Wall Street zigzag across the unchanged line for most of the session, remaining in the red until the remaining hour. Then, ending mostly higher and booked weekly gains. But, many investors fear a recession is around the corner.

Ending the week, the S&P 500 finishes higher and notches another straight weekly gain. In addition, new home buyers saw mortgage rates climb to almost 5% in the second jump this week.

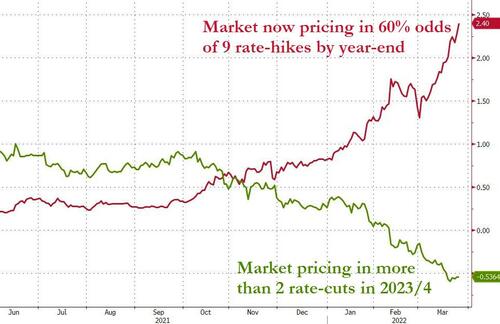

The ongoing hawkish push is higher in market expectations for 2022’s rate-hike trajectory, with nine more rate-hikes now expected by the end of December.

Yields on 2- and 10-year Treasury notes climbed to their highest daily levels in almost three years today. In addition, treasury notes posted their biggest weekly gains in several years as investors reacted to Russia’s possible reassessment of its ambitions in the month-long war in Ukraine.

Today’s aggressive sell-off of U.S. government debt pushed yields higher. Meanwhile, the spread between 5- and 30-year rates shrank below three basis points and teetered on the brink of inverting.

It’s been another very busy week for oil and gas markets. Putin threatened European gas imports, a storm knocked a major oil pipeline offline, and a Saudi oil terminal came under missile attack. Nevertheless, Brent is above $120 per barrel as bullish sentiment remains dominant.

A summary of headlines we are reading today:

- High Gasoline Prices Are Starting To Hurt Demand

- Saudi Aramco Facility Fire Under Control

- Gm To Halt Pickup Truck Production In Indiana Due To Chip Shortage

- 57% OF U.S. Households Paid No Federal Income Tax Last Year As Covid Took A Toll, Study Says

- Stocks, Gold, & Oil Surge On Week As Yield Curve Carnage Screams ‘Recession’

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

EU Intake Of Russian Gas Remains High Amid Lower Wind OutputWhile the European Union looks for ways to reduce its imports of Russian gas, flows via Ukraine remain high, at 109 million cu m daily amid lower wind energy output. Interfax reports, citing data from the Gas Transmission System Operator of Ukraine, that bookings for Thursday stood at 105.2 million cu m while todays booking are higher, at 105.8 million cu m. The numbers are in line with the long-term contract with Gazprom, which is for deliveries of 40 billion cu m of gas annually. Wind generation, meanwhile, has been on the decline, according Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Intake-Of-Russian-Gas-Remains-High-Amid-Lower-Wind-Output.html |

|

Mission Impossible: Predicting The Oil MarketIt’s been another very busy week for oil and gas markets as Putin threatened European gas imports, a storm knocked a major oil pipeline offline, and a Saudi oil terminal came under missile attack. Brent is back above $120 per barrel as bullish sentiment remains dominant, but plenty of bearish factors are still looming.Oilprice Alert.Bullish factors in oil markets are piling up, from attacks on Saudi oil infrastructure to a potential end of Russian oil exports to Europe.As these geopolitical and fundamental factors combine, our analysts Read more at: https://oilprice.com/Energy/Energy-General/Mission-Impossible-Predicting-The-Oil-Market.html |

|

High Gasoline Prices Are Starting To Hurt Demand1. OPEC Exports Underwhelm Despite High Prices Source: Kpler. – The Russia-Ukraine war has taken OPEC heavyweights out of the public limelight, somewhat concealing the fact that the 400,000 b/d monthly increments of OPEC+ routinely end up underproduced. – Saudi Arabia is the only major OPEC producer to pull off a tangible export hike over the past months in February outflows jumped to 7.15 million b/d however with Iraq and Kuwait faltering, the net effect has been lower than assumed. – Hence, OPEC producers could enjoy high prices Read more at: https://oilprice.com/Energy/Energy-General/High-Gasoline-Prices-Are-Starting-To-Hurt-Demand.html |

|

Saudi Aramco Facility Fire Under ControlA fire that broke out as a result of a Houthi missile strike on a Saudi Aramco oil storage facility in Jeddah earlier today is now under control, according to Saudi officials, with experts indicating that any potential damage to this domestic-use storage facility and distribution plant will have no impact on the Kingdoms crude oil exports. According to media reports, a huge plume of smoke was seen above the oil facility after the attack, which was part of a larger barrage of missiles. The Saudi Aramco facility on fire Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Aramco-Facility-Fire-Under-Control.html |

|

Oil Rally Undeterred By Bearish NewsU.S. West Texas Intermediate crude oil futures are trading lower on Friday, but are still up for the week. This weeks rally is being fueled by a combination of a bullish technical chart pattern and mixed-to-bullish fundamentals. The technical chart pattern is pretty clear. After erasing the war premium, bullish traders found value at $92.20. Now they are looking for a fundamental event that could launch a breakout to the upside. The fundamentals are mixed, but still leaning toward the bullish side. The theme this past week Read more at: https://oilprice.com/Energy/Energy-General/Oil-Rally-Undeterred-By-Bearish-News.html |

|

Pressure Mounts On Russia’s Oil IndustryEnergy Markets on War Footing Russia has choked throughput on a Caspian Sea pipeline carrying crude oil from the Tengiz fields in Kazakhstan to Russias Black Sea coast. Russian officials say they were forced to throttle throughput in the 1.4M bpd capacity pipeline after a related port was severely damaged due to weather conditions. They also said it could take up to 2 months to repair the damage, seemingly blaming Western sanctions for that in another veiled threat to energy markets. This pipeline pushes over 60% of Kazakhstans oil Read more at: https://oilprice.com/Energy/Energy-General/Pressure-Mounts-On-Russias-Oil-Industry.html |

|

Second Starbucks location in Mesa, Arizona, votes to unionizeThe growing union push will be one of the challenges that incoming interim CEO Howard Schultz will have to tackle when he assumes the role on April 4. Read more at: https://www.cnbc.com/2022/03/25/second-starbucks-location-in-mesa-arizona-votes-to-unionize.html |

|

Stocks making the biggest moves midday: Bed Bath & Beyond, Nio, Joby Aviation, Teva & moreThese are the stocks posting the largest moves in midday trading Friday. Read more at: https://www.cnbc.com/2022/03/25/stocks-making-the-biggest-moves-midday-bed-bath-beyond-nio-joby-aviation-teva-more.html |

|

Wisconsin senator urges Kohl’s to reject buyout offers that threaten jobs in retailer’s home stateA Wisconsin senator is urging Kohl’s to not accept any buyout offer that might precede a bankruptcy filing or threaten workers’ jobs in the state. Read more at: https://www.cnbc.com/2022/03/25/sen-tammy-baldwin-urges-kohls-to-reject-bids-threatening-jobs-in-wisconsin.html |

|

GM to halt pickup truck production in Indiana due to chip shortageGM will idle the plant, which produces Silverado and GMC Sierra pickups, the weeks of April 4 and April 11, the company said Friday. Read more at: https://www.cnbc.com/2022/03/25/gm-to-halt-pickup-truck-production-in-indiana-due-to-chip-shortage.html |

|

FAA will keep ‘zero tolerance’ policy toward unruly passengers, outgoing chief saysThe FAA instituted the policy in January 2021 to stem a surge in unruly passenger behavior. Read more at: https://www.cnbc.com/2022/03/25/faa-will-keep-zero-tolerance-policy-toward-unruly-passengers-outgoing-chief-says.html |

|

57% of U.S. households paid no federal income tax last year as Covid took a toll, study saysMore than half of Americans paid no federal income tax last year due to Covid-relief funds, tax credits and stimulus, according to a new report. Read more at: https://www.cnbc.com/2022/03/25/57percent-of-us-households-paid-no-federal-income-tax-in-2021-study.html |

|

Bed Bath & Beyond shares rise after retailer strikes deal with activist investor Ryan CohenBed Bath & Beyond announced that it has struck a deal with activist investor Ryan Cohen. Read more at: https://www.cnbc.com/2022/03/25/bed-bath-beyond-strikes-deal-with-activist-investor-ryan-cohen.html |

|

Here’s how to take a sabbatical, even if your company doesn’t offer oneSabbaticals aren’t a common workplace perk. Here’s how to approach your employer to ask for one and how to financially prepare if you decide to quit instead. Read more at: https://www.cnbc.com/2022/03/25/how-to-take-a-sabbatical-even-if-your-company-doesnt-offer-one.html |

|

Meet the women who are shaking up the male-dominated gambling industryFanDuel CEO Amy Howe and Entain’s chief, Jette Nygaard-Andersen, are making the gambling industry rethink some key issues. Read more at: https://www.cnbc.com/2022/03/25/meet-the-women-who-are-shaking-up-the-male-dominated-gambling-industry.html |

|

Here are seven milestones and storylines to watch for at the Academy AwardsThis year’s crop of nominees is a celebration of diversity, and audiences are likely to see a number of records broken during the 2022 ceremony. Read more at: https://www.cnbc.com/2022/03/25/oscars-2022-7-academy-awards-milestones-storylines-to-watch.html |

|

Stocks, Gold, & Oil Surge On Week As Yield Curve Carnage Screams ‘Recession’Stocks, Gold, & Oil Surge On Week As Yield Curve Carnage Screams ‘Recession’The ongoing hawkish push higher in market expectations for 2022’s rate-hike trajectory with 9 more rate-hikes now expected by the end of December. But as the chart below shows, as the hawkishness rises, so does the chance of a recession, and the market is expecting more than 2 rate-cuts starting next year…

Source: Bloomberg Bonds were the story of the week as the bloodbath did not stop, especially at the short-end, with 5Y yields up a stunning 44bps (while 30Y was up ‘only’ 17bps)… Read more at: https://www.zerohedge.com/markets/stocks-gold-oil-surge-week-yield-curve-carnage-screams-recession |

|

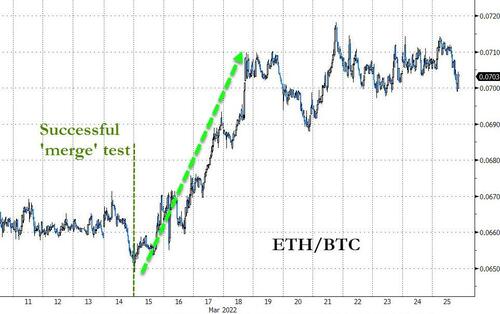

One River: It’s “Increasingly Clear That The Future Of Finance Runs On Ethereum”One River: It’s “Increasingly Clear That The Future Of Finance Runs On Ethereum”Submitted by One River Digital Research’s Marcel Kasumovich and Paul Ebner, Ethereum achieved a milestone with last week’s Merge. It is “only” public testing, but transactions are being validated for the first time. It is working. Scaling solutions to increase throughput and lower costs will accelerate innovation. Investor behavior is a vote of confidence – ether (ETH) is being valued as a reserve asset with a high store of value.

The future of finance is being built on Ethereum’s rails. Banks who have entered the digital arena have done so using Ethereum, most notably JP Morgan on its Onyx platform. Public sector trials for bond issuance were also executed using Ethereum, such as the one completed by the European Invest … Read more at: https://www.zerohedge.com/crypto/one-river-its-increasingly-clear-future-finance-runs-ethereum |

|

FBI Scuttles Ketanji Brown Celebration At LA Field OfficeFBI Scuttles Ketanji Brown Celebration At LA Field OfficeThe FBI quickly moved to quash a scheduled celebration for Judge Ketanji Brown Jackson’s Supreme Court nomination after the Washington Free Beacon published a March 11 “Save the date” flyer contained in an email which was circulated to all employees – and then reported on by Fox News’ Tucker Carlson.

The Wednesday party was to be hosted by the agency’s women’s and black affairs committees.

Following the exposure, the FBI’s Diversity and Inclusion Department fired off an email saying “The FBI must remain neutral in all political nomination and confirmation processes. Accordingly, a party for any nominee in FBI sp … Read more at: https://www.zerohedge.com/political/fbi-scuttles-ketanji-brown-celebration-la-field-office |

|

MSNBC Piece Claims ‘Health & Fitness’ Is New Gateway Drug To The Far-RightMSNBC Piece Claims ‘Health & Fitness’ Is New Gateway Drug To The Far-RightAuthored by Paul Joseph Watson via Summit News, MSNBC published an article claiming that shadowy people on the Telegram messenger service are recruiting far-right acolytes by talking about health and fitness.

Yes, really. Apparently, health and fitness is the new gateway drug to the far-right. An article headlined ‘Pandemic fitness trends have gone extreme — literally’ asserts that online fascist gym bros are colonizing mixed “martial arts (MMA) and combat sports spaces” as some kind of secret plot to amplify “neo-Nazi and white supremacist extremist ideologies.”

|

|

Calls for P&O Ferries boss Peter Hebblethwaite to resign growBoris Johnson backs Grant Shapps’ call for Peter Hebblethwaite to quit after not consulting on sackings. Read more at: https://www.bbc.co.uk/news/business-60872294?at_medium=RSS&at_campaign=KARANGA |

|

Spotify stops streaming in Russia over safety concernsNew laws threaten jail for people accused of spreading “fake news” about Russia’s armed forces. Read more at: https://www.bbc.co.uk/news/business-60881567?at_medium=RSS&at_campaign=KARANGA |

|

P&O Ferries: RMT union raised concerns over Irish Ferries last yearThe government’s response to Irish Ferries’ use of cheap labour was smaller than its response to P&O Ferries. Read more at: https://www.bbc.co.uk/news/business-60876918?at_medium=RSS&at_campaign=KARANGA |

|

Why bond market crash is actually good news for most investorsOne important reason is lower bond prices mean higher bond yields. Investors who hold bonds for income are pleased when their prices fall, because those bonds continue paying the same income as before. Read more at: https://economictimes.indiatimes.com/markets/bonds/why-bond-market-crash-is-actually-good-news-for-most-investors/articleshow/90444563.cms |

|

Latest fad on Wall Street: Judge the character of CEO before investingAmong those whose firms didn’t make the cut: Elon Musk and Mark Zuckerberg. The first data show neither Tesla Inc. nor Meta Platforms Inc. are included in the portfolio, while rival megacap stocks like Apple Inc. and Amazon.com Inc — helmed by Tim Cook and Andy Jassy, respectively — are among top holdings. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/elon-musk-and-mark-zuckerberg-fail-to-make-cut-in-high-character-ceo-etf/articleshow/90431102.cms |

|

After 20% rally in 2 days, is there more steam left in ZEE stock?“With the certainty of the merger being higher given Invesco’s support and recovery in the ad market, the stock can potentially see a re-rating in its valuation. We value ZEE at 25 times FY24 EPS and maintain our Buy rating,” Motilal Oswal Securities said while suggesting a target of Rs 410 on the stock. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/after-20-rally-in-2-days-is-there-more-steam-left-in-zee-stock/articleshow/90436910.cms |

|

: Ginni Thomas urged top Trump aide to keep fighting to overturn election: reportsConservative activist Virginia Thomas, the wife of Supreme Court Justice Clarence Thomas, repeatedly urged President Donald Trump’s chief of staff Mark Meadows to press his efforts to overturn Joe Biden’s victory in the 2020 election, according to copies of text messages seen by the Washington Post and CBS News. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7B1B-C026ABF39995%7D&siteid=rss&rss=1 |

|

Bond Report: 2- and 10-year Treasury yields see biggest weekly gain in years as investors reassess Russia-Ukraine war developmentsTreasury yields climb to their highest daily levels since 2019 on Friday, as investors track developments in the Russia-Ukraine war. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7B1A-0279E5FDBAFA%7D&siteid=rss&rss=1 |

|

In One Chart: Global pile of debt at negative yields dips below $3 trillion: Deutsche BankCentral banks are taking a huge bite out of the mound of negative yielding global debt, by talking about plans to hike policy rates to fight high inflation. Why the pile could evaporate. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7B24-3201F147AC53%7D&siteid=rss&rss=1 |