Headlines:

Gold Climbs Above $2,000 As Ceasefire Talks Crumble

The End Of The Global Economy As We Know It

Deutsche Bank Defends Decision Not To Exit Russia: It’s Not ‘Practical’ Right Now

Bonds, Stocks, & Crypto Crumble As Global Financial Conditions Tighten Drastically

Rising fuel and food costs push U.S. inflation to 7.9%

Wall Street started today’s session with the DOW gaping down, seeing a session low of almost 400 points on the negative side as U.S. inflation stays at a 40-year high. Mostly the result of a poor morning financial economy report. Higher Initial Jobless Claims and Continuing Jobless Claims reported higher numbers, and Inflation sped up in February to the fastest pace since January 1982, hotter-than-expected at nearly 8%.

Yesterday’s rally was a ‘Dead Cat Bounce’ by all observations. I didn’t think it could go any further higher, but I’m not particularly eager to gamble as I know only too well the market can stay irrational longer than one can stay solvent. Also, there are just too many unknowns that can take place with additional unknowns out there. (Or something like that!)

U.S. inflation rate climbs again to 7.9%, and if anyone has gone food shopping lately, they know food inflation is more like 20%. Oil prices end lower (WTI settles at 105), with Russia-Ukraine war headlines feeding trade volatility. When Joe Biden took office, the crude oil price increased 513%, and Ruskie Putin started bullying Ukraine. Crude oil prices have added 25% since the Ukraine invasion.

LAUGH FOR THE DAY:

Russia will recover with a ‘full bill of health,’ says Lavrov, vowing to cut ties with the West.

Tune in tomorrow for additional doom scrolling and disillusionment antics springing from Wall Street.

As usual, we have included below the headlines and news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Heres How Biden Could Bring Oil Prices DownIf you have ever wondered what it would be like if a major oil-producing country suddenly went offline, you are getting a preview of that now. I am sometimes asked whether there are any potential scenarios in which crude oil rises to $200 a barrel (bbl) and I typically say That could happen if war broke out in Saudi Arabia and it took that countrys oil production offline. Well, that also applies to Russia, which was producing more oil than Saudi Arabia when the 2021 BP Statistical Review of World Energy was released. To be Read more at: https://oilprice.com/Energy/Energy-General/Heres-How-Biden-Could-Bring-Oil-Prices-Down.html |

|

Gold Climbs Above $2,000 As Ceasefire Talks CrumbleGold resumed its charge this afternoon after the price faltered this morning on hopes of diplomatic progress between Russia and Ukraine. The price fell to $1972 per troy ounce in early trading after soaring to $2070 earlier in the week, spurred by a looming clampdown on Russian oil imports. But the price was back on the climb this afternoon after Russia-Ukraine talks yielded little progress and left investors scrambling for steady ground once again. The traditional safe-haven asset was trading at around $2007 per troy ounce at 14:20GMT on Read more at: https://oilprice.com/Latest-Energy-News/World-News/Gold-Climbs-Above-2000-As-Ceasefire-Talks-Crumble.html |

|

Why Arent Investors Interested In Geothermal Energy?The need to develop a variety of energy sources has never been so evident. As the global reliance on a few specific oil and gas sources becomes clear, it seems obvious that we should be investing in diversifying our energy mix. But while governments are looking to expand their solar and wind power, is enough being done to develop other options that could help boost the global energy supply? Geothermal energy is one such energy source that needs significantly more funding for it to be better understood and developed so it can become a commercial Read more at: https://oilprice.com/Alternative-Energy/Geothermal-Energy/Why-Arent-Investors-Interested-In-Geothermal-Energy.html |

|

Volkswagen Chief: Ukraine War Could Be Worse Than COVID For EuropeVolkswagen CEO Herbert Diess told the FT in an interview published Thursday that a prolonged war in Ukraine would be “very risky” for the European and German economies – and that it ultimately might be even worse for them than COVID. According to the FT, Diess said the economic damage from the war could be “very much worse” than the pandemic. “The interruption to global supply chains could lead to huge price increases, scarcity of energy and inflation,” Herbert Diess, chief executive of the German carmaker, told the Financial Times. “It could be Read more at: https://oilprice.com/Latest-Energy-News/World-News/Volkswagen-Chief-Ukraine-War-Could-Be-Worse-Than-COVID-For-Europe.html |

|

The End Of The Global Economy As We Know ItAt the beginning of nearly every war, including the current one in Ukraine, there are those who loudly declare that it will be over shortly and then business-as-usual can resume. They are rarely right. While no one can say for certain what the trajectory of the Russian-Ukrainian conflict will be, the economic warfare that is going on alongside it is very likely to destroy the current global trading system. The last time a worldwide trading system was destroyed was just over a century ago. From the late 1800s up to the eve of World War I the dominance Read more at: https://oilprice.com/Energy/Energy-General/The-End-Of-The-Global-Economy-As-We-Know-It.html |

|

Is A U.S. Oil Export Ban The Stupidest Thing You Could Ever Imagine?The idea to restrict or ban exports of U.S. crude oil and liquefied natural gas (LNG) is the stupidest thing, ConocoPhillips chief executive officer Ryan Lance said this week as international crude prices and U.S. gasoline prices soar amid the energy market turmoil over Russias invasion of Ukraine. Well, Id say its probably the stupidest thing you could ever imagine, the top executive of ConocoPhillips said at the CERAWeek by S&P Global energy conference in Houston on Tuesday, as carried by Natural Read more at: https://oilprice.com/Latest-Energy-News/World-News/Is-A-US-Oil-Export-Ban-The-Stupidest-Thing-You-Could-Ever-Imagine.html |

|

Major League Soccer reaches a deal to support Black banks, aiming to help close the racial wealth gapThe interest and fees will be paid in advance creating what’s called Tier 1 capital, almost immediately allowing the Black banks to offer more loans. Read more at: https://www.cnbc.com/2022/03/10/major-league-soccer-reaches-a-deal-to-support-black-banks-aiming-to-help-close-the-racial-wealth-gap.html |

|

MLB owners and players reach tentative labor deal, clearing the way for start to spring trainingBaseball is back. MLB owners and players have reached a tentative deal on a new labor pact. Read more at: https://www.cnbc.com/2022/03/10/mlb-owners-and-players-reach-tentative-labor-deal-reports-say-clearing-the-way-for-start-to-spring-training.html |

|

Stocks making the biggest moves midday: Amazon, CrowdStrike, Micron and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/03/10/stocks-making-the-biggest-moves-midday-amazon-crowdstrike-micron-and-more-.html |

|

BMW says 2021 profit surged as it favored higher-margin vehicles during chip shortageIn a preview of its full-year results, BMW said that it generated record revenue and profit in 2021 despite higher spending. Read more at: https://www.cnbc.com/2022/03/10/bmw-says-2021-profit-surged-as-it-favored-higher-margin-vehicles-during-chip-shortage.html |

|

Hypersonic aircraft start-up Hermeus raises $100 million to finish prototype, build out fleetHypersonic aircraft startup Hermeus announced a $100 million round of funding that it says will help complete development of its first prototype aircraft. Read more at: https://www.cnbc.com/2022/03/10/hypersonic-aircraft-startup-hermeus-raises-100-million.html |

|

Burger King halts corporate support for its 800-plus franchised locations in RussiaBurger King’s announcement comes after several other U.S. fast-food chains — including rival McDonald’s — suspended business in Russia. Read more at: https://www.cnbc.com/2022/03/10/burger-king-halts-corporate-support-for-its-800-plus-franchised-locations-in-russia.html |

|

Russia will recover with a ‘full bill of health,’ says Lavrov, vowing to cut ties with the WestRussia’s foreign minister on Thursday struck a defiant tone in the face of intensifying sanctions, saying his country would recover with a full bill of health. Read more at: https://www.cnbc.com/2022/03/10/lavrov-russia-to-emerge-with-full-bill-of-health-downplays-sanctions.html |

|

U.S. extends airplane mask mandate through April 18The U.S. is extending a requirement that masks are worn on planes, trains and other forms of transportation until the middle of next month. Read more at: https://www.cnbc.com/2022/03/10/us-extends-airplane-mask-mandate-through-april-18.html |

|

Retirees likely shielded from inflation hit on these expenses, report findsAnnual inflation rose by 7.9% in February, but some retirees may not feel the brunt of certain rising costs, according to a J.P. Morgan report. Read more at: https://www.cnbc.com/2022/03/10/inflation-isnt-likely-to-crush-retirees-for-these-expenses-report-finds.html |

|

United Airlines will let unvaccinated employees return to their jobs this monthUnited in August established the industry’s strictest Covid vaccine mandate. Read more at: https://www.cnbc.com/2022/03/10/united-airlines-unvaccinated-workers-can-return-to-their-jobs.html |

|

Rising airfares are giving people spring break sticker shockAccording to travel app Hopper, the average price of a domestic round-trip ticket has surged 26% over the last year to $290. Read more at: https://www.cnbc.com/2022/03/10/rising-airfares-are-giving-people-spring-break-sticker-shock.html |

|

Deutsche Bank defends decision not to exit Russia: It’s not ‘practical’ right nowSpeaking to CNBC, the bank’s CFO said the decision hinged on its duty of care to clients that still operate in the country. Read more at: https://www.cnbc.com/2022/03/10/deutsche-bank-says-not-practical-to-exit-russia-business.html |

|

Chinese EV maker Nio completes fast-path Hong Kong stock debut without raising new fundsNio joins other U.S.-listed Chinese companies with a secondary listing in Hong Kong Read more at: https://www.cnbc.com/2022/03/10/nio-completes-hong-kong-stock-debut-without-raising-new-capital.html |

|

DeSantis: “There Is No Place In Florida For COVID Theater”DeSantis: “There Is No Place In Florida For COVID Theater”Authored by Steve Watson via Summit News, Florida Governor Ron DeSantis announced that all COVID restrictions have come to an end in the State Wednesday with a video post on social media captioned “There is no place in Florida for COVID theater.”

The footage was taken from a panel talk from earlier in the week with Florida Surgeon General Dr. Joseph Ladapo and other medical experts advocating ‘closing the curtain’ on COVID restrictions (see what he did there?) “These experts agree – no masking, no mandates and no medical censorship,” DeSantis also noted. “Over the past two years, the data has shown us what works and what doesn’t work. It is long past time to stop the COVID Theater,” DeSantis asserted, adding “In Florida, we told the truth, we let the data drive our response, and we let Floridians make decisions for themselves and their children.” … Read more at: https://www.zerohedge.com/covid-19/desantis-there-no-place-florida-covid-theater |

|

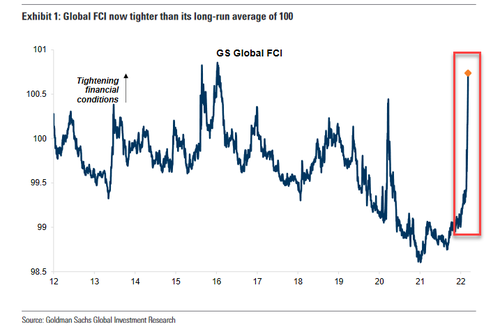

Bonds, Stocks, & Crypto Crumble As Global Financial Conditions Tighten DrasticallyBonds, Stocks, & Crypto Crumble As Global Financial Conditions Tighten DrasticallyThe invasion of Ukraine and the events that have unfolded since have changed the outlook materially. A surge in energy prices has triggered a sharp downward revision in growth expectations and has increased the uncertainty over the growth path from here, particularly in Europe, and Goldman notes, has resulted in a shift in the narrative away from reflation towards stagflation. While US equities have been more defensive in this episode, global financial conditions have now tightened materially…

Which brings us to the question of “why hike?” that we asked and answered earlier in the week. While the global picture is extremely tight, Goldman’s US financial conditions index – while notably tighter than it was – remains easier than at any other time in decades apart from 2020/2021 (which may help explain the 40 year high print in CPI today, because u … Read more at: https://www.zerohedge.com/markets/stocks-bonds-crypto-crumble-global-financial-conditions-tighten-drastically |

|

Tesla Increases Vehicle Prices As Nickel Squeeze Sparks ChaosTesla Increases Vehicle Prices As Nickel Squeeze Sparks ChaosElectrek reports Tesla, Inc. increased the price for Model 3 and Model Y this week after nickel prices skyrocketed in the most epic short squeeze in history. Before we dive into Tesla pricing, it’s important to understand that “Nickel is the single biggest component in terms of cost” for an electric vehicle, said Sam Abuelsamid, principal research analyst at Guidehouse Insights.

In the last few weeks, nickel trading on the London Metal Exchange (LME) soared over disruption from key supplier Russia after the invasion of Ukraine. The jump in nickel eventually led to a violent short covering that sent prices more than doubled to over $100,000 per ton earlier this week. The LME said it suspended trading of the metal on Tuesday because of extreme volatility. Nickel is a critical ingredient in lithium-ion battery cells. At Monday’s closing price of $48,000, a 100-kilowatt-hour battery (which has about 145 pounds of nickel) would require about $3,100 worth of nickel, which is more than double last year’s average cost. At $100,000, the nickel price for the battery would be about $6,200. Last year, nickel prices for a battery cost $1,200 on average. Automakers have long-term supply contracts to avoid surging prices, but if higher prices persist … Read more at: https://www.zerohedge.com/commodities/tesla-increases-vehicle-prices-nickel-squeeze-creates-chaos |

|

FDA Rejects Non-mRNA COVID-19 Vaccine For Children: CompanyFDA Rejects Non-mRNA COVID-19 Vaccine For Children: CompanyAuthored by Jack Phillips via The Epoch Times (emphasis ours), Ocugen said the U.S. Food and Drug Administration (FDA) declined to issue an emergency use authorization for Covaxin, the COVID-19 vaccine developed by its Indian partner Bharat Biotech, for children.

Read more at: https://www.zerohedge.com/covid-19/fda-rejects-non-mrna-covid-19-vaccine-children-company |

|

Russia hits back at Western sanctions with export bansRussia will halt exports of some types of timber and other goods until the end of 2022. Read more at: https://www.bbc.co.uk/news/business-60689279?at_medium=RSS&at_campaign=KARANGA |

|

Goldman Sachs and Western Union pull out of RussiaThe Wall Street bank and the money transfer giant pull out of Russia after its invasion of Ukraine. Read more at: https://www.bbc.co.uk/news/business-60691688?at_medium=RSS&at_campaign=KARANGA |

|

Rising fuel and food costs push US inflation to 7.9%The cost of living in the US is rising more rapidly than it has in 40 years, latest figures show. Read more at: https://www.bbc.co.uk/news/business-60696125?at_medium=RSS&at_campaign=KARANGA |

|

Silver Lining: Why Hindalco & JSPL will gain from war-hit supply chainRight now, everything is lending support to higher aluminium prices. Energy is a wild card though. With the peak winter season behind, EU gas storage levels are now finally within the 5-year range but geopolitics may still support elevated prices. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/how-indian-metal-companies-stand-to-benefit-from-global-supply-disruptions-due-to-war/articleshow/90127582.cms |

|

Can Yogi’s victory in UP election make Dalal Street investors look beyond Ukraine?Mahesh Nandurkar of Jefferies said the impact of election results are not really long-lasting for the market, especially at the state level. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/bjp-leading-in-4-out-of-5-states-is-it-enough-to-keep-bulls-in-driving-seat/articleshow/90123061.cms |

|

Sensex can hit 75,000 in just 9 months! Morgan Stanley lists 5 triggersDespite near term margin pressure due to rising raw material costs, Morgan Stanley analysts believe the new profit cycle is intact, and they expect earnings to compound at 22 per cent annually (24 per cent previously) over the coming two years. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sensex-can-hit-75000-in-just-9-months-morgan-stanley-lists-5-triggers/articleshow/90121687.cms |

|

The Moneyist: ‘I’m considered “less than” simply because I’m a woman’: I’m an unmarried stay-at-home mother in a 20-year relationship, but my partner won’t put me on our house deed. Am I unreasonable?‘To me, not being on the deed is a direct correlation to how I am devalued for my time and labor.’ Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7A79-B7945788D750%7D&siteid=rss&rss=1 |

|

Earnings Results: Oracle stock drops after earnings fall short of Wall Street’s forecastOracle Corp. shares fell in the extended session Thursday after the database-software company’s earnings missed Wall Street estimates. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7A7E-19AAFB6D2C1F%7D&siteid=rss&rss=1 |

|

Market Extra: Goodbye Libor? House spending bill offers a patch for $16 trillion debt backlog mired by the rateThe $1.5 trillion spending bill passed by the House to avert a government shutdown includes a patch for Wall Street and consumers to transition away from the scandal-plagued Libor benchmark. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7A7B-7BE85208C1D9%7D&siteid=rss&rss=1 |

A file photo shows a worker preparing a COVID-19 vaccine. (Liam McBurney/PA Media)The biopharmaceutical company said it intends to continue working with the FDA to evaluate the process for getting an emergency use authorization for pediatric use of Covaxin, it said in a March …

A file photo shows a worker preparing a COVID-19 vaccine. (Liam McBurney/PA Media)The biopharmaceutical company said it intends to continue working with the FDA to evaluate the process for getting an emergency use authorization for pediatric use of Covaxin, it said in a March …