Headlines:

Russia Struggles To Sell Its Oil After Ukraine Invasion

Ahead of State of the Union address, President Biden’s approval with Main Street is underwater

Stocks Slammed As Bonds, Bitcoin, Bullion, & Black Gold Soar

Ship Carrying 4,000 Luxury Cars Sinks Off The Azores (Is Your Bentley One Of Them?)

The DOW drops like a rock as the Ukraine-Russia invasion intensifies, WTI oil prices spikes 11% to $106 a barrel, a 7-year high. The U.S. buys 650K barrels a day from Russia, if you were unaware. Where are the sanctions on Russian Crude?

Senator Lindsey Graham (R-SC) – said, “what good are sanctions when you’ve put us in a position where we’re forced to stuff their coffers buying 650,000 barrels a day at $100 each?…doh! It’s ridiculous. Totally ridiculous.”

USD moved higher, pausing at a resistance of 96.77 then slipping to 97.43. Gold high yesterday was 1942, but steady today in the 1940 range – silver down from 25.54 to 25.32.

Red volume yesterday was fractionally and higher than average. Today it is fractionally lower.

Bitcoin is down from a high of 44100 to 43900 – Bitcoin (BTC-USD) is up 14%. As the ruble plunges to less than a penny, dealings surge in Ukraine and Russian currency for bitcoin and stablecoins.

As usual, we have included below the headlines and news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Can Europe Replenish Its Depleting Gas Inventories?Europe may have trouble replenishing its natural gas storage facilities by next winter as storage levels are at decade lows. Russia, which supplies one-third of Europe’s natgas needs, has said delivery of gas through vast networks of pipelines will continue. On Monday, Russia’s gas producer Gazprom published a statement warning there will be “serious challenges” in replenishing European gas storage facilities for next winter considering “such significant gas volumes” are needed and never has this happened ahead of the summer months. Read more at: https://oilprice.com/Energy/Natural-Gas/Can-Europe-Replenish-Its-Depleting-Gas-Inventories.html |

|

Russia Struggles To Sell Its Oil After Ukraine InvasionOil traders are staying away from Russian crude after the Western countries banned selected Russian banks from SWIFT, and Russian producers cant sell their cargoes in tenders because no one is bidding. After the Russian invasion of Ukraine, Russian cargoes have become toxic for most of the traders, insurers, and tanker owners, although the sanctions do not target energy exports. Some refiners and traders are uncertain how the bank credits would work; others are staying away to avoid reputational damage. The global oil market is starting Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Struggles-To-Sell-Its-Oil-After-Ukraine-Invasion.html |

|

EU Slaps Sanctions On Russian Steel MagnatesContinuing our coverage of the Russian invasion of Ukraine and its impact on steel prices, aluminum prices and more, the European Union has brought sanctions against two Russian metals magnates on Feb. 28. The move comes on the heels of Russias invasion last week of Ukraine. EU sanctions Russian steel magnates Alisher Usmanov, a majority shareholder in steelmaking and mining group Metalloinvest via his USM holdings vehicle, as well as Severstal chairman Alexei Mordashov, will both face travel restrictions and have their assets frozen in Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Slaps-Sanctions-On-Russian-Steel-Magnates.html |

|

The Impossible Task Of Keeping Oil Prices GroundedRussias invasion of Ukraine and the resultant sanctions have sent oil prices soaring and not even a 60-million-barrel release coordinated by IEA members could stop the rally.Chart of the Week- UK-based oil major BP (NYSE:BP) became the first company to quit its Russian operations, abandoning its 19.75% stake-controlled Rosneft at a cost of some $25 billion, coming on the back of Russias intensifying invasion of Ukraine.- This was followed by several sovereign wealth funds, prime amongst them the Norwegian one with $2.8 billion Read more at: https://oilprice.com/Energy/Energy-General/The-Impossible-Task-Of-Keeping-Oil-Prices-Grounded.html |

|

SWIFT Ban Hits Russian Coal Exports To ChinaChinese buyers of coal are having trouble securing financing to buy coal from Russia, the worlds third-largest coal exporter, as Chinas banks are wary of sanctions themselves after selected Russian banks were expelled from the SWIFT banking system. Most banks have stopped issuing letters of credit after the SWIFT sanctions. As almost all contracts are dollar-denominated, we have no other way to make the payment, a trader dealing in Russian coal and based in China told Reuters on Tuesday. Despite the fact that Russias Read more at: https://oilprice.com/Latest-Energy-News/World-News/SWIFT-Ban-Hits-Russian-Coal-Exports-To-China.html |

|

OPEC+ Is Unlikely To Break From Its Production PlanOPEC+ is widely expected to continue raising its overall production quota by 400,000 barrels per day (bpd) per the plan from last summer, despite the surging oil prices over the Russian invasion of Ukraine, a Bloomberg survey of 18 analysts and traders showed on Tuesday. The OPEC+ groupled by Saudi Arabia and Russiais meeting on Wednesday to discuss production for the month of April, while oil prices have jumped to over $100 per barrel and the market is apprehensive that it could soon have to go without at least some Russian barrels. Read more at: https://oilprice.com/Energy/Crude-Oil/OPEC-Is-Unlikely-To-Break-From-Its-Production-Plan.html |

|

Nordstrom stock spikes 35% as retailer makes key strides in its off-price Rack business, issues strong guidanceNordstrom reported better-than-expected profits and sales for the holiday quarter, prompting the retailer to offer an optimistic outlook for the coming year. Read more at: https://www.cnbc.com/2022/03/01/nordstrom-jwn-reports-q4-2021-earnings.html |

|

NASA’s massive moon rocket will cost taxpayers billions more than projected, auditor warns CongressThe cost per mission of NASA’s lunar program Artemis has climbed to more than $4 billion, the agency’s auditor told Congress. Read more at: https://www.cnbc.com/2022/03/01/nasa-auditor-warns-congress-artemis-missions-sls-rocket-billions-over-budget.html |

|

Investing Club: One of our top stocks dropped into our buy zone and we scooped up more sharesTuesday’s rough market has brought shares of this entertainment giant back down to where we said we would be buyers. Read more at: https://www.cnbc.com/2022/03/01/investing-club-one-of-our-top-stocks-dropped-into-our-buy-zone-and-we-scooped-up-more-share.html |

|

Ahead of State of the Union address, President Biden’s approval with Main Street is underwaterPresident Biden is expected to highlight economic strength but also discuss inflation in his State of the Union address. Main Street will be listening. Read more at: https://www.cnbc.com/2022/03/01/where-main-street-stands-on-the-state-of-economy-and-president-biden.html |

|

GM sells its stake in embattled EV start-up Lordstown MotorsGM’s stake in Lordstown Motors was less than 5%. The sale came in the fourth quarter after an undisclosed lockup period. Read more at: https://www.cnbc.com/2022/03/01/gm-sells-its-stake-in-embattled-ev-start-up-lordstown-motors.html |

|

Single vs. head of household: How it affects your tax returnIf you’re confusing the single and head of household filing statuses, you may be leaving tax breaks on the table. Here’s what to know for your 2021 return. Read more at: https://www.cnbc.com/2022/03/01/single-vs-head-of-household-how-it-affects-your-tax-return.html |

|

Stocks making the biggest moves midday: Target, Kroger, Foot Locker and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/03/01/stocks-making-the-biggest-moves-midday-target-kroger-foot-locker-and-more.html |

|

Russian-backed investment fund tied to influential U.S. corporate consulting firm TeneoA private equity fund backed by Russian oligarchs, who have been sanctioned by the European Union, has ties to a powerful U.S. consulting firm. Read more at: https://www.cnbc.com/2022/03/01/russian-backed-investment-fund-tied-to-influential-us-corporate-consulting-firm.html |

|

EV start-up Workhorse swings to a quarterly loss on recalls, outlines new product planWorkhorse Group expects to deliver just 250 vehicles in 2022. Read more at: https://www.cnbc.com/2022/03/01/workhorse-swings-to-quarterly-loss-on-recalls-outlines-new-product-plan.html |

|

You can watch the Netflix Marvel shows on Disney+ starting March 16Netflix’s suite of Marvel-branded television shows will arrive on Disney+ in the U.S. March 16. Read more at: https://www.cnbc.com/2022/03/01/you-can-watch-the-netflix-marvel-shows-on-disney-starting-march-16.html |

|

A new BlackRock shareholder power that may tilt proxy battles of the futureThe world’s largest money manager is making a move with this year’s shareholder meeting proxy battles that has huge implications: it’s giving votes away. Read more at: https://www.cnbc.com/2022/03/01/a-blackrock-shareholder-vote-that-may-control-future-proxy-battles.html |

|

When it comes to a will or estate plan, don’t just set it and forget itHealth issues and remarriage might prompt you to update your will, but be aware of other life changes that require a review of your estate plan, say experts. Read more at: https://www.cnbc.com/2022/03/01/when-it-comes-to-a-will-or-estate-plan-dont-just-set-it-and-forget-it.html |

|

Jeep, Dodge maker Stellantis aims to double revenue to $335 billion by 2030The automaker plans to do this while sustaining a double-digit operating profit margin as it largely moves to all-electric vehicles. Read more at: https://www.cnbc.com/2022/03/01/jeep-maker-stellantis-aims-to-double-revenue-by-2030.html |

|

The Real State Of The UnionThe Real State Of The UnionAuthored by Simon Black via SovereignMan.com, My fellow Americans. Now that my approval ratings are roughly at the same level as my blood pressure, i.e. barely detectable, and my credibility is nonexistent, I thought I might actually try being honest for a change about the real State of the Union. Just over a year ago when I took oath of office, I talked about “the common objects we love that define us as Americans. . . Opportunity. Security. Liberty. Dignity. Respect. Honor. And yes, the truth.”

So let me describe to you the State of our Union in those terms: First, opportunity. Under my leadership, inflation has reached a 40+ year high and shows no signs of abating. I’ve also demonstrated how serious I am about fighting inflation by re-appointing the very same Federal Reserve officials who created the inflation to begin with, to another four-year term. Read more at: https://www.zerohedge.com/political/real-state-union |

|

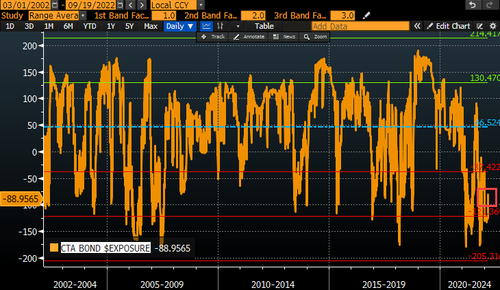

Stocks Slammed As Bonds, Bitcoin, Bullion, & Black Gold SoarStocks Slammed As Bonds, Bitcoin, Bullion, & Black Gold SoarWhile there was plenty of chaos in the world’s markets today, European sovereign bonds took the proverbial biscuit with some almost unprecedented plunges in yields.

Heading into today, Nomura had warned that with CTAs pretty much positioned 100% short across the entire G-10 bond complex, the market was ripe for a short-squeeze…

And ECB Governing Council member Olli Rehn was the spark that lit the short-squeeze tinder when he said “…given the new situation, we need to take a moment of reflection as regards the speed and way of a gradual normalization of monetary policy.” And we were off to the races Italy 10Y crashed 3 … Read more at: https://www.zerohedge.com/markets/stocks-slammed-bonds-bitcoin-bullion-black-gold-soar |

|

Tanker Rates On Russian Crude Route Soars Nine-fold In Three DaysTanker Rates On Russian Crude Route Soars Nine-fold In Three DaysLate last week, we noted something remarkable taking place in the oil tanker market: amid a general unwillingness of tanker owners to send their vessels to Russian ports, the freight rates for a medium-sized tanker to load Russian crude jumped nearly threefold overnight last Thursday. The freight rate to hire an Aframax tanker on the Baltic Sea to Europe route surged after Russia invaded Ukraine, while owners of oil tankers had already started to avoid Russian ports because of both the military invasion of Ukraine and apprehension that sanctions for oil could also come soon. Rates for oil tankers on the TD6 Black Sea-to-Med route surged more than six-fold, by $90,752/day, to $107,382/day from under $17,000, according to data from the Baltic Exchange in London. That’s the highest since April 2020. Meanwhile, Baltic Sea oil tanker rates have also soared. Ships on the TD7 Baltic-to-U.K. Cont. route rose by $13,407 to $135,148/day. This means that in under a week, rates on the TD6 route have risen more than tenfold: from Fast forward to today, when rocketing prices went orbital, and the TD17 Baltic-to-Cont U.K.oil tanker route saw costs soar by another $35k/day to $210k/day, according to the Baltic Exchange in London. That’s the highest since at least 2008. At the same time, ships on the TD6 Black Sea to Med route added $5k to $158k/day; this is a nine-fold increase from the $17,000 daily rate the route went for less than a week ago! Rates on the TD7 North Sea-Europe route added $1.7k to $78k/day Two-thirds of Russia’s crude oil exports are seaborne, from ports in the B … Read more at: https://www.zerohedge.com/markets/tanker-rates-russian-crude-route-soars-nine-fold-three-days |

|

Putin Bans Cash Exports From Russia Exceeding $10,000 In Stabilization EffortPutin Bans Cash Exports From Russia Exceeding $10,000 In Stabilization EffortRussia said Tuesday it’s not yet fully responded to the avalanche of Western and US sanctions of the last days which were triggered in the wake of the invasion of Ukraine. Foreign Ministry Spokeswoman Maria Zakharova warned that the populations of the West have not yet begun to feel what’s coming. “They (people in the West – TASS) know why they have such prices on energy sources. They know what is going on in various sectors of their economies and they understand that their leaders, who opted for this choice, have triggered corresponding processes in their own countries and must understand that,” she said during an interview with a Russian state broadcaster. “I would like to note once again: Russia has not yet imposed response measures,” she emphasized. But Russia has initiated further financial stabilization efforts amid the ratcheting economic war from the West. Confirming his statement from yesterday that we discussed as likely to prompt an immediate bid for the ‘freedom’ of crypto, Putin late in the day Tuesday (local time) issued a decree banning all cash exports of foreign currency that exceeds $10,000 in value, according to Reuters citing a Kremlin statement in Interfax. Read more at: https://www.zerohedge.com/markets/putin-bans-cash-exports-russia-exceeding-10000-stabilization-effort |

|

Russian oligarch Fridman warns sanctions will not stop warBut Mikhail Fridman avoids criticising President Putin as it could be risky for himself and staff. Read more at: https://www.bbc.co.uk/news/business-60557081?at_medium=RSS&at_campaign=KARANGA |

|

Ship carrying 4,000 luxury cars sinks off the AzoresA ship carrying thousands of luxury cars has sunk nearly two weeks after it caught fire. Read more at: https://www.bbc.co.uk/news/business-60579640?at_medium=RSS&at_campaign=KARANGA |

|

Ukraine conflict: Oil prices hit 7-year high despite emergency measuresMembers of the International Energy Agency agreed to release 60 million barrels of oil from stockpiles. Read more at: https://www.bbc.co.uk/news/business-60557077?at_medium=RSS&at_campaign=KARANGA |

|

Credit Suisse upgrades emerging markets to ‘overweight’, surpasses Europe ratingRussia, Turkey, Brazil, Malaysia, South Africa, Mexico, Korea, Thailand, Taiwan, Indonesia, China and India form its Credit Suisse’s GEM list. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/credit-suisse-upgrades-emerging-markets-to-overweight-surpasses-europe-rating/articleshow/89922189.cms |

|

Investments through P-notes decline to Rs 87,989 crore in JanuaryAccording to Securities and Exchange Board of India (Sebi) data, the value of P-note investments in Indian markets — equity, debt and hybrid securities — was at Rs 87,989 crore by the end of January compared to Rs 95,501 crore at December-end. Read more at: https://economictimes.indiatimes.com/markets/bonds/investments-through-p-notes-decline-to-rs-87989-crore-in-january/articleshow/89919439.cms |

|

Bitcoin, Shiba Inu, Ethereum rise up to 15%; Terra rallies 24%The global cryptocurrency market cap today hit the $1.9 trillion mark, after rising about 12 per cent in the last 24 hours. Total cryptocurrency trading volume jumped 34 per cent to $109.19 billion. Read more at: https://economictimes.indiatimes.com/markets/cryptocurrency/top-cryptocurrency-prices-today-bitcoin-shiba-inu-ethereum-rise-up-to-15-terra-rallies-24/articleshow/89915120.cms |

|

Earnings Results: Wish stock dives as holiday sales miss, layoffs plannedWish executives predicted a rough holiday season, but the results were even worse than expected and led to a new chief executive planning to lay off nearly 200 employees while admitting a material weakness in financial operations. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-79FA-5E1B2FB06142%7D&siteid=rss&rss=1 |

|

Market Snapshot: Dow sheds almost 600 points, U.S. stocks end sharply lower as Russia says it will begin attacks on KyivU.S. stock indexes end sharply lower Tuesday, with the Dow Jones Industrial Average posting the sharpest decline, as Russia steps up its attacks on Ukraine. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-79EC-480183DA9D75%7D&siteid=rss&rss=1 |

|

Mark Hulbert: Even after a volatile February for stocks and with markets on edge, investors aren’t yet bearish enough to spark a new rallyThe U.S. stock market’s downturn isn’t likely to reverse until more market timers throw in the towel. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-79EA-F901E0C6AA36%7D&siteid=rss&rss=1 |