Summary Of the Markets Today:

- The Dow closed down 46 points or 0.15%,

- Nasdaq closed up 0.12%,

- S&P 500 down 0.08%,

- WTI crude oil settled at 105 up 2.46%,

- USD $106.98 down 0.05%,

- Gold $1741 flat 0.00%,

- Bitcoin $21778 up 0.83% – Session Low 21215,

- 10-year U.S. Treasury 3.088% up 0.08%

- Baker Hughes Rig Count: U.S. +2 to 752 Canada +9 to 175

Today’s Economic Releases:

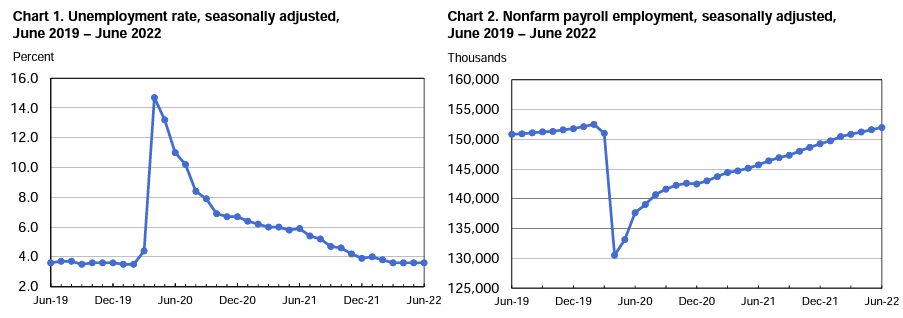

A strong jobs report for June 2022 shows gains of 372,000 in non-farm employment and the unemployment rate remains at 3.6%. This likely paves the way for a 3/4% increase in the federal funds rate at the next FOMC meeting as the Fed is charged with controlling inflation and maximizing jobs growth. The biggest employment gains were in health care (56.7K) and restaurants/bars (40.8k).

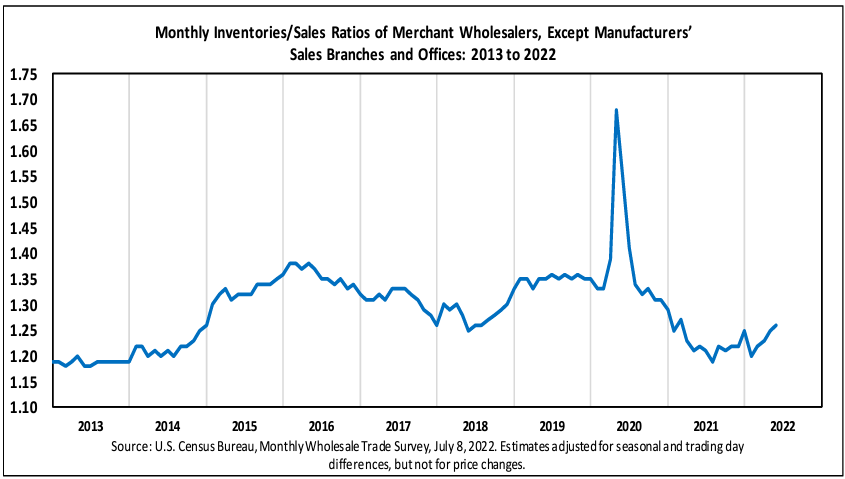

Wholesale trade for May 2022 were up 20.9% year-over-year whilst inventories were up 24.7%. This is considered a strong report.

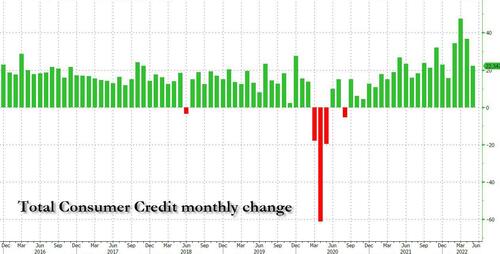

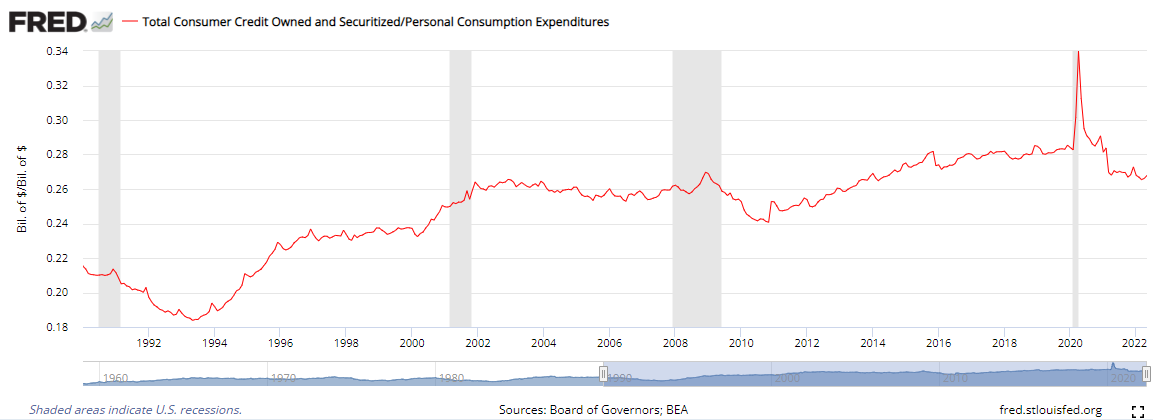

In May 2022, consumer credit increased at a seasonally adjusted annual rate of 5.9% according to the Federal Reserve. We have been hearing a lot that the consumer, due to inflation, is turning to their credit cards. However, the Fed’s headlines are not inflation adjusted (nor do they have perspective) – please see chart below where it ratios credit outstanding to consumer spending. In this chart, note that when adjusting for inflation and spending – consumer credit is about average for the 21st century.

A summary of headlines we are reading today:

- Oil Prices Bounce Back From Shocking Collapse

- Rig Count Climbs As Oil Prices Bounce Back

- Biden says Supreme Court is ‘out of control,’ orders HHS to protect abortion access

- Walmart won’t hold rival event to Amazon Prime Day, as it is already offering big markdowns

- Commodities Crushed & Bonds Battered As Stocks & The Dollar Soar

- Bond Report: Treasury yields reach highest levels in more than a week after robust U.S. jobs data

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Nordic Power Prices Plunge To Levels Not Seen Since 2020While Germany and France are grappling with record electricity prices amid low gas supply from Russia and low French nuclear power output, the Nordic countries, which rely mostly on hydro and wind power, are enjoying a large drop in prices for the days ahead. Lower demand due to summer holidays, water filling reservoirs, and windy weather these days led to an 80% slump in day-ahead power prices for the Nordic region on Friday. The average electricity prices across northern Europe for Saturday plunged to as low as $4.24 (4.17 euro) per megawatt-hour Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nordic-Power-Prices-Plunge-To-Levels-Not-Seen-Since-2020.html |

|

Oil Prices Bounce Back From Shocking CollapseOil markets saw one of the largest single-day declines in history this week, but the realities of supply and demand have since sent prices bouncing higher.Oilprice Alert: This month’s Intelligent Investor column, now available for Global Energy Alert members, outlines the bullish case for oil, gas, and coal. If you’re an investor in the energy space then now is the time to sign up for Global Energy Alert.Friday, July 8th, 2022Tuesdays oil price collapse might go down as one of the most memorable moments of the oil Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Bounce-Back-From-Shocking-Collapse.html |

|

Norway Moves To Boost Natural Gas Production FurtherNorway approved plans on Friday for three gas field developments that will further increase production from the Norwegian Continental Shelf in the short to medium term. The move comes days after Norway’s authorities approved applications from operators to boost production from several operating gas fields, the Norwegian Ministry of Petroleum and Energy said on Monday, expecting record gas sales via pipelines to Europe this year. The ministry heeded applications from operators on the shelf and allowed higher gas production from the Troll, Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norway-Moves-To-Boost-Natural-Gas-Production-Further.html |

|

Landmark WTO Agreements Look To Solve The Worlds Most Pressing ProblemsAs countries face record-high food prices, inflationary pressures and other challenges associated with the economic recovery from the Covid-19 pandemic, the 164 members of the World Trade Organisation (WTO) came together in June to pen several trade agreements to help address some of the worlds most pressing issues. In the body’s first high-level meeting in five years, held in Geneva, representatives from member countries reached a landmark series of agreements on the export of food, illegal fishing, intellectual property (IP) restrictions Read more at: https://oilprice.com/Energy/Energy-General/Landmark-WTO-Agreements-Look-To-Solve-The-Worlds-Most-Pressing-Problems.html |

|

Top U.S. LNG Producer Wants Exemption From Pollution LimitCheniere Energy, the largest LNG producer in the U.S., has requested from the Biden Administration an exemption from an EPA pollutant limit on the gas-fired turbines it uses, so it won’t be forced to shut some capacity, Reuters reported on Friday, quoting documents it had reviewed. The Environmental Protection Agency (EPA) includes, as of August, two types of stationary gas-fired turbines in the rule for limits on air pollutants such as formaldehyde and benzene. Cheniere, the top American LNG exporter, uses such turbines at its facilities Read more at: https://oilprice.com/Latest-Energy-News/World-News/Top-US-LNG-Producer-Wants-Exemption-From-Pollution-Limit.html |

|

Rig Count Climbs As Oil Prices Bounce BackThe number of total active drilling rigs in the United States rose by 2 this week, according to new data from Baker Hughes published on Friday. The total rig count rose to 752 this week273 rigs higher than the rig count this time in 2021. Oil rigs in the United States rose by 2 this week to 597. Gas rigs stayed the same at 153. Miscellaneous rigs were also unchanged, at 2. The rig count in the Permian Basin rose by 1 this week to 350. Rigs in the Eagle Ford held steady at 68. Oil and gas rigs in the Permian are 113 above where they were Read more at: https://oilprice.com/Energy/Energy-General/Rig-Count-Climbs-As-Oil-Prices-Bounce-Back.html |

|

NFL will select new Sunday Ticket partner by fall, Commissioner Roger Goodell saysThe NFL plans to choose a winning bidder for Sunday Ticket by the fall, Commissioner Roger Goodell said Friday. Read more at: https://www.cnbc.com/2022/07/08/nfl-will-select-new-sunday-ticket-partner-by-fall-commissioner-roger-goodell-says.html |

|

Another vote delay leaves Spirit’s merger with Frontier in question while JetBlue circlesSpirit Airlines delayed a shareholder vote on a planned tie-up with Frontier for a third time. Read more at: https://www.cnbc.com/2022/07/08/spirit-frontier-merger-in-question-after-another-vote-delay-jetblue-circles.html |

|

WWE’s Vince McMahon paid more than $12 million to settle sexual misconduct allegations, report saysWWE’s Vince McMahon paid $12 million to four women over the last 16 years., the Wall Street Journal reported. Read more at: https://www.cnbc.com/2022/07/08/wwes-vince-mcmahon-paid-12-million-to-settle-misconduct-allegations-report-says.html |

|

GameStop fires its CFO and announces layoffs as part of an aggressive turnaround planThe company is making staff cuts across departments as part of an effort to turn around the videogame retailer and drive growth. Read more at: https://www.cnbc.com/2022/07/07/gamestop-cfo-is-leaving-the-company-retailer-announces-layoffs.html |

|

Ford reports worst quarterly sales in China since the onset of the Covid pandemicFord on Thursday said it sold 120,000 vehicles during the second quarter in Greater China, a roughly 22% decline from a year earlier. Read more at: https://www.cnbc.com/2022/07/08/ford-q2-china-sales-were-worst-since-covid-pandemic-began.html |

|

Levi Strauss hikes dividend as second-quarter earnings exceed expectationsLevi Strauss’s second-quarter earnings topped analyst estimates. Read more at: https://www.cnbc.com/2022/07/07/levi-strauss-hikes-dividend-as-q2-earnings-exceed-expectations.html |

|

Biden says Supreme Court is ‘out of control,’ orders HHS to protect abortion accessBiden blasted the Supreme Court as “out of control” in its decision to overturn the constitutional right to terminate a pregnancy. Read more at: https://www.cnbc.com/2022/07/08/biden-says-supreme-court-out-of-control-signs-abortion-executive-order.html |

|

Stocks making the biggest moves midday: Upstart, WD-40, Vita Coco, and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/07/08/stocks-making-the-biggest-moves-midday-upstart-wd-40-vita-coco-and-more.html |

|

Spirit delays vote on Frontier deal for a third time amid bidding war with JetBlueSpirit Airlines is again delaying a shareholder vote set for Friday on its deal to merge with Frontier Airlines. Read more at: https://www.cnbc.com/2022/07/07/spirit-again-delays-shareholder-vote-on-frontier-deal-another-win-for-rival-suitor-jetblue.html |

|

Walmart won’t hold rival event to Amazon Prime Day, as it is already offering big markdownsAn abundance of inventory and plentiful discounts create an unusual backdrop for Amazon Prime Day, which has become a shopping holiday across the industry. Read more at: https://www.cnbc.com/2022/07/07/walmart-wont-hold-rival-event-to-amazon-prime-day.html |

|

How this entrepreneur quit her job to now teach people how they can afford anythingPaula Pant quit her job to travel the world and now she’s teaching people how they can afford anything. Read more at: https://www.cnbc.com/2022/07/08/how-paula-pant-quit-her-job-to-teach-people-how-to-afford-anything.html |

|

Dallas Cowboys criticized for announcing partnership with Black Rifle Coffee after mass shootingThe Cowboys’ recent partnership with Black Rifle Coffee has sparked criticism online. Read more at: https://www.cnbc.com/2022/07/07/dallas-cowboys-criticized-for-partnership-with-gun-themed-coffee-company-.html |

|

U.S. scientists enroll nearly 40,000 patients in high-stakes, $1.2 billion study of long CovidThe study, Recover, aims to complete enrollment of 40,000 people and launch clinical trials on potential treatments by the end of the year. Read more at: https://www.cnbc.com/2022/07/08/long-covid-us-scientists-to-enroll-40000-in-1point2-billion-study-.html |

|

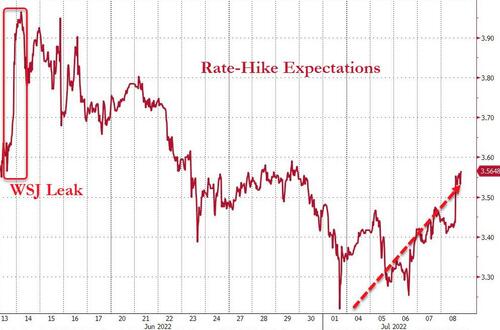

Commodities Crushed & Bonds Battered As Stocks & The Dollar SoarCommodities Crushed & Bonds Battered As Stocks & The Dollar SoarIt was a weird week in the markets as contradictory narratives flip-flopped from growth scares to inflation fears… Commodities crushed – recession anxiety, demand weaker? (but China reopening and stimulus) Bonds crushed – strong enough economy, inflation-fighting Fed hawkish Stocks strong – recession anxiety, end of Fed easing closer (Growth >> Value) Gold down hard – strong enough economy, inflation-fighting Fed hawkish Dollar up strong – strong enough economy relative to Europe (Fed ‘hawkisher’ than ECB) Payrolls headline strong BUT household survey ugly – so is the economy ‘strong enough’ or a shitshow? The bottom line is that the market shifted hawkishly with rate-hike-expectations up 25bps (1 full hike) this week…

Source: Bloomberg …with July fully pricing-in a 75bps hike and September now at around 27% odds of a 75bps hike… Read more at: https://www.zerohedge.com/markets/commodities-crushed-bonds-battered-stocks-dollar-soar |

|

Consumer Credit Hits A Brick Wall With Credit Cards Maxed OutLast month when we reported that the latest (April) consumer credit numbers were an absolute shocker, with another month of blowout revolving (credit card) debt confirming that US consumers had tapped out, and were spending themselves silly with money they don’t have, we said that the hangover was going to be brutal and painful. Well, fast forward one month to the Fed’s latest, just released consumer credit data (for the month of May) which confirmed that as expected, US consumers had maxed out their credit cards and the hangover had started. Starting at the top, total consumer credit rose just $22.3 billion, the lowest monthly total since January, and a sharp drop from both April’s $36.8 billion and March’s record $47.5 billion.

The drop was driven entirely by a sharp slowdown in revolving debt (i.e., credit card usage) which rose by just $7 … Read more at: https://www.zerohedge.com/markets/consumer-credit-hits-brick-wall-credit-cards-maxed-out |

|

Today’s America: An Economy Of ShortagesAuthored by Robert Genetski via The Epoch Times, For the first time in over 40 years, the U.S. economy is dealing with widespread shortages. Parts are unavailable for manufacturers when they need them. Airlines abruptly cancel flights. Railroads and trucks are cutting shipments. Food shelves in some areas are depleted with some areas reporting a lack of meat supplies, milk, or other essential food items.

What’s going on? Shortages and empty shelves are characteristic of economies where governments control and allocate resources. They are not characteristic of America’s free-market economy. The only other times America has faced shortages were during World Wars or during the 1970s. Read more at: https://www.zerohedge.com/political/todays-america-economy-shortages |

|

Why Goldman Is Buying Every Barrel Of Oil It Can FindWith commodity markets suffering a historic rout in the past few weeks, it will not come as a surprise to anyone that recession risks now dominate all macro markets. Earlier this week, Deutsche Bank economists wrote that the rolling 20-day move in their commodity index is now seeing the third-largest decline in 90 years, behind only the GFC, the initial Covid shock, and on a par with that seen in the early days of WWII in 1940. In March, we saw the fourth-largest 20-day uptick after the Russian invasion of Ukraine. The start of WWII and two occasions in the 1970s were the only bigger moves.

Goldman picks up on this and writes overnight that concerns over the deteriorating economic growth outlook in the US and Europe have dominated all markets lately, with commodities no exception. The BCOM and S&P GSCI total return indices respectively shed -18% and -16.5% relative to their YTD peak hit as the sell-off that initially started in industrial metals not on … Read more at: https://www.zerohedge.com/commodities/why-goldman-buying-every-barrell-oil-it-can-find |

|

Cost of living: Energy bills forecast to hit £3,363 a yearThe prediction comes as a plan is agreed to explore how to help households struggling to pay this winter. Read more at: https://www.bbc.co.uk/news/business-62094435?at_medium=RSS&at_campaign=KARANGA |

|

Tesco and Heinz reach agreement in price rowThe supermarket giant says it will stock Heinz beans and tomato ketchup again in the coming days. Read more at: https://www.bbc.co.uk/news/business-62076208?at_medium=RSS&at_campaign=KARANGA |

|

Who is Rishi Sunak?The former chancellor has launched a bid to be the next prime minister. Read more at: https://www.bbc.co.uk/news/business-51490893?at_medium=RSS&at_campaign=KARANGA |

|

Zerodha CEO Nithin Kamath says Sebi rules protect Indians when US markets catch coldIn a thread on Twitter, Kamath said most of the Sebi regulations have hurt the revenues of brokers in the short term but led to lesser volatility. “This has significantly improved the odds of retail participants doing well. One of those Nazdiki fayda dekhne se pehle, door ka nuksaan sochna chahiye things.” Read more at: https://economictimes.indiatimes.com/markets/stocks/news/zerodha-ceo-nithin-kamath-says-sebi-rules-protect-indians-when-us-markets-catch-cold/articleshow/92754313.cms |

|

Tech View: Nifty50 forms indecisive candle but further upside possible“The NSE barometer has reached its daily upper Bollinger Band as well as the upper end of a rising channel. In terms of the Fibonacci retracement, it has done little more than 61.8 per cent of the June fall. Thus, sustainability at this level will be crucial to determine further extension in the upmove. If Nifty50 crosses July 8 high of 16,275, it can head towards 16,500 in the short term,” Ratnaparkhi said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-forms-indecisive-candle-but-further-upside-possible/articleshow/92751261.cms |

|

This ICICI Group stock in bear grip could soon stage a turnaroundMotilal Oswal highlighted that the stock has corrected by 31 percent over the past 18 months, even as Nifty50 remained flat. The steep correction has been on account of a shift in the management’s focus to growth from profitability earlier and an expected reduction in ICICI Bank’s stake to sub-30 percent levels by September 2023 as per RBI regulations from 48 percent at present. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/this-icici-group-stock-in-bear-grip-could-soon-stage-a-turnaround/articleshow/92743915.cms |

|

The Tell: Home prices may still rise, but car values are set to fall from pandemic peak: GoldmanIn a sign that some inflation pressures may be easing, used car prices are expected to tumble 7% by year’s end and 18% by the end of 2023, according to a Goldman Sachs forecast. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7F71-E000FE33B7B3%7D&siteid=rss&rss=1 |

|

Bond Report: Treasury yields reach highest levels in more than a week after robust U.S. jobs dataU.S. bond yields rise for a third straight session on Friday and end the week higher on the view the Fed will continue to raise interest rates aggressively. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7F6A-77DDCE2198C1%7D&siteid=rss&rss=1 |

|

Facebook, Twitter ‘working to remove’ videos of Shinzo Abe assassination from platformsMultiple videos of the attack showing a gunman firing a double-barreled weapon twice at Abe were circulating on social media. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7F6F-2F2B4620B19E%7D&siteid=rss&rss=1 |