Summary Of the Markets Today:

- The Dow closed up 316 points or 0.98%,

- Nasdaq closed up 1.58%,

- S&P 500 closed up 1.30%,

- Gold $1943 down $39.30,

- WTI crude oil settled at $70 up $1.86,

- 10-year U.S. Treasury 3.596% up 0.119 points,

- USD $103.22 down $0.06,

- Bitcoin $28,182 – 24H Change up $279.08 – Session Low $27,473

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

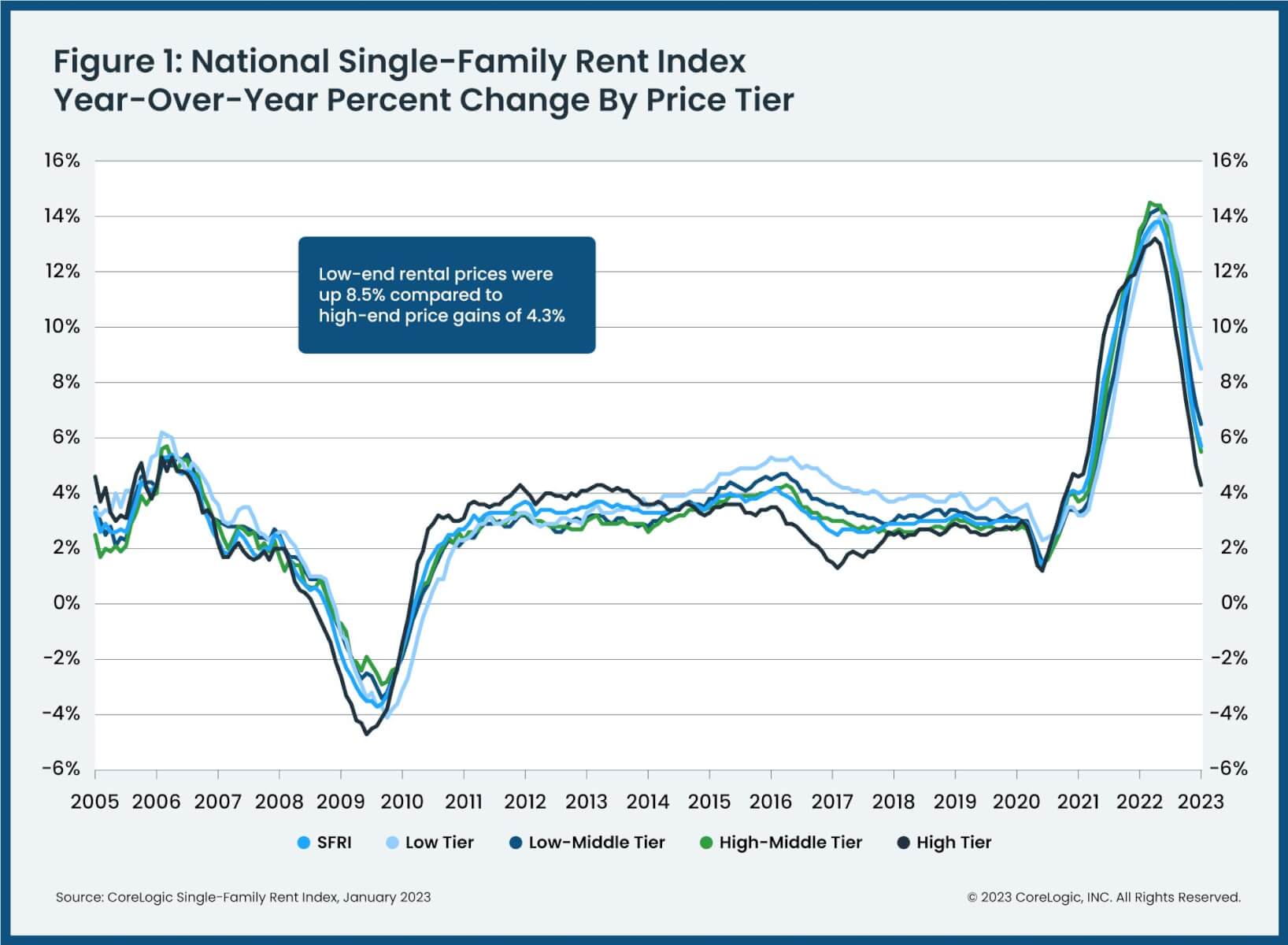

CoreLogic released its latest Single-Family Rent Index (SFRI) showing that single-family rent price growth was up by 5.7% year over year in January 2023, the lowest rate of appreciation since the spring of 2021. Orlando, Florida continued to lead the country for year-over-year rent price gains at 8.9%, but that increase has slowed significantly since the peak 25% annual growth recorded in April 2022. All 20 tracked metro areas posted single-digit annual rent price gains, with Phoenix at less than 1%.

Existing-home sales jumped 14.5% in February snapping a 12-month slide and representing the largest monthly percentage increase since July 2020 (+22.4%). Compared to one year ago, however, sales retreated 22.6% – blue line on graph below. The median existing-home sales price decreased 0.2% from the previous year to $363,000 – red line on graph below. The inventory of unsold existing homes was unchanged from the prior month at 980,000 at the end of February, or the equivalent of 2.6 months’ supply at the current monthly sales pace.

A summary of headlines we are reading today:

- U.S. Gasoline Demand Soars To Highest In Months

- Lithium Prices Hit Hard As EV Sales Stumble

- Goldman Sachs Sees Commodities Supercycle On The Horizon

- Oil Market Fundamentals Push Oil Prices Higher

- Jet Fuel Is Set To Be A Major Driver Of Oil Demand This Year

- The Fed is likely to hike rates by a quarter point but it must also reassure it can contain a banking crisis

- Stocks close higher Tuesday, S&P 500 adds more than 1% as regional banks pop: Live updates

- Home sales spike 14.5% in February as the median price drops for the first time in over a decade

- Bitcoin, ether build on recent gains as investors await Fed rate hike decision

- For The Fed, This Is No Time For Surprises

- Outside the Box: Biden’s rebuke of a bold, reform-minded crime law makes all Americans less safe

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Western Oil Companies To Bolster Presence In China’s Arch RivalThe signing of a memorandum of understanding (MoU) between India’s largest crude oil and natural gas company in India, Oil and Natural Gas Corp (ONGC), and France’s leading energy oil and gas firm, TotalEnergies, as recently tweeted by the French company, may open the way for a renewed push by Western companies in China’s arch rival in the Far East. This, in turn, might begin to shift momentum back into the US’s longstanding plans for India to act as a key counterbalance to China’s ever-increasing influence in the… Read more at: https://oilprice.com/Energy/Energy-General/Western-Oil-Companies-To-Bolster-Presence-In-Chinas-Arch-Rival.html |

|

U.S. Gasoline Demand Soars To Highest In MonthsEven before the arrival of summer driving season, gasoline demand climbed on Sunday and Monday compared to the four week average, Gas Buddy’s head of petroleum analysis Patrick DeHaan said on Tuesday. U.S. gasoline demand on Sunday and Monday was up 7% compared to the respective four week averages—and the highest level since the week of September 25, 2022, DeHaan said in a Tuesday tweet. On Monday, GasBuddy data showed that gas prices in the United States had fallen for the first time in two weeks to an average of $3.40 per gallon.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Gasoline-Demand-Soars-To-Highest-In-Months.html |

|

Iron Prices Rise Despite SVB Fallout Concerns In ConstructionJust as the construction industry finally began to recover, news of the recent SVB collapse left many in the industry feeling uneasy about the future. The collapse could have significant short-term ramifications, particularly in affordable housing markets. The long-term outlook for recovery from the collapse is also uncertain, as it may take time for the impact to fully manifest. Despite these challenges, however, the construction industry’s long-term prospects remain somewhat positive. Experts predict that construction investment will… Read more at: https://oilprice.com/Energy/Energy-General/Iron-Prices-Rise-Despite-SVB-Fallout-Concerns-In-Construction.html |

|

Lithium Prices Hit Hard As EV Sales StumbleThe price of lithium has experienced a significant decline over recent months, resulting from a deceleration in electric vehicle sales and an increasing supply of the key ingredient used in battery packs. Since November, the average price of battery-grade lithium carbonate in China has plunged from $84,500 per metric ton to $42,500, or about a 50% decline, according to Bloomberg data. Vivek Chidambaram, the senior managing director for strategy at Accenture, a consulting firm, told NYT the plunge in lithium prices could be… Read more at: https://oilprice.com/Metals/Commodities/Lithium-Prices-Hit-Hard-As-EV-Sales-Stumble.html |

|

Goldman Sachs Sees Commodities Supercycle On The HorizonInvestment banker Goldman Sachs sees a commodities supercycle on the horizon triggered by China and a shift away from capital in the energy markets and energy investments. The exodus from energy markets was brought on by panic in the banking sector, Goldman Sachs’ head of commodities, Jeff Curie, said on Tuesday at the Financial Times Commodities Global Summit according to Reuters. “As losses mounted, it spilled into commodities,” Currie said, adding that it could take months to get capital back. “We will still get a deficit by June and it will… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Goldman-Sachs-Sees-Commodities-Supercycle-On-The-Horizon.html |

|

China’s Slow Auto Sales Spurs Race To Cut EV PricesThe shift towards electrification has been gaining momentum in recent years, with governments around the world setting ambitious targets for reducing emissions from traditional internal combustion engine vehicles. China, being the world’s largest automobile market, has been at the forefront of this transition. However, despite the considerable growth in China’s electric vehicle (EV) market, retail auto sales have not seen the same increase in demand. As a result, many major car manufacturers are turning to a new strategy in an attempt to boost… Read more at: https://oilprice.com/Energy/Energy-General/Chinas-Slow-Auto-Sales-Spurs-Race-To-Cut-EV-Prices.html |

|

Texas Adds HSBC To Blacklist Of Banks Boycotting Oil And GasTexas has added HSBC to its list of companies that boycott the oil and gas industry, which could ban Texas government entities from investing in Europe’s largest bank and its funds and other products. HSBC ended up on Texas’ list after the bank recently updated its energy policy, Texas Comptroller Glenn Hegar said this week. As part of a policy to support and finance a net-zero transition, HSBC will stop funding new oil and gas field developments and related infrastructure, the banking giant said in December. Motivating the inclusion… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Texas-Adds-HSBC-To-Blacklist-Of-Banks-Boycotting-Oil-And-Gas.html |

|

How The Building Sector Became A Model For Green GrowthBuildings are a major source of energy use in the United States. Constructing new buildings, and then heating, cooling, and otherwise powering them once they’re in use accounts for a hefty chunk of overall electricity consumption. This means that the energy efficiency of the building sector has enormous implications for the country’s ecological footprint and ultimate ability to meet its climate goals. To put this in perspective: from 2005 to 2022, the U.S. added a whopping. 62.5 billion square feet to its building stock —… Read more at: https://oilprice.com/Energy/Energy-General/How-The-Building-Sector-Became-A-Model-For-Green-Growth.html |

|

Chinese Firm Set To Oust Glencore As World’s Top Cobalt ProducerChina’s CMOC Group is expected to become the world’s biggest producer of cobalt—toppling Glencore from the top spot—after it opens a new mine in the Democratic Republic of Congo later this year, according to company filings and estimates by Bloomberg. CMOC Group became one of the world’s dominant players in cobalt when it bought in 2016 the Tenke Fungurume mine in DRC, giving China a strong position in yet another mineral critical for the energy transition. Now CMOC is expected to open a new mine in DRC in the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinese-Firm-Set-To-Oust-Glencore-As-Worlds-Top-Cobalt-Producer.html |

|

Xi To Discuss China’s Peace Plan For Ukraine During Moscow Meeting With PutinRussian President Vladimir Putin and Chinese President Xi Jinping have commenced talks in Moscow, amid concerns over Putin’s deepening international isolation due to Russia’s unprovoked invasion of Ukraine. The talks with Xi give Putin a rare opportunity to show that Russia is not completely walled off from the rest of the world, despite being targeted by an arrest warrant issued by the International Criminal Court for alleged war crimes. The meeting also comes in the wake of a Chinese proposal for a political settlement in Ukraine that… Read more at: https://oilprice.com/Geopolitics/International/Xi-To-Discuss-Peace-Chinas-Plan-For-Ukraine-During-Moscow-Meeting-With-Putin.html |

|

Oil Market Fundamentals Push Oil Prices HigherOil prices appear to have taken a break from focusing on macro events, with increasing demand and disruptions in supply pushing oil prices higher at the start of the week. The real news for oil markets this week, however, will come from the Fed’s meeting.Investor Alert: Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for Global Energy Alert. Oilprice.com’s premium newsletter provides everything from geopolitical analysis to trading analysis, and all for less than a cup of coffee per… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Market-Fundamentals-Push-Oil-Prices-Higher.html |

|

Oil Prices Near $75 As Russia Extends Output Cut Through JuneRussia will continue its 500,000 barrel per day crude oil production cut through the end of June this year, Russia’s Deputy Prime Minister Alexander Novak said on Tuesday. Russia first announced the 500,000 bpd production cut in February after Novak warned that there was a risk of lower oil production this year due to EU import bans and the price cap in Russian crude oil and crude oil products. Russia’s oil production had held mostly steady in December and January despite the sanctions imposed on its crude oil. Still, the low price of Urals… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Near-75-As-Russia-Extends-Output-Cut-Through-June.html |

|

Pierre Andurand: Oil Prices Will Hit $140 This YearOil prices will surge to $140 per barrel by the end of this year, hedge fund manager Pierre Andurand said on Tuesday, adding that the recent slump was speculative on the back of the banking sector troubles. Oil demand, even when it peaks around the end of this decade, will not head for a fast decline, Andurand said at the FT Commodities Global Summit. “Even when we peak, oil demand won’t fall down so fast. We will reach peak demand towards 110 million barrels per day and then a slow decline from there,” the hedge fund manager said at the summit,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Pierre-Andurand-Oil-Prices-Will-Hit-140-This-Year.html |

|

Jet Fuel Is Set To Be A Major Driver Of Oil Demand This YearThe oil market will tighten in the second half of this year, with jet fuel demand driving a rebound in consumption, especially in China, Amrita Sen, Director of Research at Energy Aspects, said at the FT Commodities Global Summit on Tuesday. Demand in China is very consumer-driven after the reopening, Sen said at the summit, adding that gasoline and jet fuel demand are set to rebound. “That’s why I am very confident of the second-half numbers, we are going to see some really strong gasoline and jet [demand],” the energy… Read more at: https://oilprice.com/Energy/Energy-General/Jet-Fuel-Is-Set-To-Be-A-Major-Driver-Of-Oil-Demand-This-Year.html |

|

The UK Will Face A Rising Risk Of Power Supply Shortfalls This DecadeThe UK risks a shortage in stable electricity generation in the late 2020s as more coal-fired and older gas and nuclear power plants close, research commissioned by energy firm Drax Group showed on Tuesday. Peak demand for Britain’s electricity is expected to rise by 4 gigawatts (GW) by 2027, the research carried out by consultancy Baringa showed. At the same time, the imminent closure of coal-fired power plants, older gas-fired power generation, and closure of nuclear power plants will remove up to 6.3 GW of secure capacity from the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-UK-Will-Face-A-Rising-Risk-Of-Power-Supply-Shortfalls-This-Decade.html |

|

The Fed is likely to hike rates by a quarter point but it must also reassure it can contain a banking crisisThe Federal Reserve is expected to raise interest rates Wednesday by a quarter point, but it also must reassure markets it can stem a worse banking crisis. Read more at: https://www.cnbc.com/2023/03/21/fed-likely-to-raise-rates-by-a-quarter-point-but-it-must-also-reassure-markets-on-banking-system.html |

|

Stocks close higher Tuesday, S&P 500 adds more than 1% as regional banks pop: Live updatesThe market continued to rally Tuesday as investors became more optimistic that the banking turmoil would be contained. Read more at: https://www.cnbc.com/2023/03/20/stock-market-today-live-updates.html |

|

Google CEO tells employees that 80,000 of them helped test Bard A.I., warns ‘things will go wrong’In a memo to employees Tuesday, Google and Alphabet CEO Sundar Pichai wrote, “user feedback is critical to improving the product and the underlying technology.” Read more at: https://www.cnbc.com/2023/03/21/google-ceo-pichai-memo-to-employees-on-bard-ai-things-will-go-wrong.html |

|

Home sales spike 14.5% in February as the median price drops for the first time in over a decadeSales of previously owned homes rose 14.5% in February compared with January, according to a seasonally adjusted count by the National Association of Realtors. Read more at: https://www.cnbc.com/2023/03/21/february-home-sales-spike.html |

|

Investors are buying energy stocks in record amounts after a dip in oil pricesInvestors have been scooping up energy names amid a recent drop in oil prices, according to Bank of America. Read more at: https://www.cnbc.com/2023/03/21/investors-are-buying-energy-stocks-in-record-amounts-after-dip.html |

|

Bitcoin, ether build on recent gains as investors await Fed rate hike decisionCryptocurrency prices were slightly higher and investors braced for the conclusion of the Federal Reserve’s two-day policy meeting on Wednesday. Read more at: https://www.cnbc.com/2023/03/21/bitcoin-ether-build-on-recent-gains-as-investors-await-fed-rate-hike-decision.html |

|

Trump grand jury live updates: Expected indictment in porn star payoff is ‘revenge’ Haley saysDonald Trump expects to be charged over a hush money payoff to porn star Stormy Daniels. Follow live updates on the grand jury probe of the former president. Read more at: https://www.cnbc.com/2023/03/21/trump-grand-jury-live-updates-expected-indictment-in-payoff-to-porn-star-stormy-daniels.html |

|

TikTok CEO appeals to U.S. users ahead of House testimonyChew emphasized the large scale of TikTok users, small and medium-sized businesses and its own employees based in the U.S. that rely on the company. Read more at: https://www.cnbc.com/2023/03/21/tiktok-ceo-appeals-to-us-users-ahead-of-house-testimony.html |

|

Potentially deadly fungus Candida auris is spreading at an ‘alarming rate,’ CDC saysCandida auris was limited to New York City and Chicago, but has since been detected in more than half of U.S. states and has become endemic in some areas. Read more at: https://www.cnbc.com/2023/03/21/candida-auris-fungus-resistant-to-drugs-spreading-rapidly-cdc-says.html |

|

Ukraine war live updates: Putin touts China’s peace plan after talks with Xi; Russian mercenaries say Kyiv is preparing counterattackIt’s the second day of Chinese President Xi Jinping’s state visit to Moscow Tuesday. He and President Putin could sign a number of bilateral agreements today. Read more at: https://www.cnbc.com/2023/03/21/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Rapper Bad Bunny sued for $40 million over ex-girlfriend’s voice recordingThe voice recording can be heard on two of Bad Bunny’s hit songs: “Pa Ti” and “Dos Mil 16.” Read more at: https://www.cnbc.com/2023/03/21/bad-bunny-sued-ex-girlfriend-voice-recording.html |

|

Biden used first veto to save a 401(k) investment rule. Here’s what it doesPresident Joe Biden vetoed a measure that would have overturned a recent 401(k) investment rule about ESG funds. The rule loosened some Trump-era restrictions. Read more at: https://www.cnbc.com/2023/03/21/biden-veto-401k-rule-esg-investment-funds.html |

|

A lot of money is on the line for women’s pro soccer in the U.S.The National Women’s Soccer League, fresh off a year of scandal and huge growth, kicks off its season this week. Read more at: https://www.cnbc.com/2023/03/21/womens-soccer-faces-big-year-nwsl-season.html |

|

For The Fed, This Is No Time For SurprisesAuthored by Simon Flint via Bloomberg, There is an argument that the Fed will stick to its inflation-fighting mission, because it needs to focus on restoring its credibility, and this keeps a 50bps hike in play for March. However, this could be a major policy error and hence the basic choice for the central bank remains between 25bps and zero.

In detail: At current market pricing, a 50bps increase would be a significant surprise. Central banks only like to surprise if they are trying to gain credibility or alter expectations profoundly. This was true of Kuroda’s BOJ over 2013-2016 especially. Of course, of late, the Fed has been trying to re-establish sufficiently hawkish credentials and has tended to be more muscular than markets have expected. However, one shouldn’t think of this as normal. Surprises create uncertainty, and uncertainty is generally inimical to stable macro conditions. This is esp … Read more at: https://www.zerohedge.com/markets/fed-no-time-surprises |

|

Putin To Xi: “We Support Chinese Yuan Use With Asia, Africa, Latin America”In a ceremony at the Kremlin, and on the second day of Chinese leader’s Xi Jinping’s visit, Putin and Xi kicked off formal talks which will focus on the Ukraine crisis. They shook hands and stood side by side as their respective national anthems played, aired on state television. Following the meeting, they held a joint press conference, to be followed by a state dinner at the Kremlin. Last night’s greeting and starting ‘informal’ talks lasted about 4-and-a-half hours. In addition to Ukraine being high on the agenda for the ongoing summit, Xi outlined in initial comments Tuesday that China wishes to expand cooperation with Russia on trade, and hopes that Russia promotes liberalization, facilitation of trade and investment, alongside both sides maintaining security and stability of industrial and supply chains. Importantly, Xi invited Putin to travel to China at some point this year. Putin showed willingness on these points, also stressing that Russia stands ready to meet China’s growing energy needs. Read more at: https://www.zerohedge.com/geopolitical/japans-leader-makes-surprise-visit-ukraine-moment-xi-putin-summit |

|

US Gave India Intel During Clash With Chinese TroopsAuthored by Dave DeCamp via AntiWar.com, The US provided India with unprecedented intelligence-sharing during a clash between Indian and Chinese troops in December 2022 along the disputed border high in the Himalayas, known as the Line of Actual Control, US News reported on Monday. The report cited current and former US officials who said the intelligence sharing was possible thanks to a military pact Washington and New Delhi signed in 2020, known as the Basic Exchange and Cooperation Agreement (BECA). The deal was inked following deadly clashes between Chinese and Indian troops along the LAC in the Galwan Valley that killed 20 Indian soldiers and at least four Chinese troops.

Read more at: https://www.zerohedge.com/geopolitical/us-gave-india-intel-during-clash-chinese-troops |

|

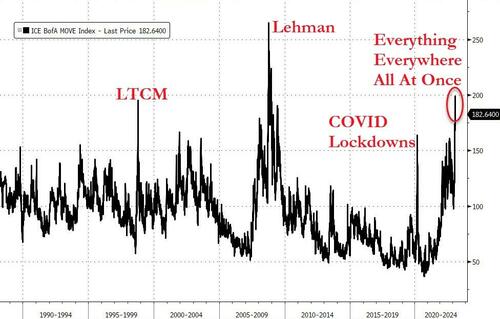

20Y Auction Sees Solid Demand Despite Jarring Treasury VolatilityWith bond volatility in the past weeks surpassing the covid crisis highs…

… some were concerned that today’s 20Y auction could be a disaster because in a time when 2Y Notes swing in daily 6-sigma moves, what can one say about stability of paper that actually has lots of duration… and a very illiquid market like the 20Y. Well, in retrospect it could have been much worse: moments ago the Treasury sold $12 billion in a 20Y paper (in the form of a 19-year 11-month reopening), which saw solid buy side demand. The high yield of 3.909% tailed the When Issued 3.906% by just 0.3bps (following last month’s 0.2bps tail) which while the biggest tail since October, was hardly indicative of a steep drop off in demand. The bid to cover of 2.53 was virtually unchanged from last month’s 2.54 and was shy of the recent average of 2.64. The internals were mediocre with Indirects awarded 67.03%, down from 75.3% last month and below the 73.0% six-auction average (it was the lowest since October). And with Directs awarded 21.1%, or the … Read more at: https://www.zerohedge.com/markets/20y-auction-sees-solid-demand-despite-jarring-treasury-volatility |

|

Stocks rebound as US and UK seek to calm investorsMarkets higher after UK and US again seek to calm investor fears over banks’ stability. Read more at: https://www.bbc.co.uk/news/business-64985356?at_medium=RSS&at_campaign=KARANGA |

|

The US interest-rate decision the world is watchingCan the Federal Reserve continue to raise interest rates in the middle of a banking panic? Read more at: https://www.bbc.co.uk/news/business-65017979?at_medium=RSS&at_campaign=KARANGA |

|

Bill Gates: AI is most important tech advance in decadesThe former Microsoft boss says AI is the second revolutionary technology he’s seen in his lifetime. Read more at: https://www.bbc.co.uk/news/technology-65032848?at_medium=RSS&at_campaign=KARANGA |

|

Nithin Kamath on where to park your cash amid ongoing banking crisisZerodha’s CEO, Nithin Kamath, said those looking to park cash without risks can invest in government securities or T-Bills Read more at: https://economictimes.indiatimes.com/markets/web-stories/nithin-kamath-on-where-to-park-your-cash-amid-ongoing-banking-crisis/articleshow/98871868.cms |

|

Temasek Holdings sells 2.8% stake in Devyani International for Rs 500 cr via block deal; Franklin Templeton MF buysFranklin Templeton Fund has picked up about 0.5% stake in Devyani International through a block deal on Tuesday. Franklin’s India Flexi Cap Fund has bought about 62 lakh shares in open market transaction for Rs 89 crore. The deal was executed at an average price of Rs 145 per share. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/temasek-holdings-sells-2-8-stake-in-devyani-international-for-rs-500-cr-via-block-deal-franklin-templeton-mf-buys/articleshow/98873976.cms |

|

Beth Pinsker: If your last-minute IRA contributions are sitting in cash, it could be costing you thousands of dollarsPeople rush to meet the tax deadline, then often let the money sit in cash, missing out on potential growth. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71BB-A0F3B7673BBC%7D&siteid=rss&rss=1 |

|

Outside the Box: Biden’s rebuke of a bold, reform-minded crime law makes all Americans less safePresident’s decision is the latest backlash to U.S. justice reform coming from both sides of the political aisle. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71B4-0ECEC755C855%7D&siteid=rss&rss=1 |

|

Tough talk aside, TikTok may have little to worry about from U.S. lawmakersAs congressional members from both parties sharpened their rhetorical knives in preparation for TikTok Chief Executive Shou Zi Chew’s testimony Thursday, the embattled company launched a counteroffensive. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71BC-3CD54299DB6D%7D&siteid=rss&rss=1 |

Stillframe o …

Stillframe o …