Summary Of the Markets Today:

- The Dow closed down 177 points 0.54%,

- Nasdaq closed down 0.72%,

- S&P 500 closed down 0.75%,

- WTI crude oil settled at 115, down 0.151%,

- USD $102.50 up 0.72%,

- Gold 1848 up 0.90%,

- Bitcoin down 0.35% to $30187,

- 10-year U.S. Treasury up 0.86% / 2.931%

Today’s Economic Releases:

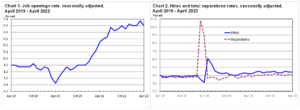

According to the U.S. Bureau of Labor Statistics, their April 2022 JOB OPENINGS AND LABOR TURNOVER report shows a modest reduction in job openings – although job openings remain well above historical values.

The ISM manufacturing index for May 2022 increased to 56.1% from April’s 55.4%. A value above 48.7 percent, over a period of time, generally indicates an expansion of the overall economy.

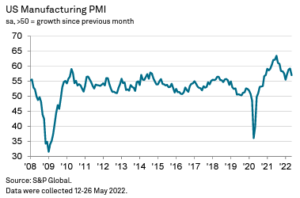

S&P Global US Manufacturing PMI™ declined from 57.0 in May – down from 59.2 in April.

The headline data from the US Census shows construction spending in April 2022 improved 0.2% month-over-month and 1.3% year-over-year. This is not inflation-adjusted – but the graph below shows inflation-adjusted values (Nov 2009 = 100), and clearly shows a decline month-over-month and year-over-year. Construction spending declines may or may not be associated with recessions.

The Federal Reserve’s Beige Book June 2022 was issued today. Their summary:

All twelve Federal Reserve Districts have reported continued economic growth since the prior Beige Book period, with a majority indicating slight or modest growth; four Districts indicated moderate growth. Four Districts explicitly noted that the pace of growth had slowed since the prior period.

A summary of headlines we are reading today:

- Russia Holds Nuclear Drills As Biden Unveils New Aid Package For Ukraine

- Mortgage rates rise sharply after three weeks of easing

- Mortgage demand falls to the lowest level since the end of 2018, even as interest rates ease a bit

- Unprecedented water restrictions begin in Southern California as drought worsens

- Stocks, Bonds, & Bitcoin Dumped As Dimon Doubles-Down On Dour Outlook

- Trade Setup: Imperative for the markets to open and stay above 16,500 levels

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

Canadian Oil Asks For More Subsidies Despite Soaring ProfitsThe Canadian tar sands are having a hell of a year. Canada’s largest oil and gas producer, Canadian Natural Resources Ltd., more than doubled its profits year-on-year in the first quarter of 2022. CNRL is now the fourth most valuable publicly traded oil and gas producer in North America, an incredible feat considering that just a year and a half ago, it was in question whether or not the oil sands would survive at all, thanks to increased scrutiny of the sectors mega-dirty crude bitumen and rising costs of operations. The sudden Read more at: https://oilprice.com/Energy/Energy-General/Canadian-Oil-Asks-For-More-Subsidies-Despite-Soaring-Profits.html |

|

Iron Prices Climb As China Reboots Its EconomyIt’s still touch-and-go for the steel sector in China despite the sprouting of the first shoots of a possible manufacturing recovery. However, last Monday, benchmark iron ore prices in the country gained a surprising 7%. This is the biggest daily rise in two-and-a-half months. Is it a sign that we should be more optimistic or just a dead cat bounce? Chinas Slow Road to Recovery Chinese manufacturing activity has thus far been down in 2022 due to a fresh COVID-19 outbreak. However, since mid-May, the market has shown some signs of recovery, Read more at: https://oilprice.com/Metals/Commodities/Iron-Prices-Climb-As-China-Reboots-Its-Economy.html |

|

Could Blue Carbon Credits Be The Future Of Sustainable Financing?The Bahamas has become the latest emerging market to seek to leverage its natural environs to fund projects to protect its environment, announcing plans to sell blue carbon credits before the end of the year. In late April the government unveiled plans that would give companies the opportunity to purchase the credits to offset their own carbon emissions. The proposed deal is based on the Bahamas estimated 4270 sq km of mangrove forests, seagrass beds, and other ecosystems that absorb and store significant amounts of carbon. Upon announcing Read more at: https://oilprice.com/The-Environment/Global-Warming/Could-Blue-Carbon-Credits-Be-The-Future-Of-Sustainable-Financing.html |

|

Windfall Tax To Cost UK-Focused Oil Firms More Than $3 BillionThe new windfall tax on profits of oil and gas companies in the UK is expected to cost the medium-sized North Sea-focused companies a total of $3.3 billion through 2025, according to investment bank Jefferies. Following months of rumors and indecision, the UK government announced last week a 25% Energy Profits Levy, commonly referred to as a windfall tax, as part of a package to ease the cost-of-living crisis stemming from huge rises in household energy bills. The move has long been opposed by the industry, which argued that a windfall Read more at: https://oilprice.com/Latest-Energy-News/World-News/Windfall-Tax-To-Cost-UK-Focused-Oil-Firms-More-Than-3-Billion.html |

|

Russia Holds Nuclear Drills As Biden Unveils New Aid Package For UkraineRussia’s nuclear forces have launched fresh drills northeast of Moscow, in the Ivanovo province, according to new Russian defense ministry statements Wednesday. Reuters cited Interfax news agency to report that “Some 1,000 servicemen are exercising in intense maneuvers using over 100 vehicles including Yars intercontinental ballistic missile launchers,” based on the Russian MoD statement. Some Western media reports are seeing the drill as a response and warning to Washington over the White House approving yet more military aid and weapons to Ukraine, Read more at: https://oilprice.com/Geopolitics/International/Russia-Holds-Nuclear-Drills-As-Biden-Unveils-New-Aid-Package-For-Ukraine.html |

|

Deutsche Bank Unit CEO Resigns Over Greenwashing RaidThe CEO of a Deutsche Bank subsidiary resigned Wednesday, just a day after German authorities launched a heavy-handed raid on the companys offices in Frankfurt over allegations of greenwashing. A whistleblower claimed that DWS, a Deutsche Bank subsidiary managing some $900 billion in assets, misled investors in its 2020 annual report by claiming that more than $450 billion in its assets met environmental, social and governance (ESG) criteria. Deutsche Bank holds an 80% stake in DWS. On Wednesday, DWS CEO Asoka Read more at: https://oilprice.com/Latest-Energy-News/World-News/Deutsche-Bank-Unit-CEO-Resigns-Over-Greenwashing-Raid.html |

|

Mortgage rates rise sharply after three weeks of easingMortgage rates are surging higher again this week after falling for the past three weeks. Read more at: https://www.cnbc.com/2022/06/01/mortgage-rates-rise-sharply-after-three-weeks-of-easing.html |

|

United Airlines plans $100 million expansion of pilot training center during hiring spreeUnited’s Denver campus will be able to accommodate 52 full-motion simulators after the extension is complete. Read more at: https://www.cnbc.com/2022/06/01/united-airlines-plans-100-million-expansion-of-pilot-training-center.html |

|

Star Wars is mostly TV now — and the Disney franchise’s often-fractured fanbase is cool with thatBy the time Taika Waititi’s untitled Star Wars film hits theaters in 2023, it will have been four years since the franchise has been on the big screen. Read more at: https://www.cnbc.com/2022/06/01/star-wars-is-mostly-tv-now-fans-are-cool-with-that-love-obi-wan-kenobi.html |

|

Ford CEO expects to see industry consolidation as the costs of transition to electric vehicles riseJim Farley said the massive amounts of capital needed to invest in EV technologies will force smaller companies to be acquired. Read more at: https://www.cnbc.com/2022/06/01/ford-ceo-expects-ev-transition-to-force-industry-consolidation.html |

|

Unprecedented water restrictions begin in Southern California as drought worsensThe new rules, which limit outdoor watering to once a week, impact more than 6 million residents in Southern California. Read more at: https://www.cnbc.com/2022/06/01/southern-california-water-restrictions-start-today-amid-drought.html |

|

Investors revisit muni bonds amid higher yields and strong creditIt’s been a tough year for muni bonds with investors cashing out amid rising interest rates. But higher yields and strong credit may be sparking a shift. Read more at: https://www.cnbc.com/2022/06/01/investors-revisit-muni-bonds-amid-higher-yields-and-strong-credit.html |

|

GM slashes prices of Chevy Bolt electric vehicles despite rising commodity costsGM cut the price of the Bolt EV by $5,900 compared with the 2022 model year, with a starting price of $26,595. Read more at: https://www.cnbc.com/2022/06/01/gm-slashes-prices-of-chevy-bolt-evs-despite-rising-commodity-costs.html |

|

Delta hikes sales forecast to pre-pandemic levels thanks to jump in travel demand and faresDelta said it expects revenue to get back to 2019 levels this quarter. Read more at: https://www.cnbc.com/2022/06/01/delta-raises-revenue-forecast-on-higher-demand-and-fares.html |

|

United Auto Workers union accuses GM joint venture of denying access to organize workersThe United Auto Workers union is accusing a new General Motors joint venture of denying its access to workers to conduct a preliminary organizing vote. Read more at: https://www.cnbc.com/2022/05/31/autoworker-union-accuses-gms-joint-venture-of-denying-access-for-organizing.html |

|

Chinese electric car start-up WM Motor files to go public in Hong KongChinese electric car start-up WM Motor filed Wednesday to go public on the Hong Kong Stock Exchange. Read more at: https://www.cnbc.com/2022/06/01/chinese-electric-car-start-up-wm-motor-files-to-go-public-in-hong-kong.html |

|

Mortgage demand falls to the lowest level since the end of 2018, even as interest rates ease a bitApplications for a mortgage to purchase a home fell 1% last week compared with the previous week, according to the Mortgage Bankers Association. Read more at: https://www.cnbc.com/2022/06/01/mortgage-demand-falls-to-lowest-level-since-2018-even-as-interest-rates-ease.html |

|

WHO says monkeypox has been spreading undetected as global cases rise to more than 550“We don’t really know whether it’s too late to contain. What the WHO and all member states are trying to do is prevent onward spread,” Lewis said. Read more at: https://www.cnbc.com/2022/06/01/who-says-monkeypox-has-been-spreading-undetected-as-global-cases-rise-to-more-than-550.html |

|

Croatian EV supercar maker Rimac raised 500 million euros to make parts for Big Auto rivalsRimac raised 500 million euros to expand its ability to build high-performance EV components for bigger automakers. Read more at: https://www.cnbc.com/2022/06/01/croatian-ev-supercar-maker-rimac-raises-500-million-euros-.html |

|

Stocks, Bonds, & Bitcoin Dumped As Dimon Doubles-Down On Dour OutlookStocks, Bonds, & Bitcoin Dumped As Dimon Doubles-Down On Dour OutlookJamie Dimon’s pessimistic shift from “storm clouds” last week to a “hurricane is down the road”, prompted market weakness shortly after the open…

It appears Dimon went full ‘Leeroy Jenkins’ with his flip-flop…

Which makes sense since US Macro conditions have notably worsened in the week since he last commented…

Source: Bloomberg … but other Fedspeak didn’t help with Bostic first…

|

|

Facebook Slumps After Sheryl Sandberg Steps Down As COOFacebook Slumps After Sheryl Sandberg Steps Down As COOJust moments after Amber Heard was found guilty of defaming Johnny Depp with malice, the stock of Facebook – which bizarrely still calls itself Meta at least until the company decides to change its name back to normal – tumbled on news that Sheryl Sandberg is stepping down as chief operating officer. Sandberg, who Bloomberg describes as “one of the most recognized figures in global business after helping Facebook transform from a startup into a multibillion-dollar advertising powerhouse” although we are confident others would have less effusive descriptions of the 52-year-old, will remain on the board of Meta according to a post on the social network Wednesday. Javier Olivan, who has led the company’s growth efforts for years, will take Sandberg’s place as COO when she formally steps down in the fall. Sandberg, a Democrat who previously served as chief of staff for Treasury Secretary Lawrence Summers, joined Facebook in 2008 and was key to turning it into a social media giant that generated almost $120 billion in revenue last year. Along the way, she became an influential author – publishing “Lean In” in 2013 – and served as the highest-profile face of the company next to CEO Mark Zuckerberg. She also answered for Facebook’s privacy and policy missteps over the years, attempting to improve its relationship with the public and regulators. In an interview with Bloomberg, Sandberg called her time at Meta the “honor and privilege of a lifetime,” but joked that it’s also “not the most manageable job anyone has ever had.” “It’s a decision I didn’t come to lightly, but it’s been 14 years,” she … Read more at: https://www.zerohedge.com/markets/facebook-slumps-after-sheryl-sandberg-steps-down-coo |

|

Goldman Sachs Reportedly In Talks With FTX For Bitcoin, Crypto DerivativesGoldman Sachs Reportedly In Talks With FTX For Bitcoin, Crypto DerivativesAuthored by Shawn Amick via BitcoinMagazine.com, Goldman Sachs is reportedly looking to integrate services with Bitcoin and crypto exchange FTX. Goldman Sachs is reportedly in talks with FTX to facilitate derivatives trading for bitcoin and other cryptocurrencies. FTX is seeking a license modification that will allow it to function as both an exchange and intermediary for derivatives. If FTX is successful in acquiring the license, it could begin the removal of intermediaries, such as Goldman, in derivatives markets. Goldman Sachs is discussing derivatives trading with bitcoin and other cryptocurrencies through a possible partnership with cryptocurrency exchange FTX, according to a report from Barron’s.

Read more at: https://www.zerohedge.com/crypto/goldman-sachs-reportedly-talks-ftx-bitcoin-crypto-derivatives |

|

JPM Sees Oil Rising Up To $136 This Month Depending On What China Does, As Trader Bets Millions On Crude Explosion To $200JPM Sees Oil Rising Up To $136 This Month Depending On What China Does, As Trader Bets Millions On Crude Explosion To $200When it comes to forecasts for the price of oil, two distinct camps have emerged on Wall Street. In one, we have Citi, whose chief commodity strategist, Ed Morse, has been pounding the table calling for lower oil and most recently telling BBG TV that the fair value of Brent futures is in the $70 range even though the international benchmark is trading around $120 a barrel. Needless to say, Morse has been dead wrong so far, and anyone who listened to him has suffered catastrophic losses on the short side, although maybe he will be correct in the end: his forecast is predicated on unprecedented demand destruction, with Citi cutting its demand estimate for products to 2.2 million barrels a day, down from 3.6 million barrels at the start of the year. Alas, despite record prices for every energy product, there has so far been zero demand destruction as even Bloomberg’s resident in-house commodity expert Javier Blas pointed out earlier today.

Read more at: https://www.zerohedge.com/markets/jpm-sees-oil-rising-136-month-depending-what-china-does-trader-bets-millions-crude |

|

Canceled flights: Tui customers angry over handling of travel miseryPassengers express fury over what they see as poor treatment after travel giant axes flights. Read more at: https://www.bbc.co.uk/news/business-61657590?at_medium=RSS&at_campaign=KARANGA |

|

Sheryl Sandberg to leave Facebook after 14 yearsHer departure comes as the social media company faces challenges, including a slowdown in sales. Read more at: https://www.bbc.co.uk/news/business-61666340?at_medium=RSS&at_campaign=KARANGA |

|

Shell’s Jackdaw gas field given go-ahead by regulatorsThe UK government is seeking to boost domestic energy output following Russia’s invasion of Ukraine. Read more at: https://www.bbc.co.uk/news/uk-scotland-scotland-business-61666693?at_medium=RSS&at_campaign=KARANGA |

|

Trade Setup: Imperative for the markets to open and stay above 16,500 levelsIn other words, it would be imperative for the markets to open and stay above the 16,500 levels. Any slip below this point is likely to invite incremental weakness. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/trade-setup-imperative-for-the-markets-to-open-and-stay-above-16500-levels/articleshow/91946176.cms |

|

Tech View: Nifty50 forms bearish candle, analysts say ‘buy on dips’“Taking that into account, Nifty50 can be expected to trade positive in the next session. In that scenario, the index can initially head to test its 200-day EMA, placed around 16,740 levels. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-forms-bearish-candle-analysts-say-buy-on-dips/articleshow/91942471.cms |

|

Rakesh Jhunjhunwala sells 25 lakh shares of Delta Corp; stake falls to 6.2%: ReportAccording to a regulatory filing by the company, the seasoned investor and his better half jointly held a 7.5 per cent stake in the company at the end of March 2022. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/rakesh-jhunjhunwala-sells-25-lakh-shares-of-delta-corp-stake-falls-to-6-2-report/articleshow/91941765.cms |

|

HPE stock dives after earnings and sales miss amid ‘inflationary environment and ongoing supply chain disruptions’Hewlett Packard Enterprise Co. reported flat results from a year ago Wednesday amid doubts about the environment for business spending on technology and shares dove in late trading. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7DF3-C880DC46F3CB%7D&siteid=rss&rss=1 |

|

Sheryl Sandberg leaving Facebook after 14 yearsSheryl Sandberg, whose 14-year run at Facebook was marked by record sales and a string of controversies, is stepping down as chief operating officer of Meta Platforms Inc. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7E02-021920350A42%7D&siteid=rss&rss=1 |

|

Crypto: DOJ charges ex-NFT marketplace employee with insider tradingThe Department of Justice has charged Nathaniel Chastain, a former product manager at the NFT marketplace OpenSea, with criminal insider trading, the government said Wednesday. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7E01-4448AD731146%7D&siteid=rss&rss=1 |

|