Summary Of the Markets Today:

- The Dow closed up +1.61% +517 points,

- Nasdaq closed up +2.68%,

- S&P 500 closed up +1.99%,

- WTI crude oil settled at 113, up 3.09%,

- USD $101.98 down 0.10%,

- Gold 1852 flat 0.00%,

- Bitcoin down 0.81% to $29265,

- 10-year U.S. Treasury up 0.004% / 2.751%

Today’s Economic Releases:

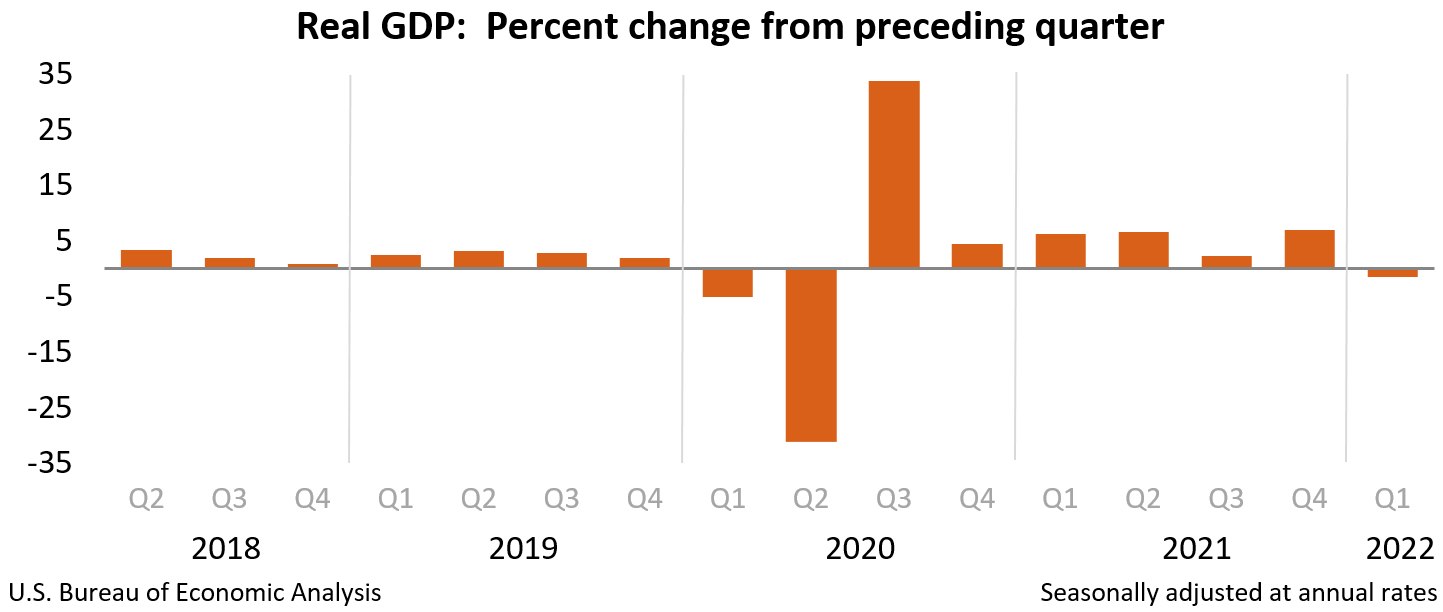

The second estimate of 1Q2022 real GDP lowered the economic growth rate to -0.4% from the advance estimates -0.3%. Still, the year-over-year growth rate is 3.5% where the headline number is an extrapolation of the month-over-month change.

The Kansas City Fed’s manufacturing index shows growth slowed in May 2022 but remains in positive territory.

According to the National Association of Realtors, April 2022 made the sixth consecutive month of decline and is now at the slowest pace in nearly a decade. Pending home sales are based on signed contracts for home purchases.

Even though the week claims modestly improved this week, the four-week rolling average continued its worsening trend.

A summary of headlines we are reading today:

- U.S. Refiners Set To Add Just 350,000 Bpd Capacity By End-2023

- Baby formula supply should return to normal in two months, FDA commissioner says

- Home listings suddenly jump as sellers worry they may miss out on the red-hot housing market

- Massive Short-Squeeze Sends Stocks Soaring As Macro Massacre Continues

- Markets Have Reached A Critical Near-Term Pivot With Huge “Trend Reversal” Implications

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Is Pandemic Pain Finally Over For The Airline Industry?Flights are rising back to pre-pandemic levels, with trips expected to increase dramatically this summer. Both leisure and business travel appear more popular as Covid restrictions ease worldwide and people resume their regular activities. Although steadily increasing fuel prices could dampen some travelers’ spirits as flight prices look set to go up. For the first time following the pandemic, business flight bookings have reached 2019 levels, according to a Mastercard Economics Institute 2022 travel analysis. The report highlights Read more at: https://oilprice.com/Energy/Energy-General/Is-Pandemic-Pain-Finally-Over-For-The-Airline-Industry.html |

|

U.S. Refiners Set To Add Just 350,000 Bpd Capacity By End-2023U.S. refiners are operating at the highest operating rate since before the pandemic, but they are not expected to bring relief to the tight fuel market through major capacity expansions in the short term. Some of the biggest refiners are working on expanding the crude oil processing capacity at large existing facilities, but those additions will not fully offset the U.S. refinery processing capacity, which closed during and right after COVID. ExxonMobil, Valero, and Marathon Petroleum are currently working on the expansion at three large Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Refiners-Set-To-Add-Just-350000-Bpd-Capacity-By-End-2023.html |

|

How Will Chinas Covid Containment Policy Affect Emerging Markets?With China’s economy slowing on the back of a strict Covid-19 containment strategy, there are concerns about the effects this might have on several emerging markets. Since the beginning of the year, Chinese authorities have implemented a series of lockdowns and curfews, including in major cities Beijing and Shanghai, to help combat a spike in coronavirus case numbers. The widespread measures have included restrictions on movement for individuals, as well as the closure of restaurants and other face-to-face businesses. While this so-called Read more at: https://oilprice.com/Energy/Energy-General/How-Will-Chinas-Covid-Containment-Policy-Affect-Emerging-Markets.html |

|

BP Reviews North Sea Investments In Wake Of UKs Windfall TaxBP will review its oil and gas investments in the UK, the company said on Thursday, after UK Chancellor Rishi Sunak presented a plan earlier in the day that would assess a 25% windfall tax on North Sea energy companies. The windfall tax is set to stick around until oil and gas prices return to normal levels, or by December 25. BP said earlier this month that it was planning on investing 18 billion in the United Kingdom by the end of 2030 to help the country to deliver on its bold ambitions to boost energy security and reach net zero. Read more at: https://oilprice.com/Latest-Energy-News/World-News/BP-Reviews-North-Sea-Investments-In-Wake-Of-UKs-Windfall-Tax.html |

|

Rystad: Oil And Gas Investment To Rise 20% In 2022Global oil and gas investment is set to rise by 20% this year, according to Rystad Energy, with growth driven by soaring oil prices and big money flowing into projects in Brazil, Guyana, West Africa and Australia, the Houston Chronicle reports. Earlier this year, Rystad had forecast 8% growth for 2022; however, with Brent consistently topping $110 and WTI flirting with the same levels, we are now witnessing the highest growth rate forecasts since 2008. In the United States, investment in shale is set to increase by 35%, with the Permian Read more at: https://oilprice.com/Energy/Energy-General/Rystad-Oil-And-Gas-Investment-To-Rise-20-In-2022.html |

|

Spain Initiates Energy Austerity With Air Conditioning LimitsSpain passed a decree this week limiting the use of air conditioning in public buildings as part of a strategy to conserve energy and reduce Europe’s dependence on Russian gas. Spain itself does not depend on gas from Russia, but its government is working to increase energy efficiency as the European Union looks to reduce reliance on Russian gas by two-thirds by the end of this year alone. Energy savings are the quickest and cheapest way to address the current energy crisis, and reduce bills, the European Commission said last Read more at: https://oilprice.com/Latest-Energy-News/World-News/Spain-Initiates-Energy-Austerity-With-Air-Conditioning-Limits.html |

|

Gap shares fall over 10% after retailer slashes profit guidance for the yearThe lower-income consumer, which is Old Navy’s target customer, is starting to feel pinched by inflation, Chief Executive Officer Sonia Syngal told CNBC. Read more at: https://www.cnbc.com/2022/05/26/gap-gps-reports-q1-2022-earnings.html |

|

3 takeaways from Dollar General, Dollar Tree earnings that sent stocks soaringDollar Tree and Dollar General boosted their outlook for the year, noting that shoppers squeezed by inflation will seek cheaper prices. Read more at: https://www.cnbc.com/2022/05/26/dollar-general-dollar-tree-boost-outlook-as-consumers-grapple-with-inflation.html |

|

Home listings suddenly jump as sellers worry they may miss out on the red-hot housing marketWith home sales slowing and mortgage rates rising, home sellers are starting to worry that the red-hot housing market is over. Read more at: https://www.cnbc.com/2022/05/26/home-listings-suddenly-spike-as-sellers-worry-theyll-miss-out-on-red-hot-market.html |

|

Macy’s stock surges as company raises 2022 profit outlook despite uncertain retail landscapeMacy’s reaffirmed its fiscal 2022 sales outlook and raised its profit guidance, expecting stronger credit card revenue for the remainder of the year. Read more at: https://www.cnbc.com/2022/05/26/macys-m-reports-q1-2022-earnings-beat-raises-forecast.html |

|

Carl Icahn loses proxy fight with McDonald’s over animal welfareActivist investor Carl Icahn lost his proxy fight with McDonald’s on Thursday, signaling that shareholders weren’t swayed by his animal-welfare concerns. Read more at: https://www.cnbc.com/2022/05/26/carl-icahn-loses-proxy-fight-with-mcdonalds-over-animal-welfare.html |

|

Justin Timberlake sells song catalog to fund backed by Blackstone in deal valued at $100 millionJustin Timberlake is the latest music star to sell the rights to his songs for a huge sum of money. Read more at: https://www.cnbc.com/2022/05/26/justin-timberlake-sells-song-catalog-for-100m-to-fund-backed-by-blackstone.html |

|

Tom Cruise sets his sights on his first $100 million domestic opening with ‘Top Gun: Maverick’This weekend Tom Cruise has a chance to do something he’s never done before — have a film open to more than $100 million at the domestic box office. Read more at: https://www.cnbc.com/2022/05/25/top-gun-maverick-could-be-tom-cruise-first-100-million-opening-weekend.html |

|

Satellite-imagery firms Maxar, Planet and BlackSky awarded billions of dollars in government contractsThe National Reconnaissance Office announced contracts worth billions of dollars over the next decade to satellite-imagery companies Maxar, Planet and BlackSky. Read more at: https://www.cnbc.com/2022/05/25/nro-announces-satellite-imagery-contracts-to-maxar-planet-blacksky.html |

|

Monkeypox does not pose a Covid-style risk despite its swift spread, top health execs sayGlobal health concerns loomed over the World Economic Forum once again this year, but business leaders say they are not worried about a new monkeypox outbreak. Read more at: https://www.cnbc.com/2022/05/26/davos-elite-dont-expect-a-covid-19-style-health-crisis-from-monkeypox.html |

|

Kohl’s stock surges on report bidders are still competing for company amid market volatilityKohl’s shares rose on hopes that the retailer could still be bought amid a volatile market and a recent disappointing earnings report. Read more at: https://www.cnbc.com/2022/05/25/kohls-stock-bidders-are-still-competing-for-company.html |

|

McDonald’s shareholders to vote on proxy fight with Carl Icahn over animal welfare practicesMcDonald’s shareholders’ meeting on Thursday morning will mark the climax of a proxy fight waged by activist investor Carl Icahn. Read more at: https://www.cnbc.com/2022/05/25/mcdonalds-shareholders-vote-on-carl-icahn-proxy-fight-over-animal-welfare.html |

|

Singapore’s air travel is rebounding despite China’s border restrictions, transport minister saysAir travel in Singapore is recovering and has reached around 40% of pre-Covid levels despite China’s border restrictions, Transport Minister S. Iswaran said. Read more at: https://www.cnbc.com/2022/05/26/singapore-air-travel-recovering-despite-lack-of-chinese-visitors.html |

|

Monkeypox is a dangerous disease threat — but has one key difference from Covid, epidemic coalition saysMonkeypox is a rare disease caused by the monkeypox virus, part of the same family as smallpox, though typically less severe. Read more at: https://www.cnbc.com/2022/05/26/covid-and-monkeypox-cepi-chief-outlines-the-disease-differences.html |

|

Biden Repeats False Claim About The Second AmendmentBiden Repeats False Claim About The Second AmendmentAuthored by Steve Watson via Summit News, Joe Biden declared Wednesday during remarks on the Texas school shooting that the right to bear arms in the U.S. is “not absolute”.

After signing an executive order to reform policing, and wheeling out George Floyd’s family for the press, Biden addressed the shooting, saying he “just sick and tired.” “When in God’s name will we do what needs to be done to, if not completely stop, fundamentally change the amount of the carnage that goes on in this country?” Biden continued. Then came the kicker. “The Second Amendment is not absolute. When it was passed, you couldn’t own a cannon…there’s always been limitations,” Biden proclaimed. Watch:

|

|

Massive Short-Squeeze Sends Stocks Soaring As Macro Massacre ContinuesMassive Short-Squeeze Sends Stocks Soaring As Macro Massacre ContinuesYou can’t make this shit up… two more disappointing US Macro data points today (GDP and pending home sales) sent the US Macro Surprise Index to its weakest since Sept 2021…

Source: Bloomberg That bad news is apparently being seen as good news by the market as rate-hike expectations slipped further

Source: Bloomberg Is The Fed really going to fold that easily? Read more at: https://www.zerohedge.com/markets/massive-short-squeeze-sends-stocks-soaring-macro-massacre-continues |

|

“This Is A Crucible Moment” – Sequoia’s Ominous Warning To Companies On How To “Avoid The Death Spiral”“This Is A Crucible Moment” – Sequoia’s Ominous Warning To Companies On How To “Avoid The Death Spiral””This is not a time to panic. It is a time to pause and reassess,” begins the thought-provoking presentation from veteran venture capital firm Sequoia Capital. But that’s about as ‘positive’ as they get as the founders of the firm warn of a prolonged market downturn and urges the startups in its portfolio to preserve cash and brace for worse to come.

And in its somewhat ubiquitous historically grim outlooks (its “R.I.P Good Times” in 2008 and “Black Swan” memo in March 2020 have become legendary) don’t expect a quick rescue and recovery this time.

|

|

Thank Retail Investors The S&P Is Not In A Bear Market, And For All Those Last Hour RampsThank Retail Investors The S&P Is Not In A Bear Market, And For All Those Last Hour RampsThere was a curious observation in this morning’s note from the BofA trading desk: the bank’s traders pointed out something we first brought attention to last night, namely the surprising last-hour ramps in spoos in the last hour of trading, and those responsible for it: “Participants will be watching for another post-lunch rally, as the SPX has now closed above the mid-session point for 4 days – the longest streak in 2 months,” BofA wrote. So what’s going on here? For the answer, we go to the latest note from VandaTrack, which suggests that our skepticism about retail participation may be misplaced. As a reminder, two weeks ago we speculated that retail investors are losing their interest in markets when we quoted from a JPM analyst report which said that the “retail buying impulse showed signs of slowing before this latest burst of selling. After adjusting for inverse ETFs, not only is the May MTD net flow negative for the first time since Mar-2020, but also the monthly inflow in April was smallest since Sep-2020.” Read more at: https://www.zerohedge.com/markets/thank-retail-investors-sp-not-bear-market-and-all-those-last-hour-ramps |

|

Every household to get energy bill discounts of £400 this autumnThe poorest will also get a lump-sum of £650 to help with the cost of living, Rishi Sunak says. Read more at: https://www.bbc.co.uk/news/business-61583651?at_medium=RSS&at_campaign=KARANGA |

|

Cost of living: What Rishi Sunak’s help means for youThe chancellor says the new support will help with soaring bills, so how will you be impacted? Read more at: https://www.bbc.co.uk/news/business-61592496?at_medium=RSS&at_campaign=KARANGA |

|

P&O Ferries boss ‘incredibly sorry’ for impact of sackingsThe company sacked almost 800 seafarers in March to replace them with cheaper agency workers. Read more at: https://www.bbc.co.uk/news/business-61595745?at_medium=RSS&at_campaign=KARANGA |

|

Trade Setup: All declines must be used to buy quality stocks; positive outlook advised for the dayThere was a good premium income opportunity on the expiry day. The levels of 15,900 and 16,200 saw a great amount of Put and Call writing. This ensured that the Nifty did not slip below 15,900 and did not move past 16,200 levels. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/trade-setup-all-declines-must-be-used-to-buy-quality-stocks-positive-outlook-advised-for-the-day/articleshow/91817774.cms |

|

Market Movers: I-T clouds on Asian Granito; Jet Airways hits turbulence before takeoffAll India Jet Airways’ Officers and Staff Association on Thursday said it had filed an appeal before the NCLAT (National Company Law Appellate Tribunal) against the Jalan-Kalrock consortium’s resolution plan for the airline. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/market-movers-i-t-clouds-on-asian-granito-jet-airways-hits-turbulence-before-takeoff/articleshow/91817518.cms |

|

These 6 stocks saw rise in profit margin for 4 quarters in a row. Worth a look?Data showed five out of these six stocks also outperformed the BSE Sensex in the last one year. Analyst estimates on five of these stocks suggest upsides of up to 58 percent. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/these-6-stocks-saw-rise-in-profit-margin-for-4-quarters-in-a-row-worth-a-look/articleshow/91807769.cms |

|

Earnings Results: Workday stock drops after earnings miss, slightly higher outlookWorkday shares fell after hours Thursday after the human resources cloud-software company’s raised forecast remained mostly below the Street consensus. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7DD5-2AF832EC03BB%7D&siteid=rss&rss=1 |

|

: Costco sales top estimates by $1 billion, but misses on same-store salesCostco Wholesale Corp. brought in $1 billion more in revenue than expected in its latest quarter, keeping the retailer on track for its first $200 billion year. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7DD5-8BA675B8FA44%7D&siteid=rss&rss=1 |

|

Market Snapshot: Dow ends higher for 5th day, scoring longest win streak in 2 months as consumer and tech sectors recoverU.S. stocks close sharply higher on Thursday, led by consumer and technology stocks, after a batch of better earnings reports from retailers and mostly benign economic data helped assuage investor concerns about a slowing economy. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7DCA-77447B91005A%7D&siteid=rss&rss=1 |