Summary Of the Markets Today:

- The Dow closed up 435 points or 1.33%,

- Nasdaq closed up 2.75%,

- S&P 500 closed up 1.84%,

- WTI crude oil settled at 117, up 2.121%,

- USD $101.80 down 0.73%,

- Gold $1850 up $10,

- Bitcoin up 0.68% to $33278,

- 10-year U.S. Treasury down 0.16% / 2.9%

Today’s Economic Releases:

The four-week rolling average of Initial Unemployment Claims modestly declined this past week and remains historically low.

ADP’s Private Employment for May 2022 declined to 128,000. Nela Richardson, chief economist of ADP wrote:

Under a backdrop of a tight labor market and elevated inflation, monthly job gains are closer to pre-pandemic levels. The job growth rate of hiring has tempered across all industries, while small businesses remain a source of concern as they struggle to keep up with larger firms that have been booming as of late.

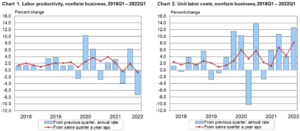

1Q2022 Non-farm business productivity declined 0.6% year-over-year whilst labor costs increased 8.2%.

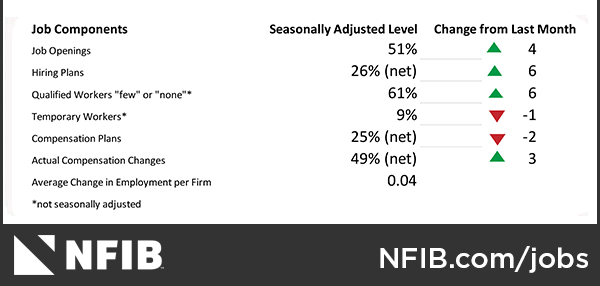

According to NFIB’s monthly jobs report, finding suitable employees for small business open positions continues to be a problem. NFIB Chief Economist Bill Dunkelberg wrote:

The labor force participation rate is slowly rising but small businesses continue to have a hard time filling their open positions. The number of job openings continues to exceed the number of unemployed workers which has produced a tight labor market and added pressure on wage levels.

A summary of headlines we are reading today:

- U.S. Economic Officials Says Biden Considering Oil & Tax Windfall Tax

- Walmart is using its thousands of stores to battle Amazon for e-commerce market share

- Ford to add over 6,000 U.S. jobs as it boosts electric vehicle production and prepares for a new Mustang

- ‘Bad News Is Good News’ – Stocks Soar As Macro-Meltdown Accelerates

- The Sheer Stupidity Of Student Loan Forgiveness While Inflation Rages Out Of Control

- Market Movers: MM Forgings zooms 9% on EV foray; La Opala starts new factory

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

Russia Will Regret Selling Alaska If Biden Unleashes Its Energy PotentialAlaska has the potential to provide the US with more oil, but it all boils down to one question: what’s more important, energy security or the environment? This issue is currently being toiled over by Biden’s administration and the Alaskan state government. As oil firms are committed to continuing major oil and gas operations in Alaska, will they be allowed to support the growing North American energy demand or will the U.S. government halt operations in favor of progressing climate policy? Several discoveries last year showed Read more at: https://oilprice.com/Energy/Crude-Oil/Russia-Will-Regret-Selling-Alaska-If-Biden-Unleashes-Its-Energy-Potential.html |

|

Rising U.S. Interest Rates Could Significantly Impact Emerging MarketsFollowing the US Federal Reserves decision to raise benchmark interest rates in recent months, analysts are closely tracking the impact this will have on emerging markets and their economies. On May 4 the Federal Reserve raised its benchmark interest rate by 0.5 percentage points to a target range of 0.75-1%, the largest increase since 2000. This followed a 0.25-percentage-point rise in March, the first since December 2018. The decision to lift interest rates comes amid attempts to control inflation in the US, which hit a 40-year high of Read more at: https://oilprice.com/Energy/Energy-General/Rising-US-Interest-Rates-Could-Significantly-Impact-Emerging-Markets.html |

|

How Russia Has Remained One Step Ahead Of Western SanctionsAs the US and EU pile on sanctions, Russia finds more ways to avoid them… The week, the EU Sets Harshest Russian Sanctions, Targeting Oil and Insurance, with exemptions to Hungary. The European Union is set to impose its toughest sanctions yet on Russia, banning imports of its oil and blocking insurers from covering its cargoes of crude, officials and diplomats say, as the West seeks to deprive Moscow of cash it needs to fund the war on Ukraine and keep its economy functioning. The sanctions, which are expected to be completed in the coming days, Read more at: https://oilprice.com/Energy/Energy-General/How-Russia-Has-Remained-One-Step-Ahead-Of-Western-Sanctions.html |

|

U.S. Economic Officials Says Biden Considering Oil & Tax Windfall TaxA White House economic advisor told a panel on Thursday that the Biden administration is now considering the U.S. congressional proposal that would place a windfall tax on oil and gas as prices at the pumps continue to soar, Reuters reports. “We are very much open to any proposal that would provide relief to consumers at the pump,” National Economic Council deputy director Bharat Ramamurti told a Roosevelt Institute panel, as cited by Reuters. Ramamurti said the White House was engaging in conversations with Congress about a windfall Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Economic-Officials-Says-Biden-Considering-Oil-Tax-Windfall-Tax.html |

|

Russia Claims Its Oil Production Will Rebound In JuneRussia is confident that it will be able to restore in June oil production lost in March and April, with this month seen as maximum recovery relative to previous levels, Russian Deputy Prime Minister Alexander Novak told state TV channel Rossiya 24 on Thursday. Our production fell slightly in March and April. It recovered to some extent in May. We see a bigger recovery in June, Novak said, as carried by Russian news agency Interfax. We are finding a point of equilibrium in the situation that is emerging due to Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Claims-Its-Oil-Production-Will-Rebound-In-June.html |

|

Study Reveals Alarming Lack Of Climate Change Research In Central AsiaA new study shows there is an alarming lack of research on climate change patterns and mitigation possibilities in Central Asia, one of the most at-risk regions on earth. The paper, A Void in Central Asian Research: Climate Change, was published recently in the journal Central Asian Survey. It states that temperatures in Central Asia are rising faster than the global average, thereby accelerating a variety of problems, including glacier melt, unreliable river flows, and increasing aridity. The environmental shifts, in turn, can have profound social Read more at: https://oilprice.com/Energy/Energy-General/Study-Reveals-Alarming-Lack-Of-Climate-Change-Research-In-Central-Asia.html |

|

Walmart is using its thousands of stores to battle Amazon for e-commerce market shareWalmart is increasingly relying on its vast network of stores to build out its e-commerce business. Read more at: https://www.cnbc.com/2022/06/02/walmart-bets-its-stores-will-give-it-an-edge-in-amazon-e-commerce-duel.html |

|

New CNN boss has a message for staffers: Cool it with the ‘Breaking News’ bannerChris Licht wrote a memo to staff on Thursday with new guidelines about when to use CNN’s ‘Breaking News’ banner. Read more at: https://www.cnbc.com/2022/06/02/new-cnn-boss-has-a-message-for-staffers-cool-it-with-the-breaking-news-banner.html |

|

Dave Roberts is one of the most powerful executives at ESPN – and he wants more diversity behind the scenesDave Roberts oversees tons of programming for ESPN, including the NBA Finals, and he’s pushing for more diversity at the network. Read more at: https://www.cnbc.com/2022/06/02/nba-finals-espn-executive-dave-roberts-pushes-for-more-diversity.html |

|

Sheryl Sandberg sold $1.7 billion worth of Facebook stock over the last decadeOver the past decade, Sandberg has sold over 75% of her shares through regularly scheduled share sale programs. Read more at: https://www.cnbc.com/2022/06/02/sheryl-sandbergs-facebook-stock-sales-total-1point7-billion-since-2012.html |

|

Ford’s U.S. sales decline narrowed in May as demand remained high for its electric vehicles and pickupsFord said its sales decline was narrower than the overall industry’s, helped by demand for the company’s latest products as the chip shortage lingered. Read more at: https://www.cnbc.com/2022/06/02/fords-us-sales-decline-narrows-in-may-amid-tight-supplies.html |

|

Harvey Weinstein’s sex crime convictions upheld by New York courtA New York appeals court has upheld Harvey Weinstein’s sex crimes conviction, rejecting an appeal that suggested he did not receive a fair trial. Read more at: https://www.cnbc.com/2022/06/02/harvey-weinsteins-sex-crime-convictions-upheld-by-new-york-court.html |

|

The IRS is working to increase its audit rates for higher earnersThe IRS is working to increase its audit rates for the wealthiest Americans, according to a statement released by the agency. Read more at: https://www.cnbc.com/2022/06/02/irs-working-to-boost-audit-rates-for-higher-earners.html |

|

Ford to add over 6,000 U.S. jobs as it boosts electric vehicle production and prepares for a new MustangFord will add 6,200 union jobs and promote another 3,000 temps to full-time status as it prepares to build more EVs and all-new versions of Mustang and Ranger. Read more at: https://www.cnbc.com/2022/06/02/ford-to-add-over-6000-us-jobs-as-it-boosts-electric-vehicle-production.html |

|

Star Wars is mostly TV now — and the Disney franchise’s often-fractured fanbase is cool with thatBy the time Taika Waititi’s untitled Star Wars film hits theaters in 2023, it will have been four years since the franchise has been on the big screen. Read more at: https://www.cnbc.com/2022/06/01/star-wars-is-mostly-tv-now-fans-are-cool-with-that-love-obi-wan-kenobi.html |

|

United Airlines plans $100 million expansion of pilot training center during hiring spreeUnited’s Denver campus will be able to accommodate 52 full-motion simulators after the extension is complete. Read more at: https://www.cnbc.com/2022/06/01/united-airlines-plans-100-million-expansion-of-pilot-training-center.html |

|

Mortgage rates rise sharply after three weeks of easingMortgage rates are surging higher again this week after falling for the past three weeks. Read more at: https://www.cnbc.com/2022/06/01/mortgage-rates-rise-sharply-after-three-weeks-of-easing.html |

|

‘Bad News Is Good News’ – Stocks Soar As Macro-Meltdown Accelerates‘Bad News Is Good News’ – Stocks Soar As Macro-Meltdown AcceleratesPlunging productivity – meh, buy it! Ugly ADP print – meh, buy it! Disappointing Factory Orders – meh, buy it! Hawkish FedSpeak – meh, buy it!

The market shrugged off hawkish comments from Lael Brainard (Fed Vice-Chair), who dismissed the ‘September pause’ idea, and Loretta Mester (Cleveland Fed), who suggested rates should get above neutral and warned that recession risk had risen. She also noted that Fed officials “all aligned” on the fact that inflation is way too high and that it’s the No. 1 problem in the economy. One market did react – short-term-interest-rates (STIRs) pushed hawkishly higher adding back a full 25bps rate-hike from the post-Bostic dovish lows… Read more at: https://www.zerohedge.com/markets/bad-news-good-news-stocks-soar-macro-meltdown-accelerates |

|

Baby Formula Shortage Hits Record 74% As Biden Admits Being AWOL Until AprilDespite all the bluster from The White House on its actions to relieve the crisis, the baby formula shortage continued to worsen last week. Earlier this week, President Biden crowed on Twitter at the actions he has taken to ‘fix’ the problem:

But, as Bloomberg reports, out-of-stock rates climbed to 74% nationally for the week ending May 28, according to data on 130,000 stores followed by Datasembly. The increase comes after rates spiked to 70% for the week ending May 21 from 45% the week prior. Read more at: https://www.zerohedge.com/political/biden-admits-he-was-awol-until-april-baby-formula-crisis |

|

Hormel CEO Warns “Large Supply Gaps” For Jennie-O Turkey BrandHormel CEO Warns “Large Supply Gaps” For Jennie-O Turkey BrandA top US food processing company warned of an upcoming shortage of its turkey products at supermarkets following one of the worst bird flu outbreaks. “Our Jennie-O Turkey Store team is facing an uncertain period ahead,” Hormel Foods Corporation CEO Jim Snee told investors in an earnings call. “Similar to what we experienced in 2015, (avian influenza) is expected to have a meaningful impact on poultry supplies over the coming months.”

Snee said the “large supply gaps in the Jennie-O Turkey Store will begin in the third quarter.” He said highly pathogenic avian influenza was confirmed in “our supply chain” in March. Since the USDA first detected bird flu in the US in mid-February, more than 38 million birds in 35 states have died. Out of that figure, 5 million turkeys in the US have been killed, with most deaths in Minnesota and South Dakota. Read more at: https://www.zerohedge.com/markets/hormel-ceo-warns-large-supply-gaps-jennie-o-turkey-brand |

|

The Sheer Stupidity Of Student Loan Forgiveness While Inflation Rages Out Of ControlThe Sheer Stupidity Of Student Loan Forgiveness While Inflation Rages Out Of ControlSubmitted by QTR’s Fringe Finance I’ve joked on my last couple of podcasts that when it comes to economic problems, the government usually has to exhaust every single one of the wrong solutions before it gets to the right one. I guess at the times I’ve said this, it was at least a little bit in jest, though I do believe the statement to be accurate as it relates to the economy over the last decade – or at least since I’ve been paying attention. Most recently, I used the expression when talking about the Biden administration’s fruitless efforts to try and curb the price of oil. The administration is literally doing everything except making it easier for oil companies to increase supply in the market. The problem that the Biden administration is trying to address is high prices. This remains easily the biggest issue of consequence heading into midterm elections, and it may even wind up still being the biggest issue when the 2024 presidential election rolls around. Just as I argued may be the case with leaking the Roe vs. Wade opinion, it appears the floundering Biden administration has adopted the strategy of diverting attention away from the problem in hopes that they can resonate with voters via other channels. There has been no bigger example of this strategy – or the administration’s profound economic ignorance – than the administration’s recently released Read more at: https://www.zerohedge.com/markets/sheer-stupidity-student-loan-forgiveness-while-inflation-rages-out-control |

|

Travel industry plea for overseas workers rejectedThe government rejects firms’ request for special visas to fill thousands of vacancies before summer. Read more at: https://www.bbc.co.uk/news/business-61671835?at_medium=RSS&at_campaign=KARANGA |

|

Missguided shoppers left chasing orders and refundsThe fast fashion brand has a buyer but shoppers are still waiting for deliveries and refunds. Read more at: https://www.bbc.co.uk/news/business-61653093?at_medium=RSS&at_campaign=KARANGA |

|

Sheryl Sandberg to leave Facebook after 14 yearsHer departure comes as the social media company faces challenges, including a slowdown in ad sales. Read more at: https://www.bbc.co.uk/news/business-61666340?at_medium=RSS&at_campaign=KARANGA |

|

Del(h)ivery failed? Why IIFL Securities sees 22% downside in the newly listed startupIIFL Securities has set a target price of Rs 442, meaning a potential downside of over 22 percent for the stock. In comparison, Credit Suisse, which sees a strong moat in terms of scale, has a target price of Rs 675. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/delhivery-failed-why-iifl-securities-see-22-downside-in-the-newly-listed-startup/articleshow/91969100.cms |

|

Trade Setup: Adopt a selective approach, profits must be protected at higher levelsThough it stayed sideways during the last half hour of the session, but largely maintained the gains. The headline index closed with a net gain of 105.25 points (+0.64%). Read more at: https://economictimes.indiatimes.com/markets/stocks/news/trade-setup-adopt-a-selective-approach-profits-must-be-protected-at-higher-levels/articleshow/91968376.cms |

|

Market Movers: MM Forgings zooms 9% on EV foray; La Opala starts new factoryIn an interaction on CNBC-TV18, the management said its sales growth to be at 80,000-90,000 tonnes in FY23. “Expect MM Forgings to get into EV business in the next couple of months,” said Vidyashankar Krishnan, the managing director of the company. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/market-movers-mm-forgings-zooms-9-on-ev-foray-la-opala-starts-new-factory/articleshow/91968175.cms |

|

Social Security can pay full benefits until 2035 before trust funds are depleted – one year later than expected – but time is still running outMedicare Part A has until 2028 before beneficiaries see a 10% benefit cut Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7E12-73D43EC0D9EE%7D&siteid=rss&rss=1 |

|

Revolution Investing: We’ve seen this movie before — the biggest tech-stock gains are still ahead of usThis tech slide is likely to follow previous patterns when newer companies remade the economy. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7E0C-E8A6416AD15F%7D&siteid=rss&rss=1 |

|

Kohl’s plans for smaller stores as dozens of existing store leases approach expirationKohl’s has announced a new real estate strategy as the department store retailer heads into a period in which a number of leases are set to expire Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7E09-1B480246A682%7D&siteid=rss&rss=1 |

|