Summary Of the Markets Today:

- The Dow closed down 164 points or 0.52%,

- Nasdaq closed down 2.26%,

- S&P 500 down 1.15%,

- WTI crude oil settled at 104 down 1.05%,

- USD $108.14 up 1.07%,

- Gold $1731 flat 0.00%,

- Bitcoin $20469 down 1.69% – Session Low 20293,

- 10-year U.S. Treasury 2.998% down 0.103%

Today’s Economic Releases:

The June 2022 Survey of Consumer Expectations which showed an increase in short-term inflation expectations but a decline in medium-term and longer-term inflation expectations. Home price growth expectations declined sharply.

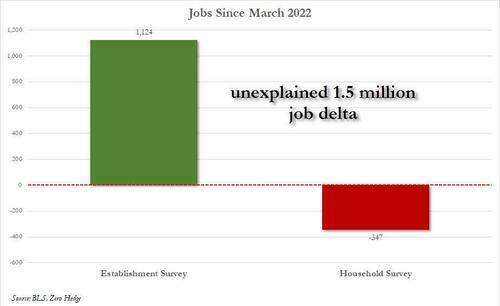

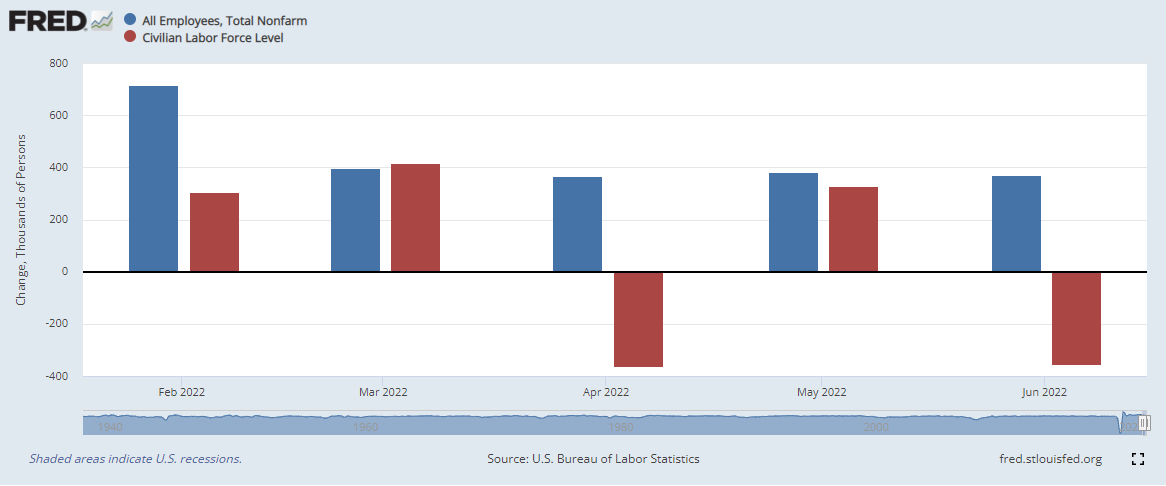

Thinking of the June 2022 BLS Employment report which came in red hot last Friday – there was a big bust between the two surveys that comprise the report. The household survey showed a 353,000 DECLINE in jobs whilst the establishment survey showed a 381,000 GAIN in jobs. This is not the first month this year this “bust” has occurred. It could be that an underlying dynamic change is invalidating the accuracy of the data gathering methodology of one or both of the surveys. The graph below shows the net change monthly for the last 5 months in the household and the establishment surveys.

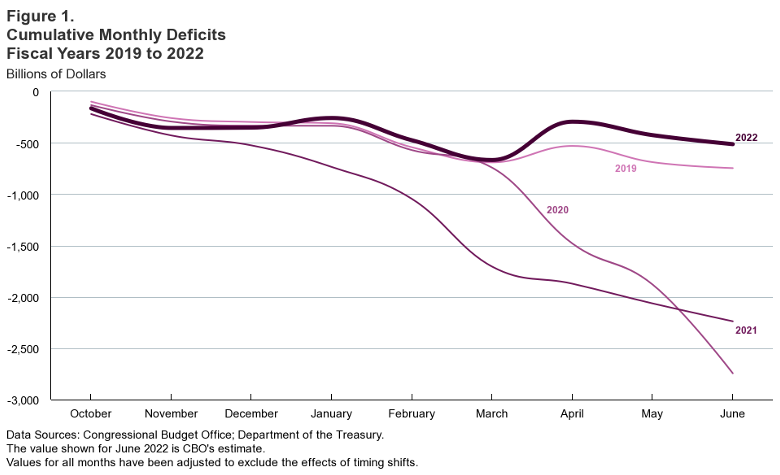

The federal budget deficit was $514 billion in the first nine months of the fiscal year 2022.

A summary of headlines we are reading today:

Soaring Prices Have Led To An Uptick In Oil Theft In Colombia

- French Industry Switches To Oil From Gas Amid Uncertainty Over Russian Supply

- Homebuyers are canceling deals at the highest rate since the start of the pandemic

- Texas grid operator tells residents to curb power as heat hits record highs

- Ford’s Mustang Mach-E electric crossover is a hit with industry insiders — that could help it take on Tesla

- Labor Market Reality-Check Sends Stocks, Bond Yields Tumbling

- Oil Dumped By Hedge Funds On Soaring Recession Risk

- Living With Climate Change: ERCOT warning: 5 electricity blackout risks facing the entire U.S., not just Texas

- Futures Movers: Natural-gas futures gain more than 6% on the shutdown of key European pipeline

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Soaring Prices Have Led To An Uptick In Oil Theft In ColombiaA notable increase in lawlessness, corruption, and violence, fueled by record cocaine production and heightened poverty, has marred the four-year term of outgoing Colombian President Ivan Duque. Not only have massacres, violent crime, poverty and cocaine production surged during Duque’s term but the incidence of petroleum theft in Colombia is spiraling higher. Washington’s habitual ramping-up of efforts to combat cocaine trafficking, which has long been a key source of income for Latin America’s criminal syndicates, is forcing Read more at: https://oilprice.com/Energy/Crude-Oil/Soaring-Prices-Have-Led-To-An-Uptick-In-Oil-Theft-In-Colombia.html |

|

Natural Gas Will Play A Vital Role In Australias Energy TransitionNatural gas will play an important role in Australia’s accelerated energy transition as the country looks to boost renewable energy sources and phase down coal, according to Alan Finkel, Special Adviser to the Australian government on Low Emissions Technology. Australia currently relies on a lot of conventional energy sources. Coal and natural gas account for around 79 percent of the country’s electricity generation, data from the government shows. Renewable energy from wind, solar, and hydropower provide the remaining 21 percent of Read more at: https://oilprice.com/Latest-Energy-News/World-News/Natural-Gas-Will-Play-A-Vital-Role-In-Australias-Energy-Transition.html |

|

Will A Gas Tax Holiday Help Ease Prices At The Pump?I believe many of our political leaders have a comic book view of how gasoline prices are set. They envision oil companies adding up all of their input costs, and then tacking on a profit margin. Oddly, sometimes the oil companies are really generous and sell gasoline for under $2.00 a gallon. Other times, the belief must be that they are super greedy and sell it for $6.00 a gallon. Adding to all of the input costs and profit margins are the taxes. State and federal governments get a cut of each gallon of gasoline sold. Since 1993, the federal Read more at: https://oilprice.com/Energy/Energy-General/Will-A-Gas-Tax-Holiday-Help-Ease-Prices-At-The-Pump.html |

|

Russian Court Overturns Suspension Of Caspian Pipeline Consortium ExportsA Russian court of appeals in Krasnodar overturned on Monday a lower court decision that had ordered the suspension of most of Kazakhstan’s crude oil exports from a Russian port on the Black Sea. Last week, a Russian court ordered the Caspian Pipeline Consortium (CPC), which operates the key export route for two-thirds of Kazakhstan’s crude oil, to suspend activities for 30 days, citing environmental violations. The exports take place from the Russian port of Novorossiysk on the Black Sea. While the port is in Russia, Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Court-Overturns-Suspension-Of-Caspian-Pipeline-Consortium-Exports.html |

|

Iron Prices Dip As Demand From China Slows2022 has been a roller coaster ride for iron ore prices, which dipped yet again on Monday. Of course, demand from Chinese steel remains the top reason for either a rise or downturn in prices. This week, as it turns out, was no different. In fact, prices tumbled immediately after analysts explained their bleak outlook for demand, citing that Chinese steel mills are reeling from losses and cutting production. Chinese President Xi Still Eager to Keep the Rebound on Track The news was so impactful that predictions of iron ore dropping Read more at: https://oilprice.com/Metals/Commodities/Iron-Prices-Dip-As-Demand-From-China-Slows.html |

|

French Industry Switches To Oil From Gas Amid Uncertainty Over Russian SupplyMajor energy-intensive industries in France look to convert gas boilers to run on oil as French and European businesses prepare for another decline or a complete halt of Russian gas deliveries to Europe, Reuters reports. No Russian gas supply would hit many energy-intensive industries in Europe, including in its biggest economies, Germany, France, and Italy. Russia has already slashed gas supply via Nord Stream by 60% over the past month and has just started the regular maintenance on the pipeline that carries gas to Germany. The two-week-long Read more at: https://oilprice.com/Latest-Energy-News/World-News/French-Industry-Switches-Oil-Gas-Amid-Uncertainty-Over-Russian-Supply.html |

|

Costco CEO’s one-word answer to whether he would raise the price of hot dogs: ‘No’The retail executive also said the company is putting off a hike in annual membership fees. Read more at: https://www.cnbc.com/2022/07/11/costco-ceos-one-word-answer-to-whether-he-would-raise-the-price-of-hot-dogs-no.html |

|

Homebuyers are canceling deals at the highest rate since the start of the pandemicHigher mortgage rates and overall inflation are causing potential homebuyers to reconsider their purchases. Read more at: https://www.cnbc.com/2022/07/11/homebuyers-are-canceling-deals-at-highest-rate-since-start-of-covid.html |

|

Justice Department investigating PGA Tour for possible antitrust violations tied to LIV GolfThe DOJ is investigating PGA Tour for engaging in potentially anti-competitive behavior in its competition with LIV Golf. Read more at: https://www.cnbc.com/2022/07/11/justice-department-investigating-pga-tour-for-possible-antitrust-violations-tied-to-liv-golf.html |

|

Frontier urges Spirit to delay the vote again, and allow shareholders to consider the ‘best and final’ offerFrontier Airlines has asked Spirit Airlines to further delay a shareholder vote on their planned merger. Read more at: https://www.cnbc.com/2022/07/11/frontier-airlines-tells-spirit-airlines-offer-is-best-and-final-asks-to-delay-vote-again.html |

|

How many F-bombs trigger an R rating? An obscure movie industry panel decidesA movie industry panel discusses how it assigns ratings to newly released films, including details about what constitutes an R rating. Read more at: https://www.cnbc.com/2022/07/09/how-are-movie-ratings-assigned-film-industry-relies-on-obscure-panel.html |

|

Rivian planning layoffs that could target about 5% of staff, report saysThe cuts will come in areas where Rivian has grown too quickly, Bloomberg reported. Read more at: https://www.cnbc.com/2022/07/11/rivian-planning-layoffs-that-could-target-about-5percent-of-staff-report-says.html |

|

Texas grid operator tells residents to curb power as heat hits record highsThe Texas regulator projected a shortage in energy reserves on Monday “with no market solution available,” but said it does not expect systemwide outages. Read more at: https://www.cnbc.com/2022/07/11/ercot-tells-texans-to-curb-power-use-as-extreme-heat-strains-the-grid.html |

|

‘Thor: Love and Thunder’ pulls in $143 million in domestic opening“Thor: Love and Thunder” tallied $143 million during its domestic debut, pushing the overall weekend haul to more than $200 million. Read more at: https://www.cnbc.com/2022/07/10/box-office-thor-love-and-thunder-has-143-million-domestic-opening.html |

|

4 things Costco CEO Craig Jelinek said in a rare interview on the economy, retail trends, and moreThe Investing Club breaks down CNBC’s interview with Costco CEO Craig Jelinek. Read more at: https://www.cnbc.com/2022/07/11/4-things-costco-ceo-craig-jelinek-said-in-a-rare-interview-on-the-economy-retail-trends-and-more.html |

|

These midyear tax strategies can trim next year’s bill from the IRS and reduce ‘unwelcome surprises’Whether you typically receive a tax refund or a bill, there’s still plenty of time to improve next year’s filing, experts say. Here are four moves to consider. Read more at: https://www.cnbc.com/2022/07/11/these-4-mid-year-tax-strategies-can-trim-next-years-bill-from-the-irs.html |

|

Ford’s Mustang Mach-E electric crossover is a hit with industry insiders — that could help it take on TeslaFord’s first real attempt at an electric vehicle has been quite a hit with critics. Read more at: https://www.cnbc.com/2022/07/10/fords-mustang-mach-e-electric-crossover-awards-could-help-it-take-on-tesla.html |

|

NFL will select a new Sunday Ticket partner by fall, Commissioner Roger Goodell saysThe NFL plans to choose a winning bidder for Sunday Ticket by the fall, Commissioner Roger Goodell said Friday. Read more at: https://www.cnbc.com/2022/07/08/nfl-will-select-new-sunday-ticket-partner-by-fall-commissioner-roger-goodell-says.html |

|

India set to overtake China as the world’s most populous country in 2023, UN saysThe United Nations’ report was released on World Population Day. Read more at: https://www.cnbc.com/2022/07/11/india-on-course-to-overtake-china-as-worlds-most-populous-country-un.html |

|

Labor Market Reality-Check Sends Stocks, Bond Yields TumblingLabor Market Reality-Check Sends Stocks, Bond Yields TumblingAs humans actually spent some time over the weekend examining the jobs data from Friday (and reading our post from Friday morning), the realization dawned that the labor market was in fact nothing like as strong as talking heads had proclaimed. Household survey losing jobs and multiple jobholders rising are not a good sign for the consumer.

That realization sent futures down Sunday night and things went just a little bit more turbo at the US equity cash open, bounced across the EU Close and then sunk back to the Lows into the close… Read more at: https://www.zerohedge.com/markets/labor-market-reality-check-sends-stocks-bond-yields-tumbling |

|

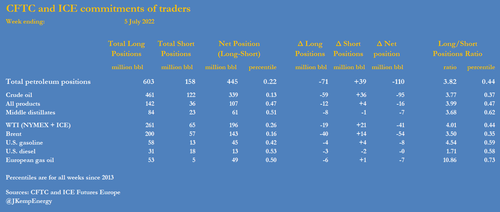

Oil Dumped By Hedge Funds On Soaring Recession RiskBy John Kemp, senior market analyst Investors dumped petroleum-related derivatives last week at one of the fastest rates of the pandemic era as recession fears intensified. Hedge funds and other money managers sold the equivalent of 110 million barrels in the six most important petroleum-related futures and options contracts in the week to July 5.

Fund managers have now sold a total of 201 million barrels in the past four weeks, according to position records published by ICE Futures Europe and the U.S. Commodity Futures Trading Commission. Read more at: https://www.zerohedge.com/commodities/oil-dumped-hedge-funds-heightened-recession-risk |

|

Corn Prices Soar As Heat Could Damage YieldsChicago corn soared the most in nearly a year after the sweltering summer heat may dent crop yields. Bloomberg reports a heatwave over the Midwest grain belt is underway during corn’s pollination period, a flowering stage for the grain, and is the most crucial development period for yield determination. High temperatures and a lack of rainfall during the pollination phase usually result in lower yields. Russia’s attacks across Ukraine’s agriculture sector and Western sanctions against Russian exports have tightened food supplies globally and shifted the spotlight on North America’s growing season.

As a result of the pessimistic outlook, corn futures in Chicago jumped as high as 5.6% on Monday. It was the most significant intraday gain since August. Read more at: https://www.zerohedge.com/commodities/corn-prices-soar-heat-could-damage-yields |

|

Peter Schiff: This Won’t Be A Short Shallow RecessionVia SchiffGold.com, The mainstream seems to have conceded that the economy is heading toward a recession. But most people aren’t too worried. They seem to think the downturn will turn out short and shallow. In his podcast, Peter explains why the recession will more likely be long and deep. Since people don’t understand the nature of the boom, they can’t understand the nature of the bust.

Last week, the Atlanta Fed raised its projection for GDP in Q2, but it still remains negative at -1.2%. That would mean we are officially in a recession with two consecutive months of negative GDP growth. Peter said everything he thought would be happening in the economy is happening.

|

|

Energy bills to rise more than predicted says Ofgem bossThe regulator’s chief executive tells MPs its previous estimate on winter bills will prove to be too low. Read more at: https://www.bbc.co.uk/news/business-62123691?at_medium=RSS&at_campaign=KARANGA |

|

Train drivers vote for rail strikes over payDrivers at eight train companies have voted to walk out but a date for action has not yet been set. Read more at: https://www.bbc.co.uk/news/business-62121258?at_medium=RSS&at_campaign=KARANGA |

|

No plans for a windfall tax on electricity producersUnlike a one-off tax on oil and gas firms, electricity generators will not be subject to the policy. Read more at: https://www.bbc.co.uk/news/business-62121228?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty50 forms small bullish candle; upside hurdle at 16,300To regain strength, the index needs to get past the 16,275 level, according to Mazhar Mohammad of Chartviewindia.in. “In that scenario, the pullback swing can further expand towards its 200-day EMA, whose value is around 16,545. Nevertheless, if we read the candles of the last three trading sessions in isolation, it is hinting at the short-term weakness that can be confirmed if the index slips below 16,115 level with initial targets close to 16,000 level,” he said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-forms-small-bullish-candle-upside-hurdle-at-16300/articleshow/92807189.cms |

|

Nomura picks up stake in smallcap multi-bagger stockThe company works with over 46 client governments, including embassies, diplomatic missions, and consulates, with an extensive network of more than 27,000 centres and a strength of over 20,000 employees and associates that provide consular, biometrics, and citizen services. It has processed over 62 million applications to date globally. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nomura-picks-up-stake-in-smallcap-multibagger-stock/articleshow/92809169.cms |

|

Can PLI, China Plus One keep India’s pharma sector in pink of health?The Indian pharmaceutical market flattened after the pandemic led to a massive upsurge in demand for drugs. The industry saw a rise in sales during the Covid spike but that settled down as the number of coronavirus cases came down, except for Q1FY2022, where the second Covid wave was dominant. This resulted in a dip in the top line of pharma companies in the successive quarters. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/can-pli-china-plus-one-keep-indias-pharma-sector-in-pink-of-health/articleshow/92797725.cms |

|

Living With Climate Change: ERCOT warning: 5 electricity blackout risks facing the entire U.S., not just TexasTexas has a unique state-run power grid, but its extreme-weather issues, and balancing natural gas and wind to create electricity, hold lessons for the nation. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7F7E-F67368FADF86%7D&siteid=rss&rss=1 |

|

PC shipments plunging, consumer demand ‘at risk of perishing in the long term,’ analysis findsPersonal-computer shipments plunged in the second quarter to levels not seen since a pandemic buying spree began more than two years ago, and consumer demand “is at risk of perishing in the long term,” according to an analysis released Monday. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7F81-23E3E63A08DC%7D&siteid=rss&rss=1 |

|

Futures Movers: Natural-gas futures gain more than 6% on the shutdown of key European pipelineNatural-gas futures rally on Monday, buoyed by the shutdown of a key European pipeline, while U.S, oil futures finish lower on the back of rising risks to energy demand from restrictions on activity in China as it attempts to squelch a rise in COVID-19 cases. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7F7B-A81F77124A65%7D&siteid=rss&rss=1 |