Summary Of the Markets Today

- The Dow up 0.3%,

- Nasdaq up 1.6%,

- S&P 500 up 0.6%,

- WTI crude oil up $1.13 to $105.74,

- gold down $50 to $1,862,

- Bitcoin up 1.7% to $38,464,

- 10-year U.S. Treasury up 10 basis points to 2.99%

Today’s Economic Releases

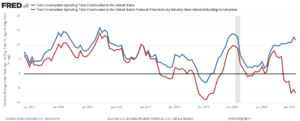

The headlines for March 2022 construction spending say it slightly improved relative to last month. Unfortunately, there is significant inflation in the sector – and the real facts show year-over-year growth has contracted over 5% (red line on graph below).

Other Economic News

As usual, we have included below the headlines and news summaries moving the markets today including:

- Can Brazil Help Fill The Supply Gap Left By The U.S. Ban On Russian Oil?

- OPEC Has Missed Its Oil Output Target Once Again

- EU Consider Exemptions As Hungary Threatens To Veto Russian Oil Ban

- Home affordability is nearly the worst on record as mortgage rates spike

- Biden kicks off $3 billion plan to boost battery production for electric vehicles

- About 150,000 people in Ukraine are using SpaceX’s Starlink internet service daily, government official says

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Can Brazil Help Fill The Supply Gap Left By The U.S. Ban On Russian Oil?Since President Joe Biden floated the idea of banning oil imports from Russia in response to President Vladimir Putins invasion of Ukraine there has been considerable speculation as to which countries can fill the supply gap. In early March 2022 Washington sent an official mission to Caracas to open negotiations with President Nicolas Maduros pariah authoritarian regime. The trip sparked fears that Bidens administration would ease sanctions against Venezuela in a cynical attempt to boost U.S. petroleum supplies thereby easing Read more at: https://oilprice.com/Energy/Crude-Oil/Can-Brazil-Help-Fill-The-Supply-Gap-Left-By-The-US-Ban-On-Russian-Oil.html |

|

The U.S. Has Lost Its Position As The Worlds Top LNG ExporterAfter briefly surpassing Qatar and Australia as the worlds top LNG exporter, the United States lost the top slot to Qatar in April as volumes in the north dropped along with heating fuel demand, Bloomberg reports. Bloomberg data now shows that Qatar exported 7.5 million metric tons of LNG in April. American LNG production was somewhat reduced in April, Bloomberg notes, due to the end of the winter season and lower demand for heating fuel. With promises to help the European Union replace Russian gas and a new American export Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-US-Has-Lost-Its-Position-As-The-Worlds-Top-LNG-Exporter.html |

|

How 3D Printers Could Transform The Energy IndustryThe potential for 3D printing in the energy industry is gradually becoming clear. After years of encouraging oil and gas majors to adopt the technology for on-site additive manufacturing, printing firms are finally being recognized for their potential in the field. The global 3D printing market was worth over $13 billion in 2021 and is expected to expand at a CAGR of 20.8 percent between 2022 and 2030. So far, one of the biggest uses of technology has been for medical needs. But as the market rapidly expands, other industries are looking Read more at: https://oilprice.com/Energy/Energy-General/How-3D-Printers-Could-Transform-The-Energy-Industry.html |

|

OPEC Has Missed Its Oil Output Target Once AgainForce majeure in Libya and under-production in Nigeria have led to a much lower increase in OPEC production for the month of April than was called for by the cartels supply agreement. According to a Reuters survey, OPEC produced 28.58 million barrels per day in April, meaning that OPECs 10 members produced only 40,000 bpd more than in March. The output deal called for a 254,000 bpd increase for OPEC countries, and a 400,000 bpd increase overall for OPEC+ production for April. This suggests a shortfall of some 214,000 Read more at: https://oilprice.com/Latest-Energy-News/World-News/Production-Declines-in-Libya-And-Nigeria-Are-Hindered-OPECs-April-Oil-Output.html |

|

The War In Ukraine Has Stalled Global Efforts To Cut EmissionsThe Russian invasion of Ukraine is upending global energy markets and short-term efforts to reduce emissions. The ongoing frantic search for non-Russian energy supply, especially in Europe, is set to keep global carbon emissions elevated in the short term as coal use grows everywhere. At the same time, Russias heavy industries, such as steelmaking and metals production, are now unable to implement imported emission-reduction technologies as the West is continuously ramping up sanctions against Moscow over Putins invasion of Read more at: https://oilprice.com/Energy/Energy-General/The-War-In-Ukraine-Has-Stalled-Global-Efforts-To-Cut-Emissions.html |

|

EU Consider Exemptions As Hungary Threatens To Veto Russian Oil BanAs Hungary threatens to veto a European Union-wide ban on Russian energy products, the bloc is now considering exemptions for Hungary and Slovakia, or a longer timeframe for the two countries to reduce their heavy reliance on Russia. Slovakia and Hungary have been among those EU members staunchly opposed to a ban on Russian oil due to their very high dependence on Russian imports. On Monday, a senior Hungarian government official said that Hungary could be ready to veto an EU embargo on Russian oil imports, Bloomberg reported. Hungarian Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Consider-Exemptions-As-Hungary-Threatens-To-Veto-Russian-Oil-Ban.html |

|

Atlassian co-CEO invests in Australian energy company to force it to go greenerMike Cannon-Brookes is on a tear with climate investments. Now he has succeeded in taking part ownership of one of Australia’s top energy companies. Read more at: https://www.cnbc.com/2022/05/02/atlassian-co-ceo-cannon-brookes-takes-11percent-ownership-of-agl-energy.html |

|

India’s record-setting heat wave in picturesIndia has been dealing with an unusually early heat wave for months. April was the third hottest April on record and March was the hottest. Read more at: https://www.cnbc.com/2022/05/02/india-heat-wave-in-pictures.html |

|

Biden administration announces $3.1 billion to make electric vehicle batteries in the U.S.The Department of Energy will provide $3.1 billion to support efforts to make EV batteries and components in the U.S. Read more at: https://www.cnbc.com/2022/05/02/white-house-announces-3point1-billion-for-us-ev-battery-manufacturing-.html |

|

Chrysler parent Stellantis plans $2.8 billion overhaul of two Canadian factories to build EVsTwo Canadian factories that build Chrysler’s minivans and Dodge’s muscle cars will be retooled for EVs Read more at: https://www.cnbc.com/2022/05/02/stellantis-plans-2point8-billion-ev-overhaul-of-canadian-factories.html |

|

Greenwich estate owner will accept bitcoin or Ethereum cryptocurrency as payment for $6.5 million propertyThe agent for the Greenwich property said it is the first time a Greenwich residence could be sold for cryptocurrency like bitcoin or Ethereum. Read more at: https://www.cnbc.com/2022/05/02/greenwich-mansion-for-sale-will-take-bitcoin-cryptocurrency-as-payment.html |

|

Starbucks union claims CEO Schultz violated labor law by ‘threatening to withhold’ benefitsThe union alleges in a letter obtained by CNBC that Schultz’s recent comments about an improved benefits plan amounted to illegal threats. Read more at: https://www.cnbc.com/2022/05/02/starbucks-union-files-nlrb-complaint-citing-ceo-schultzs-benefits-comments.html |

|

Home affordability is nearly the worst on record as mortgage rates spikeOverheated home prices and sharply higher mortgage rates are crushing housing affordability. Read more at: https://www.cnbc.com/2022/05/02/mortgage-rates-surge-as-home-affordability-nears-record-worst.html |

|

Biden kicks off $3 billion plan to boost battery production for electric vehiclesThe White House plan to accelerate battery production is part of a broader effort to shift the country away from gas-powered cars to electric vehicles. Read more at: https://www.cnbc.com/2022/05/02/biden-starts-3-billion-plan-to-boost-battery-production-for-evs.html |

|

About 150,000 people in Ukraine are using SpaceX’s Starlink internet service daily, government official saysDigital minister Mykhailo Fedorov says “rough data” about SpaceX’s Starlink shows about 150,000 people in Ukraine use the service each day. Read more at: https://www.cnbc.com/2022/05/02/ukraine-official-150000-using-spacexs-starlink-daily.html |

|

Nearly risk-free I bonds to deliver a record 9.62% interest for the next six monthsInflation-protected I bonds, a nearly risk-free asset, will pay 9.62% annual interest for the next six months. Here’s what to know before buying. Read more at: https://www.cnbc.com/2022/05/02/i-bonds-to-deliver-a-record-9point62percent-interest-for-the-next-six-months.html |

|

5 things to know before the stock market opens MondayU.S. stock futures mixed on the first trading day of May after the Nasdaq had its worst month since 2008. Read more at: https://www.cnbc.com/2022/05/02/5-things-to-know-before-the-stock-market-opens-monday-may-2.html |

|

Four tips for managing an unexpected increase in moneyKristen Heaton sold her $15 million hairbrush brand Crave Naturals for seven figures. Here’s her advice for how to manage new wealth and get the most out of it. Read more at: https://www.cnbc.com/2022/05/02/how-to-manage-a-surprise-increase-in-money-if-you-sold-your-business.html |

|

Time for a fourth Covid vaccine dose? Here’s why medical professionals are skepticalMedical professionals are undecided on whether a fourth dose of the Covid-19 vaccine would benefit the wider population. Read more at: https://www.cnbc.com/2022/05/02/medical-professionals-are-skeptical-on-a-fourth-covid-vaccine-dose.html |

|

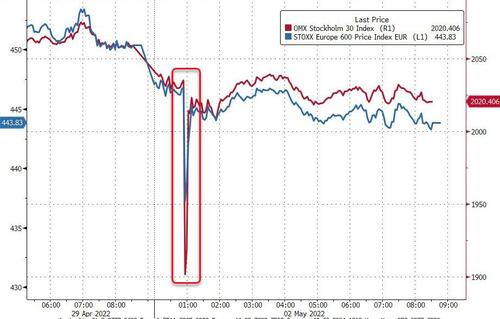

May-Day Mayhem: Stocks Dump’n’Pump, Bonds Blowout, & Commodities ChaoticMay-Day Mayhem: Stocks Dump’n’Pump, Bonds Blowout, & Commodities ChaoticWhile the Brits danced around their May-Poles (Google it), removing more of what little liquidity there was in global markets, Europe’s stock market suddenly puked overnight following a flash-crash in Stockholm (which was reportedly sparked by some shitty math by a Citi index trader)…

Source: Bloomberg US Futures also puked very briefly at that time but it wasn’t until the European close that the real carnage started to hit in US equities. But after the chaos calmed down ray of hope appeared (not in any headlines of course) which seemed to spark a buying panic in the last hour of the day… Read more at: https://www.zerohedge.com/markets/may-day-mayhem-equity-flash-crashes-bond-blowouts-commodity-chaos |

|

MyPillow CEO Mike Lindell Rejoins Twitter, Suspended Again Hours LaterMyPillow CEO Mike Lindell Rejoins Twitter, Suspended Again Hours LaterAuthored by Jack Phillips via The Epoch Times (emphasis ours), MyPillow CEO Mike Lindell announced that he rejoined Twitter Sunday after his account was banned last year, but he was quickly reported and banned from the platform.

He added: “So we started this account … Please share it with everybody you know. Let everybody you know so we can get the word out over here at Twitter in case they do take it down.”

Read more at: https://www.zerohedge.com/political/mypillow-ceo-mike-lindell-rejoins-twitter-suspended-again-hours-later |

|

Citadel’s Griffin Warns ‘West Faces Existential Problems’Citadel’s Griffin Warns ‘West Faces Existential Problems’As US equities continued their drawdown on Monday afternoon, tumbling ever-closer to the 4,000 “max pain” threshold that BofA’s Michael Hartnett warned could trigger an even more punishing selloff in stocks, Citadel’s Ken Griffin took the stage at the Milken conference in Los Angeles, where he shared some of his own apocalyptic warnings. Speaking during an interview with Bloomberg’s Erik Schatzker, Griffin warned that investors are now facing the period of highest market uncertainty since the global financial crisis. The number of risk factors facing markets are myriad – chief among them the possibility that inflation could become “unanchored”, eventually becoming self-reinforcing, which would create serious problems for the Fed and its efforts to “expeditiously” tighten monetary policy.

Should inflation ease to just 4% YoY by the end of 2022, then the Fed would be able to “relax”, Gr … Read more at: https://www.zerohedge.com/markets/ken-griffin-markets-are-facing-worst-period-uncertainty-2008 |

|

“We’re Out Of The Bubble Extremes”, But Bridgewater’s Dalio Warns ‘Overvalued’ US Stock Market Still Not “Safe”“We’re Out Of The Bubble Extremes”, But Bridgewater’s Dalio Warns ‘Overvalued’ US Stock Market Still Not “Safe”Authored by Ray Dalio via LinkedIn, The latest readings from the “bubble indicator.”

As you know, I like to convert my intuitive thinking into indicators which I write down as decision rules (principles) that can be back-tested and automated to put together with other principles and bets created the same way to make up a portfolio of alpha bets. I have one of these for bubbles. Having been through many bubbles over my 50+ years of investing, about 10 years ago I described what in my mind makes a bubble and use that to identify them in markets—all markets, not just stocks. I define a bubble market as one that has a combination of the following in high degrees: High prices relative to traditional measures of value (e.g., by taking the p … Read more at: https://www.zerohedge.com/markets/were-out-bubble-extremes-bridgewaters-dalio-warns-overvalued-us-stock-market-still-not-safe |

|

EU divided over how to step away from Russian energyEU energy ministers met to discuss a possible ban on Russian oil, but members remain split. Read more at: https://www.bbc.co.uk/news/business-61298791?at_medium=RSS&at_campaign=KARANGA |

|

EU accuses Apple of breaking competition law over contactless paymentsThe US tech giant denies it is restricting rivals’ access to its mobile payments technology. Read more at: https://www.bbc.co.uk/news/business-61300874?at_medium=RSS&at_campaign=KARANGA |

|

Law firm says staff can work from home – for 20% less payStaff can choose to work remotely, but will have their pay cut, says city law firm Stephenson Harwood. Read more at: https://www.bbc.co.uk/news/business-61298394?at_medium=RSS&at_campaign=KARANGA |

|

Hero MotoCorp Q4 Preview: Weak volumes to hit top and bottom line; margin may fall 100-150 bpsForeign brokerage Nomura India pegs profit at Rs 683.40 crore, down 21 per cent YoY. It sees sales falling to 7,447.10 crore. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/hero-motocorp-q4-preview-weak-volumes-to-hit-top-and-bottom-line-margin-may-fall-100-150-bps/articleshow/91267655.cms |

|

Can gold deliver solid returns by next Akshaya Tritiya? What analysts are sayingRavindra Rao, CMT, EPAT, VP- Head Commodity Research at Kotak Securities said since Akshay Tritiya was in May last year, MCX gold price has risen more than 7 per cent and the gains were supported by inflation concerns and geopolitical tensions. The upside, however, has been challenged by the US Fed’s monetary tightening expectations, he said. Read more at: https://economictimes.indiatimes.com/markets/commodities/news/can-gold-deliver-solid-returns-by-next-akshaya-tritiya-what-analysts-are-saying/articleshow/91253774.cms |

|

Market movers: Why Ajanta Pharma & Meghmani Organics surged up to 12%The company in a regulatory filing said the Board of Directors of the Company will meet on Tuesday, “10th May 2022 to inter-alia consider…issue of bonus shares subject to approval by the shareholders of the company.” Read more at: https://economictimes.indiatimes.com/markets/stocks/news/market-movers-why-ajanta-pharma-meghmani-organics-surged-up-to-12/articleshow/91265871.cms |

|

Market Extra: Stock market making you seasick? Here’s why trading is so choppy in 2022The stock market isn’t only weak, it’s volatile. Don’t expect smooth sailing soon. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7C9A-9B0E28D61480%7D&siteid=rss&rss=1 |

|

ESG investing was intended to make the world a better place but has become a ‘gravy train’ for companies, says NYU valuation expertAswath Damodaran argues there are always tradeoffs in business — no single measure can define the good or bad that a company does. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7C7B-0D04DA437AB2%7D&siteid=rss&rss=1 |

|

The Moneyist: ‘I’m spending a fortune on home maintenance. I realize my second husband is essentially living in my house for free’: What is a fair way to split costs?‘When I married my husband, he sold his house, which was valued at about $100,000 more than mine, but he had no equity in it.’ Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7C6E-6EBCB42DDBCC%7D&siteid=rss&rss=1 |