Headlines:

Only OPEC Can Help The West Replace Russian Oil

Oil Prices Crash By 11% As UAE Calls On OPEC To Open The Taps

U.S. Oil & Gas Association President: Cut The Crap And Approve Our Permits

Here’s What Happens To Russian Oligarch Yachts After They’re Seized

Bonds, Bullion, & Black Gold, Dumped As ‘Hope-Hammered-Hedges’ Squeeze Stocks Higher

Another day, another hedge unwind-driven, negative-delta inspired melt-up in stocks, triggered this time by optimistic headlines (that were just ‘meh’ of the same sentiment) on the Ukraine situation.

Stocks soared the most since April 2020 today (2 days after the 2nd biggest daily drop since Oct 2020). Nasdaq soared almost 4% today while The Dow ‘lagged’ with a mere gain of 2.5% before some last-minute selling pressure spoiled the big day (taking The Dow back below yesterday’s roller-coaster highs).

READ EARLIER:

Higher crude prices will have a direct impact on Americans. Less oil supply? Higher oil prices? Higher gas prices. And higher gas prices are certainly upon us: The average price per gallon in the U.S. hit a record of $4.17 yesterday (up 55 cents in a week), and it’s likely to surge even more before it gets better. Biden admitted that the decision “is not without costs here at home,” he said.

Europe’s inability to ban Russian oil and gas has been a come-to-Jesus moment that it needs to wean itself off its Russian energy addiction. Yesterday, the E.U. drew up a goal to completely stop buying Russian fossil fuels by 2030.

The U.S. rejected a surprise announcement by Poland to hand over its MiG-29 fighter jets for Ukraine to use, saying the plan could potentially spark a broader conflict with Russia.

As usual, we have included below the headlines and news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Only OPEC Can Help The West Replace Russian OilLast week, oil and commodity markets recorded their biggest weekly gains in years as shuttering of Ukrainian ports, sanctions against Russia, and disruption in Libyan oil production sent energy, crop, and metal buyers scrambling for replacement supplies. Crude prices have spiked again this week on fears that the U.S. and its allies were seriously mulling a ban on Russian oil and gas. Well, the Russian boogeyman has not been imaginary, after all: on Tuesday, President Biden imposed an immediate ban on Russian energy imports while the United Read more at: https://oilprice.com/Energy/Crude-Oil/Only-OPEC-Can-Help-The-West-Replace-Russian-Oil.html |

|

The Geopolitical Backdrop Of Russias Invasion Of UkraineAfter months of military build-up on the Ukrainian border, tensions between Russia and the West exploded in late February 2022 when Russia invaded Ukraine, a move that has resulted in a catastrophic war. This war has sent a message that will echo across the Western political apparatus and put NATOs military forces on high alert for years to come and it is now more important than ever to understand how we got here. Following the end of the Cold War, the remnants of the Soviet Union saw the Western Union of nations embolden by the Read more at: https://oilprice.com/Energy/Energy-General/The-Geopolitical-Backdrop-Of-Russias-Invasion-Of-Ukraine.html |

|

German Advisors Rule Out Extending Nuclear Plant Lifespan To Combat Energy FearsThe flip flopping in Germany over nuclear power continues, with Germanys economy and environment ministries now reverting back to their old tune of advising against extending the life of three existing nuclear power plants in the country. The ministries had “examined if and how extending the life of the power plants in question would contribute to easing Germanys reliance on Russian energy imports following Russias invasion of Ukraine,” Bloomberg wrote in a Tuesday morning wrap-up. After considering whether or not Read more at: https://oilprice.com/Latest-Energy-News/World-News/German-Advisors-Rule-Out-Extending-Nuclear-Plant-Lifespan-To-Combat-Energy-Fears.html |

|

U.S. Oil & Gas Association President: Cut The Crap And Approve Our PermitsOn March 8, while President Joe Biden announced a ban on Russian oil and gas imports, regular gasoline at one BP gas station on Chicagos South Side was nearly $5 a gallon. $25 is only giving you half a tank, Dacia, a customer who was buying a few dollars of fuel, told The Epoch Times. I probably have to go to Indiana to find somewhere else cheaper. People dont really have that much money. On March 7, average national gas prices had shattered the record set in 2008, reaching a new high of $4.104, according Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Gas-Association-President-Cut-The-Crap-And-Approve-Our-Permits.html |

|

California County Rejects Exxons Plan To Restart Oil WellsThe Santa Barbara County in California rejected this week a proposal from ExxonMobil to transport oil via tanker trucks that would have been a step toward restarting three oil platforms offshore Santa Barbara in federal waters. The pipeline owned by Plains All American Pipeline, which used to transport oil from the three platforms ruptured in 2015, causing a major spill and forcing ExxonMobil to suspend production from the three platforms. As an interim solution, the U.S. supermajor applied in 2017 for an interim trucking permit from Santa Read more at: https://oilprice.com/Latest-Energy-News/World-News/California-County-Rejects-Exxons-Plan-To-Restart-Oil-Wells.html |

|

Oil Prices Crash By 11% As UAE Calls On OPEC To Open The TapsIn a complete oil industry turnaround, The UAEs ambassador to Washington has said in a statement to the press that they favour production increases and will be encouraging Opec to consider higher production levels. Yousef al-Otaibas statement, carried by the FT, comes as both the UAE and Saudi Arabiatwo of the very few, if not the only, OPEC members that are believed to have spare capacityhave ducked calls from President Joe Biden to discuss the crisis that is brewing the oil markets after Russia invaded Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Prices-Crash-By-11-As-UAE-Calls-On-OPEC-To-Open-The-Taps.html |

|

Gas prices are spiking — don’t expect sales of electric vehicles to followSupply chain problems, pent-up demand and record-low vehicle inventory levels mean many new cars and trucks, including EVs, are already spoken for before they reach dealers lots. Read more at: https://www.cnbc.com/2022/03/09/gas-prices-are-spiking-dont-expect-sales-of-electric-vehicles-to-follow.html |

|

Impossible Foods sues start-up Motif FoodWorks for patent infringementImpossible Foods is suing Motif FoodWorks for patent infringement, claiming that the start-up’s beef alternative that uses heme too closely imitates its own version. Read more at: https://www.cnbc.com/2022/03/09/impossible-foods-sues-start-up-motif-foodworks-for-patent-infringement.html |

|

Biden restores California’s ability to impose stricter auto pollution limitsThe decision reinstates a Clean Air Act waiver that allows California to adopt stronger fuel economy standards than those of the federal government. Read more at: https://www.cnbc.com/2022/03/09/biden-restores-california-ability-to-set-its-own-auto-pollution-rules.html |

|

Disney CEO says company opposes ‘Don’t Say Gay’ bill in Florida, will meet with Gov. DeSantisThe Walt Disney Company is now publicly opposing Florida’s controversial “Don’t Say Gay” bill. Read more at: https://www.cnbc.com/2022/03/09/disney-ceo-says-company-opposes-dont-say-gay-law-in-florida.html |

|

Volkswagen unveils new electric ID. Buzz as 21st-century descendent of iconic hippie microbusVW is resurrecting its iconic microbus — the quintessential van associated with hippie counterculture of the 1960s — as an all-electric van called the ID. Buzz. Read more at: https://www.cnbc.com/2022/03/09/volkswagen-unveils-new-electric-id-buzz-microbus.html |

|

Stocks making the biggest moves midday: Amazon, Netflix, Bumble and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/03/09/stocks-making-the-biggest-moves-midday-amazon-netflix-bumble-and-more.html |

|

Here’s what happens to Russian oligarch yachts after they’re seizedEuropean governments that seized the yachts and villas of Russian oligarchs now face a more difficult question: What to do with them? Read more at: https://www.cnbc.com/2022/03/09/russian-oligarch-yachts-this-is-what-happens-after-theyre-seized-.html |

|

Macy’s CFO says the American consumer is still healthy, but lower-income shoppers could soon cut back“We’re seeing oil prices escalate, which will only elevate the expenses around essential goods,” said Macy’s CFO Adrian Mitchell. Read more at: https://www.cnbc.com/2022/03/09/macys-cfo-american-consumer-still-healthy-but-lower-income-shoppers-at-risk.html |

|

Here’s how urban and rural Americans build wealth differentlyThere are key differences between rural and urban Americans when it comes to building wealth. Here’s how it may affect retirement. Read more at: https://www.cnbc.com/2022/03/09/heres-how-urban-and-rural-americans-build-wealth-differently.html |

|

McDonald’s says Russian shutdown will cost the fast-food chain $50 million a monthMcDonald’s expects that its Russian shutdown will cost the fast-food giant roughly $50 million a month. Read more at: https://www.cnbc.com/2022/03/09/mcdonalds-russian-shutdown-will-cost-fast-food-chain-50-million-a-month.html |

|

5 things to know before the stock market opens WednesdayDow futures soared Wednesday as U.S. oil prices were breaking a three-day run to the upside. Read more at: https://www.cnbc.com/2022/03/09/5-things-to-know-before-the-stock-market-opens-wednesday-march-9.html |

|

Britain impounds private jet with suspected links to Russian oligarch amid new aviation sanctionsThe U.K. on Wednesday impounded a private jet connected to Russian oligarch Roman Abramovich under new aviation sanctions levied at the pariah state. Read more at: https://www.cnbc.com/2022/03/09/britain-impounds-private-jet-with-suspected-links-to-russian-oligarch.html |

|

Greenwald Slays ‘Fact Checkers’ After Nuland’s Ukraine Biolab BombshellGreenwald Slays ‘Fact Checkers’ After Nuland’s Ukraine Biolab BombshellAuthored by Glenn Greenwald via greenwald.substack.com, Self-anointed “fact-checkers” in the U.S. corporate press have spent two weeks mocking as disinformation and a false conspiracy theory the claim that Ukraine has biological weapons labs, either alone or with U.S. support. They never presented any evidence for their ruling — how could they possibly know? and how could they prove the negative? — but nonetheless they invoked their characteristically authoritative, above-it-all tone of self-assurance and self-arrogated right to decree the truth and label such claims false. Read more at: https://www.zerohedge.com/political/greenwald-slays-fact-checkers-after-nulands-ukraine-biolab-bombshell |

|

Bonds, Bullion, & Black Gold Dumped As ‘Hope-Hammered-Hedges’ Squeeze Stocks HigherBonds, Bullion, & Black Gold Dumped As ‘Hope-Hammered-Hedges’ Squeeze Stocks HigherAnother day, another hedge unwind-driven, negative-delta inspired meltup in stocks, triggered this time by optimistic headlines (that were really just ‘meh’ of the same sentiment) on the Ukraine situation.

Stocks soared the most since April 2020 today (2 days after the 2nd biggest daily drop since Oct 2020). Nasdaq soared almost 4% today while The Dow ‘lagged’ with a mere gain of 2.5% before some last minute selling pressure spoiled the big day (taking The Dow back below yesterday’s roller-coaster highs)…

As a reminder, until yesterday this was the second worst start to a year for stocks since 1900 (with 2009 just worse)… Read more at: https://www.zerohedge.com/markets/bonds-bullion-black-gold-dumped-hope-hammered-hedges-squeeze-stocks-higher |

|

Uranium Stocks Soar After US Said To Weigh Sanctions On Russian Nuclear Giant RosatomUranium Stocks Soar After US Said To Weigh Sanctions On Russian Nuclear Giant RosatomEarlier today we asked if Putin would voluntarily put Russian enriched uranium exports on the list of banned Russian exports, in the process sending the stocks of uranium producers sharply higher (as Russia is currently 40%-45% of the world’s enriched Uranium supply). Well, moments ago Joe Biden may have made that decision for him. According to Bloomberg, the Biden administration is considering imposing sanctions on Russia’s state-owned atomic energy company, Rosatom – a major supplier of fuel and technology to power plants around the world – although no final decision has been made and the White House is consulting with the nuclear power industry about the potential impact. Rosatom is described as “delicate target” because the company and its subsidiaries account for about 35% of global uranium enrichment and has agreements to ship the nuclear fuel to countries across Europe, which means any sanctions risk plunging Europe in darkness. Thus, any punishment would also have to exempt the work Rosatom does with Iran under the terms of the deal limiting the country’s nuclear program, which Biden is seeking to revive. In other words, if Rosatom is sanctioned, it likely means that the Iran nuclear deal – which is mediated by Russians – is dead, and oil prices will soar even higher. It’s also unclear what the sanctions would mean for U.S. nuclear plants and importers of fuel. Russia accounted for 16.5% of the uranium imported into the U.S. in 2020 and 23% of the … Read more at: https://www.zerohedge.com/markets/uranium-producers-soar-after-us-said-weigh-sanctions-russian-nuclear-giant-rosatom |

|

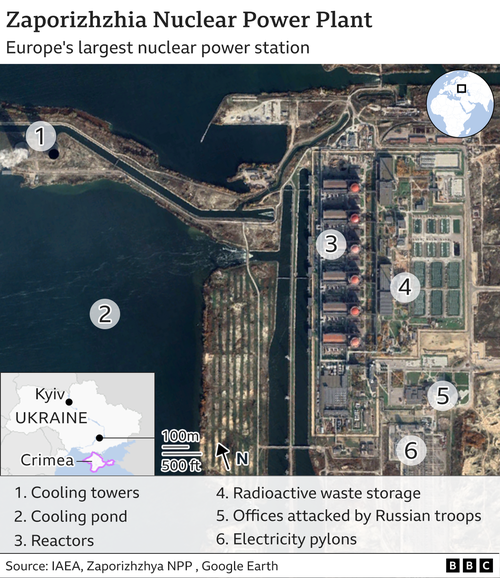

Data From Ukraine’s Largest Nuclear Power Plant Goes Offline, IAEA ReportsData From Ukraine’s Largest Nuclear Power Plant Goes Offline, IAEA ReportsUpdate (1536ET): Nuclear risks in Ukraine continue to mount Wednesday after another nuclear power plant has experienced issues. The International Atomic Energy Agency (IAEA) reports it has lost remote data transmission from its safeguards systems at Zaporizhzhia Nuclear Power Station in southeastern Ukraine.

On Sunday, IAEA said Russian forces seized Zaporizhzhia. It’s important to note that the power plant is the largest in Europe.

The deteriorating situation in the war-torn country regarding nuclear power plants is concerning. Earlier, IAEA reported Chornobyl Nuclear Power Plant … Read more at: https://www.zerohedge.com/geopolitical/ukraine-informs-iaea-chornobyl-nuclear-power-plant-lost-power |

|

Ukraine war: Cost of filling diesel family car hits record £90Diesel prices see their biggest daily jump in two decades as household budgets squeezed by rising energy costs. Read more at: https://www.bbc.co.uk/news/business-60670120?at_medium=RSS&at_campaign=KARANGA |

|

Jack Monroe says families need urgent help with rising billsPrice rises due to the Ukraine war will hit low income families hardest, Jack Monroe tells MPs. Read more at: https://www.bbc.co.uk/news/business-60674768?at_medium=RSS&at_campaign=KARANGA |

|

Will the US crack down on cryptocurrency?The US is eyeing new rules for cryptocurrencies as concerns rise about the fast-growing industry. Read more at: https://www.bbc.co.uk/news/business-60680786?at_medium=RSS&at_campaign=KARANGA |

|

How bad is the surge in crude oil for India? Let’s do some mathIn case oil prices trade above $100 for a few weeks and revert back below pre-conflict levels of $90, India will have minimal impact. If oil stays above $100 or say $120 for even 3 months or more, India’s external situation will deteriorate. Read more at: https://economictimes.indiatimes.com/markets/commodities/views/how-bad-is-the-surge-in-crude-oil-for-india-lets-do-some-maths/articleshow/90094105.cms |

|

Day Trading Guide: 2 stock recommendations for ThursdayThe appearance of multiple bullish candles ensures an immediate floor near 16,000, however, markets will continue to remain volatile due to global uncertainty and the domestic event of states election outcome due tomorrow. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/day-trading-guide-2-stock-recommendations-for-thursday/articleshow/90100964.cms |

|

Trade setup: Market likely to stay in defined range with bullish undertoneThe levels of 16,435 and 16,490 are likely to act as immediate resistance points for Nifty. The supports come in at 16,280 and 16,175 levels. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/trade-setup-market-likely-to-stay-in-defined-range-with-bullish-undertone/articleshow/90105850.cms |

|

Key Words: Kim Kardashian says she has the ‘best’ advice for women in business: Get your ass up and workSoledad O’Brien, other working women say being born rich gave the Kardashians a head start Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7A6E-E5E5B0C36A3F%7D&siteid=rss&rss=1 |

|

Earnings Results: Asana stock falls 15% after loss more than doubles, forecast calls for more red inkAsana Inc. shares retreated in late trading Wednesday, after the company reported that losses doubled from a year ago and predicted more red ink in the new year. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7A6F-5A6D7C318EF2%7D&siteid=rss&rss=1 |

|

Earnings Results: CrowdStrike stock surges 15% after results, outlook exceed Wall Street expectationsCrowdStrike Holdings Inc. shares surged in the extended session Wednesday after the cybersecurity company’s quarterly results and outlook exceeded Wall Street expectations on all fronts. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7A68-45975CEE22AD%7D&siteid=rss&rss=1 |