Summary Of the Markets Today:

- The Dow closed down 229 points or 0.71%,

- Nasdaq closed down 1.87%,

- S&P 500 down 1.15%,

- WTI crude oil settled at $95 down 1.51%,

- USD $107.18 up 0.65%,

- Gold $1716 down 0.186%,

- Bitcoin $20,828 down 5.52% – Session Low 20,760,

- 10-year U.S. Treasury 2.8% down 0.02%

Today’s Economic Releases:

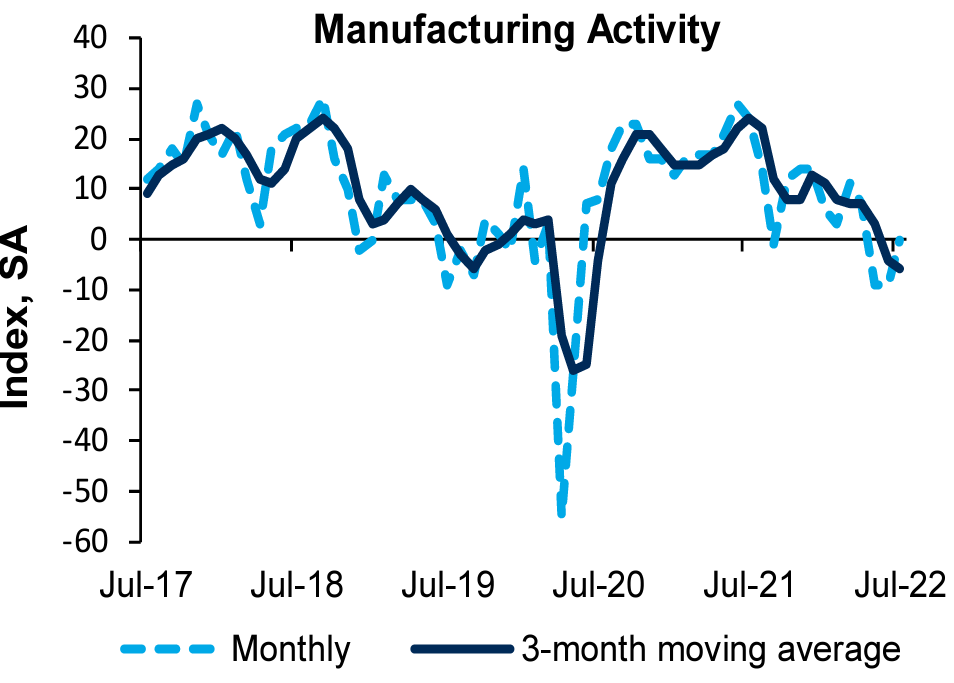

The Richmond Fed’s manufacturing index rose from −9 in June to 0 in July 2022.

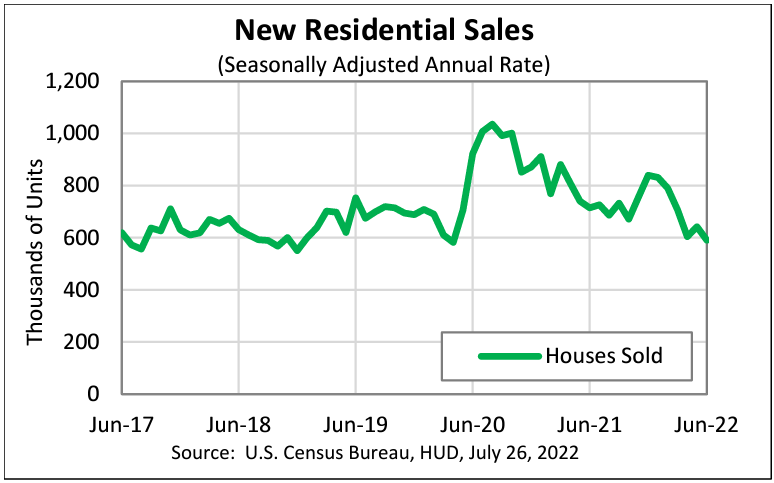

New residential sales for June 2022 was down 8.1% month-over-month and 17.4% year-over-year. The median and average sales prices continue to increase.

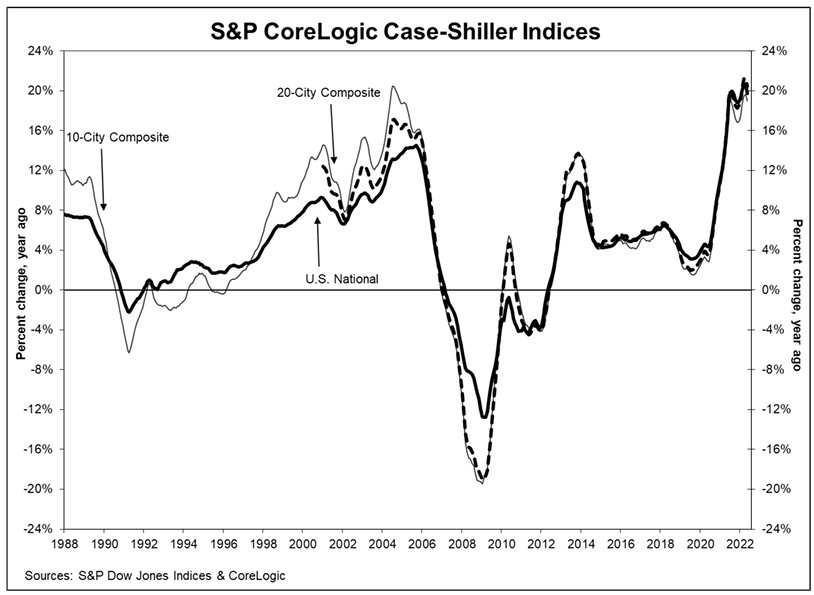

S&P Corelogic Case-Shiller Index Reports Annual Home Price Gain Of 19.7% year-over-year In May 2022. – marginally down from the 20.6% reported for April. CoreLogic Deputy Chief Economist Selma Hepp states:

Signs of slowing home buyer demand are spreading wider across markets. In May, the CoreLogic S&P Case-Shiller Index posted a second month of slowing growth, up 19.7%, but down from 20.6% peak in March and April. Nevertheless, some markets continue to heat up, particularly in Florida, but also Chicago, Boston and New York – marking search for deals in regions that suffered outmigration during the pandemic. Bifurcation in housing markets is also reflected in the ongoing competition for attractive properties that continue to have multiple offers and sell over the asking price, compared to those that are now seeing price reductions and remain unsold. But, given the continued pressure on properties that sell, home price growth is forecasted to remain elevated and in the mid-teens through the end of the year.

The Conference Board’s Consumer Confidence declined again in July 2022. Lynn Franco, Senior Director of Economic Indicators at The Conference Board stated:

Consumer confidence fell for a third consecutive month in July. The decrease was driven primarily by a decline in the Present Situation Index—a sign growth has slowed at the start of Q3. The Expectations Index held relatively steady, but remained well below a reading of 80, suggesting recession risks persist. Concerns about inflation—rising gas and food prices, in particular—continued to weigh on consumers. As the Fed raises interest rates to rein in inflation, purchasing intentions for cars, homes, and major appliances all pulled back further in July. Looking ahead, inflation and additional rate hikes are likely to continue posing strong headwinds for consumer spending and economic growth over the next six months.

A summary of headlines we are reading today:

- Oil Prices Slide As IMF Sees Global Economy Teetering On The Brink

- Russia To Leave ISS As Space Shakeup Continues

- Walmart’s slashed profit outlook sends a warning about the state of the American consumer

- General Motors falls short of Wall Street expectations as supply chain challenges dent profit

- Home price growth slowed for the second straight month in May, S&P Case-Shiller says

- Stocks, Crypto, & Yield Curve Tumble As ‘Strong Consumer’ Narrative Crushed

- Market Snapshot: Dow drops nearly 250 points as worries about big tech earnings weigh on stocks

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Aluminum Prices Plummet Despite Ongoing Supply DisruptionsA curious tug of war continues in the Aluminum industry. It remains focused on likely demand destruction due to recessionary forces, generally blamed on central banks’ rapid raising of interest rates. Of course, we’ve all watched base metals come off sharply since the end of Q1, and Aluminum has been no exception. Indeed, after peaking at more than $4,000 per ton in late March, Aluminum prices now hover in a range of $2350 to $2450. On the other hand, supply shows increasingly showing signs of distress. This remains most noticeable Read more at: https://oilprice.com/Metals/Commodities/Aluminum-Prices-Plummet-Despite-Ongoing-Supply-Disruptions.html |

|

Rosneft Begins Arctic Oil Terminal ConstructionRussia’s oil giant Rosneft on Tuesday said it had launched construction works on an oil terminal for its Vostok Oil project in the Arctic, expecting the port to become the country’s biggest oil terminal by the end of this decade. Vostok Oil, in Russia’s Far East, comprises several groups of oil fields holding an estimated 44 billion barrels of oil. Initial work on the projectbeganin January 2021. The total cost of its development has been estimated at $170 billion over the lifetime of the fields. The Vostok Read more at: https://oilprice.com/Latest-Energy-News/World-News/Rosneft-Begins-Arctic-Oil-Terminal-Construction.html |

|

White House Issues Notice Of Sale For 20 Million Barrels Of Oil From SPRThe Biden Administration has announced that it is releasing the next Notice of Sale for crude oil from the nation’s Strategic Petroleum Reserve (SPR) for 20 million barrels. As part of the Tuesday announcement, the White House cited a new analysis from the Department of Treasury that estimates that the previous SPR releases that the White House pegs at 125 million barrels along with the releases of crude oil from foreign partners as well as reduced gasoline prices by up to about 40 cents per gallon. Read more at: https://oilprice.com/Latest-Energy-News/World-News/White-House-Issues-Notice-Of-Sale-For-20-Million-Barrels-Of-Oil-From-SPR.html |

|

Oil Prices Slide As IMF Sees Global Economy Teetering On The BrinkCrude oil prices fell on Tuesday as the International Monetary Fund warned that high inflation and the Russian-Ukraine war could send the global economy to the brink of a recession. In an update to its World Economic Outlook, the IMF also slashed global GDP growth forecasts for this year, to 3.2%, as GDP already contracted in Q2. The new estimate is down from its forecast of 3.6% made in April. At 1:36 p.m. ET, WTI was trading at $95.73, down $0.97 (-1.00%) on the day. Brent crude slipped to $104.80, down $0.31 (-0.29%) on the day, with a wide Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Prices-Slide-As-IMF-Sees-Global-Economy-Teetering-On-The-Brink.html |

|

IMF: Global Economy Heading Towards Worst Slowdown In 50 YearsThe global economy could be hurtling toward one of the sharpest slowdowns in recent memory, the International Monetary Fund (IMF) warned today. A full shut-off of Russian gas flows to Europe and more upside inflation shocks would plunge growth into among the worst brackets since the 1970s. The global economic watchdog said if existing headwinds intensify, the expansion will drop to 2.6 percent and two percent in 2023 respectively, putting growth in the bottom 10 percent of outcomes since 1970. In the organization’s most likely scenario, Read more at: https://oilprice.com/Energy/Energy-General/IMF-Global-Economy-Heading-Towards-Worst-Slowdown-In-50-Years.html |

|

Russia To Leave ISS As Space Shakeup ContinuesRussia says it will quit the International Space Station (ISS) after 2024 to focus on building its own project in outer space at a time of heightened tensions between the Kremlin and the West over Moscow’s invasion of Ukraine. Speaking at a meeting with Russian President Vladimir Putin on July 26, Yuri Borisov, who Putin appointed earlier this month to head Roscosmos, said Moscow will fulfill all of its obligations at the ISS before leaving. “The decision to leave the station after 2024 has been made,” Borisov said. The announcement comes a week Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-To-Leave-ISS-As-Space-Shakeup-Continues.html |

|

Chipotle Mexican Grill is about to report earnings. Here’s what to expectChipotle shares have fallen 25% this year, dragging its market value down to $37.16 billion. Read more at: https://www.cnbc.com/2022/07/26/chipotle-mexican-grill-cmg-q2-2022-earnings.html |

|

Walmart’s slashed profit outlook sends a warning about the state of the American consumerShares of retailers including Macy’s and Amazon were down after Walmart slashed its profit forecast, warning that surging prices are squeezing consumers. Read more at: https://www.cnbc.com/2022/07/26/walmarts-slashed-profit-outlook-sends-warning-about-state-of-the-american-consumer.html |

|

WWE at crossroads as Vince McMahon’s retirement and scandals heighten sale speculationWWE can either move forward with sale discussions or take the business in new creative directions as Vince McMahon retires from his executive roles. Read more at: https://www.cnbc.com/2022/07/26/vince-mcmahon-scandals-retirement-heighten-wwe-sale-speculation.html |

|

Homebuilders are boosting incentives as they suddenly struggle to sell homesThe nation’s homebuilders are now experiencing a slowdown in sales and an increase in supply. Read more at: https://www.cnbc.com/2022/07/26/homebuilders-boost-incentives-as-they-suddenly-struggle-to-sell-homes.html |

|

McDonald’s says higher prices, value items helped boost U.S. salesShares of McDonald’s have fallen more than 6% this year, dragging its market value down to $185.2 billion. Read more at: https://www.cnbc.com/2022/07/26/mcdonalds-mcd-q2-2022-earnings-.html |

|

Coca-Cola’s earnings top expectations as sales volume recovers from pandemicCoke reported quarterly earnings and revenue Tuesday that exceeded analysts’ expectations. Read more at: https://www.cnbc.com/2022/07/26/coca-cola-ko-q2-2022-earnings-.html |

|

The bigger warehouse story behind the Walmart consumer demand issuesWalmart’s inventory build and markdowns come amid a national warehouse market in which there is little capacity left due to seasonal and pandemic trends. Read more at: https://www.cnbc.com/2022/07/26/the-bigger-warehouse-story-behind-the-walmart-consumer-demand-issues.html |

|

Adidas cuts 2022 outlook on slower China recovery, the potential for a global slowdownAdidas on Tuesday cut its financial forecast for 2022 as the sneaker and athletic brand suffers from a slower recovery in China. Read more at: https://www.cnbc.com/2022/07/26/adidas-cuts-2022-outlook-on-slower-china-recovery-potential-global-slowdown.html |

|

General Motors falls short of Wall Street expectations as supply chain challenges dent profitGM reported second-quarter earnings that missed Wall Street’s estimates after the company was unable to ship nearly 100,000 vehicles by quarter-end. Read more at: https://www.cnbc.com/2022/07/26/general-motors-gm-earnings-q2-2022.html |

|

Home price growth slowed for the second straight month in May, S&P Case-Shiller saysHome prices in May were 19.7% higher compared with the same month last year, according to the S&P CoreLogic Case-Shiller National Home Price Index. Read more at: https://www.cnbc.com/2022/07/26/home-price-growth-slowed-in-may-sp-case-shiller-says.html |

|

Stocks making the biggest moves midday: Walmart, Shopify, 3M, General Electric, and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/07/26/stocks-making-the-biggest-moves-midday-walmart-shopify-3m-general-electric-and-more.html |

|

Makeup company Glossier to sell its products at Sephora as new CEO pushes to expand the reachBeginning next year customers will be able to find Glossier’s famous “Boy Brow” and “Cloud Paint” makeup products at LVMH-owned Sephora. Read more at: https://www.cnbc.com/2022/07/26/glossier-to-sell-in-sephora-makeup-brands-first-retail-partner.html |

|

Walmart shares slump after retailer cuts profit outlook on inflation concernsWalmart CEO Doug McMillon said aggressive markdowns on items such as clothing are also hurting margins. Read more at: https://www.cnbc.com/2022/07/25/walmart-cuts-second-quarter-guidance-as-it-sees-slower-growth-due-to-inflation.html |

|

Stocks, Crypto, & Yield Curve Tumble As ‘Strong Consumer’ Narrative CrushedWalmart can’t get rid of its excess inventory, MacDonald’s is seeing lower-income customers ‘trade down’, Pulte Homes said that home order cancellations have doubled in the last 30-60 days, new home sales crashed and median prices plunged, and consumer confidence tumbled. But apart from that, the consumer is strong and the economy is definitely not in recession… if you believe the politicians and elites. The ‘r’-word is coming…

Like the message to 10% of Shopify staff today, here’s what we say to the elites…

Nasdaq led the charge lower today but all the majors were red on the day… Read more at: https://www.zerohedge.com/markets/stocks-crypto-yield-curve-tumble-strong-consumer-narrative-crushed |

|

Tech Giants Are About To Give A Key Signal On BuybacksBy Jessica Menton, Bloomberg Markets Live reporter and analyst Investors are bracing for a crucial stretch that will signal whether Corporate America is starting to stockpile cash for insurance against a cooling economy rather than using it to bolster shareholder returns. This week brings earnings releases from two key contributors to share buybacks in recent quarters — Big Tech in particular, but also energy titans like Chevron Corp. and Exxon Mobil Corp. Investors were put on notice this month after JPMorgan Chase & Co., Citigroup Inc. and Discover Financial Services said they’re pausing the repurchases because of either regulatory issues or ongoing probes. The importance of tech for this discussion is hard to exaggerate. Apple, Alphabet, Meta Platforms and Microsoft accounted for 63% of the 10 biggest S&P 500 Index share repurchases in the first quarter, data compiled by Bloomberg show. Any hint they’re stepping back will raise concern that US companies are preparing for a recession, and also weaken a pillar of support for battered stocks after firms poured historic amounts of cash into buybacks last year. Read more at: https://www.zerohedge.com/markets/tech-giants-are-about-give-key-signal-buybacks |

|

Will A ‘Less Hawkish’ Fed Be Enough To Satisfy The Neurotic Stock MarketThe last six weeks or so have seen an extended bounce in US equities that has led to the usual debate about whether it’s a ‘dead cat bounce’ bear-market rally or that the lows are in for this tightening cycle and The Fed will flip-flop and save the day again. Notably, having tagged 4,000 last week, the S&P has been under pressure, but the rebound trend remains ahead of tomorrow’s FOMC statement and presser…

Notably, the S&P is trading at the same level it was at around the end of May but as the chart below shows, the expectations for Fed actions have dramatically changed with the ‘pivot’ having shifted from June 2023 to Dec 2022 and the terminal rate significantly higher (up from 3.18% to around 3.75%). Additionally, the market’s expectations for a dovish Fed are significantly more aggressive now than at the end of May (with rates not expected to rise back to this cycle’s terminal rate until at least 2031)…this makes sense – the more they hike, the faster the recession … Read more at: https://www.zerohedge.com/markets/will-less-hawkish-fed-be-enough-satisfy-neurotic-stock-market |

|

Elizabeth Warren Blasts The Fed For The Recession, Her Solution Is InflationAuthored by Mike Shedlock via MishTalk.com, Senator Warren goes after Jerome Powell and Larry Summers in a Wall Street Journal Op-Ed. Let’s take a look.

Forget about “risk of recession”, it’s already here. Jerome Powell’s Fed Pursues a Painful and Ineffective Inflation CurePlease consider Jerome Powell’s Fed Pursues a Painful and Ineffective Inflation Cure by Elizabeth Warren. ‘That’s a non-paywalled link if you wish to read in … Read more at: https://www.zerohedge.com/political/elizabeth-warren-blasts-fed-recession-her-solution-inflation |

|

IMF: UK set for slowest growth of G7 countries in 2023The IMF cuts its UK forecast for 2023 and says the global economy is “teetering on the edge” of recession. Read more at: https://www.bbc.co.uk/news/business-62299490?at_medium=RSS&at_campaign=KARANGA |

|

EU allows get-out clause in Russian gas cut dealEU members agree to reduce gas use, but some including Ireland, Malta, and Cyprus can seek exemptions. Read more at: https://www.bbc.co.uk/news/business-62305094?at_medium=RSS&at_campaign=KARANGA |

|

Heathrow hits back at ‘bizarre’ Ryanair criticismThe boss of the UK’s largest airport says Ryanair is wrong to blame airports for travel disruption. Read more at: https://www.bbc.co.uk/news/business-62295867?at_medium=RSS&at_campaign=KARANGA |

|

Fed policy preview: What you should know as D-St braces for big rate hikeAnalysts said that the Fed statement may acknowledge the waning of the growth momentum, but Fed Chair Jerome Powell may signal the central bank’s focus on inflation during the press conference. He may hint at additional rate increases, analysts feared. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/fed-policy-preview-what-you-should-know-as-d-st-braces-for-big-rate-hike/articleshow/93134179.cms |

|

Bajaj Auto Q1 Results: Profit rises 11% YoY to Rs 1,173 crore, beats estimatesEbitda grew despite supply constraints, cost headwinds, and a weak macro-economic context. Judicious price increases, better foreign exchange realisation and a favourable mix offset the material cost inflation and enabled margin improvement, Bajaj Auto said. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/bajaj-auto-q1-results-profit-rises-11-yoy-to-rs-1173-crore-beats-estimates/articleshow/93132743.cms |

|

ICICI Bank is getting fan mail from analysts. How should investors respond?Among global brokerages, CLSA has a buy call with a target price of Rs 1,040 on ICICI Bank. Jefferies has set a target price of Rs 1,080. Morgan Stanley has an overweight rating with a target of Rs 1,040. These targets suggest upside potential of up to 35 percent of Monday’s closing price of Rs 800.90. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/icici-bank-is-getting-fan-mail-from-analysts-how-should-investors-respond/articleshow/93126789.cms |

|

: Biden touts South Korean company’s $22 billion investment in U.S. manufacturing: ‘America is back to working with our allies’President Joe Biden on Tuesday talks up a South Korean conglomerate’s plan for $22 billion in new investments in U.S. manufacturing. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7101-E4A931F92975%7D&siteid=rss&rss=1 |

|

Nancy Pelosi’s husband buys millions of dollars worth of Nvidia stock ahead of a vote on chip-manufacturing billPaul Pelosi bought as much $5 million worth of stock in software and computer chip company Nvidia in June. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7FC9-8DCB9EF9638E%7D&siteid=rss&rss=1 |

|

Market Snapshot: Dow drops nearly 250 points as worries about big tech earnings weigh on stocksU.S. stocks retreat Tuesday after Wal-Mart cut its profit guidance, while anxieties about earnings reports from American tech behemoths like Alphabet Inc. and Meta Platforms Inc. help to undermine the broader market. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7101-B96839C1C588%7D&siteid=rss&rss=1 |