Thursday’s Q2 GDP print to confirm a technical recession, the gold/silver ratio is back up at those levels – ex-COVID’s gold spike, this is ‘cheapest’ that Silver has been relative to Gold since February 1991…In simple terms, as SchiffGold.com recently noted, historically, silver is extremely underpriced compared to gold. At some point, you should expect that gap to close. Read more at: https://oilprice.com/Energy/Energy-General/Gold-To-Silver-Ratio-Rises-To-Highest-Level-Since-1990.html |

|

UK Energy Bills To Soar More Than ExpectedEnergy bills in the UK are set to surge more than expected this winter, with many households struggling to be able to pay them, after Russia further slashed gas deliveries to Europe, sending gas and energy prices for the winter and for next year soaring, UK-based consultancy BFY Group said on Wednesday. Earlier this week, Russia said that gas supply via Nord Stream the main link between Russia and Germany would be cut to just 20% of the pipeline’s capacity, days after Gazprom restarted the pipeline at 40% capacity after regular Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Energy-Bills-To-Soar-More-Than-Expected.html |

|

Sri Lanka Is Facing An Energy CatastropheAs Sri Lanka faces its worst economic crisis in seven decades, an energy catastrophe is looming for the country. Without the rapid formation of a new government that can introduce an interim budget and financial reforms, as well as financial support from neighboring countries, the country could soon run out of fuel and other essentials. There are well-founded fears that petrol stocks will soon run dry, with Minister for Power and Energy Kanchana Wijesekera announcing earlier this month that Sri Lanka had enough petrol left for less than a Read more at: https://oilprice.com/Energy/Energy-General/Sri-Lanka-Is-Facing-An-Energy-Catastrophe.html |

|

Oil Prices Rise Following Fed Rate HikeOil prices fell slightly on Wednesday following the 2:30 p.m. EST Federal Reserves announcement of another hike in interest rates by three-quarters of a percentage point for the second time in a row, while Wall Street continued to flounder in predictions as to what comes after this, while oil prices continue to climb. At 2:38 p.m. ET, WTI was trading up 2.19% on the day at $97.06 per barrel, with Brent crude trading up 2.03% on the day at $106.50. On June 15th, the Fed made its largest rate hike since 1994, raising rates by 75 basis points Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Erase-Gains-As-US-Fed-Raises-Rates.html |

|

This Tiny Island State Shows How Powerful Microgrids Can BeThree years after Hurricane Dorian slammed into the Bahamas, some of the island nation’s cities are still running entirely on generators. When the Category 5 storm crashed into the low-lying islands in 2019, it destroyed power substations and leveled essential power infrastructure like utility poles in a number of small islands. Much of this destruction looks the same now as it did then. According to CBS, Total damage and loss from Dorian is estimated at $3.4 billion [USD]. As of 2020, the gross domestic product for the Read more at: https://oilprice.com/Energy/Energy-General/This-Tiny-Island-State-Shows-How-Powerful-Microgrids-Can-Be.html |

|

Battery Recycling: The Next Big Challenge For The EV BoomWith the surge in demand for electric vehicles, the need for EV batteries and battery metals such as cobalt and lithium has risen dramatically. However, can the US (along with other nations) keep up with this rising battery metal demand while maintaining recycling efficiency? It’s a good question, but it doesn’t have a simple answer. Battery Metals Pose a Serious Health Hazard if Not Handled Properly Lithium-ion batteries are used in most electric vehicles. As the name implies, these are derived from metals like lithium and cobalt. Read more at: https://oilprice.com/Energy/Energy-General/Battery-Recycling-The-Next-Big-Challenge-For-The-EV-Boom.html |

|

Ford Motor will report its second-quarter results after the bellFord is set to report after the bell. Here’s what Wall Street is expecting. Read more at: https://www.cnbc.com/2022/07/27/ford-f-earnings-q2-2022.html |

|

McDonald’s and Chipotle say customers are trading down, visiting less often as inflation hits budgetsMcDonald’s and Chipotle Mexican Grill are seeing customers trade down and visit less often as inflation pressures their budgets. Read more at: https://www.cnbc.com/2022/07/27/mcdonalds-and-chipotle-say-customers-are-trading-down-visiting-less-often-as-inflation-hits-budgets.html |

|

‘Jeopardy!’ locks in hosting deals for Mayim Bialik and Ken Jennings“Jeopardy!” has signed on Mayim Bialik and Ken Jennings to be hosts of the show moving forward. Read more at: https://www.cnbc.com/2022/07/27/jeopardy-locks-in-hosting-deals-for-mayim-bialik-and-ken-jennings.html |

|

Gun CEOs call shootings ‘local problems’ and defend ‘inanimate’ weaponsMajor gun manufacturers have made over $1 billion in the last decade selling assault-style weapons, according to the House Oversight panel. Read more at: https://www.cnbc.com/2022/07/27/gun-companies-made-1-billion-off-assault-weapons-over-10-years-house-panel-says.html |

|

The space economy grew at the fastest rate in years to $469 billion in 2021, report saysThe global space economy grew last year at the fastest annual rate since 2014, according to a report by the Space Foundation. Read more at: https://www.cnbc.com/2022/07/27/space-economy-grew-at-fastest-rate-in-years-in-2021-report.html |

|

Vox Media cuts staff, slows down hiring as recession fears growVox Media is laying off 39 employees in what may be a sign media companies are feeling economic pressures Read more at: https://www.cnbc.com/2022/07/27/vox-media-cuts-staff-slows-down-hiring-as-recession-fears-grow.html |

|

Spirit shareholder vote finally underway on Frontier deal clouded by rival JetBlue bidSpirit Airlines shareholders are voting on a planned merger with Frontier Airlines. Read more at: https://www.cnbc.com/2022/07/27/spirit-shareholder-vote-frontier-deal-amid-jetblue-bid.html |

|

Here’s how advisors are shifting clients’ portfolios as the Federal Reserve again hikes rates by 75 basis pointsThe Federal Reserve on Wednesday raised its interest rates again, by another 75 basis points, to combat soaring inflation. Here’s how portfolios are shifting. Read more at: https://www.cnbc.com/2022/07/27/how-portfolios-are-shifting-as-the-federal-reserve-hikes-rates-again.html |

|

Boeing sticks to 2022 cash flow forecast, prepares for Dreamliner deliveries to resumeBoeing and Airbus have benefitted from a rebound in travel but supply chain and labor constraints are hindering output. Read more at: https://www.cnbc.com/2022/07/27/boeing-ba-2q-2022-earnings.html |

|

Pending home sales fell 20% in June versus a year earlier as mortgage rates soaredThe decline in sales coincided with mortgage rates soaring to over 6% last month. Read more at: https://www.cnbc.com/2022/07/27/pending-home-sales-fell-20percent-in-june-versus-a-year-earlier-as-mortgage-rates-soared.html |

|

Boeing takes additional charge for Starliner astronaut capsule, bringing cost overruns to near $700 millionBoeing disclosed a charge of $93 million in the second quarter for its Starliner astronaut capsule program. Read more at: https://www.cnbc.com/2022/07/27/boeing-starliner-astronaut-capsule-charges-near-700-million.html |

|

Mortgage demand declines further, even as interest rates drop a bitMortgage demand continues to drop, even though interest rates have come down slightly from recent highs. Read more at: https://www.cnbc.com/2022/07/27/mortgage-demand-declines-further-even-as-interest-rates-drop-a-bit.html |

|

WHO Recommends Gay And Bisexual Men Limit Sexual Partners, Anonymous Sex, To Reduce Monkeypox SpreadWHO Recommends Gay And Bisexual Men Limit Sexual Partners, Anonymous Sex, To Reduce Monkeypox SpreadThe World Health Organization on Wednesday recommended that gay and bisexual men cut back on the number of sexual partners to reduce the spread of monkeypox, after the WHO’s monkeypox expert, Rosamund Lewis, noted that men who have sex with men are the group with the highest risk of infection right now, CNBC reports.

|

|

Your Last Minute FOMC Preview: Here Is What The Fed Will Say And How Traders May ReactWe previously laid out not one but two lengthy FOMC previews (here and here), so for those who got the TL/DR vibes here today’s final quick and dirty snapshot of what the Fed will say and what the market will do in response.

First, while a 75bps rate hike is assured (the Fed did not have Nick Timiraos prepare markets for either 100bps or 50bps today), there will be no summary of economic projections at this FOMC, and thus the Fed’s statement will be much more closely parsed for its intent on the evolving rate trajectory. Here is what traders will be looking out for, according to Bloomberg’s Ven Ram: Acknowledging signs of weakness: The Fed is likely to tweak the language at the top to concede that the economy is showing signs of stress. Watc … Read more at: https://www.zerohedge.com/markets/your-last-minute-fomc-preview-here-what-fed-will-say-and-how-traders-may-react |

|

Ukraine Government Asks US To Provide ‘Gas Lend-Lease’Ukraine Government Asks US To Provide ‘Gas Lend-Lease’Authored by Dave DeCamp via AntiWar.com, The Ukrainian government on Tuesday asked Washington to provide Kyiv with a “lend-lease” program to import natural gas from the US to ensure Ukraine has enough gas for heating this winter, Prime Minister Denis Shmyhal indicated. The idea is for the US to provide gas to Ukraine and collect payment at a later time, similar to the World War II-era lend-lease program that was revived this year to facilitate military aid to Ukraine.

Read more at: https://www.zerohedge.com/geopolitical/ukraine-government-asks-us-provide-gas-lend-lease |

|

A Storm Of Indicators Show The US Consumer Is Tapped OutThe US economy is a 70% retail and service economy, which means it is entirely reliant on continued growth in domestic consumption in order to maintain all other elements of the system. With manufacturing only a small part of overall employment (8%) and agriculture also limited (10%), our country is overly dependent on spending habits and ultimately consumer debt. If we produced more goods domestically and exported more overseas then stagflation might not be as big a concern. However, as it stands now the stability of the entire machine rests on people’s faith in the economy and their willingness to continue spending in the hopes that a return to normalcy is “right around the corner.” In order to measure when our system will break, it’s important to track the health of the average consumer as well as their concerns for the future. Sadly, as soon as Americans stop spending and start saving, our economy goes down. That is the way the system has been designed. The mainstream media was quick to jump on the news this month of “increased” retail spending – overall retail sales climbed 1% for June. Of course, what they don’t mention is that official inflation is at 9.1% and REAL inflation is closer to 17%. OF COURSE, retail sales are climbing, everything costs far more than it did a year ago. But if we look at this data closer some alarms should go off. Why did retail only climb 1% when official inflation is at 9%? Sale … Read more at: https://www.zerohedge.com/economics/storm-indicators-show-us-consumer-tapped-out |

|

Train strikes: Drivers to walk out over pay on 13 AugustDrivers at nine rail companies will walk out again next month, the union Aslef says. Read more at: https://www.bbc.co.uk/news/business-62325025?at_medium=RSS&at_campaign=KARANGA |

|

US makes huge interest rate rise to tame soaring pricesThe Federal Reserve is increasing interest rates for a fourth time as it tries to control inflation. Read more at: https://www.bbc.co.uk/news/business-62310354?at_medium=RSS&at_campaign=KARANGA |

|

Gas prices soar as Russia cuts German supplyThe Nord Stream 1 pipeline is now operating at just a fifth of its usual capacity. Read more at: https://www.bbc.co.uk/news/business-62318376?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty50 forms bullish candle, can test recent high“This indicates the possible completion of a recent downward correction in the market. The positive sequence of higher tops and bottoms is intact, and Wednesday’s low of 16,438 could now be considered as a new higher bottom of the sequence. Now, one may expect the Nifty50 to move up and challenge the recent higher top of 16,752 shortly,” Shetti said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-forms-bullish-candle-can-test-recent-high/articleshow/93166266.cms |

|

After Jefferies, Credit Suisse expects 100% rally on Zomato! Should you buy this dip?Credit Suisse has maintained its ‘outperform’ rating on the stock, with a target of Rs 90. The brokerage said Zomato is on a clear road to profitability growth. It said that existing core customers would drive the food business. CS said in a duopolistic industry, the core user base will drive margins. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/after-jefferies-credit-suisse-expects-100-rally-on-zomato-should-you-buy-this-dip/articleshow/93158031.cms |

|

This Dolly Khanna stock is down 24% in 4 days but analysts see up to 80% upsideThe scrip on Wednesday traded at Rs 533.65, up 0.88 percent, but only after falling 24 percent in the previous four sessions. Brokerage Prabhudas Lilladher said healthy revenue growth was offset by adverse margins. Seasoned investor Dolly Khanna owned 1,081,526 shares or 1.2 percent stake in this company as of June 30. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/this-dolly-khanna-stock-is-down-24-in-4-days-but-analysts-see-up-to-80-upside/articleshow/93157741.cms |

|

You may become a family caregiver soon, and not even know itThe job isn’t always a planned one. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7103-38E4A27D9D10%7D&siteid=rss&rss=1 |

|

The Margin: You just won the Mega Millions $1 billion jackpot — what should you do next?The 5 things to do if you win the lottery, like the current Mega Millions jackpot, according to a sudden wealth adviser Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7103-2FE99092209F%7D&siteid=rss&rss=1 |

|

The Margin: Where the Mega Millions $1 billion jackpot ranks in the 10 biggest lottery prizes of all timeThe biggest prize — $1.586 billion — was split by three Powerball winners in 2016. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7103-134FCD8464B5%7D&siteid=rss&rss=1 |

Illustration via opindia.comAround 99% of cases are among men, while 95% of those are men who have sex with men, Lewis added.

Illustration via opindia.comAround 99% of cases are among men, while 95% of those are men who have sex with men, Lewis added.

Via Reuters”Preparation for the most difficult winter in our history continues, and in this preparation we are looking for all possible tools to be ready for any scenario,” Shmyh …

Via Reuters”Preparation for the most difficult winter in our history continues, and in this preparation we are looking for all possible tools to be ready for any scenario,” Shmyh …