Summary Of the Markets Today:

- The Dow closed down 152 points or 0.50%,

- Nasdaq closed up 0.18%,

- S&P 500 closed down 0.38%,

- WTI crude oil settled at 118, down 2.80%,

- USD $105.59 up 0.38%,

- Gold 1808 down 0.17%,

- Bitcoin $22222 down 3.02%,

- 10-year U.S. Treasury up 0.114% / 3.485%

Today’s Economic Releases:

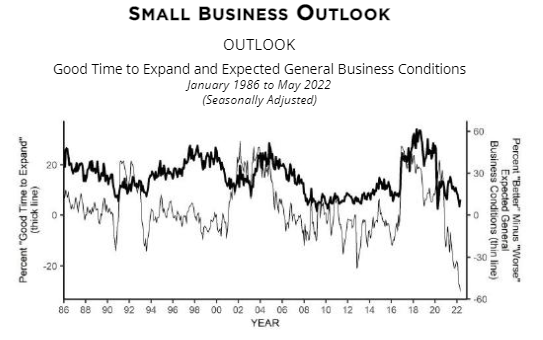

The small business (NFIB) optimism index fell for the fifth consecutive month – and is well below the average index value of 98. Worse is that small business owners six month projection of business conditions now is at the lowest level ever recorded in the 48 years of this index.

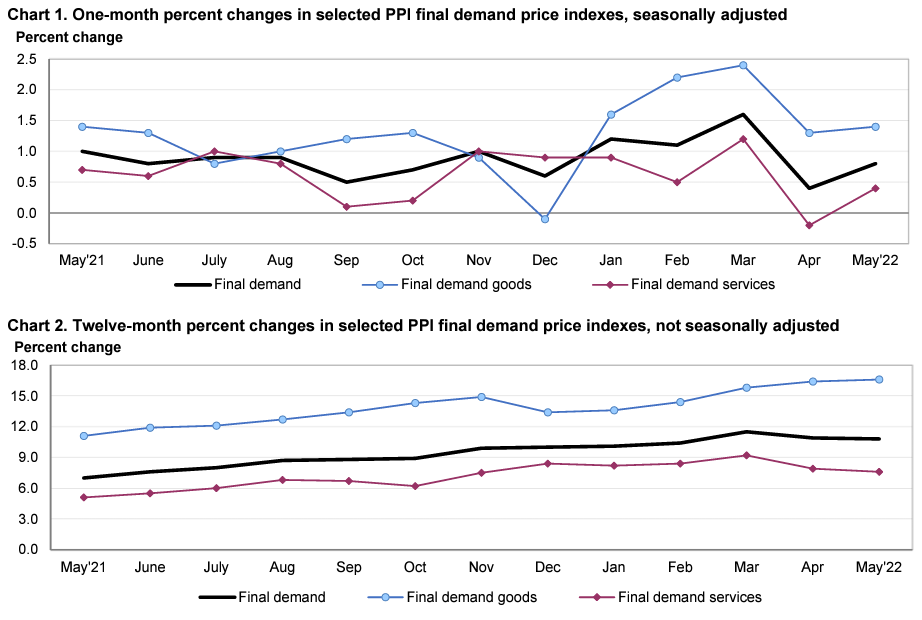

The May 2022 Producer Price Index Final Demand has inflated 10.8% year-over-year. Of course, it was energy prices which caused the current month to surge. Note that this index’s growth has been marginally slowing for the last two months,

U.S. mortgage delinquencies hit a new low in March 2022 – and the national foreclosure rate remains the lowest in 20 years.

A summary of headlines we are reading today:

- Oil Supply Fears Mount As OPEC Under-performs

- Germany Scrambles To Take Control Of Russia-Owned Refinery

- 30-year mortgage rate surges to 6.28%, up from 5.5% just a week ago

- Elon Musk says SpaceX will have Starship ‘ready to fly’ in July, amid FAA work

- Ford issues stop-sale of electric Mustang Mach-E crossovers due to potential safety defect

- Surging Oil Prices Show Business Cycle Slowdown Is Inevitable

- Bitcoin: Why is the largest cryptocurrency crashing?

- The Fed: A 75-basis point Fed move is not a slam dunk, former staffer says

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Oil Supply Fears Mount As OPEC UnderperformsReader Update: Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for global Energy Alert. Oilprice.com’s premium newsletter provides everything from geopolitical analysis to trading analysis, all for less than a cup of coffee per week. Chart of the Week- As national average gasoline prices have surpassed the $5 per US gallon mark for the first time in history, the market is set for further tightness after ten consecutive weeks of inventory declines.- With US gasoline demand Read more at: https://oilprice.com/Energy/Energy-General/Oil-Supply-Fears-Mount-As-OPEC-Underperforms.html |

|

Will Colombia’s Oil Industry Survive The 2022 Presidential Election?The outlook for Colombia’s oil industry has never been more uncertain. Not only is rising violence, fueled by poverty and cocaine production, weighing on operations but the 2022 presidential election is sparking considerable consternation that the petroleum industry’s best days may be behind it. After an intense campaign leftist senator, Gustavo Petro emerged with 40% of the vote and populist center-right construction magnate Rodolfo Hernandez gained 28% placing them in a 19 June 2022 electoral run-off to decide who will lead Colombia. Read more at: https://oilprice.com/Energy/Crude-Oil/Will-Colombias-Oil-Industry-Survive-The-2022-Presidential-Election.html |

|

Freeport LNG Not Expected To Resume Full Operations Until Late 2022Freeport LNG will not resume full operations at its liquefication plant on Quintana Island until the end of this year, according to the company’s Tuesday press release. While Chinas LNG demand may be calming the hot LNG market, news that Freeport LNG’s Texas plant will not resume full operations until late 2022 may upset the market. At this time, completion of all necessary repairs and a return to full plant operations is not expected until late 2022, Freeport LNG said, adding that partial operations could be resumed Read more at: https://oilprice.com/Latest-Energy-News/World-News/Freeport-LNG-Not-Expected-To-Resume-Full-Operations-Until-Late-2022.html |

|

Saudi Arabia Bets Big On Blue HydrogenWhile the world begins to build the infrastructure of a future hydrogen economy, the economics of global trade in carbon-free hydrogen are becoming more clear. Among countries expected to find significant opportunities in that future market is Saudi Arabia. According to a recent report from a notable Riyadh-based research institute, green hydrogen produced from electrolysis could begin to ship to the Port of Rotterdam in 2030 at prices quite competitive with European hydrogen, depending partly upon the shipping method used. The Read more at: https://oilprice.com/Energy/Energy-General/Saudi-Arabia-Bets-Big-On-Blue-Hydrogen.html |

|

Europe Imports Record LNG VolumesEurope is importing record levels of liquefied natural gas (LNG) this year as it looks to reduce dependence on Russian pipeline gas and fill gas storage ahead of next winter. The European Union and the UK saw a record high level of LNG imports in April 2022, when imports averaged 16.5 billion cubic feet per day (Bcf/d) and exceeded 19.0 Bcf/d on some days that month, the U.S. Energy Information Administration said on Tuesday. Europe’s LNG imports have jumped this year as gas storage inventories were at historically low levels from the autumn Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europe-Imports-Record-LNG-Volumes.html |

|

Germany Scrambles To Take Control Of Russia-Owned RefineryGermany is considering various ways of keeping the fourth-largest refinery in the country operating as it looks to eliminate oil import dependence on Russia by the end of the year because the refinery that provides 90 percent of the fuel to the capital city Berlin is majority-owned by Russias Rosneft. Germany has several options for the Schwedt refinery54-percent owned by Rosneftincluding expropriation. But the German authorities fear retaliation from Russia in case of expropriation, including retaliation consisting of Moscow Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-Scrambles-To-Take-Control-Of-Russia-Owned-Refinery.html |

|

Netflix, once the great disruptor, is now taking ideas from the industry it upended to jumpstart growthNetflix upended the entertainment industry by disrupting old media practices. Now it’s rethinking many of its core tenets Read more at: https://www.cnbc.com/2022/06/14/netflix-considers-ads-password-sharing-crackdown-live-sports.html |

|

30-year mortgage rate surges to 6.28%, up from 5.5% just a week agoThe average rate on the popular 30-year fixed mortgage hit 6.28% Tuesday, according to Mortgage News Daily. Read more at: https://www.cnbc.com/2022/06/14/30-year-mortgage-rate-surges-to-6point28percent-up-from-5point5percent-just-a-week-ago.html |

|

It’s a pain to fly these days. The FAA and airlines are trying to fix thatU.S. flight delays increased this year due to staffing issues, bad weather and stronger-than-expected demand. Read more at: https://www.cnbc.com/2022/06/14/faa-airlines-work-to-reduce-summer-travel-delays.html |

|

United Arab Emirates bans Pixar’s new Buzz Lightyear movie from theatersThe United Arab Emirates ban comes despite an announcement last year that the country would no longer censor movies. Read more at: https://www.cnbc.com/2022/06/14/united-arab-emirates-bans-new-buzz-lightyear-movie-from-theaters-.html |

|

Elon Musk says SpaceX will have Starship ‘ready to fly’ in July, amid FAA workSpaceX will have a Starship prototype rocket “ready to fly” by July, Elon Musk says, for a crucial milestone that is pending a regulatory license. Read more at: https://www.cnbc.com/2022/06/14/elon-musk-spacex-starship-ready-to-fly-by-july.html |

|

Real estate firms Compass and Redfin announce layoffs as housing market slowsIn filings with the Securities and Exchange Commission, Compass announced a 10% cut to its workforce, and Redfin announced an 8% cut. Read more at: https://www.cnbc.com/2022/06/14/real-estate-firms-compass-and-redfin-announce-layoffs-as-housing-market-slows.html |

|

Starbucks union: Company threatens that unionizing could jeopardize gender-affirming health careStarbucks union alleges the company is threatening to take away gender-affirming health care for unionized cafes Read more at: https://www.cnbc.com/2022/06/14/starbucks-union-company-threatens-that-unionizing-could-jeopardize-gender-affirming-health-care.html |

|

Ford issues stop-sale of electric Mustang Mach-E crossovers due to potential safety defectFord says the issue with the Mustang Mach-E crossovers could cause the vehicles to become immobile. Read more at: https://www.cnbc.com/2022/06/14/ford-issues-stop-sale-of-mustang-mach-es-due-to-potential-safety-defect.html |

|

U.S. airline bookings slipped again in May with fares 30% higher than 2019Adobe data show airline bookings fell 2.3% in May from April as fares surged. Read more at: https://www.cnbc.com/2022/06/14/us-airline-bookings-slipped-again-in-may-with-fares-30percent-higher-than-2019.html |

|

Spirit Airlines says it will decide on competing JetBlue, Frontier bids before the end of JuneJetBlue recently sweetened its offer for Spirit to include a $350 million reverse break-up fee. Read more at: https://www.cnbc.com/2022/06/14/spirit-airlines-says-it-will-pick-between-competing-jetblue-frontier-bids-before-months-end.html |

|

FAA requires SpaceX to make environmental adjustments to move forward with its Starship program in TexasThe FAA said SpaceX will be required to take more than 75 actions to mitigate environmental impacts before the company can receive a launch license. Read more at: https://www.cnbc.com/2022/06/13/faa-spacex-starship-environmental-review-clears-texas-program-to-move-forward.html |

|

Warehouse giant Prologis, a major Amazon landlord, to buy rival Duke Realty in $26 billion dealThis comes after Duke Realty in May rejected a nearly $24 billion buyout offer from Prologis, calling it insufficient. Read more at: https://www.cnbc.com/2022/06/13/prologis-amazon-warehouse-landlord-to-buy-duke-realty-for-26-billion.html |

|

American Airlines regional carriers hike pilot pay more than 50% as shortage persistsTwo American Airlines-owned carriers will give pilots big raises to slow attrition that is crimping flight growth. Read more at: https://www.cnbc.com/2022/06/13/american-airlines-regional-pilots-get-big-pay-hikes-as-competition-for-pilots-intensifies-.html |

|

Surging Oil Prices Show Business Cycle Slowdown Is InevitableSurging Oil Prices Show Business Cycle Slowdown Is InevitableBy John Kemp, senior market analyst Policymakers, economists and journalists often talk about the business cycle using the good-and-evil language of a fairy tale. Booms are attributed to wise and enlightened policies while recessions are blamed on policy errors or the need to cleanse previous excess. But the economy is not a morality play. Expansions are not a reward for virtuous and wise actions, and recessions are not a punishment for bad behaviour and mistakes. Wrenching cycles in production, employment, prices and wages can be traced as far back in history as the data will allow economic performance to be reconstructed. The “trade cycle” of booms and busts goes back at least as far as the early nineteenth century in Britain and North America. Cyclical volatility seems to reflect fundamental forces rather than blameworthy behaviour by central banks, finance ministries, markets, businesses and households. There is no sign policymakers can stabilise the cycle if they have enough information and insight about the workings of the economy. Long expansions in the 1990s, the early 2000s and the 2010s resulted in premature pronouncements about the end of the business cycle, only to be followed by recessions in 2001, 2008 and 2020. SPARE CAPACITYIn the case of the oil market, spare production capacity, inventories and prices in both crude oil and refined products are closely correlated with the business cycle. Prolonged busine … Read more at: https://www.zerohedge.com/markets/surging-oil-prices-show-business-cycle-slowdown-inevitable |

|

Watch: Biden Advisor Says Social Media Should Silence Anyone Who Criticises Green Energy “Transition”Authored by Steve Watson via Summit News, One of Joe Biden’s senior advisors told a reporter this week that social media companies should be cracking down on and censoring anyone who speeds information critical of the administration’s so called ‘green energy transition’.

National climate advisor Gina McCarthy made the comments in an interview with a reporter for Axios, stating “Now it’s not so much denying the problem. What the [fossil fuel] industry is now doing is seeding doubt about the costs associated with [green energy] and whether they work or not.” She continued, “We need the tech companies to really jump in,” on “disinformation,” noting that critici … Read more at: https://www.zerohedge.com/political/watch-biden-advisor-says-social-media-should-silence-anyone-who-criticises-green-energy |

|

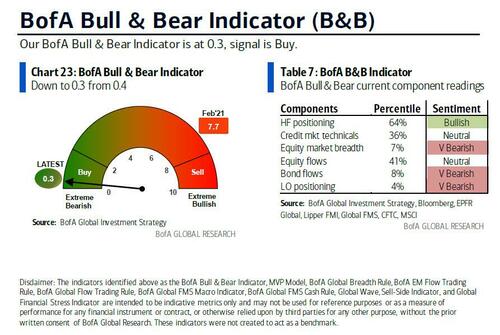

The Mood On Wall Street Has Never Been More ApocalypticThere has been a distinct pattern to 2022 – every month, when look at the latest BofA Fund Manager Survey, we find that the mood on Wall Street has never been catastrophic, dire, apocalyptic, etc.. and 30 days later we find that said mood has turned even worse. This month’s Fund Manager Survey was no difference, and a quick look at the responses to Mike Hartnett’s questions by the 300 panelists who manage $834BN in AUM suggests that one should not walk next to tall building on Wall Street, midtown or the Hudson yards. . As FMS survey organizer, Michael Hartnett writes, the US stock market officially entered a bear market on Monday (its 20th of the past 140 years) as the June BofA Fund Manager Survey (FMS) signals deeper investor misery: as we noted last Friday, the BofA Bull & Bear Indicator is now down to just 0.2 (it can’t drop below 0.0)…

… and although Wall Street sentiment is dire… Read more at: https://www.zerohedge.com/markets/mood-wall-street-has-never-been-more-apocalyptic |

|

US Economy Has “Decent Chance” Of Avoiding Recession But Things “Could Go Bad”: BernankeUS Economy Has “Decent Chance” Of Avoiding Recession But Things “Could Go Bad”: BernankeAuthored by Katabella Roberts via The Epoch Times, Federal Reserve officials have a “decent chance” of avoiding a recession in the United States with a “soft landing,” former Federal Reserve Chair Ben Bernanke said on Sunday.

Bernanke pointed to a strong labor market in the United States, saying that “with some luck, and if the supply side improves, the Fed can get inflation down without imposing the kind of costs we saw in the early ’80s.” Read more at: https://www.zerohedge.com/economics/us-economy-has-decent-chance-avoiding-recession-things-could-go-bad-bernanke |

|

Warning air travel staff issues will last into summerStaff shortages which disrupted flights recently are unlikely to be fixed soon, firms and unions say. Read more at: https://www.bbc.co.uk/news/business-61754664?at_medium=RSS&at_campaign=KARANGA |

|

Bitcoin: Why is the largest cryptocurrency crashing?The value of Bitcoin is at an 18-month low, as the cryptocurrency market continues to tumble. Read more at: https://www.bbc.co.uk/news/technology-61796155?at_medium=RSS&at_campaign=KARANGA |

|

Scrapping of electric car grants sparks backlashMotoring and car industry groups criticise the government’s decision to end the plug-in subsidy scheme. Read more at: https://www.bbc.co.uk/news/business-61795693?at_medium=RSS&at_campaign=KARANGA |

|

Zerodha founder Nithin Kamath’s next mission: Consolidate dad’s portfolio“I’m sure many Indians must be facing the same problem, just like my dad. As a first step towards attempting to solve it, we are helping our customers have a consolidated family portfolio view across Zerodha accounts,” the billionaire stock broker said on Twitter. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/zerodha-founder-nithin-kamaths-next-mission-consolidate-dads-portfolio/articleshow/92210024.cms |

|

Tech View: Nifty50 forms ‘Inverted Hammer’, recovery possibleChandan Taparia of Motilal Oswal Securities said that Bank Nifty opened negative but managed to respect its multiple support near 33,000-33,100 zones and bounced towards 33,600 levels. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-forms-inverted-hammer-recovery-possible/articleshow/92208193.cms |

|

Nifty Metal forms Death Cross; brace for more pain ahead!The Death Cross is a chart pattern that indicates the transition into the bear grip. This technical indicator occurs when the short-term moving average (say, 50-day) of a stock/sector crosses from above to below a long-term moving average (say, 200-day). Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nifty-metal-forms-death-cross-brace-for-more-pain-ahead/articleshow/92204837.cms |

|

The Fed: A 75-basis point Fed move is not a slam dunk, former staffer saysA 75-basis point hike in the Federal Reserve’s benchmark rate is a closer call than many investors think, a former staffer says. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7E8B-E0A9C97F1706%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil prices settle at lowest in a weekOil futures surrendered early gains on Tuesday, brought on by supply disruptions in Libya, to finish with a loss. Traders weigh news developments linked to the Iran nuclear deal, a waiver extension allowing U.S. banks to process Russian energy transactions, and a report that a U.S. senator intends to propose a federal surtax on certain oil companies in a move to curb inflation. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7E81-56C4477BF909%7D&siteid=rss&rss=1 |

|

The Moneyist: My parents-in-law sold their home and bought an RV. They have $200K in the bank. How can they protect their assets from being used for nursing home costs?‘If my father-in-law has to go into a nursing home and his assets are surrendered for his care, his wife has no income.’ Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7E40-FE0692FE712A%7D&siteid=rss&rss=1 |