Summary Of the Markets Today:

- The Dow closed up +0.15% +48 points,

- Nasdaq closed down -2.35%,

- S&P 500 closed down -0.81%,

- WTI crude oil settled at 110, down 0.72%,

- USD $101.75 down 0.34%,

- Gold 1866 up 0.02%,

- Bitcoin up 0.27% to $29331,

- 10-year U.S. Treasury down 0.098% / 2.761%

Today’s Economic Releases:

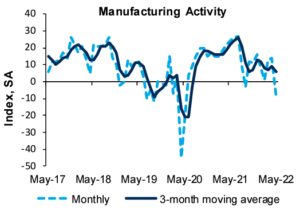

The Richmond Fed reported that their 5th district manufacturing index declined – and fell into recession territory going from an index value of 14 in April to -9 in May 2022.

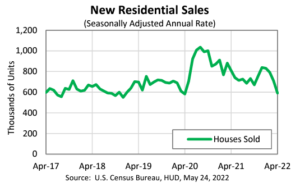

New Home Residential Sales significantly declined in April 2022 to the lowest level since the COVID lockdown / recession. This should be considered a potential recessionary marker.

A summary of headlines we are reading today:

- Stocks Will Sink Further, Economist Rosenberg Says

- Gasoline Prices Are Set To Spike This Week

- Best Buy says softer demand is sticking around, but the company isn’t planning for a recession

- Big-Tech & Bond Yields Plunge As US Macro ‘Snaps’, Gold Gains

- Dalio: “Cash Is Still Trash… But Equities Are Trashier”, Prefers Gold & Bitcoin

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Russia’s Oil Export Loophole Runs Through GreeceLast month, we reported that India had doubled down on Russian oil after the west slapped a chain of sanctions on Moscow. India has never been a big buyer of Russian crude despite needing to import 80% of its needs. In a typical year, India imports just 2-5% of its crude from Russia, roughly the same proportion as the United States did before it announced a 100% ban on Russian energy commodities. Indeed, India imported only 12 million barrels of Russian crude in 2021, with the majority of its oil coming from Iraq, Saudi Arabia, the United Read more at: https://oilprice.com/Energy/Crude-Oil/Russias-Oil-Export-Loophole-Runs-Through-Greece.html |

|

Stocks Will Sink Further, Economist Rosenberg Says Stocks are slumping, with the S&P 500 down 18% year to date. And prominent Wall Street economist David Rosenberg says the carnage isn’t over. “We always believed these past two years represented a fake bull market, built on sand, not concrete,” he wrote in a commentary on MarketWatch. “We also remain steadfast of the view that the inflation scare is going to pass very soon.” Read more at: https://www.thestreet.com/investing/economist-david-rosenberg-stocks-will-sink-further?cm_ven=RSSFeed |

|

Aramco Can’t Add Oil Production Capacity Faster Than PromisedThe world’s largest oil company, Saudi Aramco, cannot increase its oil production capacity any faster than it has already promised, the head of Saudi Aramco told Reuters on Tuesday on the sidelines of the WEF in Davos. Aramco is still planning on increasing its oil production capacity to 13 million barrels per day (bpd)but that won’t be complete for another five years. In the meantime, Saudi Arabia’s capacity remains at 12 million barrels per day. Amin Nasser, the head of Saudi Aramco, said that it could achieve this 13 million bpd goal Read more at: https://oilprice.com/Latest-Energy-News/World-News/Aramco-Cant-Add-Oil-Production-Capacity-Faster-Than-Promised.html |

|

Gasoline Prices Are Set To Spike This WeekWith U.S. drivers preparing for Memorial Day weekend, gasoline demand is set to increase just as inventories continue to drop, pushing prices even higher.The executive director of the IEA, Fatih Birol, warned that given the current supply/demand situation, there is only one thing that can stop prices from surging higher and that is Chinese demand remaining weak over the upcoming months.- According to Platts estimates, China’s April demand plummeted to 13.35 million b/d, down 11.5% year-on-year, though recovering transportation demand Read more at: https://oilprice.com/Energy/Energy-General/Gasoline-Prices-Are-Set-To-Spike-This-Week.html |

|

Europe’s Largest Port Plans To Become A Major Hydrogen HubRotterdam betting on a portfolio of hydrogen carriers Europe’s largest port is poised to become a key hub of a new hydrogen economy with numerous projects now underway along its 42-kilometer length. The Port Authority and many port-based companies are now preparing to build the infrastructure required for a complete system of local and international supply and demand converging on Rotterdam. Their confidence became apparent last week, when the city, the Port Authority, and South Holland Province signed a joint statement Read more at: https://oilprice.com/Energy/Energy-General/Europes-Largest-Port-Plans-To-Become-A-Major-Hydrogen-Hub.html |

|

U.S. Oil Refiners Brace For Hurricane SeasonU.S. oil markets are preparing for hurricane season amid already low oil product stockpiles, as forecasts predict a more active season this year. Between six and ten hurricanes could form in the Atlantic this hurricane season, which starts next month and runs through November, with peak season in September. Three of those are set to become major storm systems, according to the U.S. National Oceanic Atmospheric Administration’s (NOAA) Climate Prediction Center. Ongoing La Nina and above-average Atlantic temperatures are contributing to the Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Oil-Refiners-Brace-For-Hurricane-Season.html |

|

UK Energy Bills Could Surge By Another 42% In OctoberThe UK hasn’t seen the worst of its cost-of-living crisis as energy bills could soar by another 42% in less than six months time when the energy regulator will raise the so-called energy cap again. The UK has an Energy Price Cap in place, which protects households from excessively high bills by capping the price that providers can pass on to them. But as the price cap was raised by 54% in April because of the high energy prices in the six months prior to the decision for the increase made by energy market regulator Ofgem in Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Energy-Bills-Could-Surge-By-Another-42-In-October.html |

|

Electric vehicles are in short supply. Here’s what you can find as gas prices soarIf consumers don’t want to wait for a new EV, some models may be easier to find than others, according to industry data compiled by CNBC. Read more at: https://www.cnbc.com/2022/05/24/electric-vehicles-are-in-short-supply-heres-what-you-can-find-as-gas-prices-soar-.html |

|

Nordstrom stock surges after company raises full-year outlook, first-quarter sales top expectationsCEO Erik Nordstrom said the company has been able to capitalize on demand from people who are shopping for “long-awaited occasions.” Read more at: https://www.cnbc.com/2022/05/24/nordstrom-jwn-reports-q1-2022-losses.html |

|

NFL renews its sponsorship deal with Pepsi, but without the Super Bowl halftime showThe NFL and Pepsi officially renewed their 40-year relationship, but Super Bowl halftime rights are going back on the market. Read more at: https://www.cnbc.com/2022/05/24/nfl-renews-sponsorship-deal-with-pepsi-but-without-super-bowl-halftime-show.html |

|

Saudi fund in early talks to potentially buy Carnival’s ultra-luxury Seabourn brandCarnival is in preliminary discussions to sell its Seabourn luxury cruise brand to the Saudi sovereign wealth fund, sources say. Read more at: https://www.cnbc.com/2022/05/24/saudi-fund-in-early-talks-to-potentially-buy-carnivals-ultra-luxury-seabourn-brand.html |

|

Allbirds to start selling its shoes in select Nordstrom department storesStarting June 1, a selection of Allbirds shoes, including its signature wool sneakers, will be available for sale in 14 Nordstrom locations. Read more at: https://www.cnbc.com/2022/05/24/allbirds-to-sell-its-sneakers-in-select-nordstrom-department-stores.html |

|

Best Buy says softer demand is sticking around, but the company isn’t planning for a recessionBest Buy’s revenue beat Wall Street’s revenue estimates for the fiscal first quarter. Read more at: https://www.cnbc.com/2022/05/24/best-buy-bby-earnings-q1-2023.html |

|

Sales of newly built homes tumbled over 16% in April while prices soaredThe median price of a new home sold in April was $450,600, an increase of nearly 20% from the year before. Read more at: https://www.cnbc.com/2022/05/24/sales-of-newly-built-homes-fall-16percent-in-april-as-prices-soar.html |

|

SpaceX president defends Elon Musk over sexual misconduct claims: ‘I believe the allegations to be false’SpaceX President and COO Gwynne Shotwell defended Elon Musk in an email to employees responding to sexual misconduct allegations directed at the CEO. Read more at: https://www.cnbc.com/2022/05/23/spacex-president-gwynne-shotwell-defends-elon-musk-over-sex-misconduct-allegations.html |

|

CDC says monkeypox doesn’t spread easily by air: ‘This is not Covid’“Respiratory spread is not the predominant worry. It is contact and intimate contact in the current outbreak setting and population,” a CDC official said. Read more at: https://www.cnbc.com/2022/05/24/cdc-says-monkeypox-doesnt-spread-easily-by-air-this-is-not-covid.html |

|

NOAA forecasts a busy Atlantic hurricane season for a seventh consecutive yearThe Atlantic season has experienced a growing number of destructive, rapidly intensifying hurricanes over the past several decades. Read more at: https://www.cnbc.com/2022/05/24/noaa-forecasts-a-busy-atlantic-hurricane-season-for-7th-straight-year-.html |

|

What retail inventory misses and markdowns signal about the market’s fight against inflationThe Walmart, Target inventory misses and markdowns could just be a signal the consumer is shifting from goods to services, or a more ominous inflation warning. Read more at: https://www.cnbc.com/2022/05/24/what-retail-inventory-misses-markdowns-say-about-fighting-inflation.html |

|

U.S. Navy climate plan calls to curb emissions, electrify vehicle fleetThe Navy’s climate strategy directs the service to achieve a 65% reduction in greenhouse gases by 2030 and net-zero emissions by 2050. Read more at: https://www.cnbc.com/2022/05/24/us-navy-climate-plan-calls-to-cut-emissions-electrify-vehicle-fleet.html |

|

That vacation rental listing could be a scam. These are the warning signs to look out forAs summer heats up, you may be eager to book your next getaway. But before you commit to renting a property, be sure to double-check it’s not a scam. Read more at: https://www.cnbc.com/2022/05/24/that-vacation-rental-listing-could-be-a-scam-watch-for-warning-signs.html |

|

Big-Tech & Bond Yields Plunge As US Macro ‘Snaps’, Gold GainsBig-Tech & Bond Yields Plunge As US Macro ‘Snaps’, Gold GainsToday’s market was brought to you by three simple words…

SNAP… goes the social-media/ad-spend bubbleSocial media meltdown as Snap slashed its guidance, throwing the entire ad-supported tech sector into turmoil, and leaving gaping wide questions about the strength of the consumer. SNAP’s stunning collapse (over 40%) weighed on the entire social media landscape, crashing below pre-COVID levels…

Read more at: https://www.zerohedge.com/markets/stocks-bond-yields-plunge-us-macro-snaps |

|

National Teachers’ Guide Advises Against Use Of “Parent”, “Male”, “Female”, “Mother”, & “Father”Authored by Jonathan Turley, In academia, there have been growing controversies over language guides and usages, including the use of pronouns that some object to as matters of religion or grammar. Now the largest association of science teachers in the world has issued a guide for “anti-oppression” terminology for science teachers. In the guide, titled “Gender-Inclusive Biology: A framework in action,” the National Science Teachers Association (NSTA) has called for “gender-inclusive biology,” which includes the abandonment of terms like “parent,” “men,” “women,” “mother,” and “father.”

Under the guide, mothers are now referred to as “persons with ova … Read more at: https://www.zerohedge.com/political/national-teachers-guide-advises-against-use-parent-male-female-mother-father |

|

Dalio: “Cash Is Still Trash… But Equities Are Trashier”, Prefers Gold & BitcoinReiterating his initial “cash is trash” call from January 2020, Ray Dalio, Bridgewater Associates Founder, Co-Chief Investment Officer and Member of the Board told Andrew Ross Sorkin on CNBC this morning that:

Unfortunately, he added, this doesn’t mean that investors will be much better off keeping their money in stocks or bonds, because “equities are trashier”. Dalio warned that after more than a decade of unprecedented equity market gains, the problem has become the fact that too many investors are crowded into stocks, and while the last few weeks have been a relative bloodbath for some, Dalio says there is room for more pain to come…

|

|

Watch: Davos Elites Warn “Painful Global Transition” Should Not Be Resisted By Nation-StatesAuthored by Steve Watson via Summit News, As World Economic Forum head Klaus Schwab proclaimed that “the future is built by us” at the opening of the annual Davos gathering, two other European elites declared that the global energy crisis is a “transition” that will be “painful” for most, but should not be resisted by nations tempted to preserve their own sovereignty over the “global agenda.”

Schwab called those summoned before him a “powerful community,” and declared “We have the means to improve the state of the world, but two conditions are necessary: The first one, is that we act all as stakeholders of larger communities, so that we serve not only our self-interests but we serve the community. That’s what we call ‘stakeholder responsibility.’” “And second, that we collaborate,” he continued, addin … Read more at: https://www.zerohedge.com/geopolitical/watch-davos-elites-warn-painful-global-transition-should-not-be-resisted-nation-states |

|

Energy price cap: Typical energy bill set to rise by £800 a year in OctoberIndustry regulator Ofgem warns households that they should expect higher energy bills this winter. Read more at: https://www.bbc.co.uk/news/business-61562657?at_medium=RSS&at_campaign=KARANGA |

|

Mining giant pleads guilty to UK bribery chargesGlencore’s UK subsidiary pleads guilty to bribery in London, while the firm resolves similar US claims for $1bn. Read more at: https://www.bbc.co.uk/news/business-61567403?at_medium=RSS&at_campaign=KARANGA |

|

Cost of living: Government plan to help households could come in daysAn announcement could come as soon as Thursday after growing pressure on Downing Street, the BBC learns. Read more at: https://www.bbc.co.uk/news/uk-politics-61572226?at_medium=RSS&at_campaign=KARANGA |

|

Oh Snap! Social media stocks lose billions after Snapchat parent warningThe company was on track to lose $15 billion in market capitalization, while shares of major online advertisers and social-media firms were set to lose a combined $200 billion in value from the rout. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/oh-snap-social-media-stocks-lose-billions-after-snapchat-parent-warning/articleshow/91772295.cms |

|

Trade Setup: Shorting the market is unlikely to provide any favourable risk-reward prepositionThe Relative Strength Index (RSI) on the daily chart is 42.01. It stays neutral and does not show any divergence against the price. The daily MACD is bullish and stays above the signal line. A black-bodied candle appeared on the charts; no other formations were noticed. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/trade-setup-shorting-the-market-is-unlikely-to-provide-any-favourable-risk-reward-preposition/articleshow/91773089.cms |

|

Market movers: LIC sees first close in black; metals extend declineThe buyers converged at the stock after heavy selling in the last few days made it appetizing. It still trades down over 13 per cent from issue price of the IPO. The market cap of the firms stands at Rs 5,21,021.69 crore. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/market-movers-lic-sees-first-close-in-black-metals-extend-decline/articleshow/91771971.cms |

|

Market Extra: Chances of a markets-led recession arriving sooner than expected are growing by the day, investors and traders sayA meltdown in U.S. stock prices, driven by pessimism about the outlook, is giving way to the growing risk of a markets-led downturn, traders and investors say. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7DB0-A5A88788DB1F%7D&siteid=rss&rss=1 |

|

Key Words: Herschel Walker says he supports a ‘no exception’ abortion banWalker is currently running for a Georgia Senate seat as a Republican. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7DA3-E2D3580A076A%7D&siteid=rss&rss=1 |

|

Bond Report: 2- and 10-year Treasury yields fall to lowest levels in over a month as S&P 500, Nasdaq extend lossesA rally in Treasurys pushed two- and 10-year yields to their lowest levels in over a month on Tuesday, as two of the three major U.S. stock indexes sold off. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7DAC-F4B66A8484EE%7D&siteid=rss&rss=1 |