Summary Of the Markets Today:

- The Dow closed down 876 points or 2.79%,

- Nasdaq closed down 4.60%,

- S&P 500 closed down 3.88%,

- WTI crude oil settled at 120, up 0.29%,

- USD $105.07 up 0.77%,

- Gold 1823 down 2.52%,

- Bitcoin $23184 down 5.90%,

- 10-year U.S. Treasury up 0.214% / 3.371%

Today’s Economic Releases:

Today a recession red flag waved as the yield curve inverted – and many believe a recession follows in one to two years. The last time the yield curve inverted was in early April, and it quickly recovered. At that time, Morgan Stanley predicted that the yield curve would soon invert again and should remain inverted for the rest of 2022. Note that every recession is different, and an inverted yield curve alone usually does not result in a recession. We are currently seeing a modest slowing of employment growth and real income – but industrial production and retail sales remain relatively strong. According to Bloomberg, the current inversion was caused by “investors dumping short-term debt on concerns that aggressive rate hikes will lead to an economic slowdown.”

A summary of headlines we are reading today:

- American Shale Drillers Set To Boost Production In July

- Biden Claims Visit To Saudi Arabia Is About Israel, Not Oil Prices

- American Airlines regional carriers hike pilot pay more than 50% as shortage persists

- Astra’s stock drops 25% after rocket failed to deliver NASA mission to orbit

- “Panic”: Yields Soar After WSJ “Fed Leaker” Says Odds Rising Of 75bps Rate Hike

- Outside the Box: ‘Liquidation panic’ has taken over the stock, bond and crypto markets — and this may be the beginning of the end

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

The Worlds Top Coal Exporter Cant Afford To Go GreenHow much will it cost to wean Indonesia off coal? This is a pressing question for world leaders and climate policy-makers around the world in the lead-up to this year’s COP27 climate summit, set to take place in Sharm el-Sheikh, Egypt this November. Just before the summit, in which the world’s premier politicians, scientists, policymakers, and industry leaders convene to set goals, broker deals, and make concrete agendas to meet the emissions standards set by the Paris climate agreement in 2015, G-20 leaders are meeting in Bali to try Read more at: https://oilprice.com/Energy/Coal/The-Worlds-Top-Coal-Exporter-Cant-Afford-To-Go-Green.html |

|

American Shale Drillers Set To Boost Production In JulyU.S. Shale production in the seven most prolific shale basins is set to increase 143,000 bpd in July to 8.91 million bpd, according to the Energy Information Administration’s latest Drilling Productivity Report published on Monday. It would be the largest monthly production increase since March 2020, according to EIA data. The largest jump is expected to come from the Permian basin, increasing by 84,000 bpd from an estimated 5.232 million bpd in June 2022 to 5.316 million bpd next month. The EIA has forecast that the second-largest gainer Read more at: https://oilprice.com/Latest-Energy-News/World-News/American-Shale-Drillers-Set-To-Boost-Production-In-July.html |

|

Aluminum Prices Are Taking A BeatingAluminum prices declined overall in May. However, near the end of the month, they appeared to hit bottom and began to trade sideways. Conflicting macroeconomic and geopolitical factors continue to pressure markets, resulting in unclear direction and price trends. Shanghai Lockdowns Return, Compounding Uncertainty Shanghais reopening proved short-lived as the city stumbled back into lockdown this week. Following a surge in COVID cases, restrictions and mass testing are returning to most areas of the city. Shanghai first went into strict lockdown Read more at: https://oilprice.com/Energy/Energy-General/Aluminum-Prices-Are-Taking-A-Beating.html |

|

Biden Claims Visit To Saudi Arabia Is About Israel, Not Oil PricesPresident Joe Biden awkwardly claimed that his planned Saudi trip, where it’s expected he’ll mend ties with Saudi Crown Prince Mohammed bin Salman (MbS) and ‘move on’ from the issue of the Jamal Khashoggi murder, has not much to do with energy. He had this exchange with reporters outside of Air Force One on Sunday: Reporter: “Have you decided, sir, whether to go to Saudi Arabia?” Biden: “No, not yet.” Reporter: “What would be holding up the decision at this point? Are there commitments you’re waiting for from the Saudis on the negotiations Read more at: https://oilprice.com/Geopolitics/International/Biden-Claims-Visit-To-Saudi-Arabia-Is-About-Israel-Not-Oil-Prices.html |

|

EIA: Listed Oil And Gas Firms Spent Significantly Less On Exploration In 2021Global public companies representing 60% of total non-OPEC liquid fuels production spent last year $244 billion on exploration and development, down by 28% compared to the pre-pandemic average, the Energy Information Administration said on Monday in an analysis of 119 U.S. and international listed firms. Those companies added 19.2 billion barrels of oil equivalent to proved reserves in 2021, after net purchases and production, the EIA said in its review based on the published financial reports provided to the SEC and that Evaluate Energy Read more at: https://oilprice.com/Latest-Energy-News/World-News/EIA-Listed-Oil-And-Gas-Firms-Spent-Significantly-Less-On-Exploration-In-2021.html |

|

Oil Climbs Back To Nearly $123 After China COVID ScareBearish sentiments on oil demand coming from renewed COVID lockdowns in China that shaved $4 off oil prices early on Monday failed to maintain traction, with sweeping production outages in Libya and other bullish drivers stealing the day. By 1:37 p.m. EST, Brent crude prices had pushed their way back up to nearly $123 per barrel, with WTI trading at over $121. Early Monday saw oil prices drop as COVID concerns added to fears that a rebound in Chinese demand would take longer. Bearish sentiment was also forming as a result of concerns Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Climbs-Back-To-Nearly-123-After-China-COVID-Scare.html |

|

FAA requires SpaceX to make environmental adjustments to move forward with its Starship program in TexasIn a press release, the FAA noted SpaceX will be required to take more than 75 actions to mitigate environmental impacts before the company can receive a launch license. Read more at: https://www.cnbc.com/2022/06/13/faa-spacex-starship-environmental-review-clears-texas-program-to-move-forward.html |

|

American Airlines regional carriers hike pilot pay more than 50% as shortage persistsTwo American Airlines-owned carriers will give pilots big raises to slow attrition that is crimping flight growth. Read more at: https://www.cnbc.com/2022/06/13/american-airlines-regional-pilots-get-big-pay-hikes-as-competition-for-pilots-intensifies-.html |

|

CEOs of GM, Ford and other automakers urge Congress to lift electric vehicle tax credit capThe executives say the tax credit is critical to keep the vehicles affordable as production and commodity costs rise. Read more at: https://www.cnbc.com/2022/06/13/ceos-of-gm-ford-and-others-urge-congress-to-lift-ev-tax-credit-cap.html |

|

Latest Shanghai quarantines add more pressure to global supply chainThe latest mass quarantine measures in Shanghai, including highway closures, severely affected trucks carrying exports bound for the city’s port. Read more at: https://www.cnbc.com/2022/06/13/latest-shanghai-quarantines-add-more-pressure-to-global-supply-chain.html |

|

Warehouse giant Prologis, a major Amazon landlord, to buy rival Duke Realty in $26 billion dealThis comes after Duke Realty in May rejected a nearly $24 billion buyout offer from Prologis, calling it insufficient. Read more at: https://www.cnbc.com/2022/06/13/prologis-amazon-warehouse-landlord-to-buy-duke-realty-for-26-billion.html |

|

Jack-and-Coke in a can: Coca-Cola and Brown-Forman team up for new drinkIt marks the fourth new alcoholic drink in Coke’s portfolio in less than two years. Read more at: https://www.cnbc.com/2022/06/13/jack-and-coke-in-a-can-coca-cola-and-brown-forman-team-up-for-new-drink.html |

|

EV start-up Electric Last Mile Solutions plans to declare bankruptcy a year after going publicThe Michigan-based start-up will move to liquidate less than a year after it went public. Read more at: https://www.cnbc.com/2022/06/13/ev-start-up-electric-last-mile-solutions-to-declare-bankruptcy.html |

|

Crypto ‘is the first asset class that is accessible to anyone,’ says blockchain educator — why it’s drawing Black, Latino communitiesCNBC spoke with The Blockchain Foundation’s Cleve Mesidor about cryptocurrency’s future and how to keep the space from looking like the old world of finance. Read more at: https://www.cnbc.com/2022/06/13/crypto-is-first-asset-class-accessible-to-anyone-blockchain-educator.html |

|

Astra’s stock drops 25% after rocket failed to deliver NASA mission to orbitShares of rocket-builder Astra fell sharply in trading on Monday after a weekend launch carrying NASA satellites failed to reach orbit. Read more at: https://www.cnbc.com/2022/06/13/astras-stock-drops-after-rocket-failed-to-deliver-nasa-mission-to-orbit.html |

|

‘Jurassic World: Dominion’ nabs $143.3 million in domestic opening, ‘Top Gun: Maverick’ adds $50 million“Jurassic World: Dominion” roared to the top of the domestic box office over the weekend, generating more than $143 million in ticket sales during its debut. Read more at: https://www.cnbc.com/2022/06/12/jurassic-world-dominion-opening-weekend-box-office-.html |

|

Walmart launched a lot of apparel and home brands. Now, that strategy will be put to the testThe retailer’s desire to sell more high-margin items has taken on urgency after it disappointed Wall Street with first-quarter earnings. Read more at: https://www.cnbc.com/2022/06/12/walmart-apparel-home-brands-strategy-tested.html |

|

QuantumScape promised a revolutionary EV battery. Here’s why investors are still waitingA run in QuantumScape’s stock at the end of 2020 gave the solid-state battery maker a $54 billion valuation. But the hype appears to have all but dried up. Read more at: https://www.cnbc.com/2022/06/11/why-quantumscape-investors-are-still-waiting-for-new-ev-batteries.html |

|

The biggest mall owner in the U.S. hopes to create a new sales holiday as inflation surgesCNBC spoke with Simon Property Group CEO David Simon about this weekend’s event, the state of the retail industry and the American consumer. Read more at: https://www.cnbc.com/2022/06/11/simon-property-ceo-aims-to-create-new-sales-event-as-inflation-surges.html |

|

Snyder: The Worst Economic Gloom In 50 YearsSnyder: The Worst Economic Gloom In 50 YearsAuthored by Michael Snyder via TheMostImportantNews.com, We haven’t seen anything like this in decades. Energy prices are soaring to unprecedented heights. Food shortages in some parts of the world are starting to become quite severe. Rampant inflation is out of control all over the globe. Meanwhile, economic activity is slowing down everywhere that you look. Some are comparing this current crisis to the “stagflation” of the 1970s, but I believe that is a far too optimistic assessment. Just about everyone can see that economic conditions are rapidly deteriorating, and there is a tremendous amount of alarm about what the months ahead will bring.

According to a brand new Wall Street Journal-NORC survey Read more at: https://www.zerohedge.com/personal-finance/snyder-worst-economic-gloom-50-years |

|

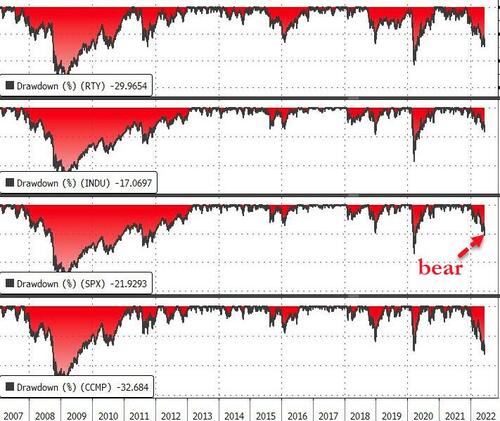

Carnage!Carnage!Well that escalated quickly. Apart from crude oil, almost all asset classes were clubbed like baby seals today as event risk anxiety (ahead of FOMC) combined with OpEx technicals ($3.4 trillion options expiration) and European ‘fragmentation’ fears and all the usual geo-political, geo-economic factors that are holding back the dip-buyers as the S&P drops into a bear market and US equities broadly test 2022 lows (while TSY yields push multi-year highs). The S&P closed down 22% from its highs and at its lowest since Jan 2021…

“…millions of voices suddenly cried out in terror and were suddenly silenced…”

As Bill Blain noted earlier, t … Read more at: https://www.zerohedge.com/markets/carnage |

|

“Panic”: Yields Soar After WSJ “Fed Leaker” Says Odds Rising Of 75bps Rate HikeRate HikeUp until this afternoon, while several banks – most notably Barclays, Jefferies and Nomura – were speculating that 75bps (or even 100bps) of rate hikes on Wednesday was possible, they were also viewed as unlikely because – as Standard Chartered’s Steven Englander said earlier – this is “not a Fed that likes to surprise”, while SGH Macro Advisors Fed watcher Ted Duy said, “The Fed has locked in 50-bp moves the for June and July meetings. A break with this near-term predictability “repudiates the Fed’s entire strategy.” It would sound like panic.” Guy continued:

Well, panic it may be, because moments ago, the WSJ’s in-house Fed leaker whisperer, Nick Timiraos, who has repeatedly been used by the Fed to strategically leak key guidance to the market, just unleashed hell Read more at: https://www.zerohedge.com/markets/panic-yields-soar-after-wsj-fed-leaker-says-odds-rising-75bps-rate-hike |

|

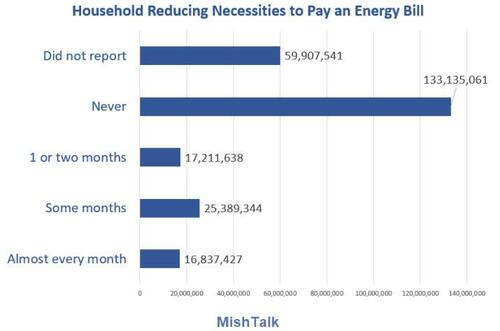

Over Twenty Million Households Struggle To Pay Energy Bills, It Will Get WorseAuthored by Mike Shedlock via MishTalk.com, Over 20 million households are behind over $23 billion on their utility bills as we head into a blisteringly hot summer…

Data from Census Bureau Household Pulse Survey, April 27 to May 9, 2022 Struggling to Pay BillsAccording to Mark Wolfe, the executive director of the National Energy Assistance Directors’ Association (NEADA ) many families are facing potential power shutoffs if they cannot pay their overdue home energy bills. “More than 20 million families are currently behind on their utility bills, owing about $23 billion, up from about $10.5 billion at the end of 2019,” Wolfe said to CNN. Census Department Household Pulse SurveyLet’s take a look at Read more at: https://www.zerohedge.com/markets/over-twenty-million-households-struggle-pay-energy-bills-it-will-get-worse |

|

Lloyds Bank staff to get £1,000 to help with cost of livingMore than 64,000 workers at the bank will get a one-off payout, following a campaign by the Unite union. Read more at: https://www.bbc.co.uk/news/business-61781313?at_medium=RSS&at_campaign=KARANGA |

|

Stocks slide over global economy concernsIt comes as official figures showed that US inflation hit a more than 40-year high last month. Read more at: https://www.bbc.co.uk/news/business-61779615?at_medium=RSS&at_campaign=KARANGA |

|

Ukraine war: Russia earns $97bn on energy exports since invasionA report warns of potential loopholes in efforts to limit use of Russian oil and gas. Read more at: https://www.bbc.co.uk/news/business-61785111?at_medium=RSS&at_campaign=KARANGA |

|

Nifty at 15K? This is where you may find valuations attractiveTechnical charts hint at some support at 15,670, followed by the 15,400 level, but analysts do not rule out a revisit of sub-15,000 levels. Fundamentally, while analysts believe it is futile to predict a bottom at this stage, given global headwinds, levels around 15,000 on the index would look attractive, analysts said while advising investors to stay light for now. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nifty-at-15k-this-is-where-you-may-find-valuations-attractive/articleshow/92184526.cms |

|

Neither Tata nor Adani, latest multibagger is a long-forgotten Birla stockSince May 25, the smallcap has been regularly hitting upper circuits to scale new 52-week-highs every day. On Monday also, the stock hit the 5 per cent upper circuit limit to trade at Rs 24.35. With a market cap of a little over Rs 500 crore, the stock’s PE has also shot up to 26x. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/neither-tata-nor-adani-latest-multibagger-is-a-long-forgotten-birla-stock/articleshow/92182230.cms |

|

Over 95% upside potential! This smallcap stock in bear grip could reverse trendHG Infra Engineering won orders worth Rs 2,180 crore and Rs 4,330 crore during FY21 and FY22, respectively. The current order book of Rs 7,970 crore provides visibility for 2.2x TTM revenue, it said.Axis Capital sees order inflow in the range of Rs 9,000-10,000 crore in FY23 with EBITDA margins in the range of 15.5-16 per cent. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/over-95-upside-potential-this-smallcap-stock-in-bear-grip-could-reverse-trend/articleshow/92177192.cms |

|

Market Snapshot: S&P 500 ends in a bear market, Dow drops almost 900 points as recession fears rise ahead of Wednesday’s Fed decisionU.S. stocks close sharply lower as financial markets reel from an acceleration in inflation just days ahead of a Federal Reserve interest-rate decision. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7E73-C210B500975C%7D&siteid=rss&rss=1 |

|

Sustainable Investing: There’s another reason companies should tread carefully with political influence — the stock market is watchingNonprofit that urges disclosure of corporate political activity is stepping up its efforts to track election-related spending, after a prod from big money managers. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7E58-AA4372A6D464%7D&siteid=rss&rss=1 |

|

Outside the Box: ‘Liquidation panic’ has taken over the stock, bond and crypto markets — and this may be the beginning of the endSome silver linings are starting to appear in a series of dark clouds. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7E7B-809103BEB832%7D&siteid=rss&rss=1 |