Summary Of the Markets Today:

- The Dow closed up 91 points or 0.28%,

- Nasdaq closed down 0.43%,

- S&P 500 up 0.13%,

- WTI crude oil settled at $97 up 1.82%,

- USD $106.45 down 0.11%,

- Gold $1718 up 1.85%,

- Bitcoin $21,803 down 4.22% – Session Low 21,606,

- 10-year U.S. Treasury 2.796 unchanged

Today’s Economic Releases:

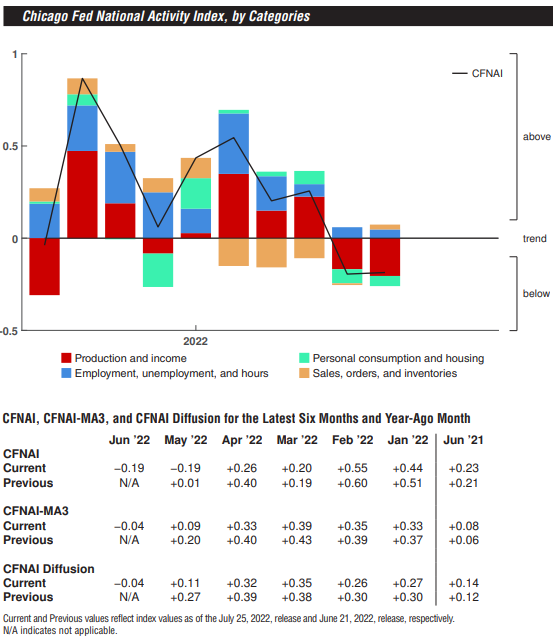

The three-month moving average of the Chicago Fed National Activity Index moved marginally into negative territory in June 2022. This is not indicative of a recession as the values are explained as follows:

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth. Periods of economic expansion have historically been associated with values of the CFNAI-MA3 above –0.70 and the CFNAI Diffusion Index above –0.35.

The point is that the three-month moving average has to fall to a value of -0.70 [this month the value is -0.04] before a recession occurs. The CFNAI is considered the best coincident indicator of the economy.

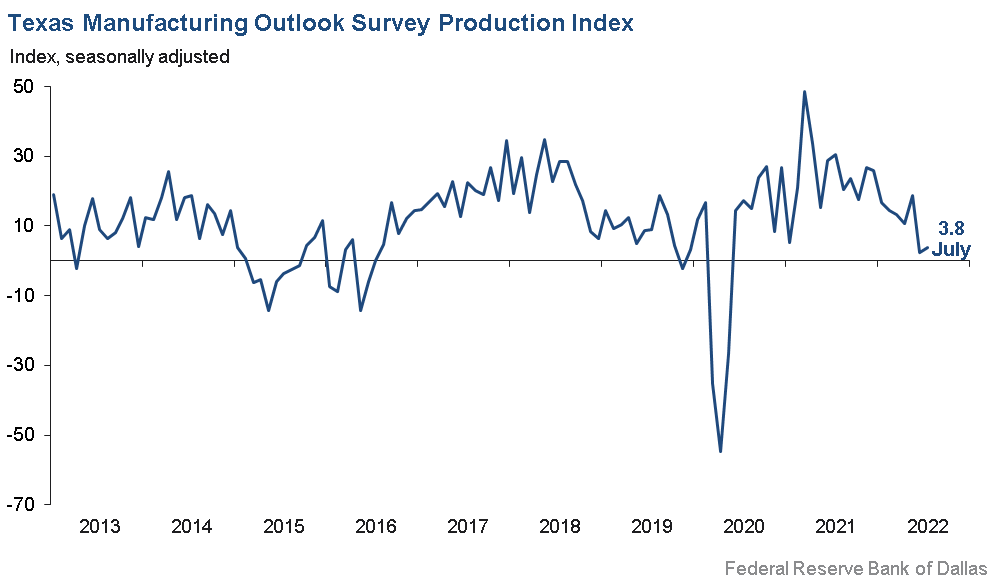

The Texas Manufacturing Outlook Survey for July 2022 was largely unchanged at 3.8, a reading well below average but still indicative of growth.

A summary of headlines we are reading today:

- Brent-WTI Spread Widens To Over $8 As U.S. Gasoline Demand Slows

- OPEC+ Is Now 2.84 Million Bpd Below Its Oil Production Target

- GM trails far behind Tesla in EV sales — CEO Mary Barra bet the company that will change

- The Mega Millions jackpot is now $810 million. Here’s how much would go to taxes if there’s a winner

- Fear prevents workers reporting low pay – report

- The Fed: Four things you will want to listen for at Wednesday’s Federal Reserve meeting

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Gulf Producers Hike Crude Prices Despite Recession FearsIn hindsight, June 2022 might go down as the last month when the markets at large were still yet to go into full panic, acknowledging economic recession as a necessity but not yet succumbing to a spiral of fear and agitation. The pricing of August-loading grades coming from the Middle East still reflects that feeling when China was still expected to finally come back from its lockdown-induced demand slump when the global shortage of supply still kept market fundamentals extremely tight. As we will see below, August 2022 will see many grades reach Read more at: https://oilprice.com/Energy/Crude-Oil/Gulf-Producers-Hike-Crude-Prices-Despite-Recession-Fears.html |

|

Is BMWs Seat Heater Subscription A Sign Of Things To Come?Recently, the MetalMiner team shared a laugh over BMWs announcement that it would introduce a subscription service in certain markets for the use of their car’s heated seats. While some of us remain avid BMW aficionados, whether or not customers will pay for the right to warm their seat remains unclear. Nevertheless, BMW and other car makers are starting to recognize the overall attractiveness of the subscription model. That is, it’s a huge help when it comes to cash flow. Even Tesla has intimated it would add software Read more at: https://oilprice.com/Energy/Energy-General/Is-BMWs-Seat-Heater-Subscription-A-Sign-Of-Things-To-Come.html |

|

Brent-WTI Spread Widens To Over $8 As U.S. Gasoline Demand SlowsThe spread between Brent crude oil prices and West Texas Intermediate (WTI) hit its widest level in over three years on Monday, with WTI down more than $8 compared to Brent as U.S. gasoline demand falls. Brent crude was trading at $104.8 on Monday 11:41 EST, while WTI was trading at $96.12, representing a spread of over $8 per barrel. Brent prices continue to be boosted by tight physical supplies, buoyed by Russia’s war on Ukraine and Western sanctions, as well as a looming European Union ban on Russian oil set to be implemented before Read more at: https://oilprice.com/Latest-Energy-News/World-News/Brent-WTI-Spread-Widens-To-Over-8-As-US-Gasoline-Demand-Slows.html |

|

The World’s Inflation Crisis Could Worsen Amid Labor ProtestsKey workers in supply chains across the globe know that their jobs have never been more crucial – and they’re taking advantage of that leverage, demanding better working conditions. Labor protests have been turning up at all spots in the global supply chain, including railways, trucking, warehouses, and ports, in locations spanning Australia to Peru, according to a new Bloomberg writeup. Katy Fox-Hodess, a lecturer in employment relations at Sheffield University Management School in the UK, commented: Global supply chains weren’t Read more at: https://oilprice.com/Energy/Energy-General/The-Worlds-Inflation-Crisis-Could-Worsen-Amid-Labor-Protests.html |

|

Nord Stream Gas Flows Drop Again As Gazprom Halts Another TurbineAmid the gas turbine chapter of the Russia gas flow saga, Gazprom has halted yet another turbine at its main compressor station in the Nord Stream 1 gas pipeline, according to Bloomberg’s Javier Blas. Gazprom announced on Monday that not only does the Russian gas producer have trouble with a turbine currently being returned to it by Canada, but it is also now halting a second turbine at its main compressor station. The flows along Nord Stream 1 will drop starting on Wednesday to 33 mcm per day. This is a 50% drop from the current flow, Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nord-Stream-Gas-Flows-Drop-Again-As-Gazprom-Halts-Another-Turbine.html |

|

OPEC+ Is Now 2.84 Million Bpd Below Its Oil Production TargetThe OPEC+ group had a massive shortfall of 2.84 million barrels per day (bpd) in June between actual production and the target oil output level as part of the deal, two delegates at the alliance told Argus on Monday. As OPEC+ is unwinding its cuts, more and more members are falling further behind their quotas due to a lack of capacity or investment in supply. In June, the compliance rate at the OPEC+ group soared to 320% from an estimated 256% in May, according to Arguss sources, suggesting that the gap between nameplate production Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Is-Now-284-Million-Bpd-Below-Its-Oil-Production-Target.html |

|

WWE hints at other probes into Vince McMahon’s alleged misconduct as it discloses $14.6 million in paymentsWorld Wrestling Entertainment on Monday disclosed $14.6 million in previously unrecorded expenses paid personally by top shareholder Vince McMahon. Read more at: https://www.cnbc.com/2022/07/25/wwe-hints-at-other-probes-into-vince-mcmahon-misconduct-discloses-millions-in-payments.html |

|

National Football League’s new streaming service NFL+ launches at $4.99 per monthThe NFL’s new streaming service will include out-of-market preseason games and mobile access to local and prime-time games. Read more at: https://www.cnbc.com/2022/07/25/national-football-leagues-new-streaming-service-nfl-launches-at-4point99-per-month.html |

|

Target chases bigger e-commerce profits with new delivery hubs, fleet of driversThe retailer has worked to reduce the costs of fulfilling online orders, a goal that’s gained importance as e-commerce becomes a bigger part of its business. Read more at: https://www.cnbc.com/2022/07/25/target-chases-bigger-e-commerce-profits-with-new-delivery-hubs-fleet-of-drivers.html |

|

Weber shares tank as grill maker announces CEO departure amid disappointing salesShares of Weber tumbled after the company said CEO Chris Scherzinger is departing amid waning consumer demand. Read more at: https://www.cnbc.com/2022/07/25/weber-shares-tank-as-grill-maker-announces-ceo-departure-amid-disappointing-sales.html |

|

GM trails far behind Tesla in EV sales — CEO Mary Barra bet the company that will changeCEO Mary Barra is betting that the electric vehicle platform GM unveiled five years ago will soon help the legacy automaker top its rivals on electric vehicles. Read more at: https://www.cnbc.com/2022/07/24/why-ceo-mary-barra-is-confident-gm-can-beat-tesla-in-electric-vehicles.html |

|

Sesame Solar is selling mobile disaster relief units powered entirely by clean energySesame sells the systems for anywhere from $100,000 to $300,000, or more for larger installations like a full medical clinic. Read more at: https://www.cnbc.com/2022/07/25/sesame-solar-is-selling-clean-energy-nanogrids-for-disasters.html |

|

Sen. Lindsey Graham introduces legislation to raise the mandatory pilot retirement age to 67Sen. Lindsey Graham is introducing legislation to increase pilot retirement age from 65 to 67. Read more at: https://www.cnbc.com/2022/07/25/sen-lindsey-graham-introduces-legislation-to-raise-mandatory-pilot-retirement-age-to-67.html |

|

4 takeaways from the Investing Club’s ‘Morning Meeting’ on MondayEvery weekday the CNBC Investing Club with Jim Cramer holds a “Morning Meeting” livestream at 10:20 a.m. ET. Here’s a recap of Monday’s key moments. Read more at: https://www.cnbc.com/2022/07/25/4-takeaways-from-the-investing-clubs-morning-meeting-on-monday.html |

|

Stocks making the biggest moves midday: Newmont, World Wrestling Entertainment, Ryanair & moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/07/25/stocks-making-the-biggest-moves-midday-newmont-world-wrestling-entertainment-ryanair-more.html |

|

Photos show the growing Oak Fire wildfire near Yosemite in California, which caused Governor Newsom to declare a state of emergencyGov Gavin Newsom declared a state of emergency for Mariposa County in California near Yosemite National Park because of wildfires burning through hot, dry land. Read more at: https://www.cnbc.com/2022/07/25/gov-newsom-declared-a-state-of-emergency-over-oak-fire-in-california.html |

|

The Mega Millions jackpot is now $810 million. Here’s how much would go to taxes if there’s a winnerAhead of Tuesday night’s draw, the jackpot has already been adjusted upward to $810 million from $790 million. Read more at: https://www.cnbc.com/2022/07/25/mega-millions-jackpot-is-790-million-if-its-won-heres-tax-bill.html |

|

We’re adding to 2 stocks that had strong earnings but saw tepid market reactionsThe companies are also in two sectors that we think are right for this rough market: oil and health care. Read more at: https://www.cnbc.com/2022/07/25/investing-club-were-adding-to-2-stocks-that-had-strong-earnings-but-saw-tepid-market-reactions.html |

|

General Motors wants to fill the ‘EV knowledge gap’ with a free online chat tool for allGM is launching “EV Live,” a free online platform that connects consumers who have questions about electric vehicles with an expert who can answer them. Read more at: https://www.cnbc.com/2022/07/25/gm-electric-vehicle-chat-tool-aims-to-fill-the-ev-knowledge-gap.html |

|

Biden Brags About Minuscule Gas Savings In Misspelled TweetWhile the Biden administration spent the first half of the year robotically blaming the “Putin price hike” for scorching inflation (most of which happened before Russia invaded Ukraine), the president’s social media team (of 70 people) managed to fire off an even more insulting tweet than their ’16 cents’ 4th of July debacle from last year.

On Monday, Biden’s @POTUS account fired off a tweet that would be hilarious if it weren’t so insulting to Americans forking over $5,000 more per year (on average) – which claims that “At current prices, the average driver will spend $35 less per month for one peson,” or “$70 less per month for a family with two cars.” Read more at: https://www.zerohedge.com/political/biden-brags-about-minuscule-gas-savings-misspelled-tweet |

|

Recession? They Will Tell Us That It’s MisinformationAuthored by Jeffrey Tucker via The Epoch Times, Last week, this space speculated that the next recession may never be called what it is. Government agencies rely entirely on the National Bureau for Economic Research to call it either way. In October 2020, the NBER posted a clarification that it does not accept the textbook definition of two successive quarters of output decline but instead deploys a more holistic view. As an example of such a deployment, NBER lists March-April 2020 as a recession due to the severity of the downturn and the high levels of unemployment. It’s hard to disagree with that judgment, though it was one of the strangest recessions in history: it was entirely forced by lockdowns. NBER in this case was using a stricter definition than the textbook. Now the White House is running with this looser approach, preparing a propaganda push later this week if the second quarter numbers report a negative return. You will see: the spokesperson will absolutely deny there is a recession. Saying there is one will suddenly be seen as a political statement. Affirming that all is well will be the “information” whereas saying otherwise will become “misinformation … Read more at: https://www.zerohedge.com/political/recession-they-will-tell-us-its-misinformation |

|

Taiwan Kicks Off 5-Day Exercise Simulating PLA Attack As White House Warns Pelosi Visit Could Spark “Crisis”Taiwan says it is prepared in the face of recent Chinese threats of “forceful measures” if US House Speaker Nancy Pelosi follows through with her widely reported and a hugely controversial planned visit to Taipei to meet with Taiwan’s leaders. The democratic-run island held large-scale air raid drills on Monday. Fox News reports that the drills took place across the island, with both a military and civilian response component. “Sirens could be heard blaring in Taipei, the nation’s capital city, signaling residents to evacuate the streets for 30 minutes,” the report details. “The country also tested its missile warning system, which sends mass text messages to residents in the event of incoming attacks.” The emergency preparedness drills will last five days, and simulate a Chinese PLA military invasion.

Read more at: https://www.zerohedge.com/geopolitical/taiwan-kicks-5-day-exercise-simulating-pla-attack-white-house-warns-pelosi-visit-could |

|

Peak Inflation? Maybe… But That’s Not The IssueAuthored by Michael Pento via PentoPort.com, The reality of record-high inflation combined with a hawkish monetary policy is slowing the economy sharply and has led to the current U.S. recession—two back-to-back quarters of negative growth. The economic contraction should soon cause inflation to roll over along with bond yields, but that isn’t necessarily indicative of a new bull market. It is much the same process that occurred leading up to the Global Financial Crisis of 2008. The major difference is that the level of inflation today is much greater than it was 15 years ago–a white-hot 9.1% for June of 2022, which is actually close to 20% if calculated using the same method back in 1980. That level is much greater than the 4.1% in December of 2007. Inflation may be peaking, but it is peaking at over 4.5x greater than the Fed’s target. Meaning, the FOMC will find it very difficult to give up its inflation fight anytime soon. It would be a different story if the Effective Fed Funds Rate was trading close to the Fed’s neutral range, which Mr. Powell believes is close to 2.5%, not the 1.58% seen today. With CPI at 9.1% and its balance sheet at $8.9 trillion, it is untenable for the Fed to remain stimulative to inflation. Indeed, the FOMC wants the interbank lending rate at 3.5-4.0% by the end of 2022. Nevertheless, the apogee of CPI is probably here; and a falling 2nd derivative of inflation would be great news for the stock market as long as it didn’t also come along with crashing economic growth. And, if the Fed were t … Read more at: https://www.zerohedge.com/markets/peak-inflation-maybe-thats-not-issue |

|

Train strikes: People told not to travel by rail during walkoutsOnly 20% of services will run and some places will have no trains on Wednesday, Network Rail says. Read more at: https://www.bbc.co.uk/news/business-62291452?at_medium=RSS&at_campaign=KARANGA |

|

Gazprom: Nord Stream 1 supply to EU to be cut furtherGazprom announces another drastic cut in supplies as the EU tries to replenish stores for winter. Read more at: https://www.bbc.co.uk/news/business-62291458?at_medium=RSS&at_campaign=KARANGA |

|

Fear prevents workers reporting low pay – reportEmployers get away with breaking minimum wage laws by intimidating staff, the Low Pay Commission says. Read more at: https://www.bbc.co.uk/news/uk-politics-62295472?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty50 forms bearish candle; index may see consolidation aheadThe negative candle had a minor upper and lower shadow. Technically, such a candle indicates the completion of a recent uptrend and the beginning of short-term downward correction from the high according to Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-forms-bearish-candle-index-may-see-consolidation-ahead/articleshow/93114279.cms |

|

Bottom fishing? Down 75% from IPO price, Dolly Khanna picked stake in this small finance bank in Q1According to the latest shareholding data, Dolly Khanna held 12,27,986 equity shares or a 1.16 percent stake in the small finance bank as of June 30, 2022. Her stake in the lender is worth Rs 9.8 crore. Her name was missing from the list of top shareholders in the March quarter. All listed entities are obliged to reveal shareholder names only if the stake is at least one percent. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/bottom-fishing-down-75-from-ipo-price-dolly-khanna-picked-stake-in-this-small-finance-bank-in-q1/articleshow/93112048.cms |

|

Up over 15% in 5 days, is this Nifty bank stock on track for a major re-rating?Domestic brokerage ICICI Securities, which is among the most bullish on the bluechip stock, is impressed by IndusInd’s NII (net interest income) growth of 16 per cent year-on-year (YoY) and stable NIMs (net interest margins) of 4.21 percent. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/up-over-15-in-5-days-is-this-nifty-bank-stock-on-track-for-a-major-re-rating/articleshow/93104693.cms |

|

The Fed: Four things you will want to listen for at Wednesday’s Federal Reserve meetingHere are 4 things investors will be listening for at the Federal Reserve’s policy announcement on Wednesday. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7100-D3F77E048D97%7D&siteid=rss&rss=1 |

|

: Robots are making french fries, chicken wings and more as restaurant kitchens gear up for an automated futureWhere robots were once seen as a possible replacement for human workers, they’re now “co-workers” operating side-by-side with staff. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7FB4-826D90F9CA23%7D&siteid=rss&rss=1 |

|

: Clover finds winning formula as it takes on the ‘Apple’ of payment devicesTucked inside nearly 40-year-old Fiserv Inc. is a Square-like business that’s actually larger than the flashy Jack Dorsey company. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7F72-4103ADE6DE1A%7D&siteid=rss&rss=1 |

< …

< …